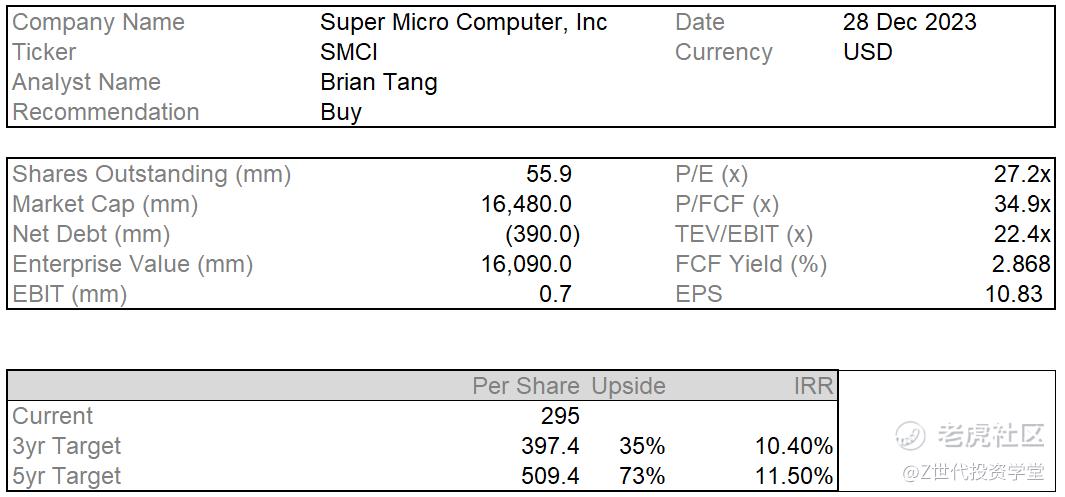

Initial Report(part1):Super Micro Computer Inc (SMCI) , 73% 5-yr Potential Upside (EIP, Brian TANG)

SMCI Company Overview:

Supermicro, founded in 1993 and located in San Jose, California, is a global technology pioneer at the forefront of innovation in Enterprise, Cloud, HPC, AI, Accelerated Computing, and 5G Telco/Edge IT Infrastructure. The design philosophy of the organization follows a building blocks technique, resulting in first-to-market, best-in-class products. Supermicro, as a Total IT Solutions supplier, provides a comprehensive suite of environmentally friendly and energy-saving systems, including servers, storage, GPUs, networking, workstations, data center racks, cooling solutions, software, and professional services.

Beyond technology, Supermicro is actively leading the liquid cooling workgroup at The Green Grid, an industry alliance focusing on improving data center efficiency. In addition to their technological skills, the corporation adheres to strict anti-corruption, human rights, responsible mineral sourcing, and supplier practices rules. Supermicro's value statement, grounded in a mission to adhere to guiding principles, connects with the idea that "Green Computing can be free... with a big bonus," highlighting their commitment to sustainable and cost-effective IT solutions.

Business Model:

Taiwan Semiconductor Manufacturing Company Limited (TSM) and chip designers such as Nvidia (NVDA), Advanced Micro Devices (AMD), and Intel (INTC) are at the heart of the semiconductor supply chain. Companies like Super Micro, on the other end of the supply chain spectrum, play an important role by expertly building and configuring top-tier chips. They employ these components to build plug-and-play servers with integrated power, cooling, and storage.

Super Micro's solutions include Artificial Intelligence (AI) and High-Performance Computing (HPC), as well as 5G, IoT, and Hyperscale infrastructure. The company distinguishes itself not only for its hardware knowledge, but also as a certified partner and reseller of enterprise application software, including relationships with well-known platforms such as Redhat by IBM. This strategic partnership expands Super Micro's capabilities by providing customers with completely integrated hardware and software solutions to meet their changing technological needs.

