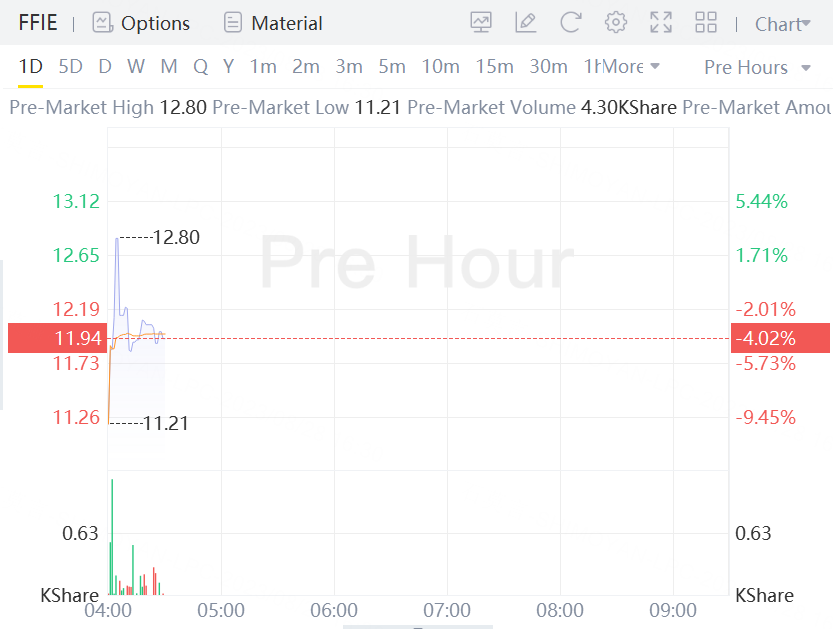

Shares of electrical-vehicle maker Faraday Future Intelligent Electric dropped 4% in premarket trading on Monday, following news the company will effect a 1-for-80 reverse share split after the close of trading.

The stock was recently down almost 15.95% at 15 cents on Friday, a three-month low. The stock opened at 18 cents and was trading as high as 20 cents before news of the reverse split.

The company shares will begin trading on a reverse-split adjusted basis on Monday.

In a filing last month, Faraday said the purpose of the reverse split was to increase the market price of Class A common shares and mitigate the risk of the stock being delisted from the Nasdaq. The stock last traded at $1 in February, according to FactSet.

"Delisting of the common stock by Nasdaq may hinder the company's ability to raise financing and may result in the company having to file for bankruptcy," Faraday said.

The company was taken public in July 2021 following a deal with special purpose acquisition company Property Solutions Acquisition Corp.

It has a market cap of $275.29 million, 1.42 billion shares outstanding and a public float of 1.38 billion shares.