- U.S. Treasury yields slip after rally

- Seagen surges on Pfizer-buyout report

- Union Pacific jumps as CEO to step down

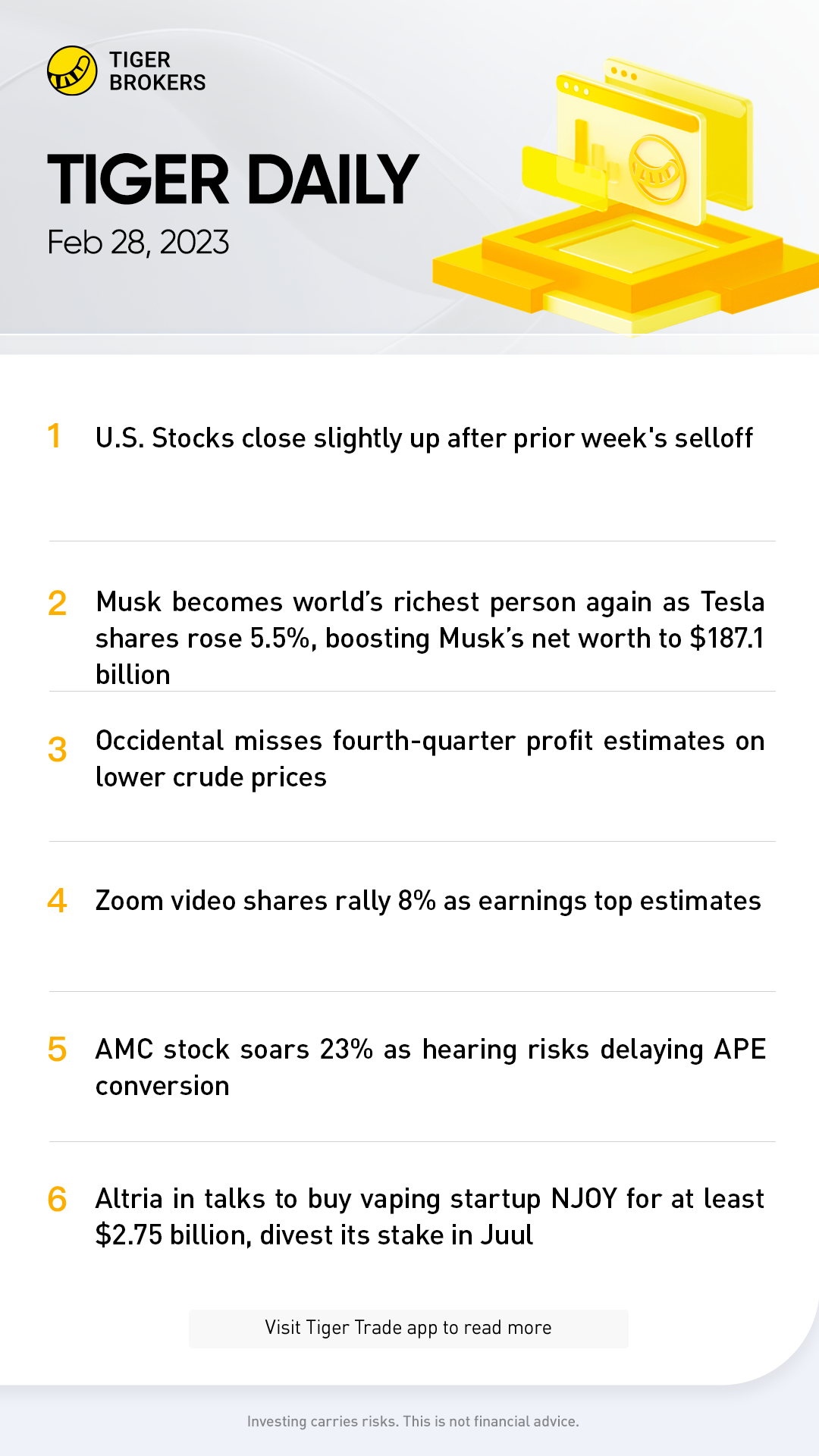

- Dow up 0.22%, S&P 500 up 0.31%, Nasdaq up 0.63%

NEW YORK, Feb 27 (Reuters) - U.S. stocks eked out a slight gain on Monday as investors engaged in some bargain hunting after last week's losses, the biggest percentage declines of 2023 for Wall Street's main benchmarks, as jitters persisted about coming interest rate hikes to tame stubbornly high inflation.

All three main stock indexes climbed more than 1% shortly after the opening bell, in part due to an easing in Treasury yields, and all three closed well off their session highs.

Stocks steadily gave up gains throughout the session as U.S. Treasury yields moved off the day's lows.

"On the heels of the worst week of the year, first three-week losing streak for the S&P since December, a little green is a welcome change but again the reality is market participants are trying to square the circle with exactly how long the Fed will leave rates high, and is a 50 basis point hike really on the table at the next meeting," said Ryan Detrick, chief market strategist at Carson Group in Omaha, Nebraska.

"It’s led to a good deal of uncertainty, and we have seen that when there is uncertainty there can be selling and volatility."

The Dow Jones Industrial Average rose 72.17 points, or 0.22%, to 32,889.09, the S&P 500 gained 12.2 points, or 0.31%, to 3,982.24 and the Nasdaq Composite added 72.04 points, or 0.63%, to 11,466.98.

Last week, the Dow Industrials fell by the biggest weekly percentage since September, and the S&P 500 and Nasdaq each had their biggest weekly percentage fall since December as economic data and comments from U.S. Federal Reserve officials heightened expectations the central bank will become more aggressive in raising interest rates.

Economists at UK-based banks Barclays and NatWest believe the Fed could ramp up the pace of its interest-rate rises in March with a half-point hike. Morgan Stanley said it no longer sees a cut by the Fed this year and expects a slower pace of 25 basis points when the central bank does begin lowering rates.

Fed funds futures show traders are pricing in a third 25 bps hikes this year and see rates peaking at 5.4% by September.

Fed Governor Philip Jefferson said he had "no illusion" inflation would quickly fall back to target and was committed to keeping restrictive monetary policy in place for as long as needed.

Data showed new orders for key U.S.-made capital goods increased more than expected in January while shipments of core goods rebounded, suggesting that business spending on equipment picked up.

Easing yields helped growth stocks rebound 0.63% while Tesla jumped 5.46% after the electric automaker said its plant in Brandenburg near Berlin was producing 4,000 cars a week, three weeks ahead of schedule according to a recent production plan reviewed by Reuters.

Seagen Inc surged 10.40% after the Wall Street Journal reported that Pfizer was in early talks to acquire the biotech firm. Pfizer's shares dipped 2.32%.

U.S. railroad operator Union Pacific climbed 10.09% as Chief Executive Lance Fritz said he would step down. Hedge fund Soroban Capital Partners had called for his ouster.

Advancing issues outnumbered declining ones on the NYSE by a 1.69-to-1 ratio; on Nasdaq, a 1.41-to-1 ratio favored advancers.

The S&P 500 posted 4 new 52-week highs and 8 new lows; the Nasdaq Composite recorded 71 new highs and 102 new lows.

Volume on U.S. exchanges was 9.89 billion shares, compared with the 10.72 billion average for the full session over the last 20 trading days.