ChargePoint: Buy The Dip Before This EV Charging Stock Could Rebound

Summary

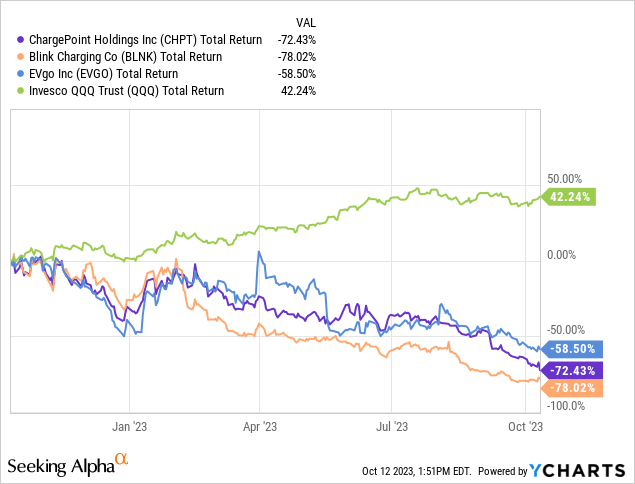

- ChargePoint's stock has plummeted 72% in the past year despite the increasing demand for EVs.

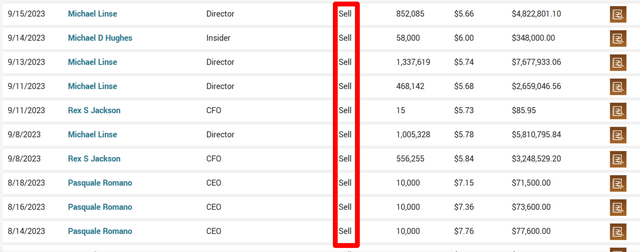

- Insiders have been selling off CHPT shares at a high rate, while short sellers are betting against the company.

- ChargePoint expects to turn profitable in late 2024, and CEO Pasquale Romano still holds a significant stake in the company.

jetcityimage

ChargePoint (NYSE:CHPT) was once considered the most elite EV charging play due to the massive increase in EV demand throughout North America and Europe.

However, I must admit that it's been a rough couple of years for CHPT shareholders since the 2021 EV boom. CHPT shares are down 72% over the last 52 weeks while the Invesco QQQ Trust (QQQ) is up 42%.

Data by YCharts

Data by YCharts

EV sales are expected to make up 80% of all global vehicle purchases by 2030 but that's nearly 7 years time away from the current fiscal year. ChargePoint's massive hype has quickly faded and insiders have been dumping CHPT shares at an extremely high rate.

Chargepoint Insider Selling (marketbeat.com)

On top of this, short sellers are betting against ChargePoint despite the company's positive environmental impact. ChargePoint's short interest is over 26% and could increase even higher if several headwinds such as higher interest rates, supply chain disruptions, or further net losses push CHPT shares even lower.

It's sad to see Wall Street put short-term profits over positive long-term environmental benefits.

However, I cannot help but see the bright side in this tough situation and spot a massive buying opportunity for this EV charging station SPAC if you maintain a long-term outlook.

ChargePoint is Losing a Lot of Money

During periods of high-interest rates, investors show no mercy when it comes to small-cap stocks that lose money. ChargePoint was once considered the "axe and pick" investment for the ongoing EV revolution but the entire market sentiment has quickly changed.

In Q2 2023, ChargePoint finished the quarter with $150 million in revenue (Up 39% YoY) and lost $125.3 million (Up 35% YoY) or 53 cents per share despite increased demand for electric vehicles.

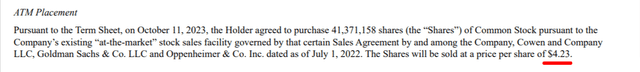

Since ChargePoint isn't profitable, the company raised $175 from institutional investors such as Antara Capital to bolster ChargePoint's balance sheet.

In a recent SEC filing, ChargePoint sold 41,371,158 at a price of $4.23 per share.

ChargePoint 10Q October 2023 (sec.gov)

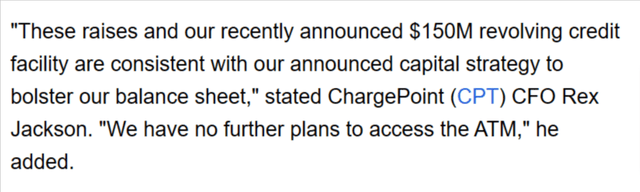

ChargePoint CFO Rex Jackson stated that the company has enough funds to last well into 2025 and doesn't need any additional capital raises.

