Argonaut Gold: Back On The Sale Rack

Summary

- Argonaut Gold reported Q3 production of ~53,900 gold-equivalent ounces, a 17% increase from the previous year, but below expectations.

- Unfortunately, the company faced unplanned downtime at its Magino mine, resulting in lower-than-expected production and had to sell an additional 1.0% NSR to raise cash.

- In this update, we'll dig into the Q3 results, the updated valuation, and whether the stock is now back to offering an adequate margin of safety below US$0.30.

DarrelCamden-Smith

Just over two months ago I wrote on Argonaut Gold (OTCPK:ARNGF), noting that it was time to consider taking profits at $0.54. This is because the company was in the less predictable ramp-up phase at Magino, had seen a 100%+ rise in its share price off its lows, and was dealing with difficulty filling all of its positions in a tough labor market. Since then, the stock has massively underperformed the Gold Juniors Index (GDXJ) and slid ~45% and we've seen another 1.0% royalty chopped off Magino in a recent sale to Franco-Nevada Corporation (FNV). In this update, we'll dig into the Q3 results, the updated valuation, and whether the stock is now back to offering an adequate margin of safety below US$0.30.

Magino Mill - Company Website

All figures are in United States Dollars.

Q3 Production & Sales

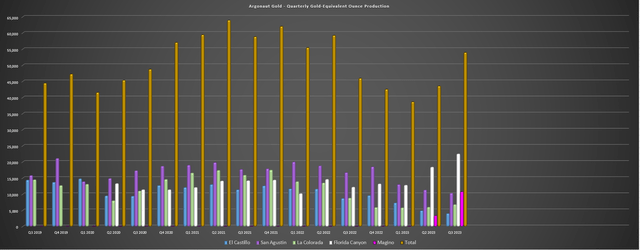

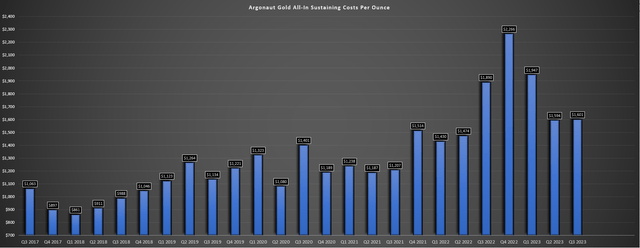

Argonaut Gold released its Q3 results earlier this month, reporting quarterly production of ~53,900 gold-equivalent ounces [GEOs], a 17% increase from the year-ago period. This was driven by a sequential improvement in production at Magino during its ramp-up phase (commercial production declared in November after quarter-end), offset by lower planned production at the company's Mexican assets which it has deemed non-core. The result was revenue of $104.8 million (Q3 2022: $75.3 million) on the back of ~54,600 ounces sold at $1,888/oz vs. ~38,600 ounces sold at $1,895/oz last year (gold forwards benefited Argonaut in the previous period with its sales price above the industry average in Q3 2022 but did not this period due to the higher gold price). Meanwhile, all-in sustaining costs [AISC] improved to $1,601/oz vs. $1,893/oz in the year-ago period, translating to an AISC margin of $287/oz and cash flow of $43.2 million ($21.1 million before changes in working capital).

Argonaut Gold - Quarterly Production by Mine - Company Filings, Author's Chart

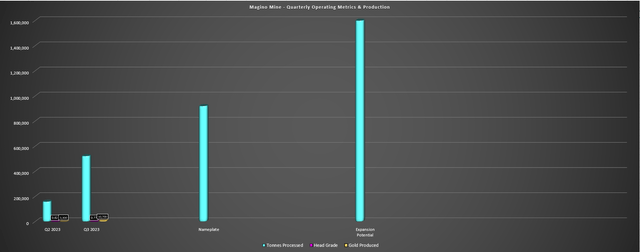

While these results were an improvement, they weren't nearly as strong as the market had hoped, with Magino expected to achieve commercial production earlier in Q3 and expected to produce up to 80,000 ounces this year. Unfortunately, Argonaut shared that it had 20 days of unplanned downtime with issues related to the ball mill motor drive and inching system as well as the SAG mill motor. Since the issues, throughput has been just below nameplate capacity at 9,200 tonnes per day quarter-to-date (10,000 tonnes per day nameplate), suggesting the first full quarter at full production levels will be Q1 2024 vs. Q3 2023 previously. This impact on the balance sheet led to Argonaut having to sell another royalty to Franco-Nevada on Magino to generate cash to be in line with its financial covenants for total proceeds of ~$29.0 million including up to $1.45 million in non-core royalty sales excluding Magino.

