The world’s largest market capitalization company, Nvidia Corp (NASDAQ:NVDA), will report its September quarter earnings on Wednesday, Nov. 20. The street is keenly waiting for the company to report its financials as its shares have risen 191% year-to-date but declined by 2.5% over the last month.

On a year-to-date basis, Nvidia has outperformed the Nasdaq 100 Index, which grew by 24%, whereas, the technology company has underperformed the index in the last month, following Nasdaq 100’s growth of 0.87%.

What Happened: While many analysts expect good results from the chipmaker, technical analyst, and chief investment officer at NeoTrader, Dr C.K. Narayan says that “the trend is resolute in Nvidia charts.” He expects the stock to trade upwards of $140 per share if the third-quarter financials beat the street expectations.

#NVDA Tomorrow is big day as NVDA reports. The trend is resolute in NVDA no doubt, but I espy some supply emerging at 140+ levels in the stock. So, good numbers will have to beat Street expectations for the trend to continue. Depends on what is baked in already. pic.twitter.com/vQDcoIGQ2F

— Dr.C.K.Narayan (@CK_Narayan) November 19, 2024

Earnings Expectations

Nvidia, led by Jensen Huang has forecasted third-quarter revenue of approximately $32.5 billion, driven by strong demand for its Hopper and Blackwell GPUs.

These GPUs are expected to bolster Nvidia's data center segment. The Blackwell units, priced between $30,000 and $40,000, are in high demand, with production ramping up in the fourth quarter of 2024.

Nvidia is fully supply-constrained on new products, which could limit the potential upside for the current quarter and the company’s outlook, said Joseph Moore, a Morgan Stanley analyst. Morgan Stanley maintains Nvidia as a top pick with an ‘overweight’ rating, raising the price target from $150 to $160.

Also read: Nvidia’s Blackwell Chip Revenue Could Hit $6 Billion Next Quarter: Analyst

Historical Nvidia Earnings Data

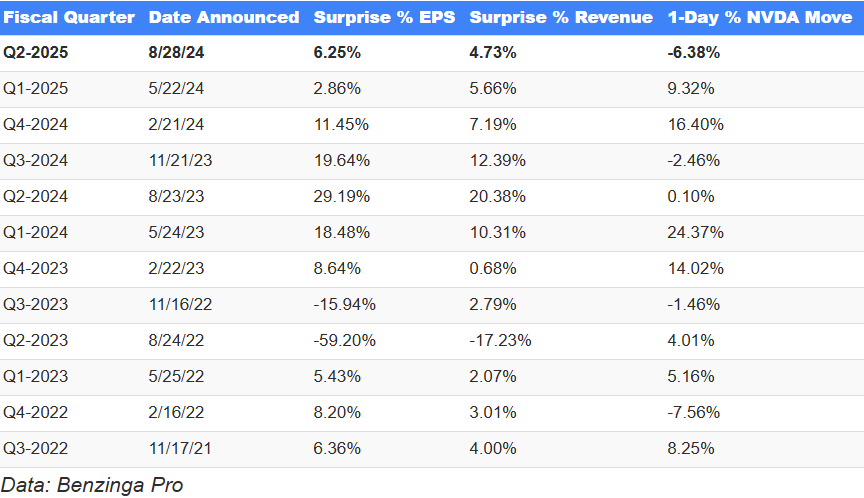

According to a recent Benzinga report and Benzinga Pro data over the last 12 quarters, Nvidia has exceeded earnings-per-share (EPS) expectations 10 times and missed revenue expectations only once.

On average, Nvidia shares moved 5.3% in the single trading day following its earnings release.

The largest 1-day gain followed its first quarter 2024 earnings, when the stock surged 24.4%, while the worst reaction occurred after fourth quarter 2024 results, with a decline of 7.6%.

Here’s a snapshot of the company’s recent earnings performance:

Read next: Why Nvidia Earnings May Trigger Massive S&P 500 Volatility

Image via Shutterstock