ChargePoint CFO Rex Jackson Quote (seekingalpha.com)

This is an extremely bullish indicator in my opinion, which is why I'm finally buying CHPT shares again after a long hiatus.

The Company Expects to Turn Profitable in Late 2024

While many ChargePoint bears think the company may go bankrupt, I find it fascinating that management believes the company will break even in Q4 2024.

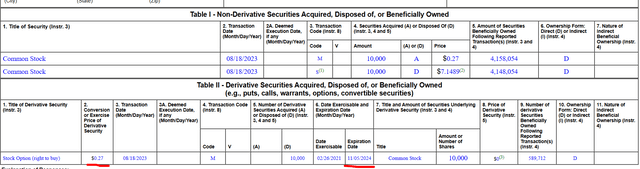

In order to validate these claims, I researched ChargePoint's latest insider trades and noticed that ChargePoint CEO Pasquale Romano owns several call options priced at $0.27 with an expiration date of 11/04/2024.

This expiration date occurs during the same period that ChargePoint believes it will break even and turn its first positive EBITDA quarter.

If that turns then ChargePoint could benefit from a short squeeze as short sellers buy back CHPT shares to return their borrowed shares. This doesn't look likely until at least 4 quarters or more so be patient.

Another bullish sign is that Pasquale Romano still owns 1,990,345 CHPT shares worth ~$7 million as of Q3 2023.

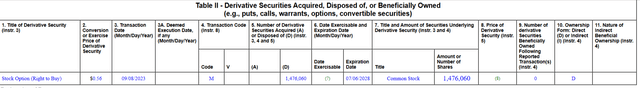

He also purchased call options expiring in November 2024 and July 2028 at 27 cents and 54 cents, respectively.

Pasquale Romano CHPT Insider Trades (sec.gov)

Pasquale Romano CHPT Insider Trades Part 2 (sec.gov)

Despite his heavy selling this year, ChargePoint's CEO holds a rather large stake in the company and hasn't sold any shares since August 18th, 2023.

Risk Factors

- Higher interest rates: ChargePoint is one of the many EV charging station stocks that have fallen due to a high-interest rate environment. If interest rates continue increasing then more investors may turn towards safe havens such as bonds or HYSAs rather than negative profit margin growth stocks

- Geopolitical Events: There is a lot of geopolitical conflict going around now plus an upcoming United States presidential election in 2024. President Joe Biden showed tons of support for EV charging companies but a new administration may sing a different tune.

- More Dilution: While management said there isn't a need for more share offerings, you can never be too sure in this day and age. CHPT stock is already trading below $4 and another dilutive offering could send the stock trading much lower.

- Rising Interest Payments: ChargePoint extended the maturity of its $300 million loan term note from April 1st, 2027 to April 1st, 2028 at a much higher interest rate of 7% while adjusting the conversion price from $24.03 to $12. This will increase negative cash flow due to interest payments unless ChargePoint pays off the note or converts this agreement into common shares before the maturity date.

- Short Selling from Antara Capital: Antara Capital is a hedge fund that's well known for betting against AMC stock in the past by shorting AMC shares. It's highly likely that Antara Capital bought more shares to provide more shares available for shorting.

My Gameplan for CHPT Stock

I've remained bullish on CHPT shares despite all of the negativity surrounding the company. I don't like seeing management dump so many shares as of late but it appears much of the insider selling is finished.

CHPT stock looks extremely oversold on the Weekly RSI chart so I decided to start buying the stock again during this period of peak fear. CHPT's weekly RSI is 25 but any number below 30 is considered "oversold".

CHPT Weekly RSI Chart (tradingview.com)

I may consider some call options expiring in January 2025 as a lottery ticket play.

The EV revolution may come sooner than we anticipate and I truly believe ChargePoint will benefit from the massive shift from ICE vehicles to "smart cars".

ChargePoint trades at a slightly higher P/S ratio than its competitors Blink Charging and EVgo but I still like the company's massive charging footprint over its smaller competitors.

EV Charging Station Stocks by P/S Ratio

| Company (Ticker) | P/S Ratio |

| ChargePoint (CHPT) | 2.35 |

| Blink Charging (BLNK) | 1.90 |

| EVgo (EVGO) | 1.97 |

It takes guts to buy stocks when nobody else wants them. Perhaps taking a risk with CHPT could pay off handsomely in the long run if you believe EVs are a critical part of the global economy's future.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.