- Baker Hughes falls on missing Q4 profit estimates

- Activist investor Elliott Management takes stake in Salesforce

- Chips surge on Barclay's upgrade

- Indexes up: Dow 0.76%, S&P 1.19%, Nasdaq 2.01%

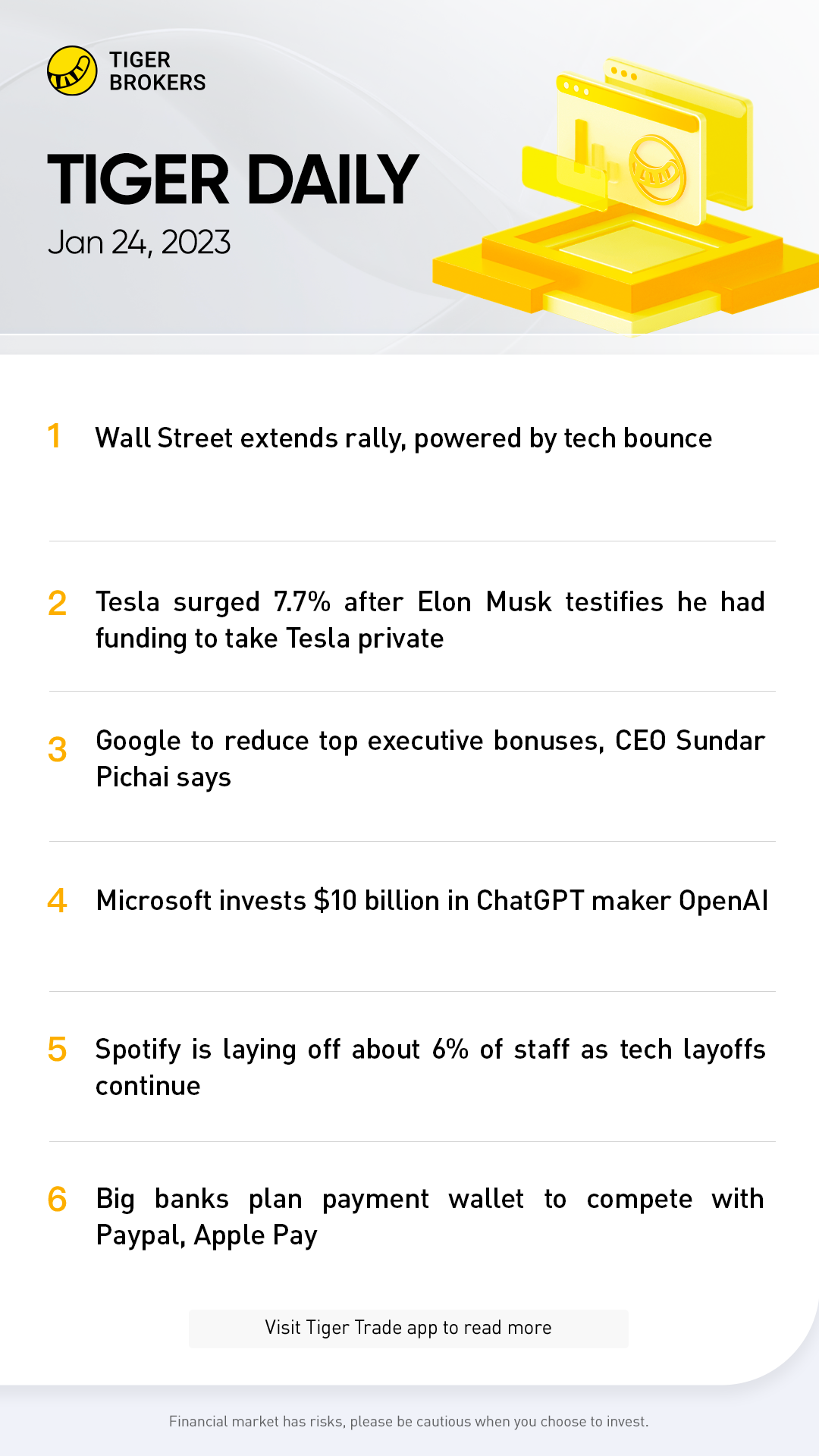

Wall Street closed sharply higher on Monday, fueled by surging technology stocks as investors began an earnings-heavy week with a renewed enthusiasm for market-leading momentum stocks that were battered last year.

