Comstock Resources: When The Market Gives You Lemons

Summary

- Comstock Resources stock is down 20% due to warmer weather and high gas storage levels.

- New LNG plants set to open in 2024-2026 will create new demand for gas.

- The future investment case for Comstock Resources depends on higher gas prices and potential catalysts in the Haynesville region.

- CRK is in the buy zone at current prices.

viafilms/iStock via Getty Images

Introduction

Comstock Resources (NYSE:CRK) is down 20% this month, following a decline back to the low-3's for Natty. Warmer weather and the prospects of more of the same, just crushed the stock. Then there are the relentless injections into gas storage, nearing what some call tank-top, with the addition of another 60 BCF last week. By any measure we are well supplied with gas, and it's interesting and a little surprising we are landing out in the $3.00 range.

CRK price Chart (Seeking Alpha)

We are in near-uncharted territory, above the most recent run on tank-top in November of 2020, at 3,790 TCF. We might be able to pack in another TCF but in terms of working gas capacity, about 4 TCF is the limit that can be withdrawn at 1.1 BCF/D. We are now at 3,883 BCF in storage.

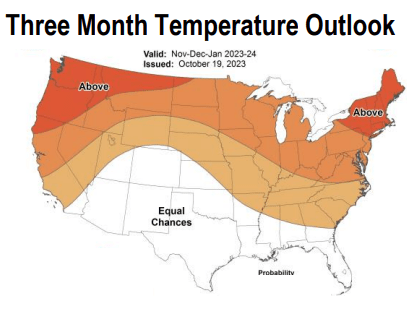

We are literally swimming in gas right now thanks to prolific wells in the Marcellus, Haynesville/Bossier, and the Delaware basins. The good news is winter is approaching (I don't have it in me to say "Winter is coming," one more time), as the icy blast of a couple of weeks ago heralded. The bad news is it was a one-off "Indian Summer" head fake, if the El Nino forecast from the National Weather Service is to be believed.

NWS 3 month forecast (NWS)

But, do not despair...there's more good news! As has been oft reported in these pages and elsewhere, help is on the way! Help in the form of about ~5 BCF/D of new demand coming from several LNG startups in 2024-26. Reuters notes in a recent article that three new liquefaction plants will start shipping in that time frame, and will need commensurate gas supply.

The next U.S. LNG plants expected to open are the QatarEnergy-Exxon joint venture at Golden Pass in Texas in late 2024, the first phase of Venture Global LNG's Plaquemines in Louisiana in 2024-2026, and Cheniere Energy Inc's (LNG.A) expansion at its Corpus Christi plant in Texas in 2025.

But, the first of those - Golden Pass - is still a year away and there is probably six months of commissioning before it comes up to full speed. So, as near as it seems to be, new gas demand from LNG is still somewhat of a future story.

In that context, we will review Q-3 for Comstock and see if we think the current rally is a launching point for continued gains, or if we might expect a slightly better entry point down the road a bit. In our last article on the company, we gave it a buy rating, but just couldn't bring ourselves to pull the trigger. I have a tendency to over-analyze stuff, a result of my primary career where I was constantly analyzing mud filtercakes for improvement. It is a well-known fact that if you stare at a mud filtercake long enough...you will eventually.... start writing articles on Seeking Alpha.

DIF filtercake (Author's files)

Behold a mud filtercake (the white stuff) atop an aloxite testing disk. Actually, I didn't have to stare that long at this one, it was pretty good. RDF filtercakes are designed to be < 1/32nd" thick to prevent deep invasion of mud filterate to the reservoir. I am boring y'all now so I will move on. (Can you believe I spent nearly 35 years doing this day in and day out?)

The thesis for CRK

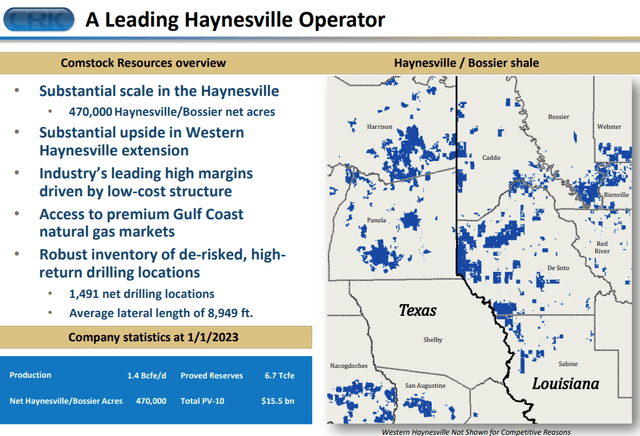

The company is the dominant driller in the Haynesville/Bossier play, running 7 rigs and 3-frac crews consistently. This play, poised 200 miles above the most massive accumulation of LNG liquefaction plants in the world, is a natural winner in the low cost supply sweepstakes. Drilling in the Haynesville is expensive-the reservoir is deep and hot, but properly stimulated, the wells come in prolifically. Some wells CRK has been completing on the Western edge of the Haynesville have IP-30's in the 35-40 MCF per day.

