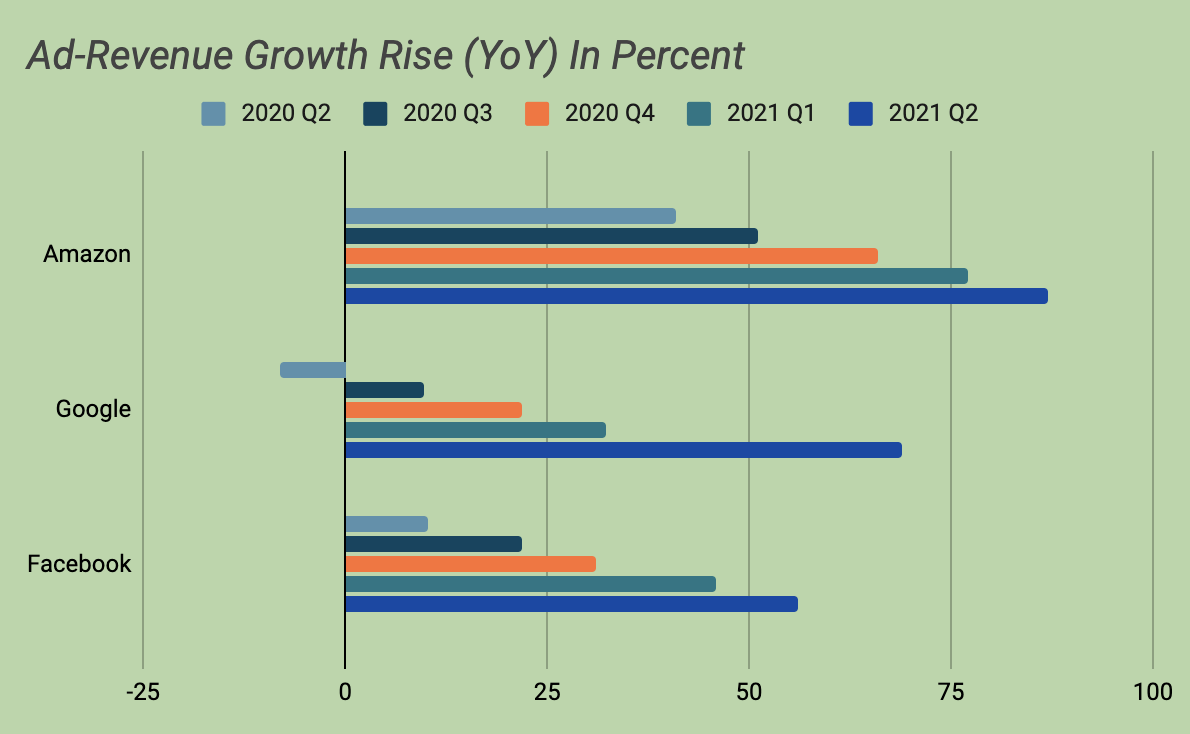

Amazon.com Inc’s (NASDAQ:AMZN) advertising business grew the most in two-and-a-half years in the second quarter amid stiff competition, outpacing the growth of key tech rivals Alphabet Inc (NASDAQ:GOOGL) (NASDAQ:GOOG) and Facebook Inc (NASDAQ:FB).

What Happened: The e-commerce giant's advertising revenue, which is gradually turning out to be a key source of growth for the company as momentum in other businesses slows, grew a whopping 87% year-over-year to $7.9 billion in the quarter ended June 30.

On a sequential basis too, Amazon’s growth pace outpaced that of rivals.

The Seattle-based tech giant does not break out specific financials for advertising, but its “Other” category “primarily includes sales of advertising services, as well as sales related to our other service offerings,” as per the company’s earnings statements.

