Asml Q2: King forever!

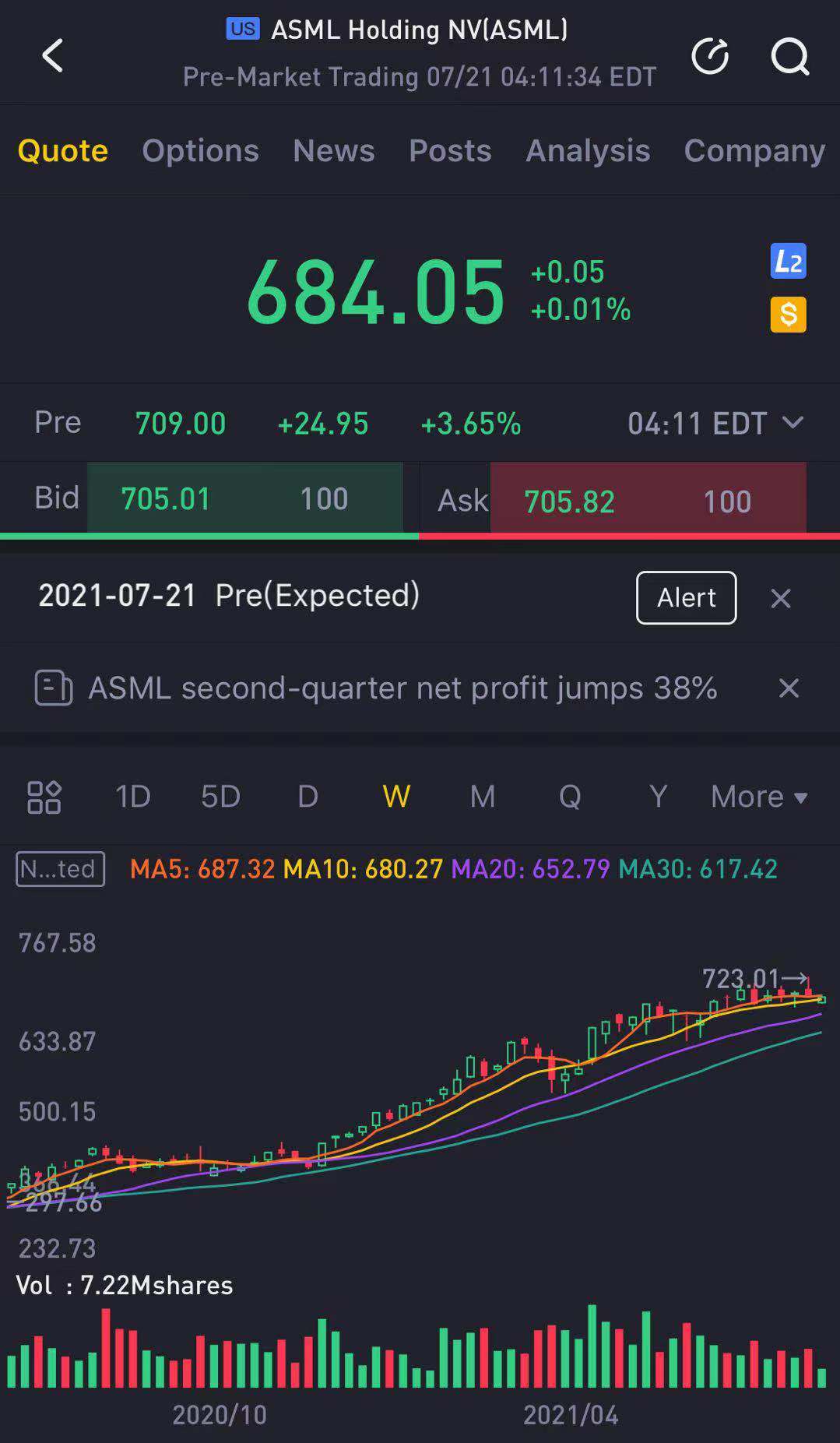

ASML$ASML Holding NV(ASML)$ , the overlord of lithography machine, has just released its second-quarter financial report. Its single-quarter revenue is slightly lower than expected, and its net profit is slightly higher than expected. There is no surprise or shock on the whole.

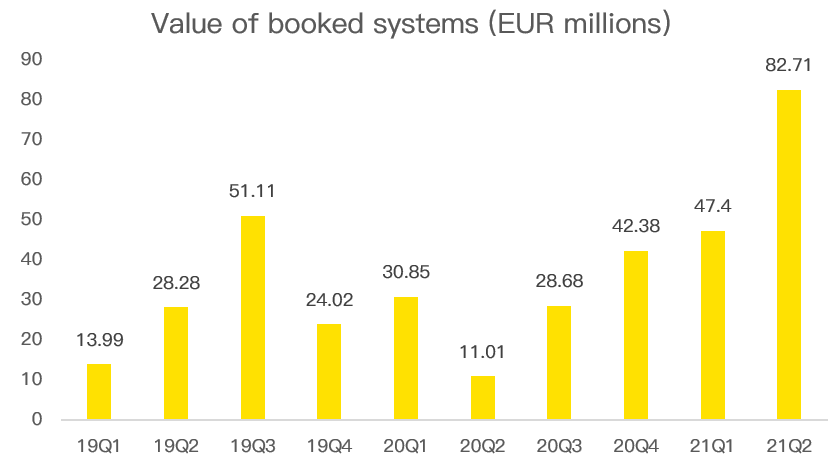

However, there are two exciting figures. One is that the scheduled value of lithography machines has reached 8.27 billion euros, a record, and the total order backlog has reached 17.5 billion euros. The other is that Asml raised its revenue growth rate in 2021 from 30% to 35%!

