What's your favorite bitcoin ETF?

Today's most significant market development undoubtedly lies in the approval of the digital asset (Bitcoin) spot ETFs. Bitcoin ETFs have been approved by the Securities and Exchange Commission after an extensive review period. Early in the day, friends asked me about the 11 approved ETFs and potential investment opportunities.

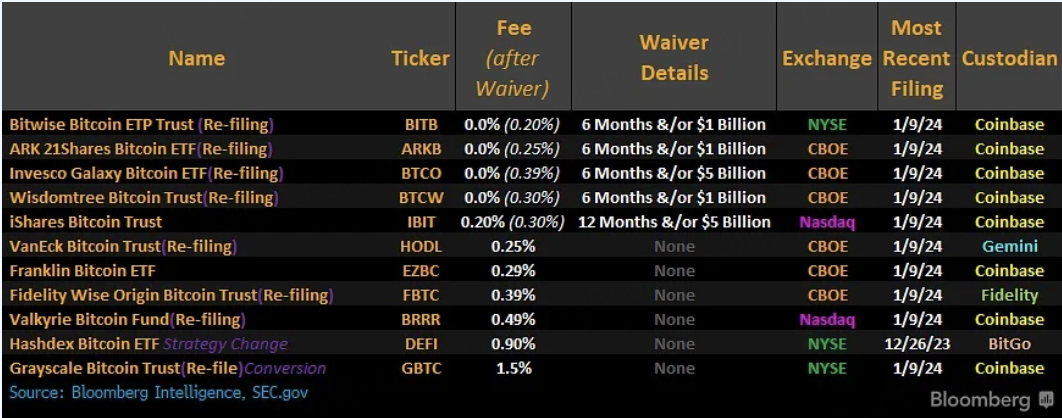

Firstly, here's a list of the 11 approved ETFs:

The approved issuers include prominent names like Cathie Wood, BlackRock, Fidelity, and Invesco.

In most cases, approved Bitcoin ETFs have a common foundation that complies with regulations set by the U.S. Securities and Exchange Commission (SEC) to ensure investor protection and market integrity. However, each fund possesses distinct characteristics, offering investors a variety of choices to align with their investment preferences.

ETF Fees

You can check ETF fees from the above form.The Bitcoin ETF rates range from 0.20% to 1.5%, with $Bitwise Bitcoin ETF(BITB)$ marking the cheapest with its 0.20% listing. $ARK 21Shares Bitcoin ETF(ARKB)$ follows closely at 0.25%, $VanEck Bitcoin Trust(HODL)$ , while Invesco Galaxy and Fidelity trade at 0.39%.

ETFs Bitcoin Custodian

While most ETF issuers hire the Coinbase Custodian Trust to store and manage their underlying bitcoin assets, VanEck, Valkyrie and Fidelity have taken a different approach.

Different Type

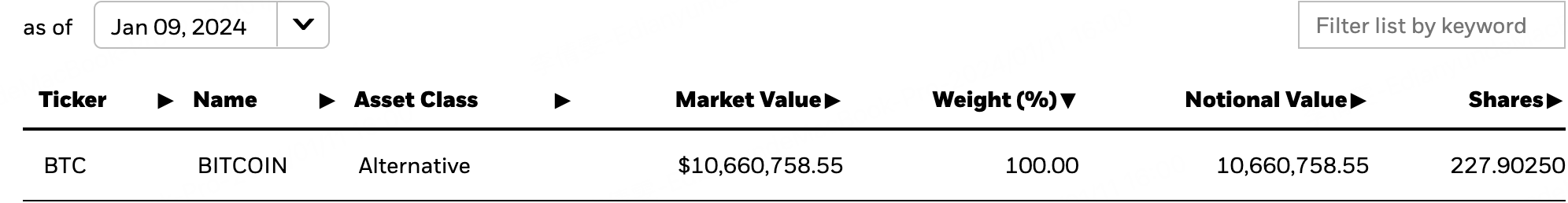

$iShares Bitcoin Trust(IBIT)$ The iShares Bitcoin Trust seeks to reflect generally the performance of the price of bitcoin.BlackRock will waive a portion of the Sponsor’s Fee for the first 12 months commencing on January 11, 2024, so that the fee will be 0.12% of the net asset value of the Trust for the first $5.0 billion of the Trust’s assets.

$ARK 21SHARES BITCOIN ETF(ARKB)$ seeks to track the performance of bitcoin, as measured by the performance of the CME CF Bitcoin Reference Rate .

