- Oil prices add to inflation woes post-OPEC+ output cut

- U.S. weekly jobless claims increase more than expected

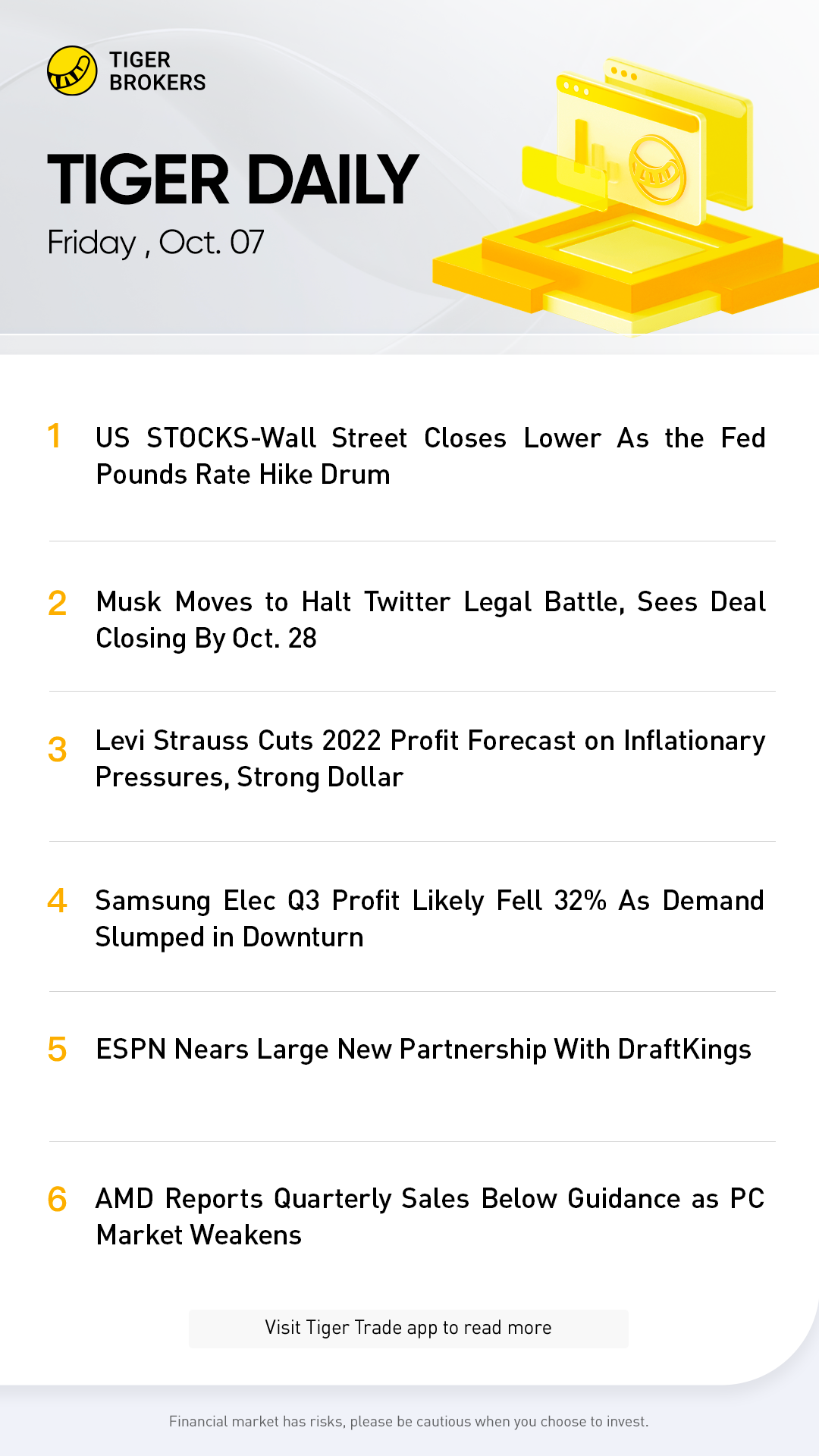

- Indexes fall: Dow down 1.15%, S&P 1.02%, Nasdaq 0.68%

Wall Street's major indexes closed lower on Thursday as concerns mounted ahead of closely watched monthly nonfarm payrolls numbers due on Friday that the Federal Reserve's aggressive interest rate stance will lead to a recession.

Markets briefly took comfort from data that showed weekly jobless claims rose by the most in four months last week, raising a glimmer of hope the Fed could ease the implementation since March of the fastest and highest jump in rates in decades.

The equity market has been slow to acknowledge a consistent message from Fed officials that rates will go higher for longer until the pace of inflation is clearly slowing.

Chicago Fed President Charles Evans was the latest to spell out the central bank's outlook on Thursday, saying policymakers expect to deliver 125 basis points of rate hikes before year's end as inflation readings have been disappointing.

"The market has been slowly getting the Fed's message," said Jason Pride, chief investment officer for private wealth at Glenmede in Philadelphia.

"There's a likelihood that the Fed with further rate hikes pushes the economy into a recession in order to bring inflation down," Pride said. "We don't think the markets have fully picked up on this."

Pride sees a mild recession, but in the average recession there has been a 15% decline in earnings, suggesting the market could fall further. The S&P 500 has declined 22% from its peak on Jan. 3.

Despite the day's decline, the three major indexes were poised to post a weekly gain after the sharp rally on Monday and Tuesday.

The labor market remains tight even as demand begins to cool amid higher rates. On Friday the nonfarm payrolls report on employment in September will help investors gauge whether the Fed alters its aggressive rate-hiking plans.

Money markets are pricing in an almost 86% chance of a fourth straight 75 basis-point rate hike when policymakers meet on Nov. 1-2.

To be clear, not everyone foresees a hard landing.

Dave Sekera, chief U.S. market strategist at Morningstar Inc , said growth will remain sluggish for the foreseeable future and likely will not start to reaccelerate until the second half of 2023, but he does not see a sharp downturn.

"We're not forecasting a recession," Sekera said. "The markets are looking for clarity as to when they think economic activity will reaccelerate and make that sustained rebound.

"They're also looking for strong evidence that inflation will begin to really trend down, moving back towards the Fed's 2% target," he said.

Ten of the 11 major S&P 500 sectors fell, led by a 3.3% decline in real estate. Other indices also fell, including semiconductors, small caps and Dow transports. Growth shares fell 0.76%, while value dropped 1.18%.

Energy was the sole gainer, rising 1.8%.

Oil prices rose, holding at three-week highs after the Organization of the Petroleum Exporting Countries plus its allies agreed to cut production targets by 2 million barrels per day (bpd), the largest reduction since 2020.

The Dow Jones Industrial Average fell 346.93 points, or 1.15%, to 29,926.94, the S&P 500 lost 38.76 points, or 1.02%, to 3,744.52 and the Nasdaq Composite dropped 75.33 points, or 0.68%, to 11,073.31.

Tesla Inc fell 1.1% as Apollo Global Management Inc and Sixth Street Partners, which had been looking to provide financing for Elon Musk's $44 billion Twitter deal, are no longer in talks with the billionaire.

Alphabet Inc closed basically flat after the launch of Google's new phones and its first smart watch.

Volume on U.S. exchanges was 10.57 billion shares, compared with the 11.67 billion average for the full session over the past 20 trading days.

Declining issues outnumbered advancing ones on the NYSE by a 2.32-to-1 ratio; on Nasdaq, a 1.42-to-1 ratio favored decliners.

The S&P 500 posted three new 52-week highs and 31 new lows; the Nasdaq Composite recorded 46 new highs and 118 new lows.