Effects of China’s Debts on Your Investments

China’s economy is the world’s third largest after the US and EU. Looming economic problems in China could spell trouble for investors back in the USA. The New York Times wrote recently about why China has a giant pile of debt. How much debt does China have and how could it affect your investments? To get a sense of China’s debt situation we look back at what happened to Japan at the end of the 1980s and how it has affected their economy for the last three decades.

Powerful Trading Software. Simplified.

In the late 1980s Japan seemed set for economic conquest of the world. Its economy was roaring, rich Japanese were buying American iconic assets like Colombia Pictures, Rockefeller Center, Pebble Beach Golf Club, and Firestone Tire & Rubber. Then a hidden mountain of debt dragged the Japanese economy down. In the more than 30 years since, Japan has never regained its economic swagger as a direct competitor to the USA. Today we see China’s rise to economic power threatened by a mountain of debt. Will China’s economy go the way of Japan’s.

Why Is China’s Economy Important to US Investors?

It is tempting to say that China in on the other side of the world. Thus we should not worry about economic consequences of Chinese debt problems. However, many US companies have foreign direct investment in China. Ten percent of GM’s income comes from China. Tesla gets twenty-one percent of its revenue from China. Apple gets a fifth of its income from China and a third of its growth. Investors in these companies or those with direct investments in Chinese companies have stakes in China’s economic prosperity. China imports huge amounts or raw materials as well as advanced technical products and technology. A severe economic slump will have dramatic effects on economies in both the developing world and developed economies.

How Bad Is China’s Debt Problem?

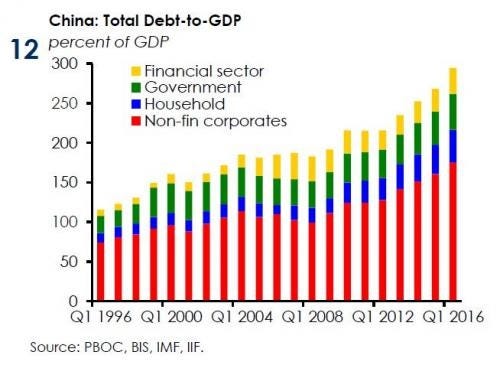

The Japan Times writes that China’s $23 trillion local debt mess is going to get worse. They are writing about estimates by Goldman Sachs of municipal government debts in China that far outstrip the taxing ability of those jurisdictions. $23 trillion is the amount of know governmental debt in China. The total of all debt public and private is about $51.9 trillion. The total of all debt in China is more than two and a half times the country’s gross domestic product.

Is China Going to Follow Japan Into Economic Decline?

There are four factors to consider. One is the huge amount of Chinese debt. The others are the aging of China’s population, the real estate crisis, and China’s global ambitions. The Chinese have studied the Japanese situation. One of the problems with Japan appears to have been a too drastic and too rapid elimination of non-performing loans. China appears to be aiming for a “soft landing” by dealing with bad loans more gradually. A problem in this regard is that debt issues could simply get worse if the government drags its feet in dealing with it.

Falling Chinese Birth Rate

China had a one couple, one child policy for decades. This was meant to slow their population growth, which it did. It also has left the country with a demographical dilemma. They have lots older folks at or near retirement when they need taxes from younger workers to pay their debts. They also need workers to maintain the growth of their economy. China does not have an influx of folks who want to live there such as in Europe of North America. Suggestions include raising the retirement age which would buy China perhaps a decade until the demographic penalty really takes hold.

Chinese Real Estate Crisis

For years as the Chinese economy grew it was easy to borrow and build factories or housing. Now the Chinese real estate sector is overbuilt and overleveraged. China is full of empty apartments in middle-sized cities and real estate developers are swimming in debt. Real estate prices are falling as developers sell properties below market to get cash. China, like Japan, is a nation of savers and one of the preferred ways to save for retirement has always been to buy property. The real estate crisis has not only hurt real estate developers but also cut into the savings of Chinese who do not have the same social security safety net as Americans.

Chinese Strategic Ambitions

Another issue that is going to affect China going forward is the desire of its rulers to achieve global economic and strategic dominance. They are building up their military and their nuclear arsenal. They are pushing programs to move ahead of everyone else areas like supercomputing and artificial intelligence. The US, EU, UK, Japan, Australia, India and others have come to see China’s actions as strategic threats. The evolving trade war threatens to cut off supplies of rare earth minerals for the West and advanced technologies for China. This issue along with Chinese debt carry the risk of a recession in China that could spread globally. Not only could direct investments in China be affected but investments in all economies and all countries.

Grab This Video Showing How to Trade Wedge Breakouts

Originally published at https://profitableinvestingtips.com on July 14, 2023.

Effects of China’s Debts on Your Investments was originally published in InsiderFinance Wire on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?