No doubt, 2021 has been a stellar year for U.S. stocks.

The S&P 500 index is headed for a stellar 27% annual gain as of Friday, the last day of trade in a year when highly transmissible coronavirus variants have kept the pandemic at the forefront.

But while such outsized stock-market gains have been fairly rare in the past 70 years, past performance shows that 2022 still could be a robust year for returns, according to a review of historical S&P 500 performance by Truist Advisory Services.

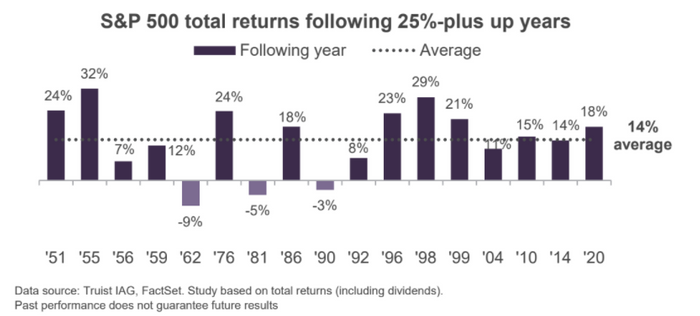

Indeed, Keith Lerner, co-chief investment officer at Truist, found the S&P 500 has produced at least 25% annual returns (including dividends), only 18 times since 1950. But in the following year, the broad-based index rose 82% of the time, notching average annual gains of 14% (see chart).

"Two(T of the three years where stocks failed to rise, 1981 and 1990, coincided with recessions," Lerner wrote, in a Friday client note. "Our work suggests near-term recession risk remains low."

"The other downside market outlier was 1962, which was challenged by a flash crash and deteriorating investor confidence," Lerner wrote.

The coming year will kick off with Federal Reserve monetary policies that remain highly accommodative for financial assets, at least in its first few months. Pandemic support by central banks has been credited with underpinning the global economic recovery, while keeping credit flowing, but also pushing up asset prices to sometimes worrying levels.

The Dow Jones Industrial Average was poised for a 19% annual gain for 2021, while the Nasdaq Composite Index advanced about 22%, according to FactSet.

Fed Chairman Jerome Powell outlined plans in December to more aggressively reduce the central bank's hallmark $120 billion in monthly pandemic bond purchases, in a bid to combat inflation that's touched 1980s levels. It is targeting March as a potential end date for the program, after about two years. The Fed also penciled in three rated hikes in 2022.