ARM oversubscribed by 10x! Will you buy into it?

The largest IPO in the US is coming from $Softbank Group Corp(SFTBY)$ , with its subsidiary, $ARM Holdings Ltd(ARM)$ .

According to the submitted documents, the IPO price range is between $47 to $51 per share, with a market valuation ranging from $48.2 billion to $52.3 billion.

Recently, it has been reported by insiders that $ARM Holdings Ltd(ARM)$ is already oversubscribed by more than ten times. It is likely to increase its pricing range, and the valuation may exceed $54.5 billion.

Introduction to $ARM Holdings Ltd(ARM)$

Read more:Dive in ARM IPO: 8 Points Tells Why This IPO Such a Big Deal

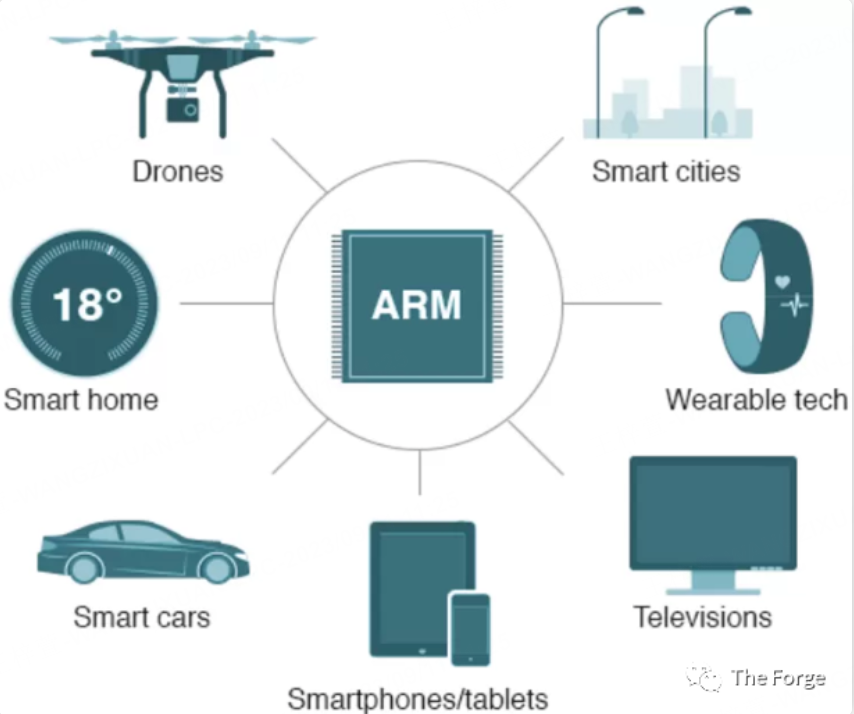

ARM is a chip design and technology licensing company. The majority of global software, including operating systems for smartphones, personal computers, and vehicles, run on ARM's CPUs.

ARM primarily operates through two business models: licensing, where they charge fees for IP licenses, and royalties, where they charge based on the number of chips manufactured. Royalties are the main source of ARM's revenue.

Arm’s IPO backed by big tech and chip giants

Many top-tier tech giants are also interested in joining the IPO.

Back in September 2020, $NVIDIA Corp(NVDA)$ have planned to acquire ARM for $40 billion, but the acquisition ultimately failed due to regulatory issues.

According to ARM's supplementary information, the list of IPO investors includes big names like $Apple(AAPL)$, $Alphabet(GOOG)$, $NVIDIA Corp(NVDA)$ , $Advanced Micro Devices(AMD)$, $Intel(INTC)$, $Samsung Electronics Co., Ltd.(SSNLF)$ , $Taiwan Semiconductor Manufacturing(TSM)$.

Overvalued but low growth?

However, many analysts believe that ARM's valuation may be too high. As of June 30, 2023, ARM's net profit was $667 million, and with a market valuation of $52.3 billion, its price-to-earnings (P/E) ratio is as high as 78.46.

Furthermore, ARM's price-to-sales (P/S) ratio is also high, similar to NVIDIA, but its business growth rate and scale are not as impressive as NVIDIA's. Therefore, analysts believe that ARM may struggle to justify its current valuation.

Do you think ARM's valuation is expensive or not?

Can its growth prospects support this valuation?

Will ARM's debut see an increase or a decrease in its stock price, and by how much?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

👍👍