'Trading any speech is tough, so I'd be reacting and not anticipating,' analyst says

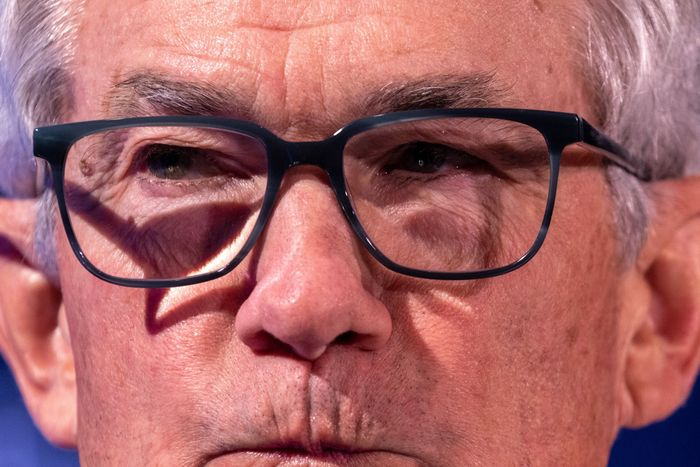

The stock market's bounce back from last year's carnage will be again put to the test as investors closely listen to Federal Reserve Chairman Jerome Powell's testimony before Congress this week for clues to just how high interest rates need to go to win the fight against inflation.

Powell will deliver the latest semiannual report on monetary policy and the economy on Tuesday to the Senate Banking Committee and on Wednesday to the House Financial Services panel. Both hearings begin at 10 a.m. Eastern. Powell's testimony will probably be his last public remarks before the next policy meeting of the Federal Open Market Committee, or FOMC, on March 21-22.

Fundstrat's head of research, Tom Lee, expects Powell to reiterate the "data dependence" message in his speech, affirming market expectations for another 25 basis point increase in the fed-funds rate at the March meeting.

"Many 'inflationistas' are saying a 50-basis-point hike is needed because the January data was so 'hot' -- that is the data reactivity of the bond and stock market, but we expect Powell to emphasize that rates are near neutral now, so there is less of a need to be higher in a hurry and now Fed can be data dependent by the way," wrote Lee, in a Monday note.

Fed-funds futures traders have priced in a 69.4% chance of a 25 basis point rise, and a 30.6% chance of a 50 basis point increase, according to the CME FedWatch tool. Traders had seen only a 3.3% chance of a 50 basis point rise a month ago.

A run of stronger-than-expected economic data that began in early January, including the January inflation report which showed prices were not moderating as fast as the Fed would like, and robust employment data, has forced financial-market investors to rethink the Fed's path and bet on bigger rate hikes in its next policy meeting.

Fed policy makers stepped down to a 25 basis-point increase last month after a half-point move in December and four jumbo 75 basis-point rate increases last year.

St. Louis Fed President James Bullard and Cleveland Fed President Loretta Mester both said last month that they had supported a 50-basis-point hike at the Jan. 31-Feb. 1 meeting. Minutes of the meeting showed that a "few" policy makers had backed the bigger move. Neither Bullard nor Mester are voting members of the FOMC in 2023.

Fed policy makers may be particularly reluctant to boost the size of rate increases after downshifting at the last meeting, analysts said.

"Moving to 50-basis-point would be a sizable change in policy and reversal of the slowing and frankly, would be viewed as undermining Fed credibility," wrote Lee.

Chris Weston, head of research at Australia-based brokerage Pepperstone, said in a note on Sunday that Powell will "likely defend the Fed's actions" and "likely make out they are going to do everything they can to bring down inflation to target."

However, given the fact that both the market and Fed are living data point to data point, Weston said they are still "flying blind" until they get February nonfarm payroll data on Friday and the February consumer-price index on Feb. 13, which, in theory, could result in them targeting a terminal rate "north of 6% and require 50-basis-point increments" to get them there in a quicker fashion, said Weston.

"The market is expecting some movement from his words, but trading any speech is tough, so I would be reacting and not anticipating," Weston added.

Economists surveyed by The Wall Street Journal expect February payrolls to have grown by 225,000. However, economists at Wall Street banks such as Deutsche Bank and Jefferies, see the figure coming in way above consensus estimates.

U.S. stocks finished mostly higher on Monday, with the S&P 500 and the Dow Jones Industrial Average each rising around 0.1%. The Nasdaq Composite shed 0.1%. Last week, the Dow Industrials rose 1.7% for the week and snapped a four-week losing streak. The S&P 500 gained 1.9%, while the technology-heavy Nasdaq advanced 2.6%, according to Dow Jones Market Data.