Investors are once again working up the fortitude to bet against GameStop and AMC roughly 18 months after last January's infamous "meme stock" short squeeze sent GameStop shares surging more than 1,000%.

That move was so sharp that it eventually prompted Robinhood (HOOD) and other retail brokerages to restrict trading -- a decision that prompted a congressional hearing and widespread outrage among thousands of traders who were unable to close positions.

At least one hedge fund, Melvin Capital, lost billions on its bet against GameStop $(GME)$, forcing it to seek an emergency cash infusion. More than a year later, Melvin decided to wind down.

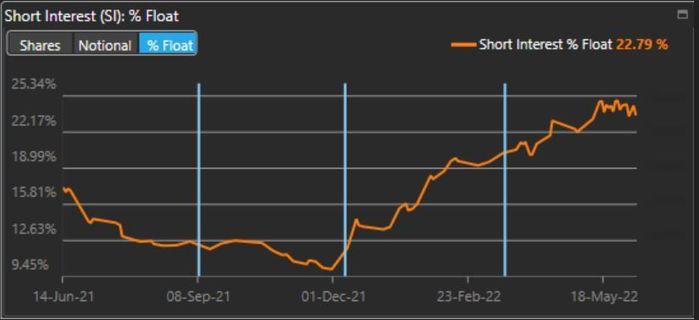

Although short interest is now nowhere near the exaggerated levels that preceded January 2021's historic rally, data from S3 Partners shows that short interest in both GameStop and AMC Entertainment Holdings Inc. $(AMC)$ is looking elevated once again, having reached its highest level in about a year. By comparison, shortly before the trading frenzy really kicked off 18 months ago , short interest in GameStop reportedly exceeded 100%, which is possible since shares can, in theory, be borrowed and sold short more than once.

The recent rise in short interest was noted in both company's earnings reports: GameStop reported its earnings for the first three months of 2022 last week, while AMC reported last month.

According to the S3 Partners data, short interest is equivalent to 23% of GameStop's float.

And for AMC, that figure is 22%.

Wall Street analysts who cover GameStop and AMC are generally pessimistic. Analysts expect earnings per share to contract for both stocks heading into the next fiscal year, according to the FactSet median estimate.

And there's good reason for that -- at least as far as GameStop is concerned. Wedbush's Michael Pachter, who has been covering GameStop since February 2002, says investors have good reason to be skeptical.

"The fundamentals are bad, with spending on new initiatives (NFT marketplace, crypto wallet) wiping out the little bit of profits we expected them to earn from their core business," Pachter said. "They lost money in the holiday quarter for the first time ever...and their cash balance declined by around $700 million over the last three quarters. They burned $300 million in cash in the most recent quarter, but some of that was an inexplicable buildup of inventory (they don't answer questions, so no idea what they are doing)."

GameStop shares rallied ahead of their latest earnings report, but have drifted lower since. They are down nearly 10% since the start of the year, while AMC shares have fallen more than 50% in that time. GameStop shares ended Tuesday up 14.4% at $146.50, compared with a 52-week high of $344.66. AMC shares closed with a gain of 9.4% at $13.07, compared with a 52-week high of $64.96.