State Of REIT Nation: Not Out Of The Woods, Yet

Summary

- Two years of persistent rate-driven pressure on commercial and residential real estate markets appeared to be easing in early 2024, but firming inflation has again muddied the outlook.

- Expectations of "Higher for Longer" have merely shifted to "High for Long." Many private equity funds and some highly-levered REITs were ill-prepared for a period of sustained 4-5%+ benchmark rates.

- Private markets are finally feeling the pain that beset public REIT investors since 2021. Commercial property values have now declined over 20% nationally, and nearly 40% in some troubled segments.

- Outside of the office sector, the pockets of distress remain entirely debt-driven as property-level fundamentals remain buoyant, but the refinancing clock is still ticking towards zero for many "zero rate heroes."

- Macroeconomic conditions are evolving in an ideal manner for public REITs to finally exploit their competitive advantage - access to nimble equity capital and long-term fixed-rate debt - which was of little advantage in the "lower forever" environment.

cmart7327

State of the REIT Nation

In our State of the REIT Nation, we analyze the recently released NAREIT T-Tracker data. Earlier this month, we published our REIT Earnings Recap which analyzed Q4 results on a company-by-company level, but this report will focus on higher-level macro themes affecting the REIT sector at large.

Hoya Capital

Rates Up, REITs Down... Again

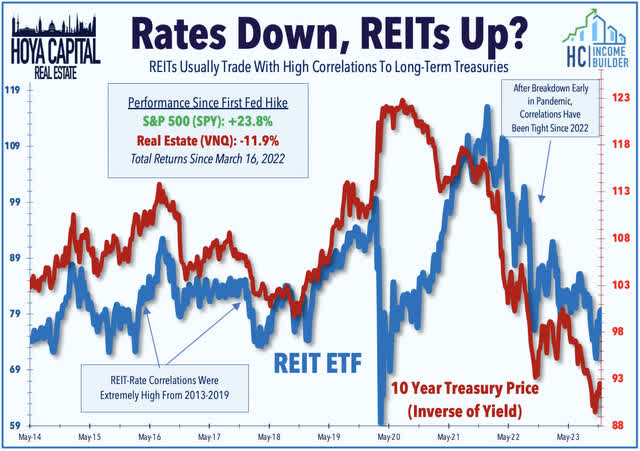

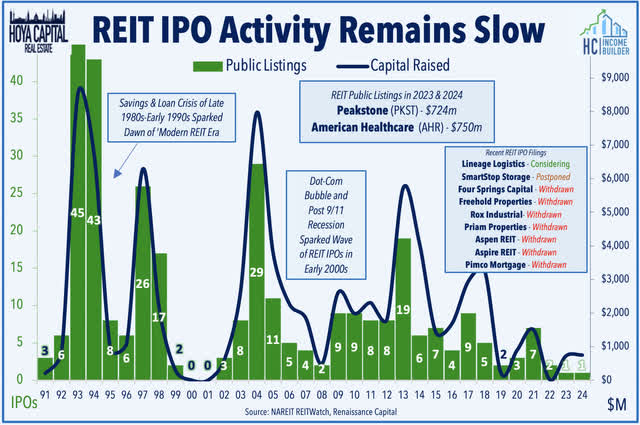

Two years of persistent rate-driven pressure on commercial and residential real estate markets appeared to be easing in early 2024, but the recent firming of inflation and buoyant economic momentum has again muddied the outlook. Real estate markets have been an easy transmission mechanism of the Federal Reserve's historically swift monetary tightening cycle, which resulted in the largest increase in the Federal Funds rate in any two-year period since 1981 on an absolute basis and the single-most significant increase on a percentage basis. Concern about real estate is warranted given that the two prior rate hike cycles that exceeded 400 basis points - the late 1980s cycle that sparked the Savings & Loan Crisis and the mid-2000s cycle that sparked the Great Financial Crisis - resulted in significant distress and disruption within in the real estate industry. This concern has resulted in a nearly one-to-one correlation between REIT valuations and benchmark long-term interest rates, and has resulted in a roughly 35 percentage-point underperformance from the Vanguard Real Estate ETF (VNQ) compared to the S&P 500 since the rate hike cycle began.

