U.S. stock futures were pointing to a higher start for Wall Street at the end of a volatile week, after Federal Reserve Chairman Jerome Powell cooled speculation over the potential for 75-basis point rate hikes.

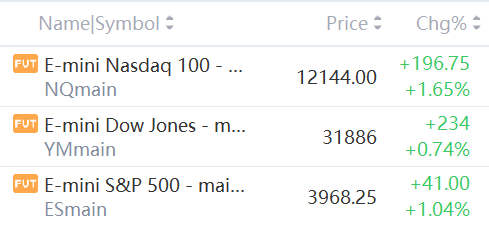

- S&P 500 futures rose 1.04% to 3,968

- Dow Jones Industrial Average futures rose 0.74%, to 31,886

- Nasdaq 100 futures climbed 1.65% to 12,144

The Fed is not “actively considering” a 75-basis point interest rate increase, Fed Chairman Powell told Marketplace after the market close on Thursday, though he also said the central bank may not be able to engineer a “soft landing” for the economy.

Stocks pared losses on Thursday after the Senate confirmed Powell him to a second term.

But even if equities can manage a win on Friday, all three indexes are headed for sizable weekly losses, led by the Nasdaq, down 6.3% as of Thursday. That would mark the battered tech index’s sixth straight weekly loss, with the Dow industrials set to mark its seventh consecutive weekly loss, off 3.5%.

Down 4.6%, the S&P 500 is also poised to mark a sixth-straight weekly fall, as it also skirts bear market territory, defined as a drop of 20% from a recent peak. Off 18.1% from a Jan. 3 record high, the S&P would only need to close at or below 3,837.24 to enter a bear market.