Option Witch | Tesla Stock Is Facing Obstacles - Sell Covered Calls for Protection

$Tesla(TSLA)$ recently reported weaker-than-expected Q4 earnings, sending shares tumbling more than 12% the following day. Lackluster growth, margin headwinds, and the lack of a clear outlook were the driving forces for the selloff.

Despite already being down 23% in 2024, it seems that the path of least resistance is not upside. Elon Musk's $55 billion pack package at electric vehicle maker Tesla was voided by a Delaware judge after a shareholder lawsuit claimed his hefty pay package was unduly approved. Tesla shares fell 2.94% to $184.96 in premarket trading on Wednesday.

Since Tesla stock is facing some obstacles. This is good for near-term expiring covered call option plays. Investors can make extra income with these trades.

Selling covered call options is a strategy adopted by many large funds. It can also be used by retail investors in the US stock market. You can get income while holding it.

This strategy is very suitable for stocks that have long-term positions but are in bearish sentiment recently. It can be a good strategy for mature investors to roll over when holding some targets for a long time.

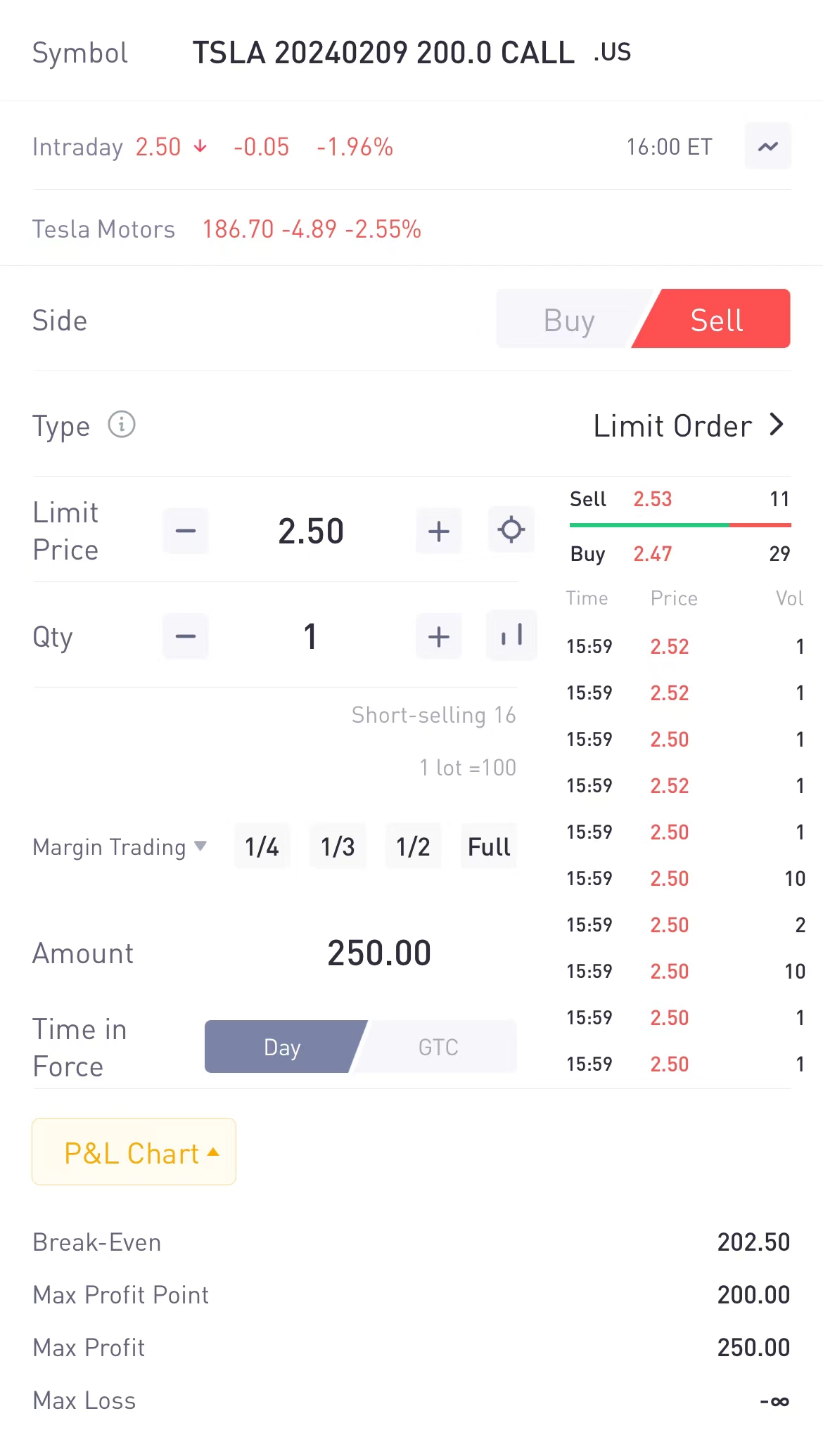

For example, the $200 calls are now trading for $2.5 or so, and the covered call yield is 1.25% (i.e., $2.5/$200). The expiration period is more than one week away from today and it is nearly 5% out-of-the-money. For radical investors, $195 strike is also considerable cause it could generate more potential gains.

