Spark New Zealand Limited: Undervalued Dividend Grower

Summary

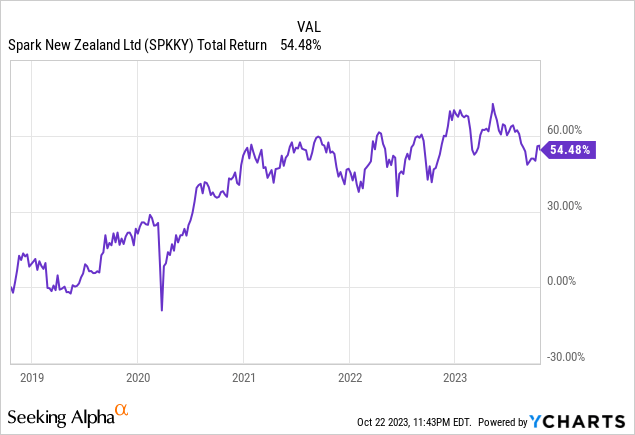

- Spark New Zealand is a top pick for dividend investors, with a solid yield of 5.67% and capital appreciation over the past five years.

- The company has a dominant position in the New Zealand telecommunications market, benefiting from near-monopolistic pricing.

- Spark is exploring growth opportunities in 5G rollout, IoT services, and diversification into other segments like health and sport.

xijian

Spark New Zealand Limited (OTCPK:NZTCF, OTCPK:SPKKY) is one of my top picks in my NZ dividend stock portfolio. The dividend yield is solid, at 5.67%. It's also among the few NZ dividend stocks that have received capital appreciation over the last five years. I found it hard to find NZ companies that can offer both, and Spark delivers.

With dividends reinvested, the company returned 54.48% to investors over the last five years.

Data by YCharts

Data by YCharts

My investment thesis for Spark is that it has more in store for investors, especially those in New Zealand. There is the issue of currency risk and not benefiting from the imputation credits attached to dividends. But despite these issues, Spark has a bright future for international investors.

Company Overview and Competitive Position

Spark New Zealand Limited, established as Telecom Corporation of New Zealand in 1987, has become a leading digital services provider. It is headquartered in Auckland, New Zealand. The company plays a pivotal role in the country’s telecommunications and digital services sector, providing various services, including fixed-line, mobile network, and internet services.

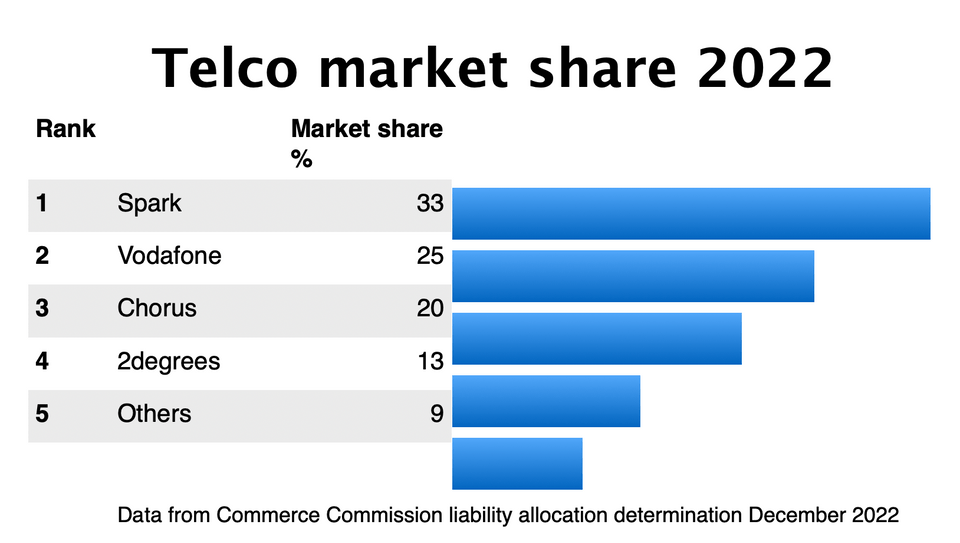

Due to its sheer market size in New Zealand, Spark has a significant competitive moat. The New Zealand Commerce Commission ranked Spark as having a significant edge over its closest rival, Vodafone.