Argonaut Gold - All-in Sustaining Costs Per Ounce - Company Filings, Author's Chart

Obviously, these results were not ideal and it's not surprising that the market punished Argonaut with lower production at Magino set to offset the expected production beat (5% - 10% above guided range) at its United States and Mexican operations. That said, the Q3 results with ~53,900 GEOs at $1,601/oz do not reflect what the new Argonaut Gold will look like once it has shed its lower-life and higher-cost Mexican assets and with its new vision of becoming a solely Tier-1 producer by focusing on Florida Canyon (Nevada) and Magino (Canada). And assuming the company is successful ramping up Magino and optimizing Florida Canyon, Argonaut has the potential to be a ~220,000 ounce producer at sub $1,325/oz AISC with Magino expected to be a ~$1,100/oz producer (adjusting for inflationary pressures) at its base case 10,000 tonne per day rate.

We saw clear evidence of improving operations at Florida Canyon in Q3 by lowering cut-off grades to increase throughput, with ~22,400 ounces at AISC of $1,531/oz vs. ~12,100 ounces at $2,201/oz in the year-ago period.

Magino Mine - Quarterly Operating Metrics, Gold Production & Nameplate/Expansion Potential - Company Filings, Author's Chart

Recent Developments

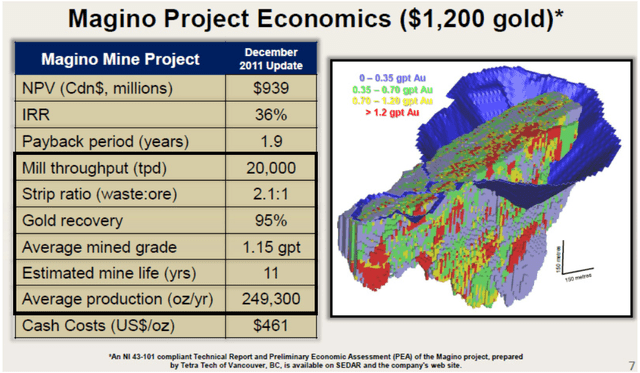

At first glance, owning a ~220,000 ounce producer (or ~270,000 ounces while La Colorada is still producing in Mexico) may not seem that exciting, but it's important to note that Magino looks like it could be significantly larger than the current footprint. This is because it is permitted for 35,000 tonnes per day, has the potential to expand to 15,000 to 20,000 tonnes per day at a conservative incremental cost of ~$70 million with a second ball mill and gyratory crusher, and this mine would look very different at 17,000 to 20,000 tonnes per day which looks to be the goal. In fact, at ~17,000 tonnes per day and even a more conservative grade of 1.05 grams per tonne of gold, this would be a ~193,000 ounce per annum operation. Meanwhile, at ~20,000 tonnes per day at 1.05 grams per tonne of gold, the asset would be capable of producing ~226,000 ounces per annum, and there could be upside to grade as these assumptions are slightly below reserve grades. In fact, this is what Prodigy Gold initially envisioned for Magino (albeit today's Magino has a higher-strip), as shown below.

