Lottery-type stocks like GameStop, AMC Entertainment and Bed Bath & Beyond have delivered speculative gains but typically underperform the market.

The odds remain stacked against GameStop, even with the unexpected profit the company reported earlier this week.

That's because GameStop $(GME)$, at its now much-higher stock price, is just as overvalued as it was before, if not more so. Its share price has been pushed higher in no small part by speculators who are attracted to the stock's lottery-type trading characteristics. Stocks with similar characteristics tend to underperform the market, on average.

In labeling GameStop a lottery-type stock, I'm referring to its past returns. The stock has what statisticians call a long right-hand tail -- representing the small chance of winning big, like a lottery. To illustrate, consider GameStop's daily returns over the month leading up to its latest earnings report. Its average daily percentage change over that period was a loss of 0.7%, with no daily return greater than 5.1%. But in the trading session following the earnings report, the stock jumped 35.2%.

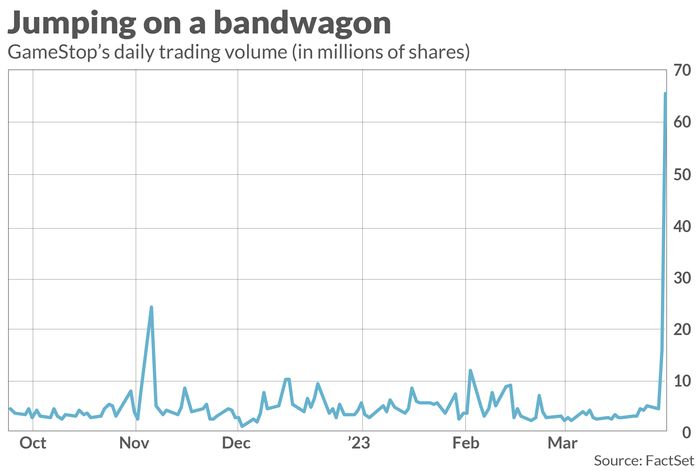

Speculators piled into the stock in a big way, as you can see from the accompanying chart. In contrast to an average daily trading volume over the prior six months of 4.6 million shares, volume jumped to more than 65 million on the day after the earnings report.

Many of the speculators who propelled GameStop's stock higher have no interest in the company's long-term turnaround prospects. They instead piled into the stock in hopes of winning big on a short-term trade. To that extent, the stock's price will be higher than is justified by the company's fundamentals, and therefore overvalued. This is one reason, according to a recent study circulated by the National Bureau of Economic Research, lottery-type stocks proceed to underperform the market, on average.

This tendency may have already begun with GameStop. In after-hours trading the same day in which its trading volume skyrocketed, the stock was trading for 5% less than its volume-weighted average price during the day session.

A stock acquires lottery-like characteristics because of a feedback loop involving volatility, investor attention, and social media.

The NBER study, entitled "Attention, Social Interaction, and Investor Attraction to Lottery Stocks," was conducted by Turan Bali of Georgetown University; David Hirshleifer of the University of Southern California; Lin Peng of Baruch College; and Yi Tang of Fordham University. The researchers found that a stock acquires lottery-like characteristics because of a feedback loop involving its volatility, investor attention, and social interactions via channels such as social media.

What happens is a stock with relatively dull day-to-day trading will suddenly come to life. Its huge one-day gain will attract the attention of speculative traders looking for more, pushing the stock even higher --at least temporarily. Social media then catches on, causing the stock to become even more volatile and attracting even more attention. Notice that this feedback loop has nothing to do with a stock's underlying net worth.

Further evidence of this feedback loop is provided by the jumps in other meme stocks in the immediate wake of GameStop's unexpected profit. AMC Entertainment $(AMC)$and Bed Bath & Beyond $(BBBY)$soared in concert, for example. Yet GameStop's surprisingly good earnings have nothing to do with the prospects for either of these other two companies. Apparently, the only reason their stocks rallied along with GameStop is because they too are lottery-type stocks and speculators are interested in a quick profit.

Investors -- as opposed to gamblers -- should be on their guard.