Commerce Commission

In relatively more minor economies like New Zealand and Canada, it's not unusual to see a few giant companies dominate their respective markets, and Spark is no different. It's remarkably different even when comparing New Zealand's telco landscape to Australia, which has dozens of telcos with comparatively even market shares. The lack of choice in New Zealand is also seen in other sectors, such as our supermarkets. No matter the business, the result is more or less the same: It's suitable for investors due to benefiting from near-monopolistic pricing - yet at the expense of consumers who buy these products.

There is aggressive acquisition infighting between Vodafone, Spark, and 2degrees. But the threat of a new entrant kicking the apple cart too hard is far off and remote. Yet, it hasn't stopped some companies from trying. I remember seeing Orcon and Black and White, two promising telco startups, eventually bought out by rival Australian companies. Then, dozens of other startup telcos tried to leave their mark in New Zealand and failed. My point is that Spark's position in the New Zealand market is more or less unrivaled due to New Zealand's economy, competitive forces, and, to a lesser extent, geography. This is, of course, great news for those of us who own shares.

Financials and Growth Potential

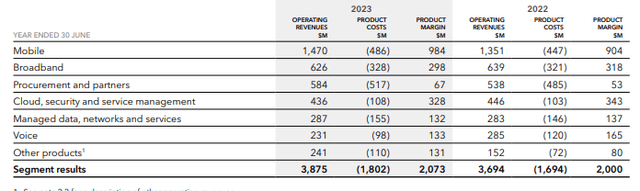

Spark's primary operating segments are Mobile and Broadband, and it also has a growing Cloud, security, and service management offering. Its Mobile segment is by far its most profitable.

Spark

Despite Mobile and Broadband being Spark's bread and butter, New Zealand's small market size has necessitated diversification into additional technologies to drive future growth.

One major initiative Spark explores is the 5G rollout with the New Zealand government. The New Zealand Government has struck a deal with major telecom operators, including Spark, to expedite the 5G rollout in regional towns. This initiative aims to enhance mobile wireless coverage, especially in rural areas. In exchange for their accelerated efforts, the operators will receive long-term access to the 3.5GHz spectrum band essential for 5G services. The agreement mandates the operators to quicken the 5G deployment, improving nationwide connectivity, particularly benefiting rural and regional areas.

This move by the New Zealand government mirrors previous efforts in vastly improving New Zealand's broadband and fiber internet access. The country went from having some of the world's slowest (and most expensive) internet speeds to now being in the top 20. This is another reason I'm bullish on Spark due to its collaborative and mostly friendly ties with the New Zealand government and regulators, which is essential for maintaining its position.

As per Spark's Q2'2023 earnings report, it's also exploring other avenues for driving shareholder value. Some of these initiatives include Spark's Internet of Things [IoT] service, which has grown significantly. Connections grew 39% to 1.2 million. Spark Health and Spark Sport are other segments where Spark continues diversifying its business model.

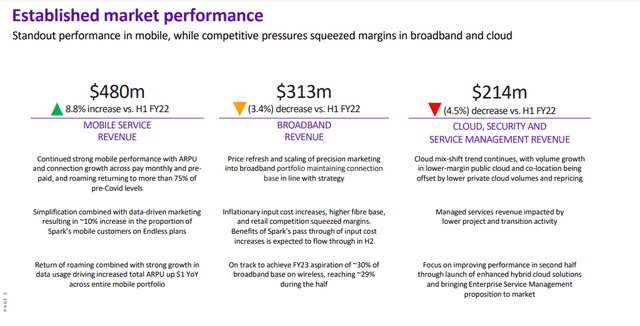

Spark

But most importantly, Spark continues to experience growth in its Mobile services segment, as it reported an 8.8% increase in revenue from the same period last year. Broadband dipped slightly, but Spark is addressing this by driving growth via its rural (wireless) broadband offering.

Spark

Spark also has other initiatives in the works.

