Time Frame for Trading Fundamentals

Over the short term markets are driven by the sentiment of those buying and selling. Over the long term the markets are driven by fundamentals such as quarterly profits, interest rates, and events both domestic and foreign. Long term investors generally do very well by determining the intrinsic value of a stock. They will ideally buy the stock in a depressed market or use an approach like dollar cost averaging to avoid always buying at market peak prices. Either way they tend to make handsome profits over time. Thus the time frame for investing in fundamentals is five years, ten years, or longer. Fundamentals are important for those who trade options as well. However the time frame for trading fundamentals is not the same as for long term investing.

The Market Only Cares When It Cares

While a long term investor cares about what a stock will be worth in ten years, many short term investors, traders, and especially day traders could not care less. Because at Top Gun Options our time frame for trading options is typically days or weeks at the most, we need to pay attention to the market that we have and not the one that we would like to have. An excellent example of when fundamentals matter and when they do not comes from the Covid-19 pandemic, Covid market crash, and the sharp recovery a month later.

Naïve Traders and Investors and Their Experience in a Rising Market

Back before Covid-19 swept across the planet there was a guy who gave pizza reviews on social media. He had quite a following. He decided to start giving advice on stocks as well. Within the short time that he had been paying attention, the market kept going up and up. Every pullback was followed by an advance. So, Mr. Pizza Review Guy told his followers that “stocks always go up.” Within his short attention span this had been absolutely correct. Of course, anyone with any experience in the market or anyone who bothered to learn about the history of the US stock market knew about the Financial Crisis, Great Recession, and market crash. They knew about the Dot Com crash and even the 1929 crash that ushered in the Great Depression. What followers of the pizza review guy did not know was this. When fundamentals come to bear on a market that was rising beyond what fundamentals would support, the bottom eventually falls out and there is an implosion. While the market being overpriced is part of this, there is commonly another event like the collapse of the US housing market in 2008 or the emergence of a viral plague in late 2019.

The Market Suddenly Cares a Lot

At Top Gun Options we pay attention to what is going on domestically and what is happening far from our shores. We use the DRINC acronym for Democrats, Russia, Iran, North Korea, and China. Democrats stand for excessive domestic spending (by both parties). Russia is an ongoing threat to global stability and its invasion of Ukraine upset world markets and is still doing so. Iran and North Korea are dangerous and have the potential to cause havoc in their respective world regions. China’s regional and global ambitions have the potential to cause even more trouble than Russia. Back at the end of 2019 the market was happily going up and up. Meanwhile we heard reports of a virus raging through China. Cities of millions of people were being shut down. Crematoriums were burning bodies day and night to the point where the smoke was visible from space. And the market did not care.

We knew there was trouble brewing because of the important part that China plays in the global supply chain. Nevertheless, we traded the market that we had while being aware of the risks of the new Covid-19 virus. When a reporter asked Trump about the virus and he soft peddled it saying it was not a problem for the US we realized the time had come to pivot in our trading. We went long on volatility, bought puts on the S&P 500, held cash, and went bearish on our strategies across the board. Fundamentals were suddenly going to make a huge difference. At Top Gun Options we virtually printed money for the next month as the market imploded. We only pivoted to bullish strategies when the Federal Reserve opened the floodgates with credit and near-zero interest rates.

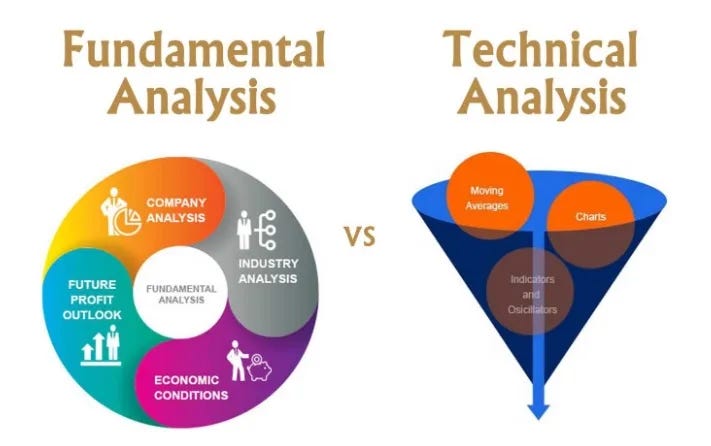

Knowing when to rely more on fundamentals than on technical factors takes experience. Working with one of the trading squadrons at Top Gun Options is a good place to gain this necessary experience.

Originally published at https://topgunoptions.com on September 4, 2023.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.