Pros and Cons of Defensive Stocks

Although inflation has come down the Federal Reserve is still not totally finished with interest rate hikes. Thus the risk of a recession later this year or in 2024 remains. A common investing strategy when a recession looms is to buy defensive stocks like Procter & Gamble, McDonalds, or Coca Cola. The rationale is that these companies are generally not hurt by a recession as much as other companies. Investors know this and tend to rotate their investments into defensive stocks when they fear a recession. Very often such stocks go up in price while the rest of the market falls. What are the pros and cons of defensive stocks?

What Are Defensive Stocks?

Companies that have a constant demand for their products have stable stock prices year in and year out. These companies tend to pay good dividends and very commonly have been doing so for decades. In writing about choosing dividend stocks we noted that companies that have been paying dividends for a long time fall into three categories. They are dividend kings, dividend aristocrats, and dividend champions. Kings have been paying dividends for more than 50 years like Coca Cola, Johnson & Johnson, and 3M but include smaller companies as well. Aristocrats have been paying dividends for more than 25 years and are in the S&P 500. Champions have been paying dividends for more than 25 years and have steadily raised their dividends virtually every year. In general, any stock that falls into one of these categories is also a good defensive stock.

Are Defensive Stocks Just for Defense?

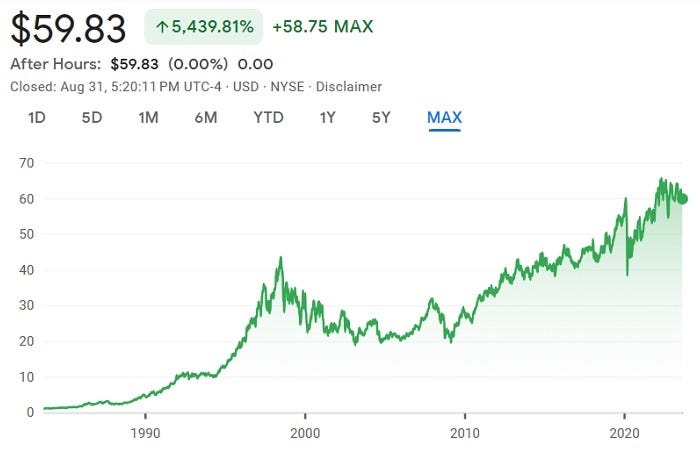

Some investors will move into what they consider to be defensive stocks like Coca Cola or Procter & Gamble when they fear a recession. Others invest in these same companies for the long term. Allowing for stock splits one of today’s shares of Coca Cola sold for $1.08 forty years ago in 1983. Today the stock trades at $59.83 closing out August of 2023. The stock has a 3.08% dividend yield. Thus its annual dividend is nearly twice the value of its share price forty years ago. While this stock has not seen the stellar growth of Microsoft it has also done very well over the years at the same time that tech companies like Blockbuster, Iomega, and Compaq fell off the earth. Defensive stocks fall into the widows and orphans stock category. They are secure sources of quarterly revenue and steady growth with a minimum of oversight required.

Drawbacks of Defensive Stocks

For all of the good things about defensive stocks, there are a couple of drawbacks. Last year we wrote about how very often bear markets are the key to future wealth. The Fed raising rates hit the market and may stocks fell. One of them was Nvidia, which dropped from $329 a share to $120 a share. Then it soared to its current price of $493 a share. Anyone who went and hid in defensive stocks out of fear of a recession probably missed out on an opportunity to profit from a stock at the center of the AI boom. Alternatively, if a person simply put their money into a computer software company that went public in 1986, that stock (Microsoft) would be 3437 times as valuable today. The bottom line is that while defense stocks are a good place to hide during troubled economic times, you are potentially giving up spectacular investing possibilities as well.

Powerful Trading Software. Simplified.

Originally published at https://profitableinvestingtips.com on September 6, 2023.

Pros and Cons of Defensive Stocks was originally published in InsiderFinance Wire on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.