CRK Haynesville Footprint (CRK filings)

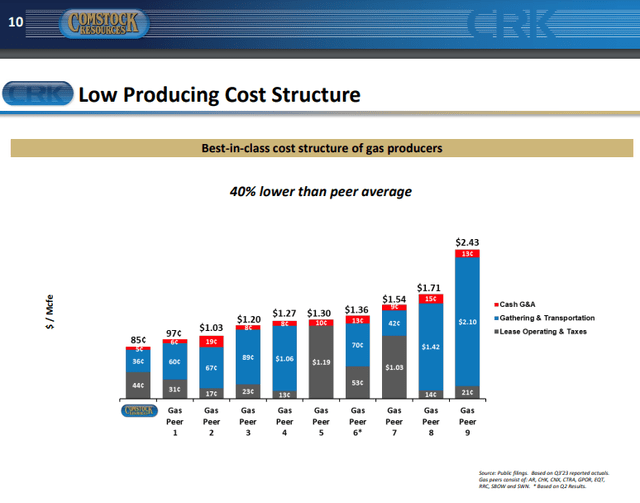

CRK was strategic in its 2019 expansion into the Haynesville with the $2.2 bn acquisition of Covey Park Energy. The Covey Park deal picked up 293,000 acres at $7,500 per acre. This helps give CRK a best-in-class cost structure as the slide below notes.

CRK low cost structure (CRK)

If gas prices truly have turned a corner for the coming winter season, then CRK is going to see a huge rise in cash flow, and solidifying the investment case.

A couple of potential catalysts for the Haynesville

Drilling has dropped off dramatically over the last year. The Haynesville rig tally has gone from 72 in January to 38 as of last Friday's Baker Hughes release. Production has been maintained around 16 BCF/D by DUC withdrawal, while at the same time building DUCs. Since January, we have burned ~60 DUCs and as of July report began adding to the count, which stands at 737 for the basin. A rise of ~131 from January. The point of all this, with DUCs going back into inventory, daily output from the Haynesville should start to drop. Any sign of this should be very supportive for gas prices.

Next we have the rising gas tallies from the Permian. Since January Permian gas output is up 3 BCF/D to 24 BCF/D. There are about 5 BCF/D of pipelines new built and expansion underway for increased Permian gas, but as you can see gas output will consume that pretty quickly. And, those are all going to the Houston area. Pipeline constraints could put a crimp on Permian exports to the prime LNG markets in Louisiana, creating opportunity for CRK and other Haynesville drillers. But, let's remember this new demand is at least a year to year and a half away from arriving.

Q-3 for CRK

CRK hit production targets of 1.4 BCF/E thanks to its prolific Western edge wells, with 2 new completions that bring the total on-line to 7. This was a 4% increase YoY. The average of these is flowing 29 mm mcfd, and there will be a couple of more TIL'd before year's end.

Revenues and EBITDA improved QoQ to $376 mm and $195 mm respectively, but were off by a factor of 4 YoY-which is easily explained by $9.00 gas vs $2.20 gas. Cash flow for the quarter was $167 mm, and fell short of needs for capex and opex, the difference of which was covered under their revolver, and brought LT Debt to $2.5 bn. The company faces no significant maturities until 2027 and has current liquidity of $1.2 bn.

18% hedging narrowed the gap with the NYMEX reference pricing of $2.55 to $2.41. The company had positive EPS of $0.05 per share, up QoQ from -$0.17 in Q-2, and down from $1.50 in Q-3 of 2022.

CRK also noted that it has brought on a Midstream partner to connect its Western Haynesville acreage to export lines. Miles Allison, CEO, commented on the details of this partnership-

We're excited to partner with Quantum Capital Solutions, an affiliate of Quantum Capital Group to build out this system to handle future growth. To that effect, we have set up a mid-stream partnership with QL to build out the system to increase the capacity fourfold, will contribute to Pinnacle gathering and treating system to the partnership and QL will contribute 100% of the capital required up to $300 million for the build out of the gathering and treating system. We'll operate the partnership, which will be called Pinnacle Gas Services and will direct is activities. Quantum receives a preferred return and 80% of distributions until the investment hurdle is achieved, then that reduces to 30%.

Your takeaway

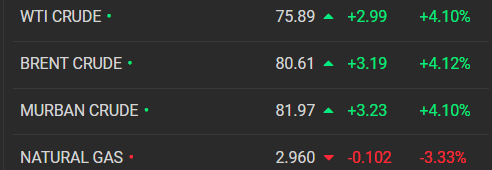

A few weeks ago, I wasn't convinced the rally in gas and CRK had legs, and held off getting out the check book. The case for sustaining the $3.50ish gas price seemed pretty elusive to me at the time. A check of gas prices in the currently seems to support this concern, with them flirting with the high $2.9's. So further weakness may await.

Oil price chart (Oil Price)

It is clear that even with its low cost structure, the company needs higher gas prices in the $3.50-$4.00 level for it to have a strong investment case. That said, the technicals convinced me to dive in with a starter position to which I may add if we see further declines. I am not smart enough to pick a bottom, but I do see long term opportunities in this stock and wanted to own it.

On the technical side, CRK has declined below its 200 day SMA, which is short term a bearish signal. Recently CRK had capital inflows to the stock at triple the normal 3-4 mm share trading volume, which is bullish. The stock is currently sitting on support near the $10.50, from where its bounced twice recently. The seagulls have a Hold rating on the stock. Price targets range from $9.00 on the low side to $17 on the high side. The median is $13.50, suggesting a ~30% upside to current prices with just a little good news.

Investors looking for growth and modest income should consider if CRK meets their investing risk profile.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.