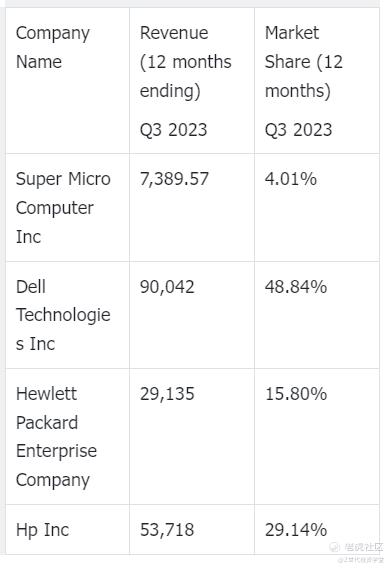

Market Share:

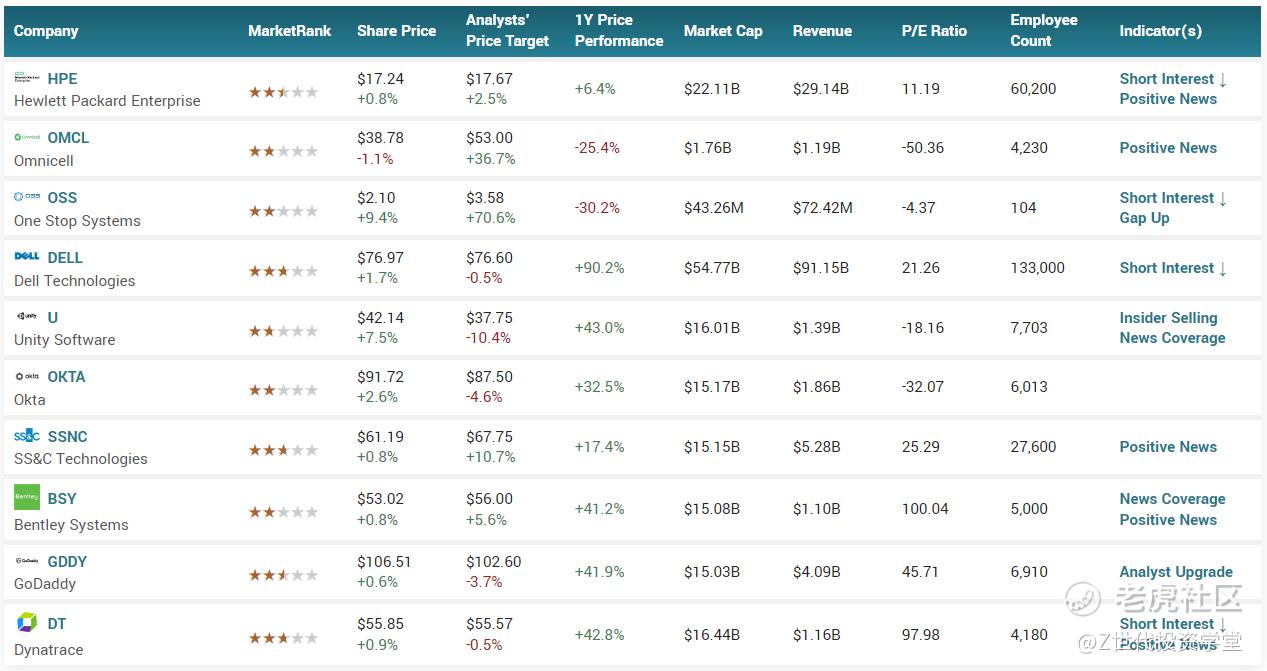

Competitor Analysis:

Economic Moat Analysis using SWOT:

Strengths:

In comparison to competitors, SMCI is known for their cutting-edge technology and unique solutions.

SMCI has a high emphasis on research and development, allowing it to seek product expansion and stay ahead of competition in technical breakthroughs.

SMCI has a strong global presence with operations in many countries, enabling it to access a larger consumer base and respond to changing market situations.

Customer pleasure is prioritized at SMCI, and great customer service is provided, resulting in significant client loyalty.

Weaknesses:

SMCI relies largely on third-party sources for components and parts. This has the potential to disrupt supply chains and cause quality control concerns.

SMCi has significant debt, which may jeopardize its financial stability and capacity to invest in research.

SMCI's global presence is also a problem, as it is relatively modest in comparison to its competitors. This inhibits its ability to enter new markets.

The technology industry is prone to quick regulatory changes and legal challenges, which could have an influence on SMCI's operations and profitability.

Opportunities:

Expansion into emerging markets, as SMCI can look for prospects in Asia, Latin America, and Africa. Such areas have greater growth potential, and SMCI can diversify its customer base and income stream by creating a strong global presence.