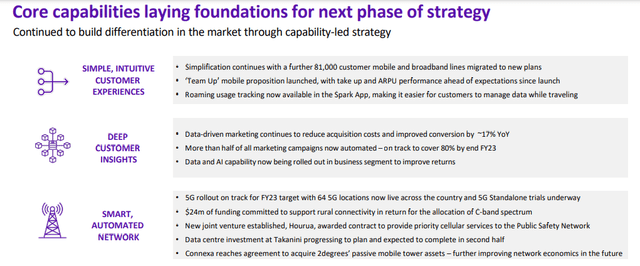

The company continues simplifying its customer offerings, migrating 81,000 customer mobile and broadband lines to new plans and launching a unique ‘Team Up’ mobile proposition that has exceeded expectations. Enhancements like roaming usage tracking have been added to the Spark App for customer convenience.

In marketing, data-driven strategies have led to a ~17% YoY improvement in conversion rates, and over half of all marketing campaigns are now automated, aiming for 80% automation by the end of FY23.

The 5G rollout for network development is on schedule, with 64 locations live, and trials for 5G Standalone are underway. Investments in rural connectivity and data centers are progressing, and a new joint venture, Hourua, will provide priority cellular services to the Public Safety Network. Additionally, an agreement to acquire 2degrees’ passive mobile tower assets will improve network economics in the future.

Spark

Revenue Growth, Cash Flow, and Margins

Here's what makes Spark a truly blue-chip company: Its financials and the massive cash flow it generates yearly.

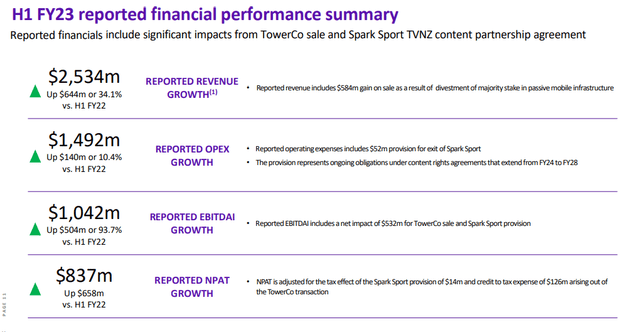

Spark New Zealand Limited reported a substantial increase in its financial metrics in H1 FY23 compared to H1 FY22. The reported revenue grew by 34.1%, amounting to $2,534 million, boosted by a $584 million gain from divesting a majority stake in passive mobile infrastructure.

Operating expenses (OPEX) saw a rise of 10.4%, reaching $1,492 million, including a $52 million provision for the exit of Spark Sport. Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) surged by 93.7%, reaching $1,042 million, influenced by the TowerCo sale and Spark Sport provision. Net Profit After Tax (NPAT) experienced significant growth, increasing by $658 million, adjusted for tax effects related to the Spark Sport provision and the TowerCo transaction.

Spark

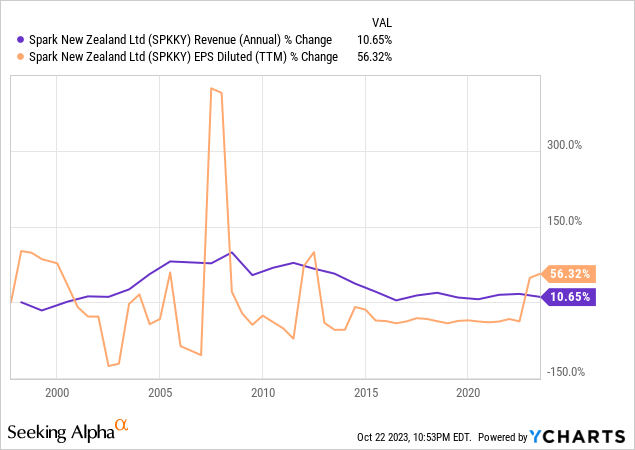

Looking back over the years, these financial results aren't just a once-off. Revenues and diluted EPS have increased steadily since the company's inception.