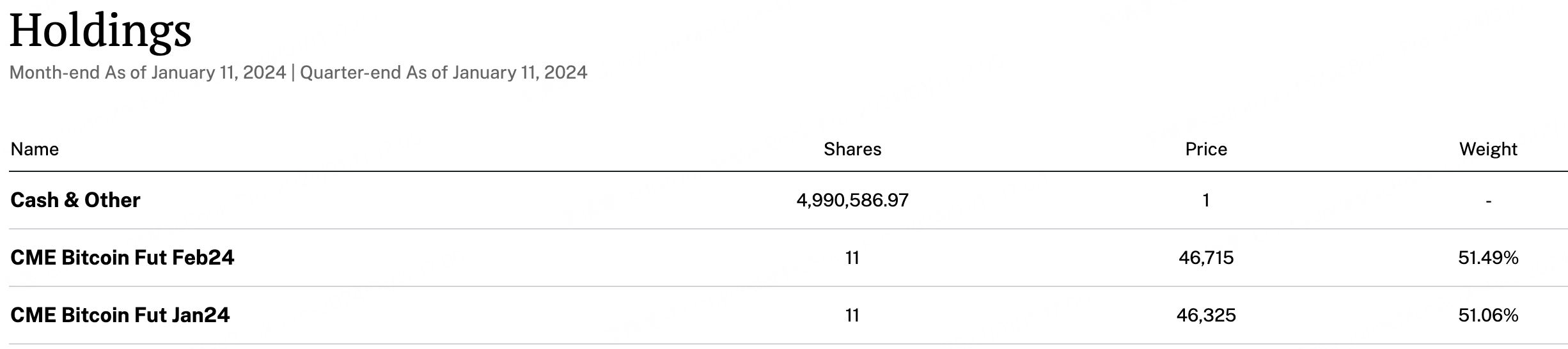

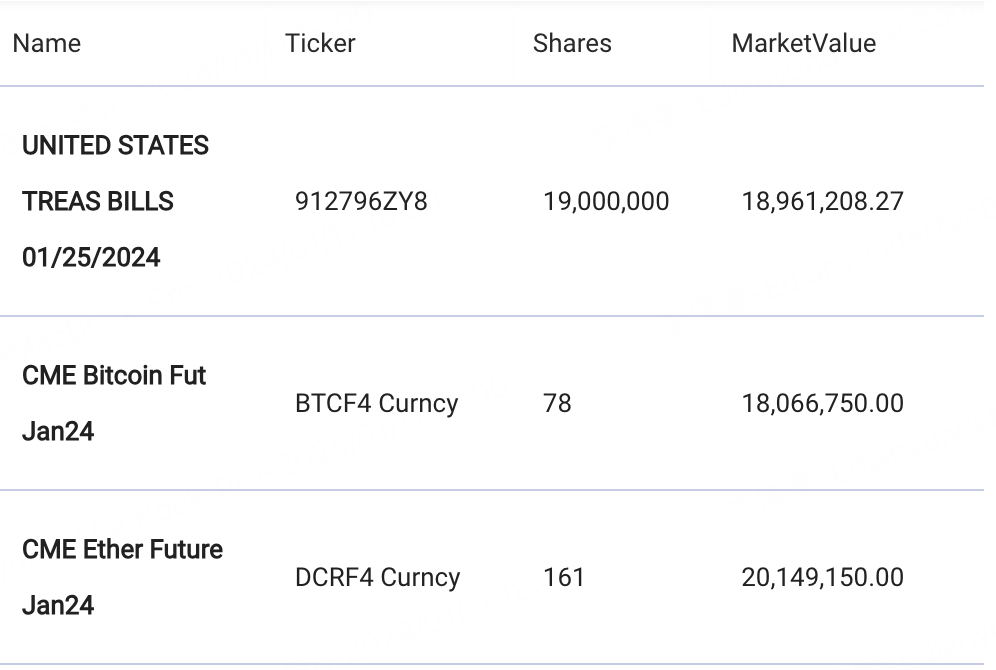

Now, let's look at ETFs tracking Bitcoin futures contracts:

(Note: These ETFs may incur losses due to contango during futures rollover.)

$Hashdex Bitcoin Futures ETF(DEFI)$ The Hashdex Bitcoin Futures ETF provides exposure to the world’s first decentralized blockchain-based digital currency.

$Valkyrie Bitcoin Fund(BRRR)$ an actively managed ETF available through Nasdaq that invests primarily in bitcoin and ether futures contracts

Next, let's explore a few ETPs:

(Note: ETPs are debt securities, not equity, and can be created and redeemed based on authorized participants' requests, traded on exchanges like stocks.)