All three major stock indexes extended Friday's gains, with the tech-heavy Nasdaq leading the pack, boosted by semiconductor shares .

"(Chips are) a group that's been depressed, so I’m not too surprised," said Peter Tuz, president of Chase Investment Counsel in Charlottesville, Virginia. "We're going to see earnings from these companies over the next couple of weeks and that will be where the rubber meets the road."

"It’s a group that was ripe for a rebound."

The session marks a calm before the storm in a week jam-packed with high profile earnings reports and back-end loaded with crucial economic data.

Investors are all but certain the Federal Reserve will implement a bite-sized interest rate hike next week even as the U.S. central bank remains committed to taming the hottest inflationary cycle in decades.

"(Investors) are pretty comfortable that they’re going to see lower rate hikes from the Fed, that we are rounding the corner on inflation and interest rate hikes," Tuz added. "Stocks can do well in that environment, especially the big growth stocks that drive the market."

Financial markets have priced in a 99.9% likelihood of a 25 basis point hike to the Fed funds target rate at the conclusion of its two-day monetary policy meeting next Wednesday, according to CME's FedWatch tool.

The Dow Jones Industrial Average rose 254.07 points, or 0.76%, to 33,629.56, the S&P 500 gained 47.2 points, or 1.19%, to 4,019.81 and the Nasdaq Composite added 223.98 points, or 2.01%, to 11,364.41.

Of the 11 major S&P 500 sectors, all but energy ended green, with tech shares enjoying the largest percentage gain, up 2.3% on the session.

The fourth-quarter reporting season has shifted into overdrive, with 57 of the companies in the S&P 500 having posted results. Of those, 63% have delivered better-than-expected earnings, according to Refinitiv.

Analysts now see S&P 500 fourth-quarter earnings, on aggregate, dropping 3% year-on-year, nearly twice as steep as the 1.6% annual drop seen at the beginning of the year, per Refinitiv.

This week, Microsoft Corp and Tesla Inc, along with a spate of heavy-hitting industrials including Boeing CO, 3M Co, Union Pacific Corp, Dow Inc, and Northrop Grumman Corp, are expected to post quarterly results.

The Philadelphia SE semiconductor index jumped 5.0%, its biggest one-day gain since Nov. 30 after Barclays upgraded the sector to "overweight" from "equal weight."

Tesla surged 7.7% after Chief Executive Elon Musk took the stand in his fraud trial related to a tweet saying he had backing to take the electric automaker private.

Baker Hughes Co missed quarterly profit estimates due to inflation pressures and ongoing disruptions due to Russia's war on Ukraine. The oilfield services company's shares dipped 1.5%.

Cloud-based software firm Salesforce Inc jumped 3.1% following news that activist investor Elliot Management Corp has taken a multi-billion dollar stake in the company.

Spotify Technology SA joined the growing list of tech-related companies to announce impending job cuts, shedding 6% of its workforce as rising interest rates and the looming possibility of recession continue to pressure growth stocks. The music streaming company's shares rose 2.1%.

On the economic front, the U.S. Commerce Department is expected to unveil its initial "advance" take on fourth-quarter GDP on Thursday, which analysts expect to land at 2.5%.

On Friday, the wide-ranging personal consumption expenditures (PCE) report is due to shed light on consumer spending, income growth, and crucially, inflation.

Advancing issues outnumbered declining ones on the NYSE by a 2.77-to-1 ratio; on Nasdaq, a 1.73-to-1 ratio favored advancers.

The S&P 500 posted 11 new 52-week highs and no new lows; the Nasdaq Composite recorded 82 new highs and 19 new lows.

Volume on U.S. exchanges was 11.99 billion shares, compared with the 10.62 billion average over the last 20 trading days.