Data by YCharts

Data by YCharts

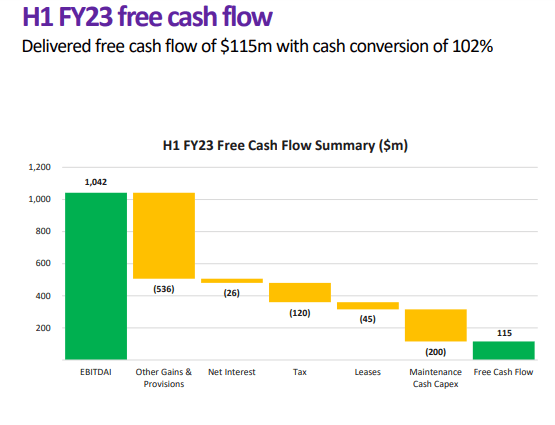

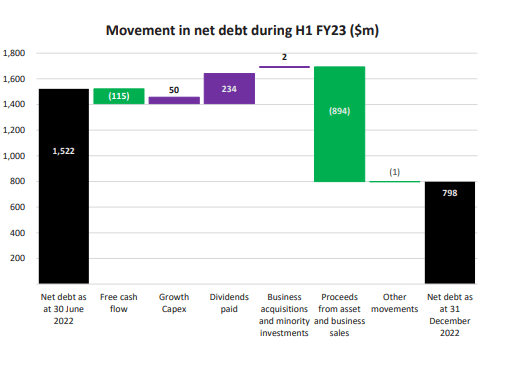

Spark's free cash flow situation is a bit more complicated, but there's still good reason for investors to feel bullish about its long-term potential. In H1 FY23, Spark reported a free cash flow of $115 million, a decrease of $49 million compared to H1 FY22. This was impacted by a $28 million lower EBITDA and $27 million higher tax payments due to timing differences.

Spark

For H2 FY23, the free cash flow is expected to improve due to EBITDA growth driven by mobile services, stabilization in broadband and voice, normalized timing of tax payments, and managed maintenance capital expenditure. The company remains committed to an FY23 free cash flow aspiration of approximately $460 million to $500 million, albeit expecting to be on the lower end of the range. Additionally, there has been a year-to-date improvement of $30 million in working capital, mainly due to software licensing and billing timing.

In terms of Spark's net debt, things look positive. Reported net debt decreased by $724 million due to the repayment of short-term debt facilitated by the proceeds received from TowerCo.

Spark

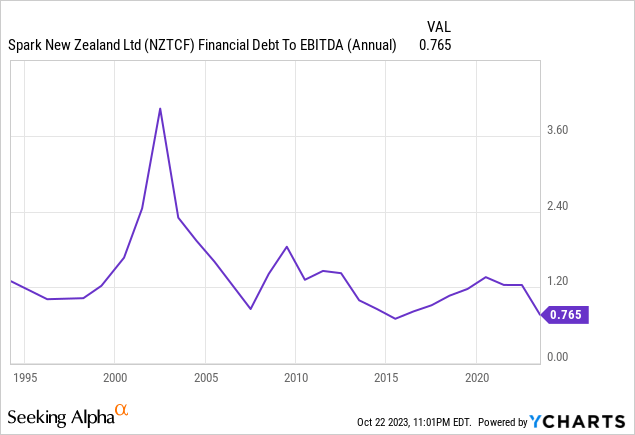

The company's financial debt to EBITDA has fallen to just 0.76. This means it would take Spark just over half a year to pay back all of its debt using EBITDA alone, thus putting it in a very stable and liquid position.

Data by YCharts

Data by YCharts

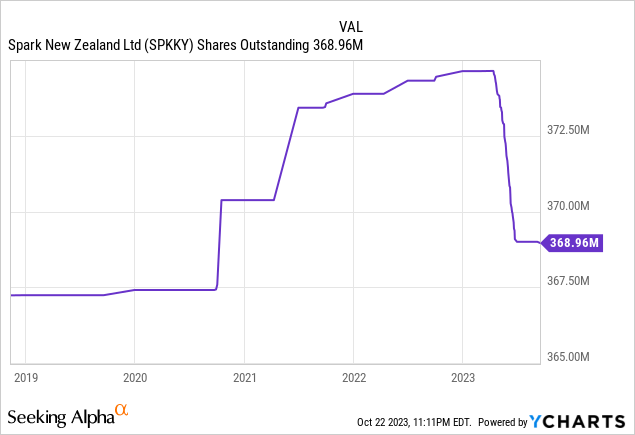

Finally, Spark also pays big dividends and uses its excess cash to repurchase shares. Spark committed to buy back $350 million worth of shares in March 2023, and this buyback program is ongoing at the time of writing.

