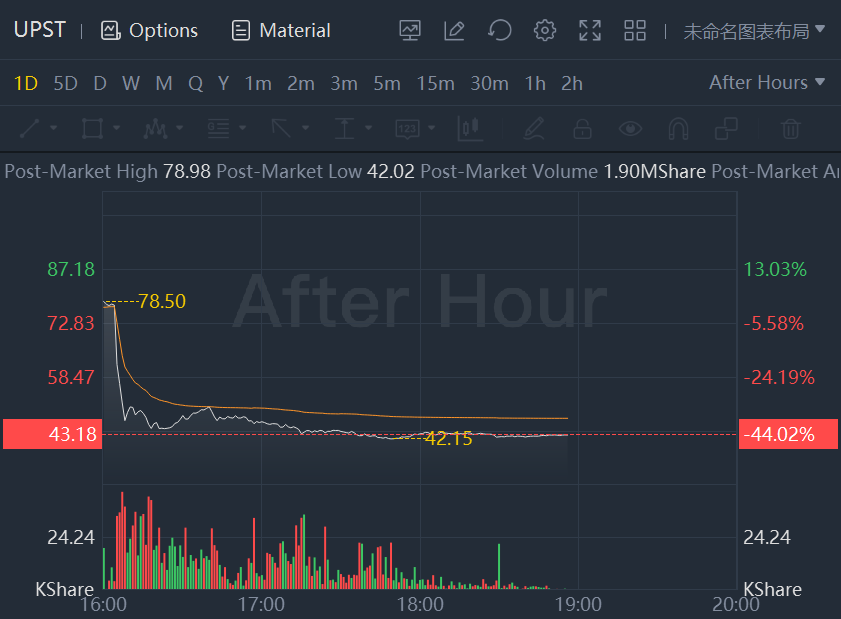

Shares of Upstart Holdings Inc. plunged more than 44% in after-hours trading Monday after the company cut its forecast for the full year, warning that the current macroeconomic climate is expected to weigh on loan volume.

The company, which uses artificial intelligence in lending decisions, now expects 2022 revenue of roughly $1.25 billion. Its prior forecast was for about $1.4 billion in revenue.

The rise in consumer interest rates means that "on the margin, a whole bunch of people that would have been approved are no longer approved," Chief Executive Dave Girouard said on Upstart's earnings call.

"So there's a whole bunch of loans that just never happened at all, and there's a bunch of people that are still approved, but the interest rate is a few percentage points higher, and a certain fraction of them are going to decide that's not the product that they want," he said, especially citing the case of discretionary purchases.

Additionally, Chief Financial Officer Sanjay Datta noted that while delinquencies were "unnaturally low" for about 18 months, the trend has reversed given the absence of government stimulus activity.

Delinquency dynamics also contribute to higher interest rates quoted to consumers, he said, though Upstart has seen a stabilization in delinquency trends over the past 60 days.

"Given the general macro uncertainties and the emerging prospects of a recession later this year, we have deemed it prudent to reflect a higher degree of conservatism in our forward expectations," Datta said on Upstart's earnings call.

For the second quarter, Upstart anticipates revenue of $295 million to $305 million, while analysts had been expecting $335 million.

The bleaker forecast overshadowed better-than-expected results for Upstart's most recent quarter, as revenue jumped to $310 million from $121 million, while analysts had been expecting $300 million.

The company generated $314 million in fee revenue, up 170% from a year prior, whereas the FactSet consensus was for $287 million

Upstart also reported first-quarter net income of $32.7 million, or 34 cents a share, compared with $10.1 million, or 11 cents a share, in the year-earlier period. After adjusting for stock-based compensation and other expenses, Upstart earned 61 cents a share, up from 22 cents a share a year prior and ahead of the FactSet consensus, which was for 53 cents a share.

"We are actually quite pleased and quite happy with the results," Girouard said on the earnings call. While he appreciates "that 2022 is a complicated year in the economy," he emphasized that he's "exceptionally confident in the strength of the business and is optimistic about our future, as we have been."

Shares of Upstart have lost 31% over the past three months as the S&P 500 has fallen 13%.