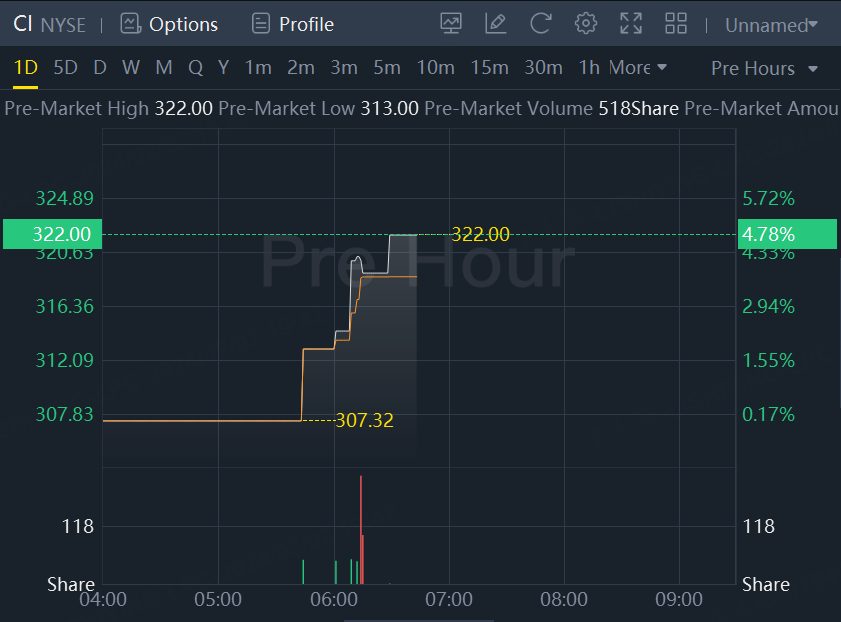

Feb 2 (Reuters) - Health insurer Cigna Group raised its 2024 profit forecast on Friday after lower-than-expected medical costs and strong demand in its pharmacy benefit management unit helped it beat fourth-quarter profit estimates, sending its shares up nearly 5% in premarket trading.

The company now expects full-year profit to be at least $28.25 per share, compared with earlier forecast of at least $28. Analysts estimate $28.29 per share in 2024 profit.

The raised forecast is in contrast to a warning from Humana that higher costs due to increased care will hit its 2024 and 2025 profit. Humana is a large player in the market for Medicare Advantage (MA) plans for adults aged 65 and above.

Cigna, however, has a lesser presence in the MA market, compared to Humana and UnitedHealth, both of which flagged an increase in medical procedures in the fourth quarter.

Cigna's medical care ratio, the percentage of premiums spent on medical care, came in at 82.2% in the quarter ended Dec. 31, below LSEG estimates of 84.2%.

The health insurer said higher pricing of some of its plans helped to keep its costs under check.

For 2024, the company forecast medical care ratio between 81.7% and 82.7%, compared with analysts' estimate of 81.93%.

Cigna reported a 35% jump in profit to $6.79 per share on an adjusted basis in the fourth quarter, beating analysts' estimate by 25 cents.

Adjusted sales in the company's Evernorth unit, under which it operates pharmacy benefit management business, jumped 12% to $40.52 billion.

Pharmacy benefit managers (PBMs) act as intermediaries between drugmakers and insurers. They get after-market discounts from drugmakers to add treatments to the lists they recommend to insurers and companies offering coverage for employees.

Cigna shareholder's net income fell to $1.03 billion in the quarter, from $1.19 billion a year earlier, mainly due to loss on sale of businesses and a deferred tax benefit.