The Dow and S&P 500 ended slightly lower on Tuesday (August 22nd) as investors stayed worried the Federal Reserve will keep interest rates higher for longer and as banks shares eased. The Nasdaq finished barely in the green.

Regarding the options market, a total volume of 33,430,959 contracts was traded, down 8% from the previous trading day.

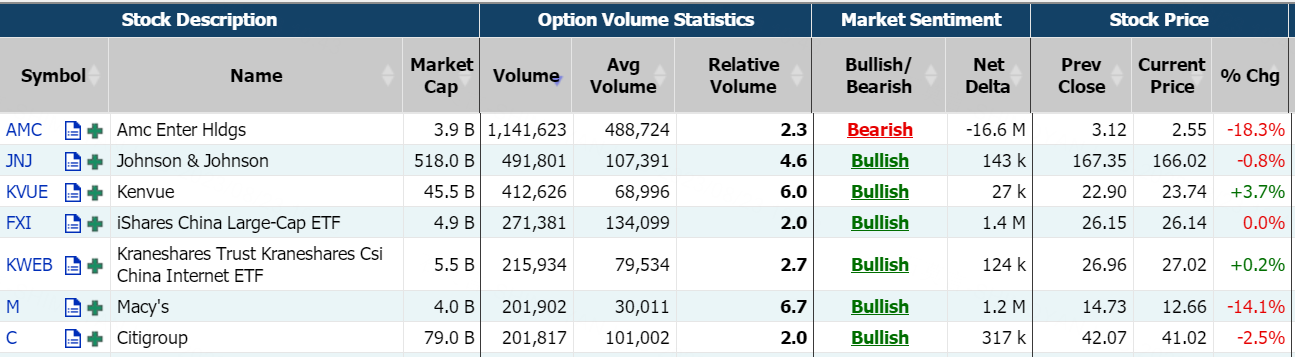

Top 10 Option Volumes

Top 10: SPY; QQQ; TSLA; AMC; NVDA; AAPL; IWM; VIX; JNJ; KVUE

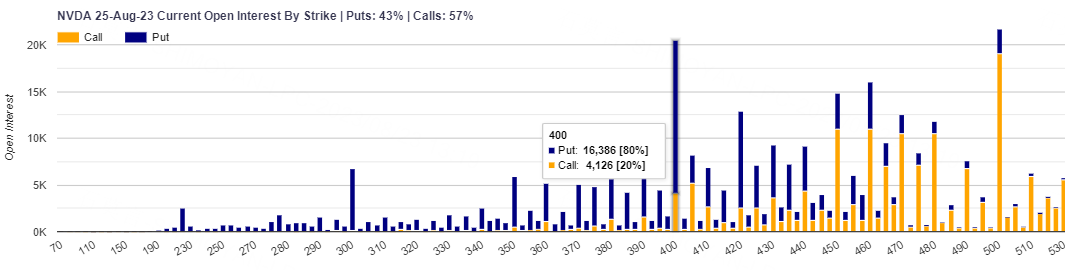

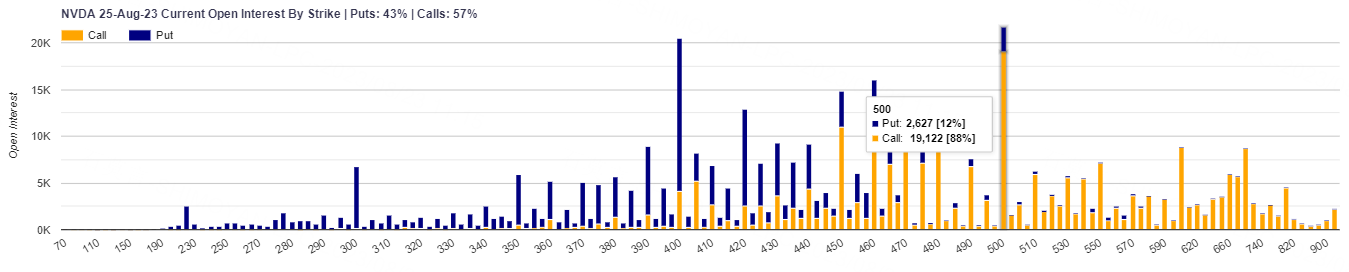

Investors are wagering that the furious swing in Nvidia shares after Wednesday’s earnings report. Among Nvidia's contracts expiring this week, the largest open interest comes from $500 strike Call options with a total amount of 19,122 as of Tuesday.

