Netflix Earnings Forecast: Will Q1 "Horror" be staged again?

On July 9th, it was reported that the new users were the horror data of Netflix$Netflix, Inc.(NFLX)$ . In Q1, because the growth of new users was less than expected, the market completely ignored the expectation of financial report, and the stock price was directly lowered to 10 points after the financial report was released, which made the stock price of Netflix Q2 keep rising, but it still did not return to $549.57 on the eve of the first quarterly report. After the US stock market closed on July 20th, Netflix will release its Q2 financial report in 2021. Will the "horror" scene be staged again? What are the key points worth paying attention to?

Review of First Quarter Performance

Netflix's profit and revenue in the first quarter of this year were higher than market expectations, but the growth of users fell sharply, and the decline rate far exceeded expectations. As a result, Netflix's share price plunged after the results were announced, with a rapid decline of more than 10% and once fell to 13%.

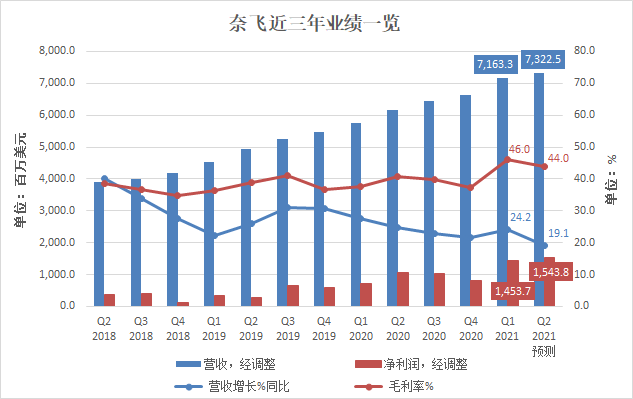

The financial report shows that Netflix's revenue in the first quarter was 7.16 billion US dollars, a year-on-year increase of 24%, exceeding the market expectation of 7.14 billion US dollars; Diluted earnings per share (EPS) was US $3.75, a year-on-year increase of 139%, higher than the market expectation of US $2.98; Net profit was US $1.707 billion, up 141% year-on-year, compared with US $709 million in the same period last year.

In addition, Netflix's gross profit margin reached a new high of 46% in the first quarter, mainly due to the delay and cost reduction of content production costs. The market expects that the gross profit margin will decline to 44% in the second quarter.

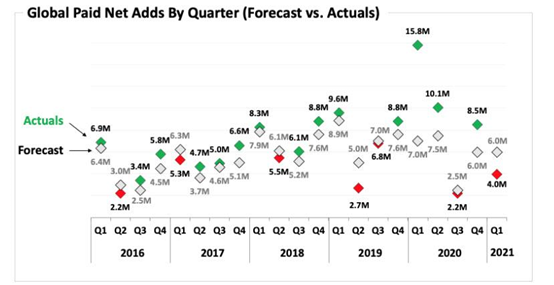

In the first quarter, it was the number of new users mentioned above that gave the stock price a blow. According to the financial report,In the first quarter, Netflix's global paying users only increased by 3.98 million, which was nearly 37% lower than the market expectation of 6.29 million, and decreased by nearly 75% compared with the net increase in paying users in the first quarter of last yearThe market expects the net increase of users to decrease by about 60% year-on-year.

The main reason why the growth of users is less than expected is that the rapid growth in 2020 overdraws the future increment of users and the growth of offline activities brought about by economic recovery.

What factors deserve attention in the second quarter:

1. Can new users return to rapid growth?

As for the weak growth of new users in the industry in the first quarter, Netflix believes that it is mainly attributed to the influence of cardinal utility and epidemic situation on content production, or that the rapid growth in 2020 overdraws the future user increment and the growth of offline activities brought about by economic recovery.

Will this situation improve in the second quarter? In the short term, due to the high uncertainty of the epidemic in the world, the production of superimposed dramas has not been fully restored,Therefore, the growth of company users is still facing uncertainty in the short term.However, relying on huge content barriers and user experience, the overall user retention rate of the company is still improving, and the user stickiness is still good. The company also continuously improved ARPPU by raising the subscription price and improving the account system. In the first quarter, the overall ARPPU of the company was US $11.5 (+6.1%), which was significantly improved compared with the previous quarter.

In the long run, the general trend of users migrating from traditional media to streaming media platform has not changed,Netflix will continue to benefit from this trend. The peak level of TV families in the world (excluding China) is close to 800 million. Compared with Netflix's 200 million users, there is still plenty of space.

2. Streaming media competition is hot, and Netflix continues to improve its content production capabilities

In terms of content production in the second quarter, the efforts were obvious. At the end of June, Netflix announced that it had reached a cooperative relationship with Amblin Partners led by world-renowned director Steven Spielberg. According to the agreement, Amblin expects to produce at least two movies for Netflix every year, and the specific starting time has not yet been determined. Spielberg may even take charge of some films himself, and Netflix is expected to fund some of them. Amblin's previous production of Green Book won the Oscar for Best Picture in 2019.

In addition, Netflix also showed its ambition in the fields of virtual reality and games. Recently, Netflix announced that it has cooperated with the powerfulTVProducer Shonda Rhimes reached a new deal. Bridgerton, a series produced by Remus, shines brilliantly on Netflix. According to Netflix, "Bridgerton" is the highest-rated show in the streaming platform's history.

The new deal strengthens Netflix's partnership with Remus in several ways, such as opening the door to drama films and investing in Remus' company programs to diversify Hollywood before and after the camera.Netflix also said that the cooperation with Remus also includes the opportunity to exclusively produce and distribute potential games and virtual reality content.

In the long run, CITIC Securities said that Netflix's competitive advantage is still obvious.The market is generally worried about the impact of mainstream entertainment companies such as Warner, Disney and NBCU, as well as technology giants such as Apple and Amazon on the growth of Netflix users. However, Netflix relies on industrial production capacity and is strongWith large content recommendation and operation capabilities, its competition barriers are still outstanding, while the company's continuous improvement on the mobile side (such as caching and short comedy) will further enhance user stickiness.

At present, Netflix accounts for less than 10% of American TV, and the medium and long-term TAM is still vast. With the continuous optimization of Netflix's content production and cash management, and the improvement of profits caused by network effect and scale effect brought by user growth, Netflix's asset-liability structure and cash creation ability are expected to be greatly improved.

According to Netflix's first-quarter shareholder letter, the company repaid 500 million US dollars in debt in the first quarter, and plans to reduce the debt scale to 10-15 billion US dollars. In 2021, on the basis of achieving balance in FCF, a repurchase plan of no more than 5 billion US dollars will be carried out. The positive progress of capital structure and shareholder policy will also positively support the company's medium and long-term stock price.

Second quarter performance guidance provided by Netflix

In terms of performance guidance,Netflix expects that 1 million new paying users will be added in the second quarter, far less than the net increase of 10.06 million in the second quarter of last year,It is also far lower than the net increase of 4.44 million expected by the market; EPS is expected to be $3.16 in the second quarter, higher than the market expectation of $2.67.

How does Bloomberg see Netflix's second-quarter results

Bloomberg unanimously predicted that Netflix's revenue in the second quarter was 7.322 billion US dollars, a year-on-year increase of 19.1%; The adjusted net profit was US $1.544 billion, a year-on-year increase of 35.2%; Adjusted earnings per share was US $3.34, up 33.1% year-on-year.

July 21 09:30 Click to make an appointment to watch Netflix live!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

ok