Dividend stocks are facing stiffer competition, thanks to a big spike in bond yields. A risk-free 10-Year Treasury note was recently yielding 3.7%, up from 1.63% at the start of 2021. That's well above the S&P 500 index's dividend yield of 1.76%, making bonds more attractive for income investors.

But this isn't the time to give up on dividends as an income source. A healthy payout stream can diversify income in your portfolio. And with consumer price inflation running at an 8.3% annualized clip, stocks with dividend growth can help your income stream hold up better than bonds with fixed interest.

"Dividend growers really do protect you from rising rates and inflation because you are getting that growing income stream," says Thomas Huber, manager of the $19 billion T. Rowe Price Dividend Growth fund.

Despite the Federal Reserve's plans to keep raising interest rates and slow the economy in its fight against inflation, companies with resilient revenue are raising payouts. Even with earnings growth declining for those in the S&P 500, the index's overall payout should rise 10% this year, estimates Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. That would mark the first double-digit increase in S&P 500 dividends since 2015.

Treasury inflation-protected bonds, or TIPS, meanwhile, aren't offering any protection. The iShares TIPS Bond exchange-traded fund $(TIP)$ has lost 11% in 2022, including interest payments.

Stocks with rising dividends could also falter, of course. Target $(TGT)$, for one, is a dividend "aristocrat," a company that has raised its dividend for at least 25 years. Target has hiked its payout for 51 consecutive years, including a 20% increase in June, to an annualized $3.60 a share, good for a 2.8% yield at the stock's recent price around $153.

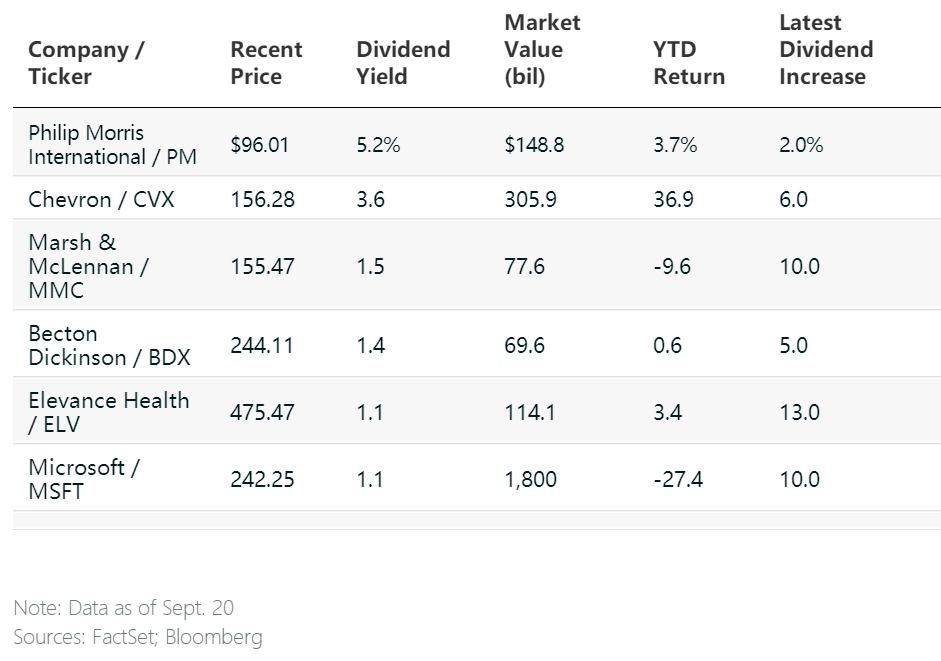

Rising Payouts

These companies are raising their dividends at a healthy clip and their payouts look secure.

A larger holding in the portfolio is Chevron $(CVX)$. It yields 3.6% and has been a winner, gaining about 37%, with dividends included, this year.

Oil stocks won't fare well if global demand for the commodity slumps once the war in Ukraine winds down. A slowing global economy would also cool the outlook for crude. The Columbia fund's longtime manager, Barclay, thinks Chevron looks resilient, though. "They have been disciplined in their capital expenditure" spending, he says, adding that Chevron's diversified operations across the energy chain provide some stability.

Chevron hiked its quarterly dividend by 6% in January to $1.42 a share. It's annual payout is expected to hit $5.97 a share in 2023, up 5%, with a payout ratio at 35% of earnings.

More appealing for its yield is Philip Morris International $(PM)$. Shares of the tobacco maker offer 5.2% and have notched a 3.7% total return this year. The company recently raised its quarterly payout by about 2%, or two cents, to $1.27 a share.

Philip Morris sells its products overseas, where declining tobacco use and regulation aren't as much of an overhang as in the U.S. Its IQOS heated tobacco device, sold abroad for now, brought in 29% of revenue last year. The company aims to nearly double that by 2025. "You are getting paid to wait with that 5% yield," says Huber, who owns the stock.

Investors shouldn't overlook stocks with low yields but rising payouts and solid core businesses, too.

Insurance brokerage Marsh & McLennan, for one, yields just 1.5%. But its dividend is growing at a good clip. The company boosted it in July by about 10%, to 59 cents a share, or $2.36 annualized.

Marsh doesn't have heavy capex needs, a big drain on cash for many industrial companies and those in other sectors. Barclay cites Marsh's steady revenue gains as supportive of the dividend, which is expected to rise. It will hit $2.45 in 2023, according to consensus estimates, with a payout ratio at a comfortable 33%.

Marsh's stock is down 9.6%, including dividends, this year. That's a good showing against the S&P 500 financials sector, off 17.7%. Marsh has proved resilient in recessions, growing earnings per share in all economic contractions going back to 1952, CEO Daniel Glaser told investors in July. Factors supporting its growth include inflation, which helps insurance pricing, and higher rates, which benefit its fiduciary income and profitability.

The beaten-down tech sector also has some attractive dividend stocks. One that Barclay likes is Microsoft $(MSFT)$, a fund holding since 2004, when the software giant first started paying a dividend. True, Microsoft shares yield a meager 1.1%. But the payout has been climbing steadily, including a 10% hike this past week to 68 cents a quarter.

Most investors don't own Microsoft for its dividend, instead looking for it to provide capital gains from areas like videogames and enterprise software. The shares are off about 27% this year, largely matching the tech sector's slide. Still, Barclay likes the long-term setup. "When you step back and look at the earnings and cash flow, they continue to grow, " he says.

Two more defensive picks to consider: Medical-device company Becton Dickinson $(BDX)$ and health insurer Elevance Health (ELV). Huber likes both for their "defensive growth" business models, he says.

Becton, yielding 1.4%, is up a hair this year, including its dividends. The company hiked its quarterly payout by 5%, to 87 cents a share, late last year. Shareholders should get another increase later in 2022.

Elevance yields 1.1% but raised its quarterly by 13% this year, to $1.28 a share. At about $475, the stock goes for 15 times estimated 2023 earnings and has "room for multiple expansion," says Huber. Its dividend should expand, too, nothing to sneeze at in a downbeat market.