Magino Project Economics (20k TPD, Prodigy Gold) - Prodigy Gold

Plus, as stated by Argonaut's new CEO Richard Young recently:

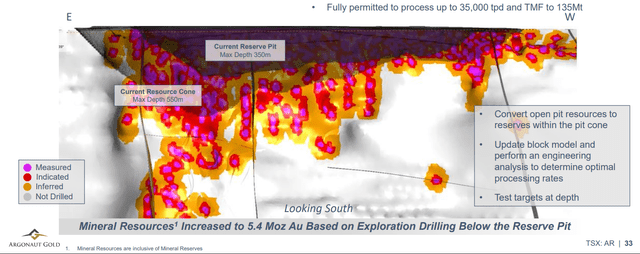

"Last year the company drilled shallow high-grade mineralization below the reserve pit bottom and the thought was about a high-grade underground to supplement the open-pit reserves. But as Marc Leduc [COO] and I came in, we didn't love how the underground hung together. But fortunately, that drilling ended up in a much larger open-pit with a similar strip ratio to our current reserve strip ratio. Based on those encouraging results, we raised flow-through equity to look at converting that resource into reserves. We began the infill program in August and are targeting to convert 500,000 to 1.0 million ounces of resources into reserves, but overall the hope is that we can convert 2.0 of the 3.0 million ounces into reserves outside of the current reserve pit".

- Argonaut Gold CEO, Richard Young, September 2023

Magino Reserve Pit & Resource Upside For Future Mine Plan - Company Website

As the above statements highlight and the above image shows, there looks to be considerable upside outside of the previous reserve pit, and the company has also noted that it is looking at testing targets west of Magino for potential satellite opportunities. And not only would Magino at a 200,000+ ounce per annum rate (potentially as early as 2027) push Argonaut's production to closer to 300,000 ounces, but it would dramatically lower costs at the mine due to the benefit of economies of scale. Plus, at a ~17,000 tonne per day rate which is being actively explored (a more comprehensive update on this opportunity likely to come out by Q4 2024), Magino would be generating over $110 million in free cash flow even at a $1,925/oz gold price assumption and using conservative cost/sustaining capital estimates and adjusting for inflation looking out to 2026, with peak free cash flow closer to $160 million.

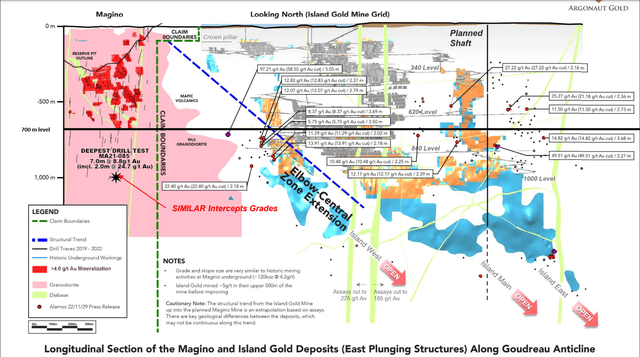

Argonaut Gold's Magino & Alamos' Island Gold Mine - Argonaut Website

The last point worth noting is that we still don't know the extent of the underground potential here, and while management wasn't elated with the underground potential below the pit as a future feed source, it is quite clear from the Island Gold Mine next door that grades improve even further below 700 meters, with Island Gold being a company-maker for Alamos with it currently undergoing a major expansion to push production to 300,000 ounces per annum from the underground alone. And as shown above, Argonaut has hit exceptional intercepts at depth (7.0 meters at 8.8 grams per tonne of gold) below the 700 meter and Alamos has hit even better intercepts to the east including 5.05 meters at 97.21 grams per tonne of gold, 2.18 meters at 22.4 grams per tonne of gold, and 2.18 meters at 13.9 grams per tonne of gold. So, with Argonaut barely scratching the surface here given its focus on open-pittable ounces, this is certainly a nice kicker to the story for a potential suitor, not to mention its new 10,000 tonne per day mill.

Valuation

Based on ~890 million shares, a share price of US$0.28 and an estimated ~$165 million in net debt, Argonaut trades at a market cap of ~$250 million and an enterprise value of ~$415 million. This places it a lower capitalization than many single or dual asset producers in the market today in Tier-1 jurisdictions like Karora (OTCQX:KRRGF), and Wesdome (OTCQX:WDOFF) despite the fact that Argonaut Gold also has two mines in Tier-1 ranked jurisdictions, but a larger production profile, strong leadership in Richard Young (former President & CEO of Teranga), and one mine capable of producing over 225,000 ounces per annum once optimized. Plus, Magino has an industry-leading mine life of ~20 years, making it attractive to a potential suitor, especially given that there looks to be meaningful upside from a reserve standpoint (management believes it can convert upwards of 1.0 million ounces to reserves).

