Cimpress Benefits From Customer Acquisition And Margin Management

Summary

- Cimpress's customer acquisition increased in Q1 due to a focus on value-added products and expanding product breadth.

- The company's margin expansion outlook is strong as input costs decrease and cost reduction measures take effect.

- CMPR's revenue growth in Q1 was driven by higher demand in Europe, while the US market faced challenges from an uncertain economy.

- The stock is reasonably valued versus its peers.

SeventyFour/iStock via Getty Images

CMPR Improves Value Proposition

I have been discussing Cimpress plc (NASDAQ:CMPR) in the past, and you can read my latest article here. In that piece, I found it was getting leverage from the pricing traction compared to its previous year. In the current iteration, I find CMPR's customer acquisition zoomed in Q1 as it focused on providing more value-added products and enriching its product breadth. In effect, its order value has increased. Following new product introductions, its above-average growth in Europe offset relatively low growth in North America. The company's margin expansion outlook is robust as input costs fall. The gains from the cost-curtail exercises will befall in 2024.

However, the growth curve faces challenges from an uncertain economy and industry environment in the US. As I had identified in my previous article, the company's negative shareholders' equity remains a concern. Cash flows, on the other hand, showed remarkable improvement in Q1. The stock is reasonably valued. With some factors favoring an improved outlook, I consider the stock a "hold" for the medium term.

Customer Growth: The Core Driver

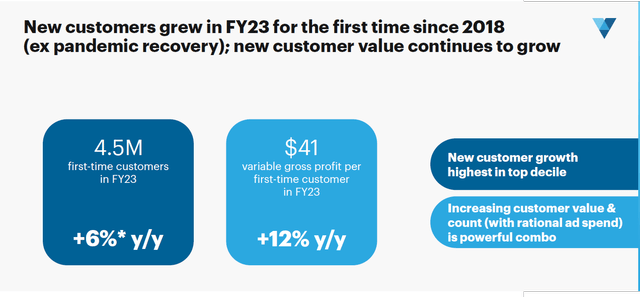

CMPR's 2023 Investor Day Presentation

In Vista, the company's primary segment, CMPR's customer acquisition accelerated in Q1 2024. Overall, the company's new customers grew by 13% in Q1 compared to a year ago. Although the repeat customers declined compared to a year ago, it showed positive momentum quarter-over-quarter. The other value driver for the company was the reduction in value-destructive advertising. Instead of relying on advertising expenditure, it concentrated on producing higher-value products. So, moving to higher-value products enhanced the company's value proposition even without pricing increases.

The company will continue to strengthen its efforts to increase its customer base, including repeat customers. Over the past several quarters, it has re-positioned its brand by enriching its product breadth, helping accelerate growth, and broadening the areas of high-value products. In Q1, the sales growth in Vista resulted from the contribution of growth in orders and higher average order values. A product mix and pricing, in turn, led to higher average order value.

Outlook Explained

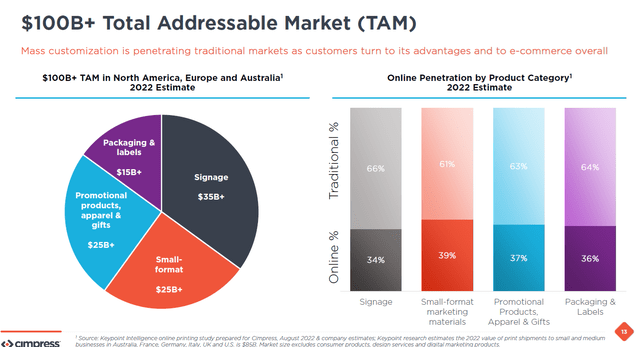

CMPR's 2023 Investor Day Presentation

In FY2024, CMPR's management expects revenues to grow by 8%, while the organic (constant-currency) revenue growth should be 6%. Because its profit margin and cash flows trended up in Q1, it raised its FY2024 adjusted EBITDA guidance to ~$425 million, which would be 25% higher than FY2023. It increased its FY2024 operating income guidance to $206 million. It also expects adjusted EBITDA-to-free cash flow at ~40%.

The Q1 Value Drivers

Much of the development in Q1 resulted from order growth in Europe due to a higher demand for packaging, labels, and marketing materials. New product introductions helped generate impressive demand in this region. North America, on the other hand, was relatively sedate.

A geographical migration on top of the technology migration benefited the European market. Plus, the company put in place organizational changes in March of 2023. So, the company witnessed meaningful improvements in customer credit rates, resulting in higher revenues in Europe.

