KE Holdings (NYSE:BEKE) reported quarterly losses of $(0.08) per share which beat the analyst consensus estimate of $(0.22) by 63.64 percent. This is a 138.1 percent decrease over earnings of $0.21 per share from the same period last year. The company reported quarterly sales of $2.10 billion which beat the analyst consensus estimate of $1.58 billion by 32.91 percent. This is a 31.60 percent decrease over sales of $3.07 billion the same period last year.

Business and Financial Highlights for the Second Quarter of 2022

- Gross transaction value (GTV) was RMB639.5 billion (US$95.5 billion), a decrease of 47.6% year-over-year. GTV of existing home transactions was RMB393.5 billion (US$58.7 billion), a decrease of 39.6% year-over-year.GTV of new home transactions was RMB222.7 billion(US$33.3 billion), a decrease of 55.3% year-over-year. GTV of home renovation and furnishing was RMB1.3 billion (US$0.2 billion), compared toRMB47 millionin the same period of 2021. GTV of emerging and other services was RMB22.0 billion (US$3.3 billion), a decrease of 68.8% year-over-year.

- Net revenue swere RMB13.8 billion (US$2.1 billion), a decrease of 43.0% year-over-year.

- Net loss was RMB1,866 million (US$279 million). Adjusted net loss was RMB619 million(US$92 million).

- Number of storeswas 42,831 as ofJune 30, 2022, a 19.0% decrease from one year ago.Number of active stores was 41,118 as of June 30, 2022, a 16.2% decrease from one year ago.

- Number of agents was 414,915 as of June 30, 2022, a 24.4% decrease from one year ago.Number of active agents was 380,284 as of June 30, 2022, a 23.9% decrease from one year ago.

- Mobile monthly active users (MAU) averaged 43.0 million for the three months ended June 30, 2022, compared to 52.1 million in the same period of 2021.

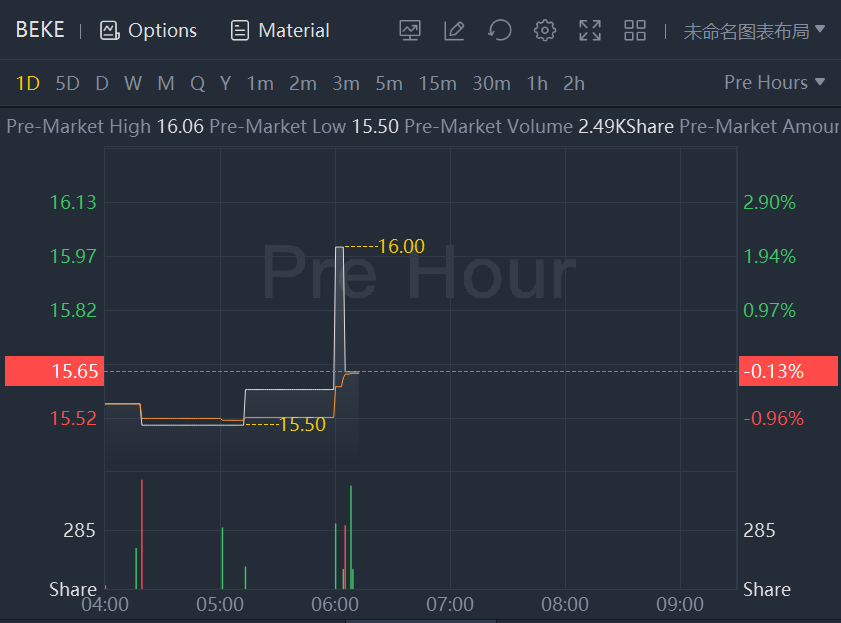

KE Holdings shares fell slightly in premarket trading.