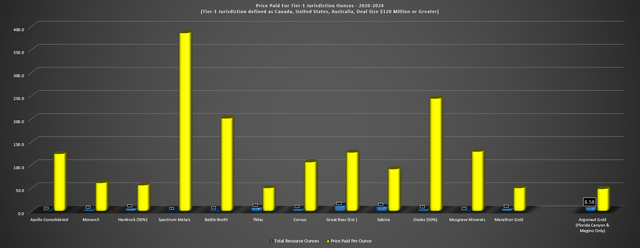

Price Paid for Tier-1 Jurisdiction Ounces (Developers & TMAC Resources 2020 to 2024) - Company Filings, Author's Chart

Looking at how the valuation stacks up vs. other Tier-1 jurisdiction acquisitions over the past few years, we can see that Argonaut Gold is valued at just ~$73/oz on M&I ounces which is 62% below the average and 45% below the median price paid for M&I ounces in acquisitions since 2020. Meanwhile, on a total resource ounce standpoint, Argonaut is valued at just ~$48/oz which is below the price paid for Marathon despite Argonaut being a dual-asset producer already in commercial production, and over 50% below the median price paid for total resources since 2020. However, it's important to note that these average and median figures shown above are what suitors have paid for development assets (with the exception of TMAC which was immediately moved into care & maintenance), hence the total acquisition cost of Argonaut to a suitor would be materially lower. The reason? Argonaut has already sunk ~$700 million into Magino, while projects like Great Bear, Goose, Windfall and others will need capital of $300 million to $1.3 billion to get into production even after the price paid.

To make this an apples to apples comparison, I have excluded all of Argonaut's resources at its Mexican operations and used reserves solely at Magino and Florida Canyon.

To further illustrate how ridiculous the current valuation is for Argonaut, we can see that even on Magino alone Argonaut trades at a steep discount to the median average price paid for M&I ounces of $193/oz and $132/oz, respectively vs. Argonaut at $91/oz. Plus, this doesn't place any value on the sulphide opportunity at Florida Canyon (highlight intercept of 54.9 meters true width at 8.8 grams per tonne of gold), nor does it place value on the deeper underground opportunity at Magino, with Magino being a stone's throw from one of the highest-grade gold mines in Canada that's currently undergoing a major expansion. Hence, I would argue that the current valuation for Argonaut is an absolute steal, and could certainly attract suitors now that there's one less Tier-1 project available with Marathon Gold (OTCQX:MGDPF) off the market it would appear assuming no second bid comes in over the top of Calibre (OTCQX:CXBMF).

