Oil futures rose on Friday after major producers raised output as expected and outages in Libya raised concerns about reduced supply.

What's happening

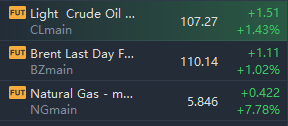

The West Texas Intermediate front-month crude futures contract rose $1.51, or 1.43%, to $107.27 a barrel on the New York Mercantile Exchange.

Brent crude futures , the global crude benchmark, rose $1.11, or 1.02%, to $110.14 a barrel on the ICE Futures Europe.

August natural gas futures rebounded 42 cents, or 7.78%, to $5.84 per million British thermal units, after plunging about 17% on Thursday.

What's driving markets

Oil prices have come off multi-year highs in recent weeks -- with Brent retreating from more than $140 a barrel touched in March -- amid concerns that slowing economic growth may crimp demand.

However, lingering worries about tight supply, and signs activity in China is picking up, continue to support energy prices.

On Thursday, the Organization of the Petroleum Exporting Countries and its allies confirmed a proposal to boost output by another 648,000 barrels a day in August.

The West would like to see more supply in order to curtail inflation and reduce reliance on Russian production following the country's invasion of Ukraine. With that in mind, traders will be keeping a keen eye on whether U.S President Joe Biden can convince Middle East producers to increase supply further when he visits the region in mid-July.

"The market is stuck in the push-pull between the current deteriorating macro backdrop and the looming threat of a recession, pitted against the strongest fundamental oil market setup in decades, maybe ever," said Michael Tran, commodity strategist at RBC Capital Markets, in a note to clients.

Adding to fear about inadequate output was news that Libya's National Oil Company had declared force majeure on Thursday as the country's political crisis deepens. Daily exports have fallen to about a third of production seen in "normal circumstances," NOC said.

In addition, strikes next week on Norwegian oil platforms may cut 4% of the country's production, according to Reuters.

There was better news for U.S households on Thursday, when natural-gas prices slumped to a three-month low after the extended shutdown of a large liquified natural-gas plant in Texas helped utilities to boost their stockpiles. Natural-gas futures are well off the 14-year high near $9.5 per mBtu touched less than a month ago.