The situation is excellent, and Asml is almost a king forever!

After the financial report was released, the trading price of Asml in Amsterdam market rose by over 4%!

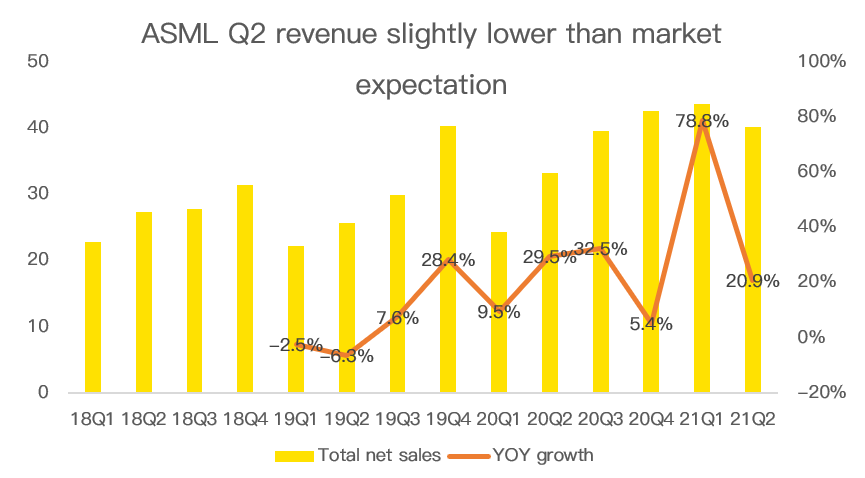

Q2 is slightly lower than market expectations

Asml earned 4.02 billion euros in revenue in the second quarter, up 20.9% year-on-year, which was at the lower limit of the company's guidance range of 4-4.1 billion euros, slightly lower than the market expectation of 4.092 billion euros.

Peter Wennink, CEO, believes that in the second quarter, about 300 million euros of products have not been accepted by the factory, so this part of revenue has been postponed to the third quarter, and Q2 is still a good quarter on the whole.

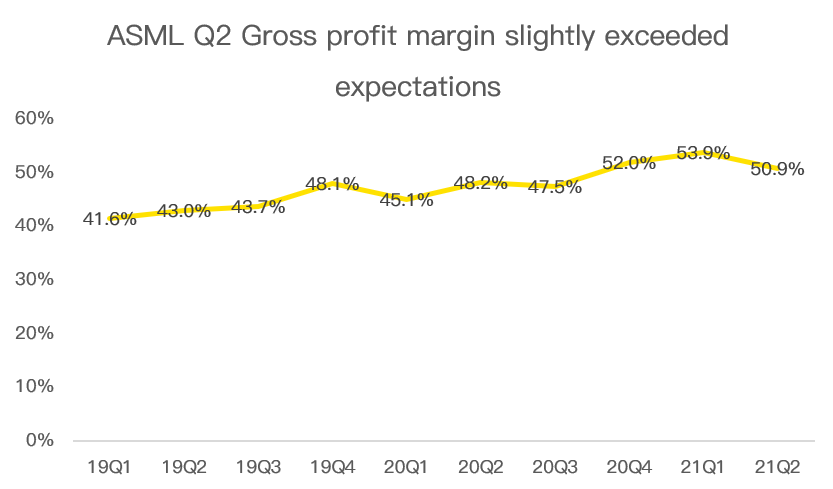

In terms of gross profit margin, it slightly exceeded expectations in the second quarter, achieving 50.9%, exceeding the 49% gross profit margin guideline given by the Company.

The main reason for exceeding expectations is that downstream customers have upgraded their systems and increased their gross profit margin in order to improve productivity. In addition, there are some one-time profit and loss impacts.

Gross profit margin exceeded expectations, which directly increased net profit. The total profit in the second quarter reached 1.038 billion euros, slightly exceeding the market expectation of 1.027 billion euros.

Overall, Q2 data is slightly lower than expected.

The predetermined value of lithography machine has set a historical record!