As the company continues to normalize its earnings after COVID and inflationary pressures, I expect its outstanding shares to drop back to 2020 levels. This is due to the company returning focus to its core operations over making acquisitions, which is why those shares were issued in the first place.

Data by YCharts

Data by YCharts

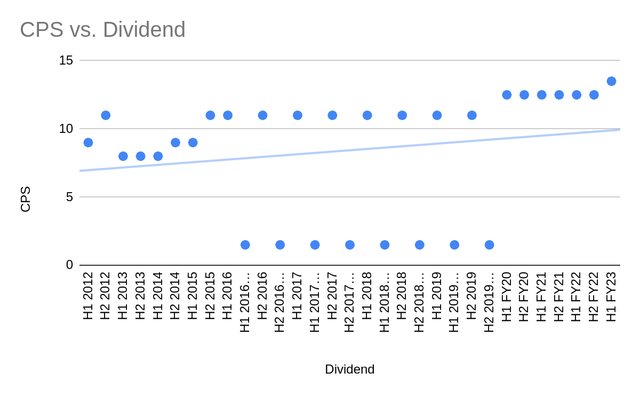

Spark pays dividends twice per year. Investors get a larger one in the first half and a special dividend paid at the end of the year.

The trend for Spark's dividend is generally positive, and management has shown commitment to returning value to shareholders through a mix of dividends and stock buybacks.

Its dividend growth is well above the inflation rate from 2012 to 2023, and Spark's free cash flow is robust enough to support future dividend increases.

Author supplied

Valuation

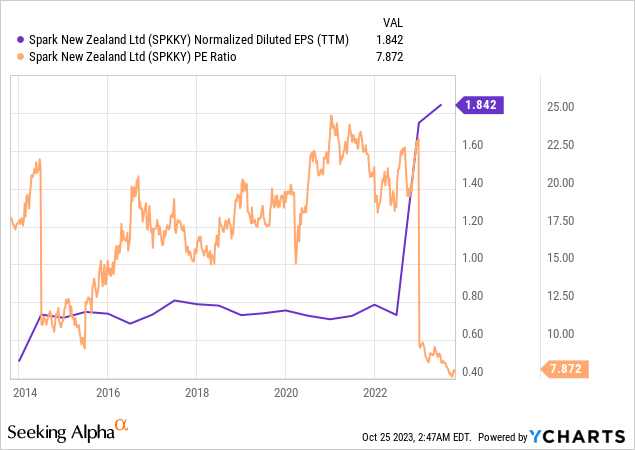

Now might be an excellent time to pick up shares. Its diluted EPS benefitting from the share buyback program has surged to new highs over the last five years. Furthermore, its P/E ratio has dropped to new lows over the same period.

As the buyback continues into next year, diluted will increase. This makes Spark comparatively undervalued where historical performance is concerned.

Data by YCharts

Data by YCharts

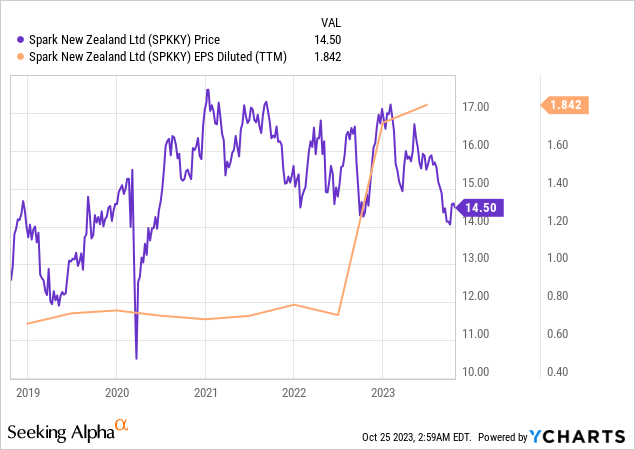

Spark's share price dropped shortly amid its diluted EPS surging higher.

