Elastic: In Search Of A Competitive Advantage

Summary

- Elastic's stock has risen due to expectations of generative AI's impact on its search business.

- Software in general is beginning to look expensive again, and Elastic is no exception. The company's growth will need to pick up substantially to support its current valuation.

- The demand environment remains soft though, which may make it difficult for Elastic to live up to investor expectations.

- Either way, investors will still likely need to wait at least a few more quarters for the impact of generative AI on Elastic's business to become more apparent.

DKosig

Elastic's (NYSE:ESTC) stock is up significantly from its early 2023 lows, largely on the back of growing expectations in regard to the impact of generative AI on its search business. I previously suggested that improving sentiment towards Elastic's stock may not be warranted based on the company's fundamentals. The stock is up nearly 40% since then, while growth has remained flat, and margins have improved slightly.

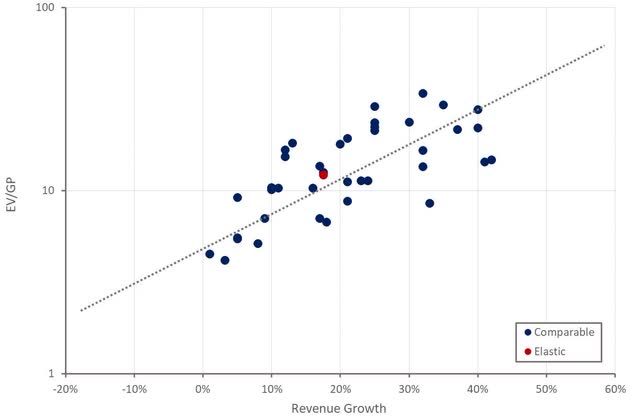

While Elastic's profitability continues to improve, the company's growth and ability to attract new customers are both still fairly modest. Elastic's stock is no longer undervalued relative to peers, and is in fact beginning to look expensive given its middle of the road security and observability businesses. Expectations for the search business are high, and it may be difficult for Elastic to deliver on this.

Market

Given the hype around LLMs and their early application to search, Elastic would seem to be a beneficiary. As an example of the potential impact, Walmart (WMT) is working with Microsoft (MSFT) to embed generative AI search capabilities into its website. This is designed to provide shoppers with a curated list of items based on their search query. Many organizations are likely to head down this path (both internal and customer facing applications) in coming years, and some of those are likely to utilize Elastic.

GPU investment must flow through to infrastructure and applications at some point and is already at a level which implies tens of billions of dollars of additional annual cloud revenue in coming years. Investors will likely need to wait at least several more quarters for any gains to become apparent though. Many companies are still struggling to get their hands on GPUs. Even with access to GPUs, there is a there is a time lag between when hardware is received and actually deployed in a data center. Snowflake (SNOW) has stated it typically takes 6 months from when hardware is purchased to when it goes into production. Customers then need to ramp consumption before Elastic will see meaningful revenue.

While there has already been a small number of software beneficiaries, the business model is still unclear for many companies. For example, LLMs could undermine the economics of internet search. Only a fraction of the necessary increase in spending needs to find its way to a company like Elastic to create a large tailwind though.

Figure 1: NVIDIA Data Center Revenue (source: Created by author using data from NVIDIA)

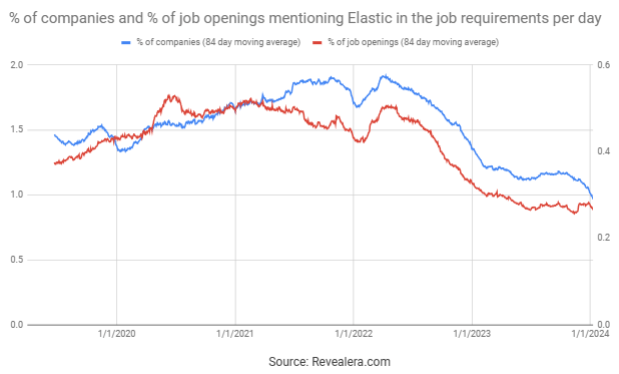

In the meantime, Elastic still has to contend with a tepid macro environment. Elastic has suggested that the macro environment has been stable, although customers remain cost conscious. While IT spending appears to have stabilized somewhat, customers continue to optimize consumption and scrutinize spending. Something that is particularly prevalent amongst smaller organizations. This is problematic for Elastic as its customer base skews towards smaller organizations. A healthier demand environment would likely see Elastic's growth accelerate meaningfully, but I see little reason to expect this in 2024.

Elastic

Search has always been at the core of Elastic's business and generative AI is breathing new life into search. For example, vector search and hybrid search significantly improve video and image search results. This should provide a tailwind, but this needs to be weighed against the fact that observability and security now dominate Elastic's business.

Elastic's Elasticsearch Relevance Engine (ESRE) can be used to build generative AI applications and is seeing rising adoption. Elastic believes that its background in search and capabilities across semantic search, vector search and hybrid search provide it with an advantage. ESRE includes a built-in vector database, which hundreds of customers began to use in the second quarter. Elastic also now offers ELSER, a proprietary model which enables customers to implement semantic search without training.

Elastic is also embedding AI in its observability and security products through AI assistants. These are part of Elastic's enterprise subscription tier and help to differentiate its products from the opensource software.

Elastic also continues to build out the capabilities of its platform through small acquisitions, recently acquiring Opster. Opster develops products for monitoring and managing Elasticsearch, including AutoOps, which provides insights into cluster health, improves search performance and reduces hardware costs. Opster is not expected to contribute meaningful revenue in the near-term.