For those who sold the short-term put, it's still reasonable to sell near-term covered calls if they are forced to buy Tesla shares. They still have the chance to lessen unrealized losses even if misjudged the direction before earnings report.

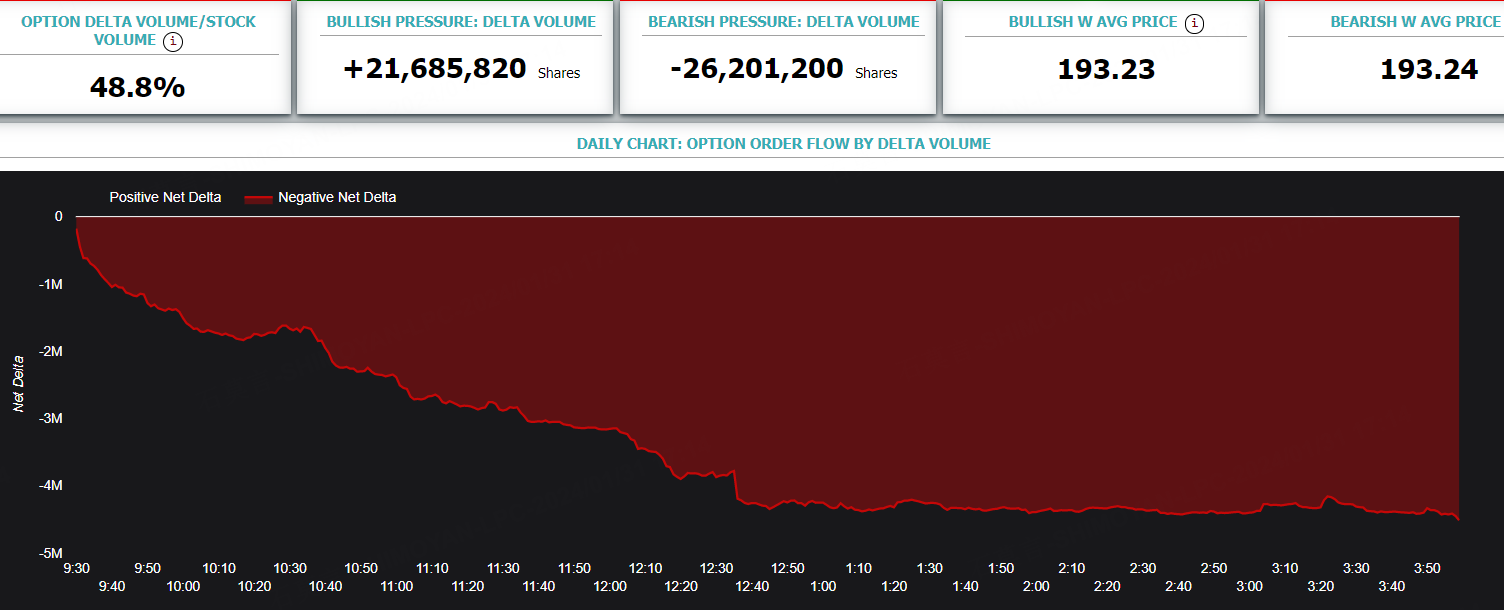

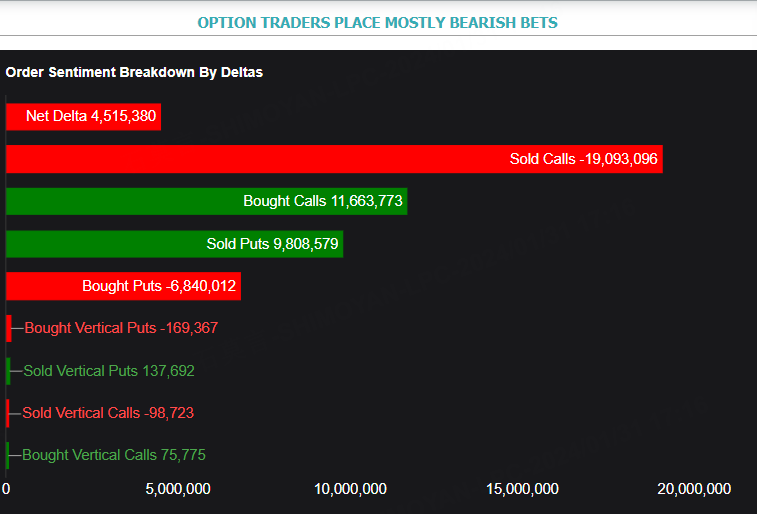

The volume of Tesla's activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold), also showed huge bearish sentiments.

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

From the chart below, we can see that based on option delta volume, traders sold a net equivalent of -1,975,464 shares of Apple stock. The largest delta volume came from the 02-Feb-24 195 Call, with traders getting short 3,012,391 deltas on the single option contract.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- HiTALK·01-31Agree, it's time for covered calls!LikeReport