Traders are betting on a swing in the stock of about 11%—up or down—through the end of the week, options pricing shows. And that is well above the average move of about 7% seen after the last eight earnings releases. The robust activity suggests some traders are fearful of missing out on further gains in Nvidia, while others are likely eager to take advantage of the big one-day moves in its shares. Nvidia’s $400 strike put options expiring August 25 also worth attention with a total number of 16,386 open interest as of Tuesday.

Recent estimates from industry watchers indicate that Tesla’s China unit is in position to report impressive August numbers, with estimates showing the car maker receiving 13,900 insurance registrations in the week ending August 20.

It seems that the company has achieved approximately 39,400 new insurance registrations in China within this month. This figure indicates a positive outlook for Tesla, particularly given the anticipated emphasis on the domestic market by Giga Shanghai in the upcoming weeks.

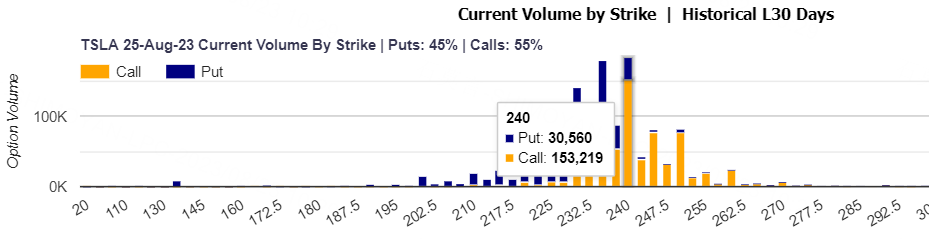

Shares of TSLA are up 0.83%. A total number of 2.15 million options related to Tesla was traded. A particularly high trading volume was seen for the $240 strike call options expiring August 25th, with a total number of 153,219 option contracts trading on Tuesday.

Most Active Options

Most Active Trading Equities Options:

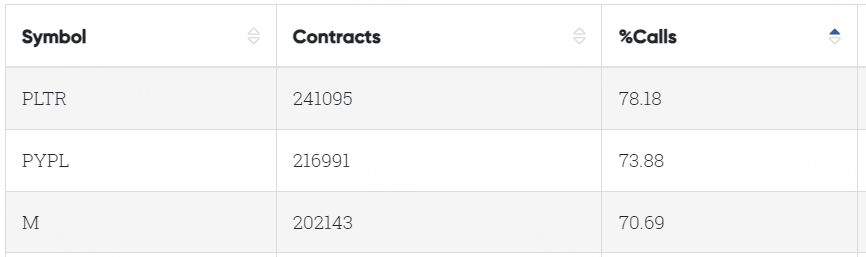

Special %Calls>70%: Palantir; PayPal; Macy's

Unusual Options Activity

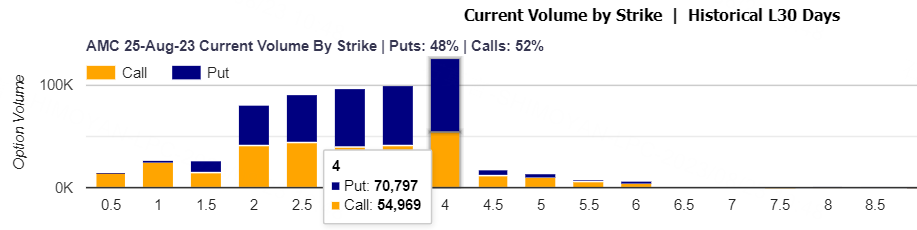

AMC Entertainment and AMC Preferred Equity units are both slipping for a second straight day on the threshold of a transformative share conversion the theater chain launched in order to raise new equity.

AMC's common shares were down 18.27% on Tuesday amid three separate trading halts for volatility. The stock had tumbled 24% Monday. Meanwhile, the company's preferred equity units (APE) were down 11.32% on Tuesday, adding on to Monday's 7% decline.

While both securities are declining, the price gap between them is narrowing ahead of AMC's planned major moves this week: a 1-for-10 reverse stock split to come on Thursday, and the conversion of APEs into AMC common stock on Friday.

A total number of 1,141,623 options related to AMC was traded. A particularly high trading volume was seen for the $4 strike put options expiring August 25, with a total number of 70,797 option contracts trading on Tuesday.

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: M; AAPL; AGNC; KIM; VFC; GOEV; TAL; JWN; PTON; VLY

Top 10 bearish stocks: AMC; TSLA; PLTR; NKLA; PFE; PYPL; PBR; KMI; BAC

Based on option delta volume, traders bought a net equivalent of 1,249,965 shares of Macy's stock. The largest bullish delta came from buying calls.

The largest delta volume came from the 15-Sep-23 13.5 Call, with traders getting long 541,619 deltas on the single option contract. $M 20230915 13.0 CALL$

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club