Potash As A Long-Term Play

Summary

- The market likely reached a trough this year after suppliers Mosaic and Nutrien decided to sell potash to China at a figure well below prices in Brazil.

- There is a good case for a rebound in potash prices over the next 18 months, driven by increasing demand and higher mine utilization.

- Intrepid Potash is a potential value investment in the potash sector, with a cheap valuation compared to peers and solid fundamentals.

SergeyMihalenko

By Garrett Baldwin

Investors have been taken aback by the crash in global prices of a little-known agricultural input - potash.

It consists of several potassium compounds, including potassium carbonate (K2CO3) and potassium chloride (KCl). It's critical for the growth of plants, making it a key ingredient of fertilizer. Miners dig it up mostly in Canada, Russia and Belarus.

Speculation about potash became heavy in 2022 because of the vital role Ukraine and Russia play in potash production. Markets anticipated dramatic shortages in supply after Russia invaded its neighbor, but by the start of 2023, the narrative shifted to a case of oversupply and weakening demand.

The chart below shows a massive affordability challenge for buyers in late 2021 through 2022 and an ensuing decline.

Potash stocks performed poorly in the first half of 2023 as global spot prices pressed lower. The market likely reached a trough this year after suppliers Mosaic (MOS) and Nutrien (NTR) decided to sell potash to China at a figure well below prices in Brazil.

Can we now predict a rebound? There's a good case for one over the next 18 months.

tastytrade

Buyers catching up

Potash's price bottomed in mid-2023, said Joel Jackson, equity research analyst at BMO Capital Markets. "I think all markets are buying," he told Canadian Network BNN Bloomberg. "We had 'skipping' in potash buying last year from farmers, so we have a lot of catch up."

Jackson also noted that Belarus has increased its volume but has failed to reach full capacity. Chinese demand is also forecasted to improve in the back half of 2023.

Increasing demand will improve mine utilization at higher levels, Jackson suggested in the interview. Recovering demand, mixed with higher utilization, may stabilize prices, which can lift spot prices higher.

In the United States, demand could remain robust because of drought. Kansas, for example, is experiencing its driest conditions in 60 years.

Meanwhile, Australia might lose a third of its wheat crop to drought this year, and China's output could decline by 30 million bushels, according to Reuters.

That's in the short term. Over the long term, there's an even more bullish case. A "fourth wave" for potash prices that could take the commodity much higher, according to BHP analysts Huw McKay and Parth Goyal.

In 2021, the analysts outlined three historical supply waves with clear imbalances. The first came in the 1970s, with substantial demand catchup after the development of deposits in Saskatchewan. The second happened in the post-Soviet era with the disruptive impact of the collapse of the USSR. The third was a demand-driven boom in the back half of the bullish commodity era in the late 2000s.

Now, McKay and Goyal cite demand shock from regions in the former Soviet Union. Given a surge in potash use globally - especially in China and Brazil - they noted that in 2021 that global potash markets were subject to "fly-up pricing."

Brazilian and U.S. buyers began hoarding potash in warehouses because they were concerned about shortfalls in availability. In response, global producers - seeing higher prices - began expanding capacity. The BHP analysts noted that markets experienced a "buyers strike," which helped fuel a sudden downturn in pricing.

Supply dropped, and so did demand in the backside of 2022, helping to drive the significant selloff. The fundamentals suggest a more balanced global supply market in the years ahead, helping to stabilize prices.

"On a structural basis, though, given the growing size of the market and corresponding resource availability," McKay and Goyal concluded in a report, "it is unlikely that the industry will return to the conditions we saw in the second half of the 20th century."

Finding value in potash

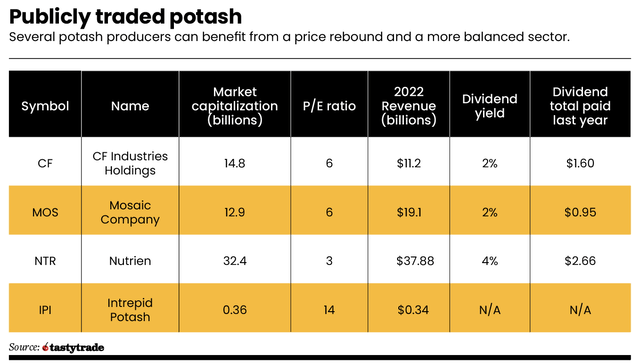

Several potash producers can benefit from a price rebound and a more balanced sector. Industry leaders include the aforementioned Mosaic and Nutrien, as well as CF Industries (CF). But one can make the case Intrepid Potash (IPI) is a good value.

The Denver-based Intrepid sits with a market capitalization of $338.4 million. That's good news for retail investors, given that the small company will remain off the institutional radar.

Intrepid owns three potash evaporation mines in Utah and New Mexico. Its solar evaporation method is considered the cheapest and most environmentally safe way to produce potash and salt. When it reported earnings on Aug. 2, profits came up short but revenue topped expectations by $19.69 million. Shares have been steadily rising.

The company's executive chairman, Robert P. Jornayvaz, said during the earnings call that "positive company and industry fundamentals drove another solid quarter of results with our second quarter adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) totaling just under $16 million, bringing our first half figure to approximately $32 million. Strong sales were again a key highlight for Intrepid. And in the second quarter, our potash sales volumes were approximately 40% higher than the second quarter of last year."

During the call, the team also highlighted the macroeconomic risks to supply, including drought in the United States, "unabated war" in Europe, faltering grain deals and port disruptions.

Compared with its peers, Intrepid is cheap. Its EV-EBIT (the ratio between enterprise value and earnings before interest and taxes) is 9.88, compared with an industry median of 10.98. It's also trading at just 48% of its tangible book value of $55.27. The fair value is about $40.14, according to GuruFocus, representing a solid upside from its 52-week low of $17.23 in June.

But this is a commodity company with solid capital management and an Altman Z score of 3.86, signaling it faces little chance of a credit problem. Its cash-to-debt ratio stands at 6.7x.

A more rebalanced industry in two or three quarters and improving fundamentals could take this stock back to fair value in the year ahead.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.