The tail end of fourth-quarter earnings season and several economic indicators will be this week's highlights. With roughly 35 companies left to report, S&P 500 earnings are down more than 3% from the same period a year ago, according to Refinitiv.

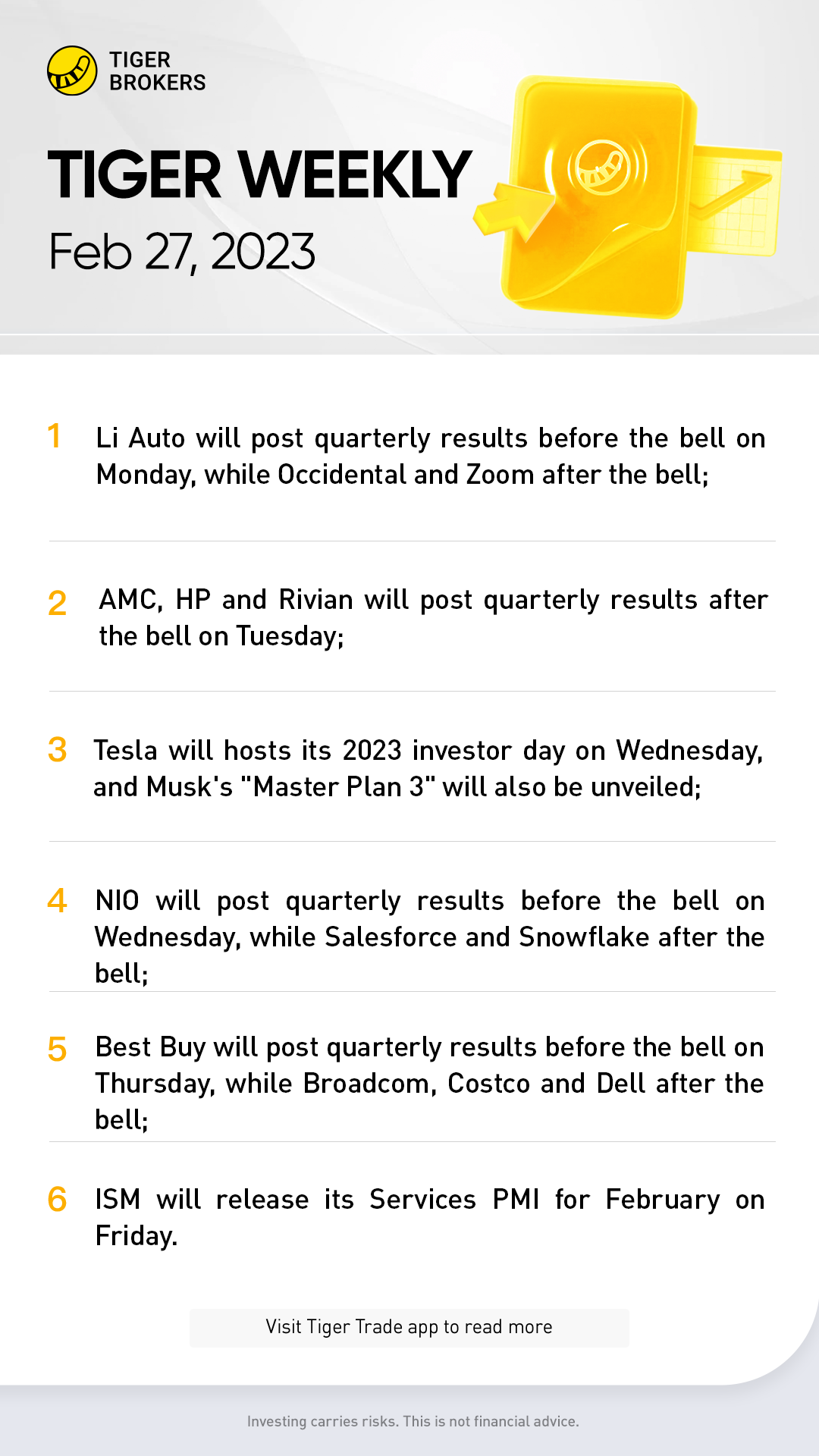

Occidental Petroleum, Workday, and Zoom Video Communications will publish their latest results on Monday, followed by AutoZone, Monster Beverage, Norwegian Cruise Line Holdings, and Target on Tuesday. Dollar Tree, Lowe's, Salesforce, and Snowflake will go next on Wednesday, then Best Buy, Broadcom, Costco Wholesale, and Kroger report on Thursday.

Investor days this week will include events from Chevron and Goldman Sachs Group on Tuesday. Tesla may unveil a new, sub-$30,000 model on Wednesday.

Economic data out this week starts with the Census Bureau's durable-goods report for January on Monday. That's often seen as a decent proxy for business investment. On Tuesday, the Conference Board will release its Consumer Confidence Index for March. That's expected to continue an upward trend.

The Institute for Supply Management will publish the Manufacturing Purchasing Managers' Index for February on Wednesday, followed by the Services equivalent on Friday. The former is expected to hold roughly steady from the prior month, while the latter is seen declining but remaining in expansion territory.

Monday 2/27

Occidental Petroleum, Workday, and Zoom Video Communications report quarterly results.

The Census Bureau releases the durable-goods report for January. Economists think that new orders for manufactured durable goods declined 3%, to $278 billion.

Tuesday 2/28

AutoZone, Agilent Technologies, Bank of Montreal, Bank of Nova Scotia, HP Inc., Monster Beverage, Norwegian Cruise Line Holdings, Ross Stores, Sempra Energy, and Target announce earnings.

Chevron and Goldman Sachs Group hold their 2023 investor days.

The Conference Board releases its Consumer Confidence Index for February. The consensus estimate is for a 109.2 reading, slightly higher than January's. The index has rebounded from the 2022 low in July, buoyed by a strong labor market. In January, nearly half of respondents said that jobs were "plentiful," while only 11.3% said that jobs were "hard to get."

S&P CoreLogic releases its Case-Shiller National Home Price Index for December. Expectations are for home prices to show a 4.9% increase, year over year, following a 7.7% gain in November. Annualized home-price growth peaked at a record 20.8% last March and has decelerated every month since then.

The Institute for Supply Management $(ISM)$ releases its Chicago Business Barometer for February. The consensus call is for a 45 reading, roughly even with the January data. The index has had five consecutive monthly readings below 50, indicating a contracting economy, but this hasn't shown up in the gross-domestic-product data, with fourth-quarter GDP growing at a seasonally adjusted annual rate of 2.7%.

Wednesday 3/1

Tesla hosts its 2023 investor day at its Gigafactory in Austin, Texas. The company will unveil CEO Elon Musk's "Master Plan 3," geared to achieving very large scale in vehicle and battery production. Analysts expect Musk to announce Tesla's cheapest model yet, starting at less than $30,000.

Dollar Tree, Lowe's, Royal Bank of Canada, Salesforce, and Snowflake release quarterly results.

ISM releases its Manufacturing Purchasing Managers' Index for February. Economists forecast a 47.9 reading, in line with the January figure. The index has been below the expansionary level of 50 since November.

Thursday 3/2

Anheuser-Busch InBev, Best Buy, Broadcom, Costco Wholesale, Dell Technologies, Hewlett Packard Enterprise, Hormel Foods, Kroger, Marvell Technology, and Toronto-Dominion Bank hold conference calls to discuss earnings.

Friday 3/3

ISM releases its Services PMI for February. Expectations are for a 54.5 reading, about one point less than previously. The services sector has held up better than the manufacturing sector, as there is still pent-up demand from pandemic restrictions.