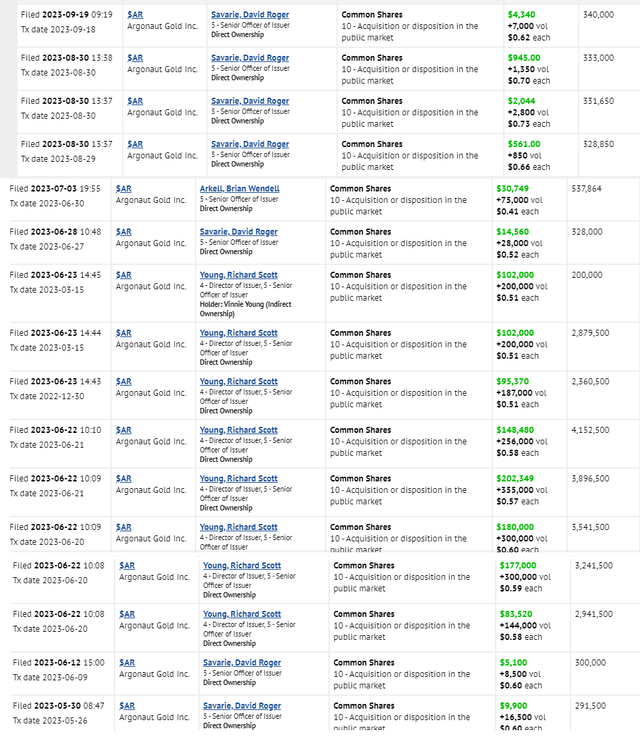

Talk is cheap with every management believing their stock is undervalued but the current management team has put their money where their mouth is, with new CEO Richard Young scooping up ~1.9 million shares at prices ranging from ~US$0.36 to ~US$0.43, and Vice President General Counsel, David Savarie also actively buying over the past few months (in addition to previous VP Exploration, Brian Arkell who has since retired). This is certainly a significant vote of confidence, and it's not surprising that the team is bullish on the stock when the upside case for Magino with a ~17,000 tonne per day throughput rate is an estimated NPV (5%) of ~$1.12 billion using a $1,875/oz gold price assumption (includes impact of hedges from 2023 to 2027 and making conservative assumptions on costs due to inflation + near-term contractor usage).

Argonaut Gold Insider Buying - SEDI Insider Filings

So, what's a fair value for the stock?

Using what I believe to be a conservative estimated net asset value of $580 million at a 0.90x P/NAV multiple (subtracting out net debt and estimated corporate G&A from value of Magino, Florida Canyon, and Mexican assets), I see a fair value for the stock of US$0.65. However, this places a more conservative value on Magino (not the blue sky potential scenario of up to 20,000 tonnes per day and no value on the deeper underground opportunity), and it places a combined value of just $160 million on Florida Canyon and the Mexican assets, with the Mexican assets likely to be divested over the next 18 months (which I see as quite conservative as it discounts any upside from the possible deeper sulphide opportunity at Florida Canyon). However, in a more bullish case for Magino with a meaningful throughput expansion (which the company has been vocal about) and assuming a throughput rate of 17,000 tonnes per day from Q1 2027 going forward, I see a fair value for the stock of ~$790 million or US$0.89 per share.

Hence, if the company can execute successfully on growing reserves and building Magino into a larger asset, I see over 200% upside in the stock looking out to 2026.

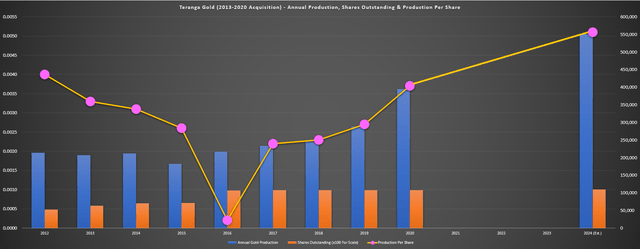

For those unfamiliar, Argonaut's new CEO Richard Young built Teranga from a single-asset producer in 2010 to a dual-asset producer while transforming Sabodala into a larger mining complex with the addition of Massawa, an asset that would have been a 400,000 ounce producer under Teranga if it were not acquired by Endeavour Mining (OTCQX:EDVMF) for ~$2.0 billion. Notably, it was also one of the few gold producers to hold the line on production per share from 2013 to its sale in 2020, and these per share growth metrics don't entirely do the company justice.

This is because Teranga's President & CEO Richard Young had positioned the company to become a ~550,000-ounce producer with Wahgnion and Sabodala-Massawa at industry-leading costs (sub $1,025/oz), with the BIOX Expansion at Sabodala-Massawa (currently near completion under Endeavour) set up to turn this mining complex into a 400,000 ounce per annum asset at sub $800/oz all-in sustaining costs, with another ~150,000 ounces on the side from Wahgnion. And at this production profile, Teranga would have seen meaningful production per share from 2013-2024 (shown below).