Data by YCharts

Data by YCharts

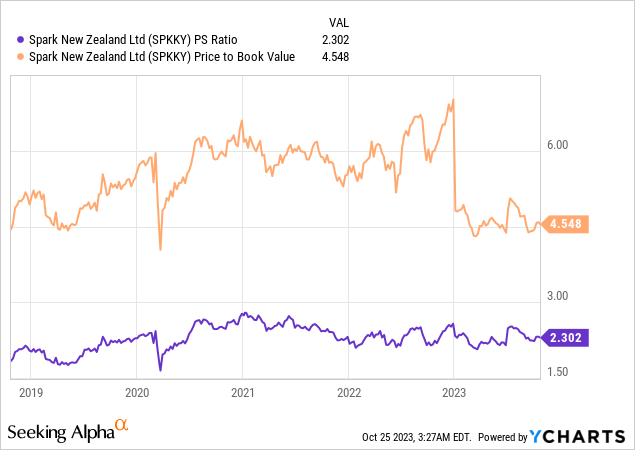

Other metrics, like price-to-book, took a hit due to its assets falling amid divestments. Price-to-sales has remained stable, which shouldn't be surprising due to New Zealand's small economy and the nature of Spark's business.

Data by YCharts

Data by YCharts

To explain the fall of Spark's stock price relative to its diluted EPS, besides the broad declines in the equities market in the U.S. and the NZX 50, New Zealand held its general election last month. A large part of the incoming right-leaning Prime Minister Christopher Luxon's campaign was to advocate for the rights of property owners. New Zealand doesn't have capital gains tax on the sale of properties in certain situations, and certainly not on the family home. Luxon also ruled out a wealth tax, which kept the property market's appeal.

Property investment is a massive part of New Zealand's economy, as it is equally well-embedded in New Zealand's culture and way of life. Getting on the property ladder is seen as the fundamental way of building wealth, in the country, much more than investing in the stock market or even in superannuation schemes like KiwiSaver.

Most importantly, though, Luxon's campaign centered around providing tax relief to the middle class as New Zealand deals with surging inflation.

Luxon plans to fund these tax cuts by selling $5 billion worth of New Zealand homes per year to overseas buyers. These homes will be at the top end of the market, which in New Zealand dollars is $2 million apiece (USD 1.17 million). Economists have predicted that Luxon's plan will further drive up New Zealand's high house prices on the bottom and middle ends of the market, which was a critical rebuttal by the political opposition to Luxon's plan.

Therefore, I believe that we've seen a rotation of capital out of the already less-popular share market in New Zealand further back into property investment, which can partially explain the drop in Spark's stock price despite its improving fundamentals.

In terms of Spark's valuation relative to its peers, there are few comparisons we can make. Vodafone rebranded to One New Zealand earlier this year. The infrastructure development company Infratil owns a 99% stake in One New Zealand. The company has investments in a variety of other industries, too, such as renewable energy and healthcare, making such a comparison infeasible if we want to compare apples to apples. The next competitor, 2Degrees, is privately held but has recently explored launching an IPO.

Risks

One of the principal risks of investing in Spark is an opportunity cost compared to investing in U.S. stocks. However, the company is a safe dividend grower and is one of the few companies that provide capital appreciation in the NZX; the New Zealand market offers limited room for growth.

Investors will undoubtedly get a better return from investing in U.S. stocks, even net of fees and taxes, due to having a higher total return potential. Dividends paid in U.S. dollars are also a nice bonus with the companies, which can substantially improve one's effective dividend yield when converted back into NZD.

For this reason, I invest most of my funds in U.S. stocks but keep sizable positions in both New Zealand and Australian companies.

Conclusion

Spark is one of my favorite stocks on the NZX. Its financial performance and dominance in its primary operating segments make it attractive. Its management is also unafraid to take risks and explore new avenues for driving future growth. I see 5G and IoT services becoming major catalysts, and its growth in its crucial Mobile services segment means it will have sufficient resources to explore these trends.

Furthermore, on a diluted EPS to P/E basis, Spark is relatively undervalued, and I believe it will become more undervalued as more shares are repurchased. Its dividend yield is attractive and significant, which should keep the value of its shares stable when investors see an opportunity they can't easily ignore.

Spark should be in every New Zealander's portfolio, and I believe its share price will continue to rise while delivering safe income. For international investors, Spark still provides secure income and expected capital appreciation while offering diversification benefits.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.