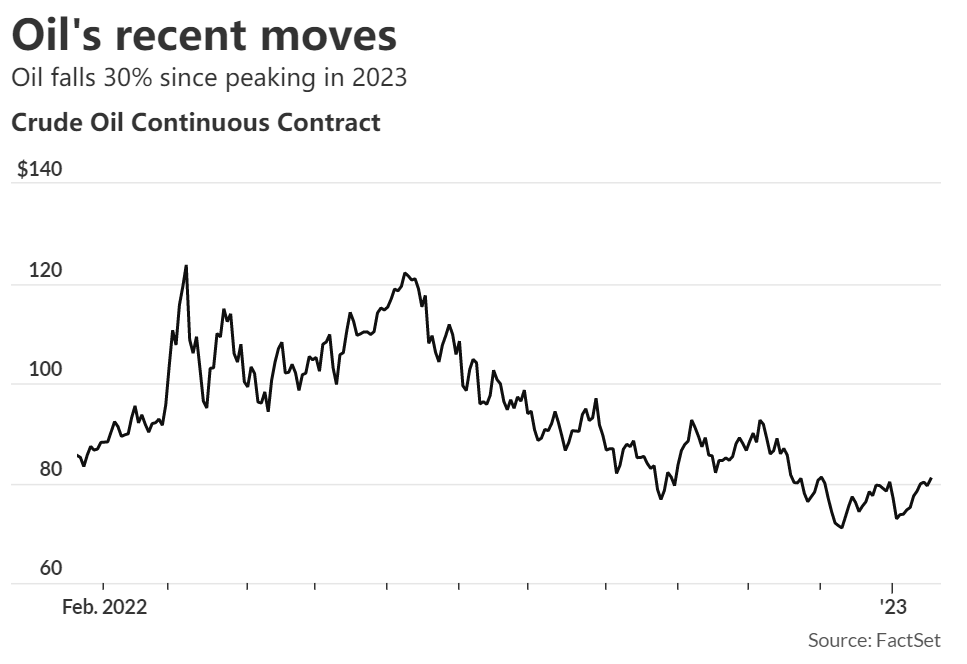

Crude-oil prices are up thus far in 2023, but fund manager Cathie Wood sees a substantial drop in global oil uptake that could result in a powerful swing lower for the fossil fuel.

"We believe that the demand for oil," estimated to be at about 100 million barrels a day, "is going to drop over the next five years" by 30%, Wood said on Thursday during a quarterly seminar for clients of ARK Invest's suite of funds.

That's "because of not only electric vehicles and the increased in electric-vehicle miles," but also autonomous taxi services, Wood predicted, referencing her popular holding, Tesla Inc. (TSLA).

The ARK Invest CEO made the case that crude oil has held its value, on a relative basis, due to a number of factors, including China's gradual reopening from its zero-COVID policies and a replenishment of the U.S. Strategic Petroleum Reserves, which were tapped to help mitigate the growing costs of oil last year.

"We could be talking $50 [a barrel]," Wood said.

Wood's exchange-traded funds were once darlings of the post-COVID-19 speculative boom on Wall Street. The flagship ARK Innovation (ARKK) fund rose around 150%during 2020 and helped to burnish Wood's reputation, but a rapid rise in interest rates has helped to capsize her growth-focused investing strategy. ARK Innovation ended 2022 down nearly 67%, after falling 24% in 2021.

The flagship fund is currently enjoying a pop, up over 11% year to date. By comparison, the Dow Jones Industrial Average is up 0.5%, the S&P 500 index has gained 1.6% and the technology-heavy index Nasdaq Composite Index is up 3.7%.