Teranga Gold - Annual Gold Production, Shares & Production Per Share + 2024 Estimates (If Not Acquired) - Company Filings, Author's Chart & Estimates

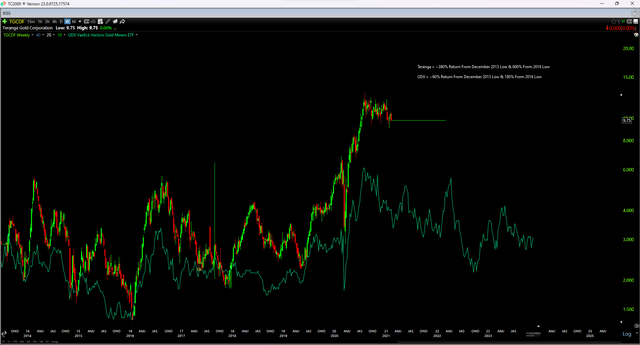

This per share growth at Teranga under Richard Young was achieved by acquiring counter-cyclically with the Gryphon Minerals purchase in 2016 (~$63 million purchase price for Golden Hill earn-in, Wahgnion, and Gourma projects). Wahgnion would pour its first gold in 2019 with an estimated After-Tax NPV (5%) of ~$650 million at $1,700/oz gold (10x the purchase price for just 1 asset acquired), and later the Massawa acquisition in 2019 for $380 million. While Massawa wasn't an significant of a win, this was a solid deal for a non-core asset from Barrick that has transformed the Senegal mining complex (Sabodala-Massawa) into a larger, longer-life and lower-cost asset today, and one of the lowest-cost assets in Africa. Not surprisingly, this accretive growth and outperformance in production and NAV per share helped Teranga to significantly outperform the GDX with a ~380% return from its 2013 lows vs. a 60% return for the Gold Miners Index.

TGZ vs. GDX Share Price Performance - Worden.com

Risks & Negatives

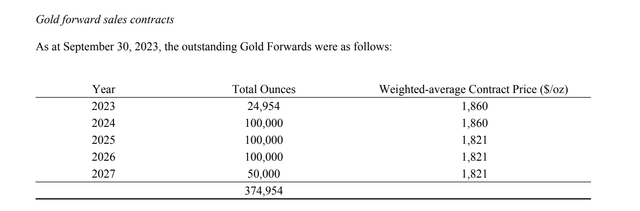

As highlighted above, there are certainly risks to the investment thesis, with the potential for a final equity raise during this period of tighter working capital ($6.9 million deficiency at quarter-end ahead of royalty sale) and Magino still working to ramp up to full production levels, with commercial production reached on November 1st, suggesting that the first quarter of full production will be Q1. The other negative worth noting is that the company has a material amount of hedges related to its 2022 financing to cover the capex blowout at Magino, with ~375,000 ounces hedged at an average price of ~$1,834/oz. This gives Argonaut less leverage to the gold price assuming a production profile of ~220,000 ounces in 2025/2026 at Florida Canyon and Magino combined, with 45% of production hedged at below spot prices.

That being said, the impact should be much lower in H2-2026/2027 if the company can deliver on its Magino optimization plans given that Magino could produce 200,000 to 220,000 ounces at a 15,000 to 17,000 tonne per day rate, translating to total production of ~300,000 ounces.

Argonaut Gold - Gold Forward Sales Contracts - Company Filings

The second negative is that cost pressures could remain near-term with Magino's costs above expected levels, with the company noting that the filling of positions for its permanent workforce is near completion, but "sourcing labor remains a challenge in the current economic environment", meaning that any vacant roles are having to be filled by higher-cost contractors. I don't see this as a big deal to the long-term thesis and Richard Young stated in a recent interview that this is largely due to not rushing its hiring and ensuring it they get the right workers, as discussed below. Given the winding down of major construction operations next year (Cote Gold and Greenstone), I would expect a more favorable labor environment in H2-2024, suggesting this will be a short-term issue.

"The challenge in Ontario is that there are construction projects everywhere, and we've got three projects being built in Northern Ontario so there's a lot of competition for skilled workers. And part of it is making sure we hire the right people, with the right values, and the right background, and that will be part of our team. We just want to make sure we hire good people, so it is taking time but we will get there".