The Cost Reduction Trend

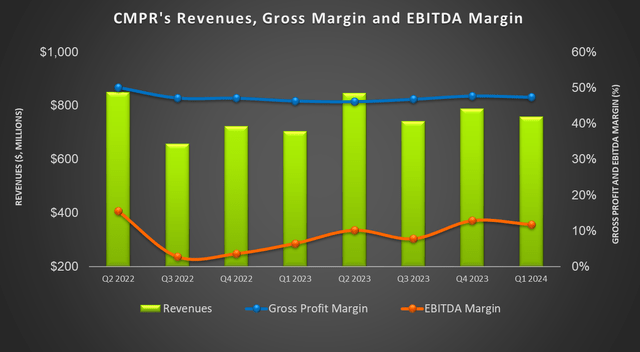

Seeking Alpha

On the operating margin side, a few factors have benefited CMPR's margin expansion over the past few quarters. Paper costs were reduced, mostly in Europe but also in North America. Energy costs, which went up significantly a year ago, came down and lowered the elevated cost structure in some regions, like Italy. According to the company's estimates, the cost per kilowatt hour has more than halved over the past year.

Besides the favorable changes in input costs, CMPR initiated a cost reduction measure in March. At that time, it announced a $100 million of expected benefits from that exercise. Approximately 75% of the total benefits were expected to accrue in the first few months of FY2024. The company believes that it is on track to achieve its goal.

Industry Factors

The ISM Services PMI fell to 50.6 in December 2023 compared to 52.7 in November. Sloppy new order growth, low employment, and inventory contraction led to the fall. The PMI remaining close to 50 can adversely affect CMPR's outlook, but I do not see much to worry about as long as it stays above that number.

Q1 Performance Analyzed

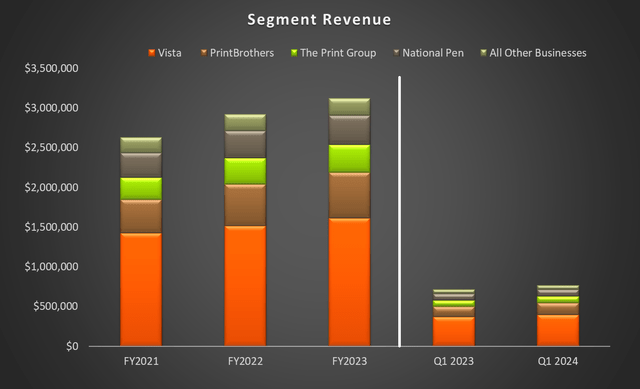

CMPR's Filings

Segment-wise, CMPR's revenue growth in the Vista segment was 7.4% in Q1 2024 compared to a year ago. Most of the revenue push came from promotional products, apparel, and gifts. The segment saw an 18.8% adjusted EBITDA margin. The segment accounted for 52% of the company's consolidated revenues in Q1. Due to Vista's significant contribution to the consolidated profit, its gross margin (real terms) expanded by 100 basis points, year-over-year.

Among CMPR's other segments, National Pen grew by 6.8% compared to a year ago, while the growth in The Print Group was the highest (14.7%). However, the adjusted EBITDA margin for The National Pen group was the lowest among its segments in Q1 (9.5% EBITDA loss). Overall, the company's consolidated adjusted EBITDA grew by more than 500 basis points year-over-year in Q1. The improvement includes the benefit of cost reductions.

The Challenges And Other Risks

In Q1, I witnessed an impact on CMPR's revenues due to the revenue timing changes. It mitigated its revenue growth by 200 basis points. However, with an improving backlog, the timing factor should subside for the rest of the year. Also, the positive impact of price hikes in the Upload and Print businesses, initiated in FY2023, is expected to wane this year.

There are some concerns over the demand side, too. While orders stabilized in some markets, lower quantities per order marked the Upload and Print businesses. In reseller channels, revenue trends have softened. The negative impact, however, was concentrated on the Print group. Vista and Upload business appear to ride on a steady scale.

Vista, which generates most of its sales, was reorganized in Q3 2023 to suit expert design and marketing partners for small businesses. This required heavy investments. Also, the initiative can add complexity to its decision-making process. If the effort does not bring the intended results, it can affect the company's future plans and profitability adversely.

Cash Flows and Debt

In Q1 2024, CMPR's cash flow from operations turned positive due, in part, to higher revenues. Free cash flows (or FCF) also turned positive in Q1 2024 compared to a year ago.

CMPR's shareholders' equity is negative due to treasury shares (i.e., share repurchases) and accumulated other comprehensive losses. The company has been prioritizing the reduction in net leverage. During Q1, it purchased $21 million worth of debt. Net leverage was reduced to 3.5x in Q3, and it aims to reduce it to below 3.25x by FY204.