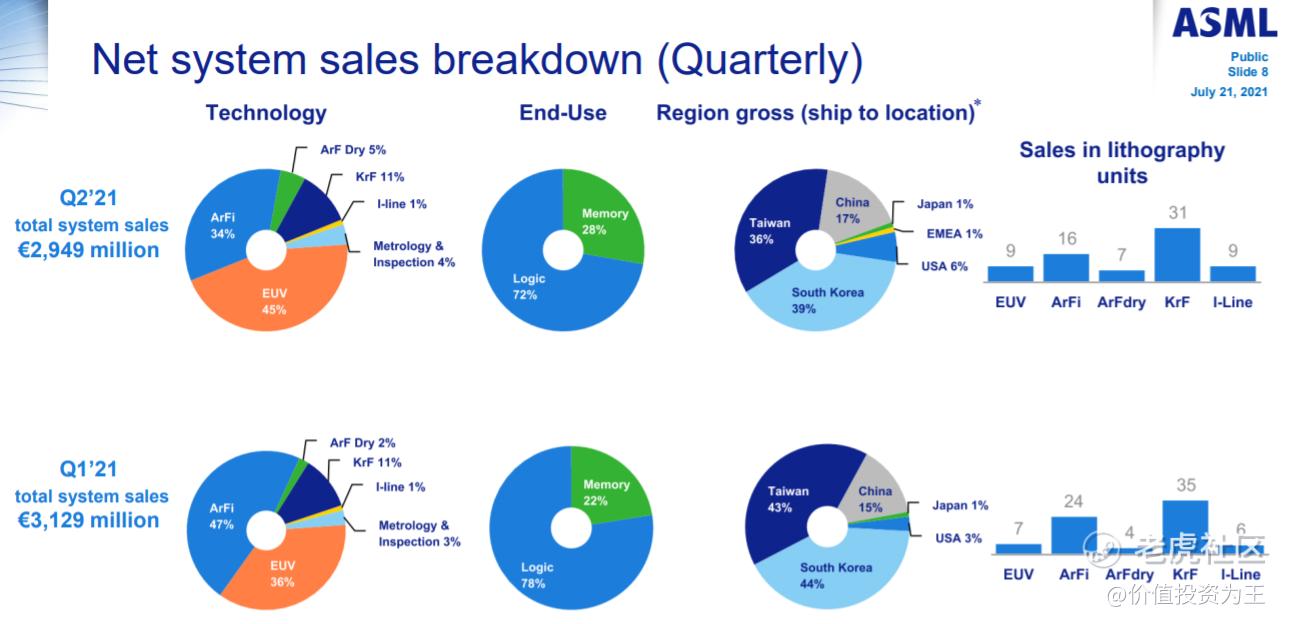

Compared with the bland data of Q2 revenue and net profit, Asml's lithography machine sales set a historical record.

In the second quarter, Asml sold 72 lithography machines, including 9 EUVs, 55 DUVs and 9 UVs.

In terms of the predetermined value of lithography machines, it reached 8.27 billion euros in the second quarter, setting a historical record, and the total order backlog reached 17.5 billion euros! The total number of lithography machines is 167, most of which are EUV.

In order to meet customer demand, ASML plans to increase the production capacity of lithography machines to 55 units in 2022 and over 60 units in 2023, and the predicted market demand exceeds 60 units.

Asml, who is not worried about selling, is a king forever!

Q3 guidance and outlook for 2021 are strong!

Perhaps Q2 performance is bad news for some investors, but judging from Q3 guidance and raising the 2021 revenue forecast, Asml's performance in the second half of the year is still strong.

Specifically, the Q3 performance guidelines given by the Company are as follows:

1. Revenue is expected to be between 5.2 billion and 5.4 billion euros, with a year-on-year growth rate of 31.4%-36.4%;

2. The gross profit margin is between 51% and 52%;

3. The R&D cost is about 645 million euros.

According to Q3 guidance, revenue growth rate and gross profit margin are better than Q2, which is good news.

Benefiting from the strong demand from downstream customers, Asml raised its revenue growth rate in 2021 from 30% to 35% in this quarter's financial report.

Don't worry about future growth!

In the past year, affected by Novel Coronavirus, online demand broke out, driving the semiconductor industry to be in short supply, and Asml downstream customers such as TSMC expanded production one after another.

At present, the industry agrees that the shortage of production capacity will last until 2022.

In the short and medium term, ASML is expected to eat a wave of upgrade dividends by improving product performance. For example, ASML began to ship more advanced EUV NXE: 3600D in the second quarter, which increased the production efficiency by 15%-20% compared with the previous generation 3400C.

At the same time, the more advanced measurement equipment Yieldstar 1385 began shipping, the product is 50% more efficient than the previous generation Yieldstar 1375 production.

Generally speaking, more advanced equipment can be sold at higher prices and have better profitability.

In the long run, benefiting from the explosion of artificial intelligence and high-performance computing demand, the demand for lithography equipment will be supported from a longer period, so there is no need to worry about the future of ASML.

Summary:

Asml Q2's performance revenue was slightly lower than expected, but Q3 guidance was strong and the overall revenue forecast for 2021 was raised, and the future prospects were bright.

Asml has set a new historical record in the predetermined value of lithography machines, and the strong demand is expected to continue until 2022.

In the long run, artificial intelligence and high-performance computing will continue to increase the demand for lithography equipment, and Asml will always be a king!$ASML Holding NV(ASML)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

[微笑] [微笑]

[微笑]

Like for like

就算低于预期,也是王者

[思考] [思考]

[思考]

[思考]