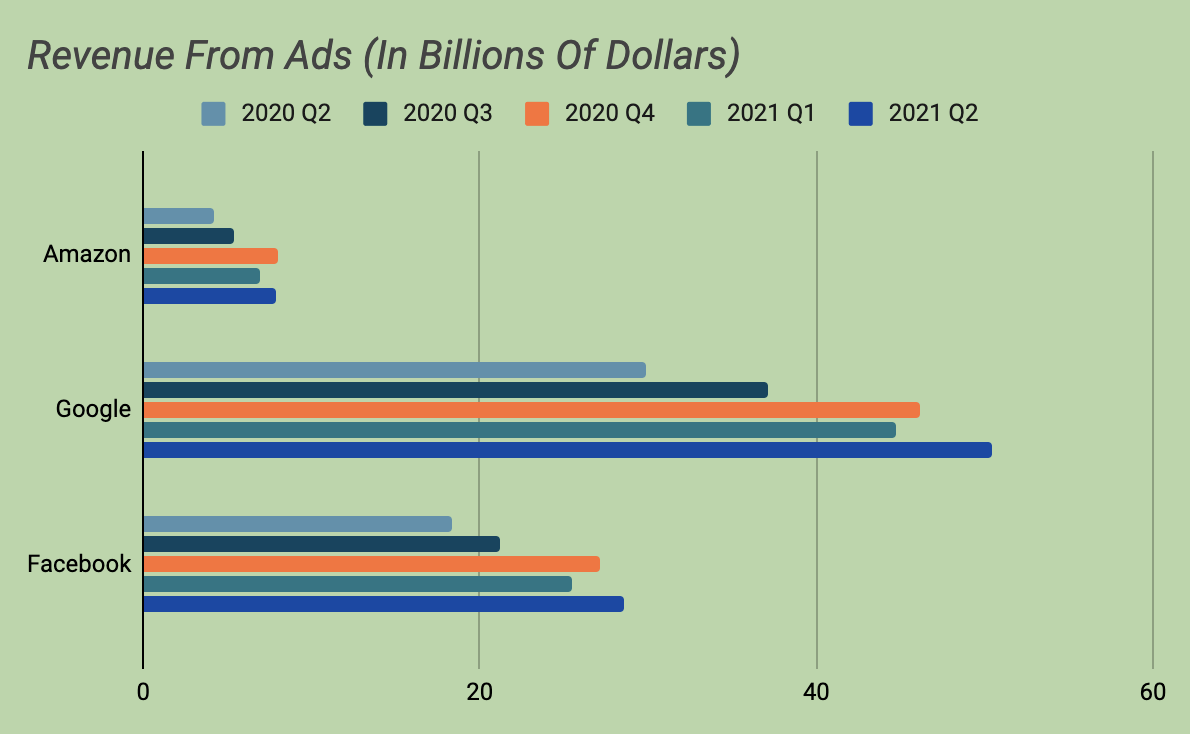

How Rivals Stack Up? Amazon’s advertising arm is still small when compared with its peers. At the end of the second quarter, Google’s advertising revenue is over six times bigger than Amazon’s, while Facebook's ad revenue is over four times bigger.

Google and Facebook together command over 50% share of the digital advertising market and have in the past few quarters seen a sharp uptick in revenue growth.

Google’s ad revenue increased 69% to $50.44 billion in the second quarter. A year ago, the company’s revenue from the ad business took a hit from the COVID-19 pandemic. Video streaming platform YouTube delivered an 83% jump in revenue to $7 billion during the quarter, matching that of video streaming rival Netflix Inc’s (NASDAQ:NFLX) quarterly revenue.

Facebook's total advertising revenue rose 56% from a year earlier to $28.58 billion in the second quarter, contributing a lion's share of the company’s total revenue.

Why It Matters: Amazon and rivals such as Google and Facebook have seen their advertising business benefiting from stay-at-home consumption since the beginning of the pandemic and the subsequent reopening of the economy.

Amazon draws ad revenue mostly from charging companies to promote their products on Amazon’s online marketplace as well as streaming platforms. The company said it launched over 40 new advertising features and self-service capabilities in the quarter and expanded the services it offers in Australia, Europe, India, Japan and Saudi Arabia.

The Seattle-based tech giant, which booked total sales of $113.1 billion in the second quarter and a profit of $7.8 billion, is expected to account for 10.7% of the U.S. digital ad market in 2021, as per eMarketer's estimates, and the share could grow to 12.8% by 2023.

Price Action: Amazon shares closed 0.84% lower at $3,599.92 on Thursday and were down 7.44% in extended hours.