What Does The Relative Valuation Tell Us?

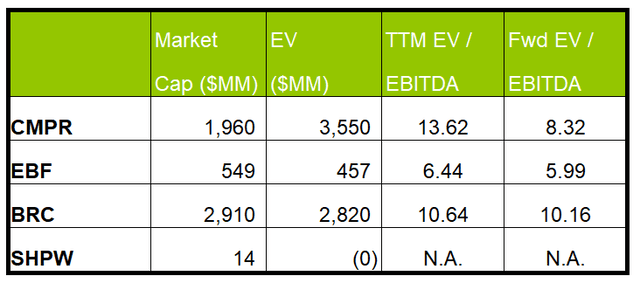

Author Created and Seeking Alpha

CMPR's forward EV/EBITDA multiple versus the current EV/EBITDA multiple is expected to contract more steeply than its peers. This implies that its EBITDA is expected to rise more sharply than its peers next year, which typically results in a higher EV/EBITDA multiple. The company's EV/EBITDA multiple (13.6x) exceeds its peers' (EBF, BRC, and SHPW) average. The current multiple is also close to its past five-year average. So, the stock appears to be reasonably valued compared to its peers.

If it trades at the past average in the medium term, it can climb 19% from the current level. However, given the economic and industry challenges, I think it will stay close to the current level in the short term before producing the forecast returns.

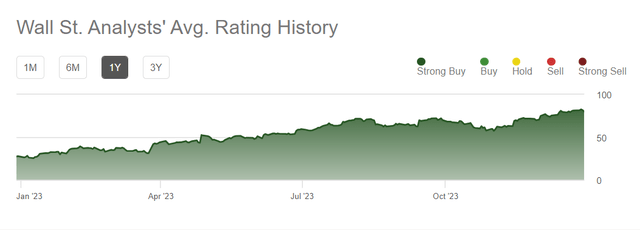

Analyst Rating

Seeking Alpha

Two Wall Street analysts rated CMPR a "buy" (including "Strong Buy"), while none recommended a "hold" or a "sell." The consensus target price is $95, which indicates ~28% upside potential at the current price. However, I think, given the sales headwinds, Wall Street analysts are overestimating the returns.

Why Do I Keep My Call Unchanged?

In my previous article, I was relatively optimistic about CPMR. New customer additions, better pricing, and increased bookings culminated when the industry outlook brightened. On top of that, cost rationalization was yielding its effects. However, the balance sheet and relative valuation multiples were not favorable. I wrote:

In a competitive market, it focused on marketing development. Vista, the most prominent of its segments, witnessed a well-balanced margin expansion in Q4. As pricing maintains its positive momentum, it will likely see continued margin expansion in FY2024. The company's cost curtailment exercises will also help its operating margin growth.

After Q1 2024, CMPR benefited from growth in orders and higher average order values. A geographical migration to Europe and technology migration helped it gain momentum. Its revenue growth met some challenges, too. The industry drivers are not sufficiently strong. The company's balance sheet and relative valuation have not changed much since my last article. I think the stock will remain on "hold" for some time.

What's The Take on CMPR?

Seeking Alpha

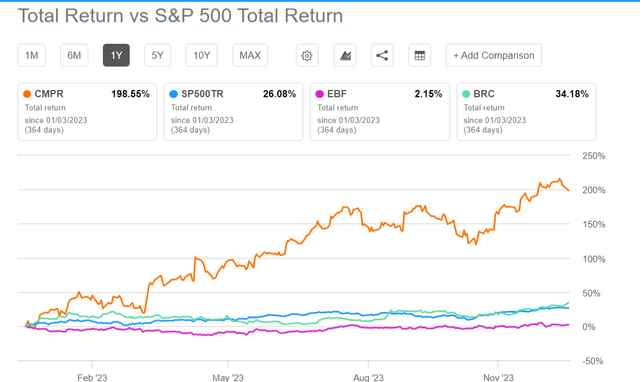

CMPR shifted its strategy from relying on promotional expenditure to concentrating on producing higher-value products. A better product mix and improved pricing lead to higher average order value. Higher demand for packaging, labels, and marketing materials. The company saw margin growth in Europe as energy costs decreased noticeably in that region. On top of that, the majority of its expected benefits will accrue this year. So, the stock steeply outperformed the SPDR S&P 500 ETF (SPY) in the past year.

In contrast, repeat customers have recently declined, prompting the company to focus on acquiring new customers. The company's negative shareholders' equity remains a concern. However, it reduced net leverage in Q1. Considering all aspects, I would recommend "holding" the stock for higher returns in the medium term.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.