Strategic partnerships and alliances enable SMCI to engage with other technology firms. SMCI can acquire additional resources at low prices by utilizing the strengths of its partners.

Cloud computing and data center solutions are in high demand, and SMCI can profit on this trend by providing tailored goods and services to these markets. This allows SMCI to carve out its own niche.

Threats:

Strong market competitors, both huge and little. SMCI is up against stiff competition, particularly in this narrow technology industry. This is not an exception for newcomers.

Changes in government rules concerning data security and privacy can have an impact on business operations. Furthermore, when rules are imposed, it can affect the cost of their investment.

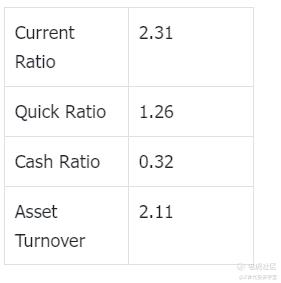

Key Ratios and Margins: All values updated annually at fiscal year end

Liquidity

Solvency (Annual data as of 30 June 2023) - Debt Ratio)

Investment Theses:

Anticipated growth in Artificial Intelligence hardware presents a favorable outlook for Super Micro (SMCI) owing to its distinctive business model.

Artificial intelligence (AI) equities have seen tremendous increase, driven by genuine revenue and earnings growth, as AI applications become increasingly important for businesses in the 2020s. Advanced Micro Devices (AMD) CEO Lisa Su, known for her track record of success, forecasts a significant increase in the AI chip market. Initially expecting growth from $30 billion in 2023 to $150 billion by 2027, she changed her forecast to a $45 billion market in 2023, with a projected increase to $400 billion by 2027.

With the immediate adoption of tighter US trade restrictions on China, it is possible that Nvidia's (NVDA) AI processors would flood both the US and global markets in the coming months. This is projected to exacerbate SMCI's short-term positive conditions. This optimistic prediction creates a great opportunity for Super Micro, a server maker, as AI servers are likely to contribute significantly to market growth. While some consider server manufacturers to be essentially assemblers of proprietary chips, the intricacy of AI necessitates innovation in server design, which aligns with Super Micro's strengths. Super Micro began as a motherboard maker in the 1990s and has now evolved into a vertically integrated system manufacturer, creating and optimizing all components in-house. This technique permits customized models for varied purposes and assures a quick time-to-market, giving OEMs and ODMs a competitive advantage over more conventional alternatives.

In essence, Super Micro's distinct business strategy, based on in-house component Super Micro Computer's earnings over the next few years are expected to increase by 82%, indicating a highly optimistic future ahead. This should lead to more robust cash flows, feeding into a higher share value.development and a modular "building block" architecture, puts the company favorably in the rapidly changing world of AI-driven server technology. Competitors would encounter difficulties in modifying their existing business models to match Super Micro's vertically integrated approach, making it difficult for them to reconfigure and compete effectively in this dynamic market.

SMCI’s high growth potential at a cheap price

Super Micro Computer is well-positioned for a bright future, with an expected 82% increase in earnings over the next three years. This optimistic forecast is projected to result in higher cash flows, which will contribute to higher share value.

SMCI’s forward-looking investment plans, allowing them to stay ahead of competitors in the IT services market

Super Micro Computer Inc (SMCI) announced better-than-expected earnings for the fiscal fourth quarter and received an upgraded outlook earlier this month from Susquehanna analyst Mehdi Hosseini. Wedbush analyst Matt Bryson raised Super Micro Computer from Underperform to Neutral, with a $250 price target. The company's bullish fiscal 2024 outlook is attributable to a fundamental shift, specifically investments in generative AI training for customers other than large cloud service providers (CSPs), such as developing cloud, enterprise, and sovereign entities. Bryson's upgrade comment revealed evidence of further significant orders outside of CSPs, with increased demand reported in the United Kingdom and some Middle Eastern countries looking for GPUs.

Tight availability of H100/A100s and longer lead times were also noticed into at least the first quarter of next year, and in some cases, through the first half of 2024. Bryson believes that this setup reduces the possibility of SMCI experiencing a downturn in the coming quarters. Super Micro Computer's stock had gained by 6.38% to $274.55 as of the most recent release.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.