Apple Inc. continued its streak of revenue declines into a fourth consecutive quarter, beating overall sales expectations but coming up short in China.

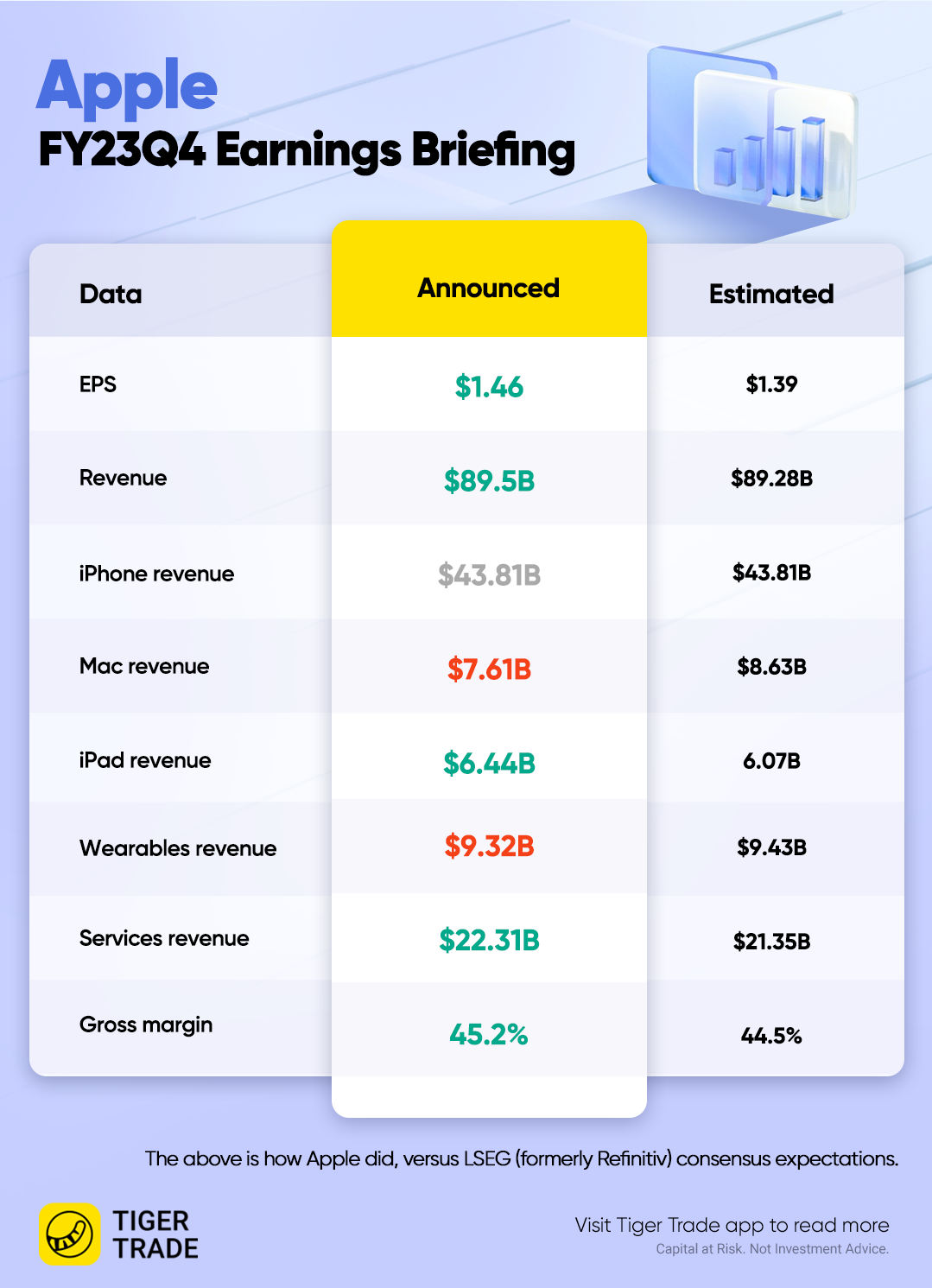

The company had seen revenue fall on a year-over-year basis during each of the previous three quarters, and it posted $89.5 billion for the fiscal fourth quarter Thursday, down from $90.1 billion a year before. Analysts were modeling $89.3 billion.

Will Apple $(AAPL)$ be able to generate revenue growth in the holiday quarter? Management left that up in the air, with Chief Financial Officer Luca Maestri saying that the company expects a "similar" revenue total in the December quarter relative to a year ago.

That guidance didn't seem to match Wall Street's hopes. Consensus expectations were for $123.1 billion in December-quarter revenue, whereas the company posted $117.2 on the top line in that same period a year before.

Apple shares were off 2.8% in late trading following the earnings call.

While the company expects iPhone revenue to grow on a year-over-year basis, iPad and wearables revenue could "decelerate significantly from the September quarter due to a different timing of product launches," according to Maestri.

He noted that last year's December quarter benefited from an extra week, while this year's could see a 1-percentage-point negative impact from foreign exchange.

For the September quarter, Apple $(AAPL.UK)$ reported iPhone revenue of $43.8 billion, up from $42.6 billion a year before, matching the FactSet consensus. The September quarter included just over a week's worth of sales of the new iPhone 15 lineup, which came out amid investor concerns about spending trends and China competition.

Overall Greater China revenue came in at $15.1 billion relative to $15.5 billion a year before, whereas analysts were projecting $16.8 billion.

Chief Executive Tim Cook said on the earnings call that while the iPhone business hit a September-quarter revenue record in mainland China, Macs and iPads weighed on performance as year-ago numbers benefited from pent-up sales following earlier factory disruptions.

Overall Mac revenue fell to $7.6 billion from $11.5 billion a year earlier, while iPad revenue dropped to $6.4 billion from $7.1 billion. The FactSet consensus was for $8.5 billion and $6.2 billion, respectively.

While Maestri called out the tough comparisons to a year-earlier period driven by pent-up demand, he also noted "challenging market conditions" for the Mac.

Wearables, home and accessories revenue came in at $9.3 billion, down from $9.7 billion a year before. Analysts were looking for $9.5 billion.

The company saw services revenue grow to $22.3 billion from $19.2 billion and exceed the FactSet consensus, which was for $21.4 billion.

"From a category standpoint, literally, we set records in each one of the big categories," Maestri said of the services business. "We had all-time records for App Store, for advertising, for cloud, video, Apple Care, payments and a September-quarter record for music."

Net income for the September quarter was $23.0 billion, or $1.46 a share, compared with $20.7 billion, or $1.29 a share, a year before. Analysts were looking for $1.39 a share in earnings.

The stock is up 36% so far this year, while the Dow Jones Industrial Average DJIA has gained about 1%.