Financial Analysis

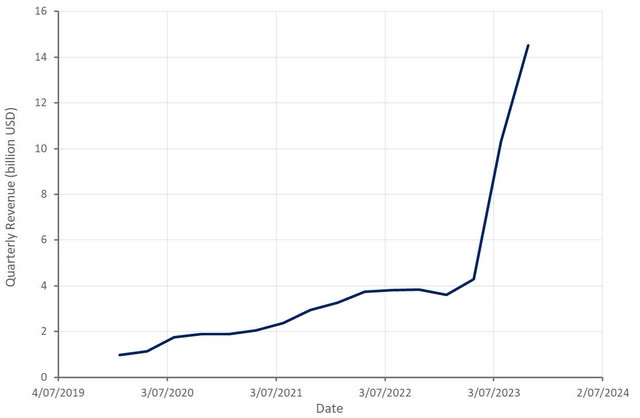

Revenue grew 17% YoY in the second quarter, with Elastic Cloud growing 31%. EMEA grew fastest during the quarter, followed by APJ and the Americas. While this growth is reasonable given the current demand environment, it is probably not sufficient to justify Elastic's current valuation.

Elastic expects 319-321 million USD revenue in the third quarter, representing 17% YoY growth at the midpoint. This is probably slightly conservative, but I don't expect Elastic's growth to accelerate meaningfully in the near-term. While Elastic believes that AI is a tailwind, it is early days in terms of monetization. Customers need to implement solutions and ramp usage before Elastic will see significant incremental revenue.

Figure 2: Elastic Revenue Growth (source: Created by author using data from Elastic)

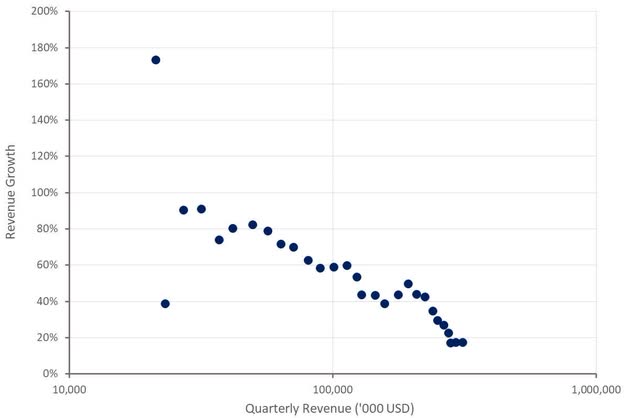

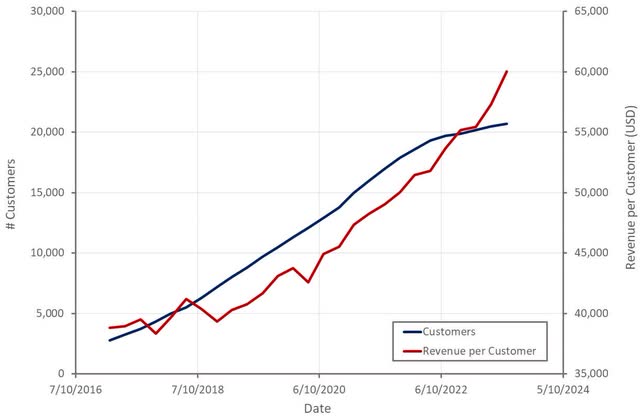

While Elastic continues to struggle to expand its customer base, it is still seeing some success amongst larger customers. For example, the number of customers with greater than 100,000 USD ACV increased roughly 16% YoY. Elastic stated that it had a number of key wins in the second quarter where it displaced incumbent observability and security solutions.

Figure 3: Job Openings Mentioning Elastic in the Job Requirements (source: Revealera.com)

Elastic also continues to drive expansion within its existing customer base, albeit at a fairly low rate. The company's net expansion rate was approximately 110% in the second quarter, although this could improve through 2024 as optimization efforts wind down and generative AI tailwinds pick up.

Figure 4: Elastic Customers (source: Created by author using data from Elastic)

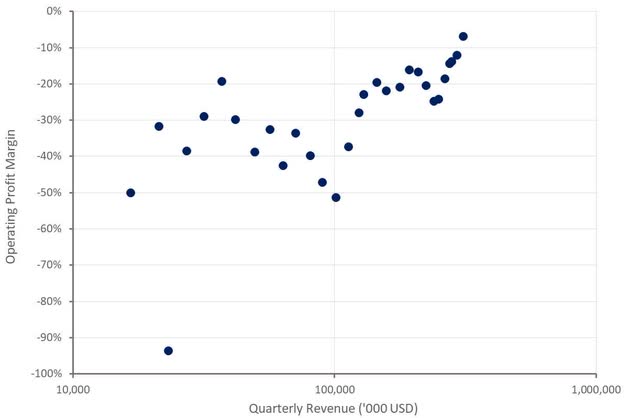

One of the more impressive aspects of Elastic's business recently has been the improvement in profitability. Given Elastic's scale and growth rate it really should be profitable on a GAAP basis, something that the company appears set to achieve in coming quarters. Positive cash flows and improving profitability have likely contributed to Elastic's recent multiple expansion, although investor focus on profitability appears to have waned in recent months.

Figure 5: Elastic Operating Profit Margin (source: Created by author using data from Elastic)

Conclusion

Elastic's valuation compressed significantly in 2022 on the back of concerns relating to the company's competitive positioning. Its two most important end markets are security and observability, and Elastic is not a leader in either of these. The company's narrative has therefore been largely based around platform consolidation and enabling lower costs for customers, which has failed to inspire investors. The potential for generative AI to reinvigorate Elastic's search business has now changed this. Expectations are high though and it is not clear whether growth will accelerate sufficiently to support Elastic's current valuation.

Figure 6: Elastic Relative Valuation (source: Created by author using data from Seeking Alpha)

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.