A day after Square Inc (NYSE:SQ) reported its fourth-quarter results and announced the purchase of $170 million worth of Bitcoin (CRYPTO: BTC), an analyst at Guggenheim Securities upgraded the shares of the payment processor.

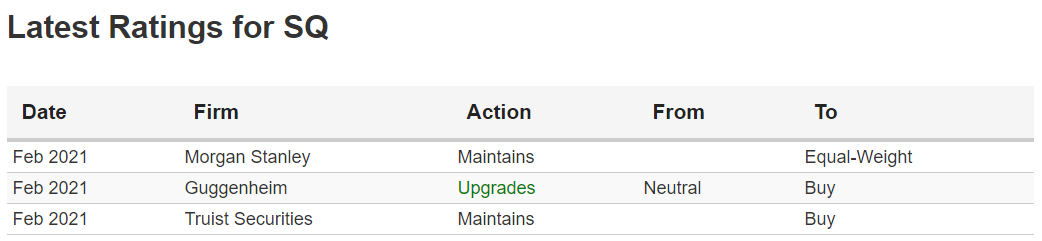

The Square Analyst: Jeff Cantwell upgraded Square shares from Neutral to Buy, with a $288 price targeting, suggesting 21% upside potential from current levels.

The Square Thesis: The weakness in Square shares seen over the past two days is largely a near-term momentum-driven reaction to the decline in the price of bitcoin this week, analyst Cantwell said in a Thursday morning note.

This presents an opportunity for investors to buy the stock, especially as the company reported strong quarterly results and the management discussed many areas of emerging operational strength, the analyst said.

This bodes well for the company's future, and places it on the path towards much greater levels of revenue, EBITDA and EPS generation in coming periods, he added.

Particularly, seller segment results continued to strengthen in the fourth quarter, thanks to the company's strategic initiatives in omnichannel/online and meaningful expansion upmarket with mid-market merchants, Cantwell said.

The outlook for the segment, the analyst said, looks increasingly positive, as small and medium businesses are showing confidence in a post-vaccine environment.

The Cash App, according to the analyst, is in solid shape. It will likely continue to add revenues rapidly, driven by bitcoin and equity investing.

Combining the two ecosystems increasingly sounds feasible and should create new synergies that will likely expand Square's top and bottom lines, the analyst said.

Bitcoin, according to the analyst, is still in the early stages of a significant move higher, and this is positive for Cash App, as well as Square's balance sheet. Additionally, another round of stimulus will likely provide a boost to the company's two ecosystems, he said.

Square Price Action: After pulling back by about 14% over the past three sessions, Square shares were last seen downing 4.3% to $227.11 Thursday.