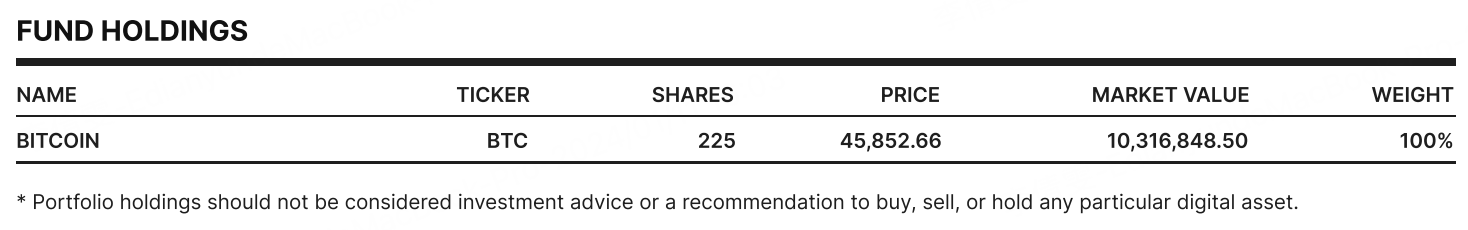

$Fidelity Wise Origin Bitcoin Fund(FBTC)$ An ETP by Fidelity, tracking Bitcoin's performance with the benchmark being Fidelity Bitcoin Reference Rate.

$Grayscale Bitcoin Trust (BTC)(GBTC)$ Launched by Grayscale, GBTC is a passively managed Bitcoin trust fund tracking The CoinDesk Bitcoin Price Index (XBX) with the highest management fee of 1.5%.

$WisdomTree Bitcoin Fund(BTCW)$ An ETP by WisdomTree, tracking Bitcoin's price performance.

Now, let's explore ETFs tracking the performance of companies related to blockchain:

$Invesco Galaxy Bitcoin ETF(BTCO)$ Invesco Galaxy Bitcoin ETF (BTCO): Launched by Invesco, BTCO tracks the Alerian Galaxy Global Cryptocurrency-Focused Blockchain Equity, Trusts, and ETPs Index, including companies like GBTC, MARA, APLD, CAN, etc.

There are a few ETFs for which detailed information is yet to be found, and any contributions are welcome:

$Bitwise Bitcoin ETF(BITB)$ An ETF by Bitwise Asset Management, allowing indirect investment in Bitcoin through the stock market, with a 6-month fee waiver at the start of trading.

$Franklin Bitcoin ETF(EZBC)$ Launched by Franklin, aiming to track Bitcoin's price performance.

$VanEck Bitcoin Trust(HODL)$ An ETF by VanEck with a 0.25% management fee, providing investors exposure to Bitcoin's performance.

What are the impacts of these 11 approved ETFs?

The most direct impact is the potential attraction of a large number of institutional and retail investors. ETFs typically offer a more accessible entry into the market for institutional investors through conventional stock trading platforms. If Bitcoin ETFs are approved, institutional investors may find it easier to participate in the Bitcoin market in traditional ways, potentially increasing market liquidity and depth.

Furthermore, the approval of Bitcoin ETFs will provide a more convenient way for retail investors to add Bitcoin to their portfolios without directly buying and storing cryptocurrencies. This convenience may encourage more retail investors to enter the Bitcoin market.

According to a report by Standard Chartered Bank, the approval of related ETFs could significantly change the game for Bitcoin, allowing both institutional and retail investors to invest in Bitcoin without directly holding it. It is estimated that it could attract $50 to $100 billion in funds this year alone and push the price of Bitcoin to $100,000. Other analysts believe that the inflow of funds in the next five years could be close to $55 billion.

What are the investment opportunities?

The most direct investment approach would be the aforementioned 11 ETFs. However, personally, I believe there are substantial risks in trading stocks related to Bitcoin. The underlying asset itself has significant volatility, so if considering buying, it's advisable to avoid using leverage and limit exposure to a small percentage of the account, perhaps 10% or less.

In addition, I prefer investing in Bitcoin exchanges or brokerages, wallets, and other companies providing mid-to-low-level trading and services. Companies involved in mining and manufacturing mining equipment would be my next consideration.

Overall, the approval of these 11 ETFs opens up new possibilities for both institutional and retail investors, providing a more accessible and convenient route to invest in Bitcoin. $Tiger Brokers(TIGR)$ $Robinhood(HOOD)$ $Coinbase Global, Inc.(COIN)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great ariticle, would you like to share it?

Great ariticle, would you like to share it?

Blackrock