- Argonaut Gold CEO, Richard Young, August 2023

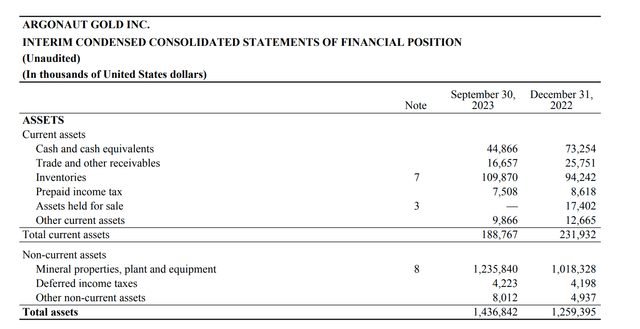

The third and risk worth pointing out is that Argonaut's balance sheet is certainly weaker than some of its peers with just ~$45 million in cash as of quarter-end (~$74 million following sale of royalties subsequent to quarter-end), and with ~$228 million in debt (excluding $57 million in convertible debentures). And with the Mexican assets still not sold to provide additional capital, Argonaut noted that it is reviewing options of either financing its loan facilities or raising additional equity. Since then, it has raised ~$29 million through royalty sales and may be able to avoid raising additional capital at depressed prices if the gold price can stay at current levels (over half of its production benefiting from higher prices than its hedges). Still, with limited free cash flow generation until Q1 2024 when Magino is fully ramped up at a steady state of 10,000 tonnes per day for a full quarter with higher grades being milled (and hopefully a better labor position with more staffing vs. contractor usage), the company could remain in the penalty box short-term, and it's impossible to entirely rule out a final equity raise and continued share price weakness.

Argonaut Cash Position - Company Filings

Summary

Argonaut Gold certainly has one of the weaker balance sheets sector-wide with ~$165 million in net debt (excluding ~$57 million in convertible debt) after its recent royalty sale, and recently received a waiver on its covenants related to the higher than planned project construction cost (~$700 million vs. ~$660 million) and the delayed ramp-up to commercial production and also negotiated a deferred settlement on $19.1 million gold prepaid advances from December 31st, 2023 to March 31st, 2024. These developments certainly may not inspire much confidence, and the delayed plant ramp up at Magino certainly hasn't helped matters (plant reliability issues). Finally, while the company is planning to shed its Mexican assets to become a solely Tier-1 producer, this is a less favorable environment for selling assets, suggesting it's best to be quite conservative on modeling proceeds from the sale of its non-core mines.

That said, much of these worries look priced into the stock at a share price of US$0.28 (~$250 million market cap), and while it's not possible to entirely rule out a final small equity raise to improve the balance sheet, I would argue that the possibility of another 5-7% share dilution is more than priced into the stock as well. Plus, as I noted with Marathon Gold, waiting on the sidelines for an equity raise to provide a cheaper entry was that it may be acquired in the interim and this is precisely what happened. In Argonaut's case, a low-ball offer and "take-under" like we saw with Marathon looks less likely due to the large position held by GMT Capital (~30% of shares), but even a larger 60-70% premium deal from current levels would still provide a lot of value for the suitor given that Magino's value alone looks to be $800 million to $900 million if this asset runs as it's expected to over its mine life (even excluding expansions).

Magino Mine - Company Website

A better entry may present itself if Argonaut needs to raise capital one final time, but even including any added dilution I see Argonaut as one of the most undervalued Tier-1 producer today and a top-3 opportunity in the small-cap producer space. Plus, it's certainly positive to have strong leadership with Richard Young at the helm, and I can't imagine that he took this role just to run two small-scale mines at Florida Canyon and Magino with total production of ~250,000 ounces. Instead, I think the vision is to build another 400,000-ounce producer by scaling Magino up, going after the sulphide opportunity in Nevada at Florida Canyon, and potentially acquiring a third Tier-1 jurisdiction mine down the road. Hence, for investors willing to be contrarian and bet on the long-term vision for the company in this period of extreme negative sentiment, I see Argonaut as one of the better reward/risk bets in the market today.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.