Hoya Capital

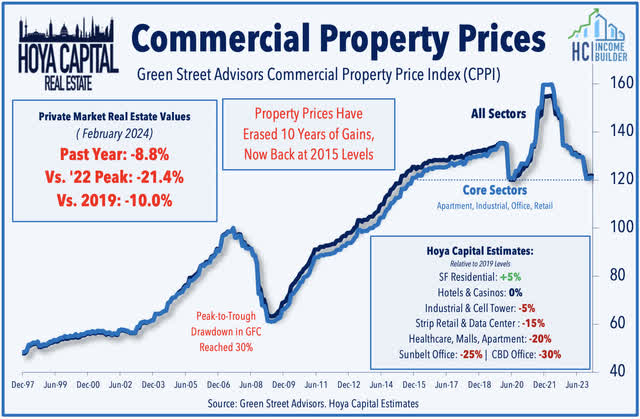

With just three Fed rate cuts now expected this year - down from a peak of nearly seven implied by swaps markets back in January - expectations of "Higher for Longer" have merely shifted to "High for Long" - and that would be a problem for many private equity funds and some highly-levered REITs were ill-prepared for a period of sustained 4-5%+ benchmark rates, nor for a period of double-digit percentage point declines in property values. Green Street Advisors' data shows that private-market values of commercial real estate properties have dipped by 21.4% from the peaks in April 2022 and have now given back all of their pandemic-era gains. By comparison, the peak-to-trough drawdown in this valuation index during the Great Financial Crisis was 30%. We've noted that the 20-25% drawdown level can be a critical "capitulation threshold" - a level that matches the maximum Loan-to-Value ("LTV") ratio accepted by conventional commercial real estate lenders.

Hoya Capital

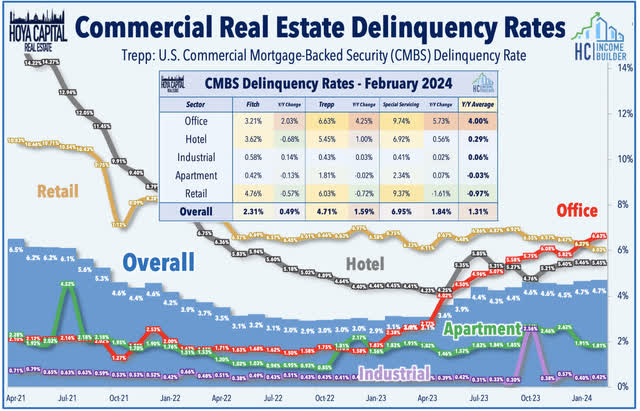

"Hope" has been the only strategy for some highly-levered property owners amid a dearth of buying interest and limited capital availability - "hope" that interest rates recede before their "debt clock" expires. The Mortgage Bankers Association's 2023 Loan Maturity Survey showed that roughly 20% of the $4.7 trillion of outstanding commercial mortgages held by lenders and investors will mature in 2024 - a relatively manageable sum for the broader real estate sector - but the clock is ticking ever louder for the firms sitting on a significant pool of variable rate debt, and it's beginning to slowly-but-surely show-up in delinquency and distress rates. We track three delinquency measures - Fitch's CMBS Delinquency Rate, Trepp's CMBS Delinquency Rate, and Trepp's CMBS Special Servicing Rate. Trepp reported this month that the overall commercial real estate delinquency rate rose to 4.71% in February - up from 3.12% last year to the highest level since December 2021. Office delinquencies have accounted for effectively all of this increase, however, surging to 6.63% from the record-lows last year of 1.75%. Trepp's CMBS Special Servicing Rate climbed to 7.14% overall and 10.04% in the office sector. Industrial real estate is the only other sector that has posted a year-over-year increase across all three metrics, but remains near record-lows of 0.50%.

Hoya Capital

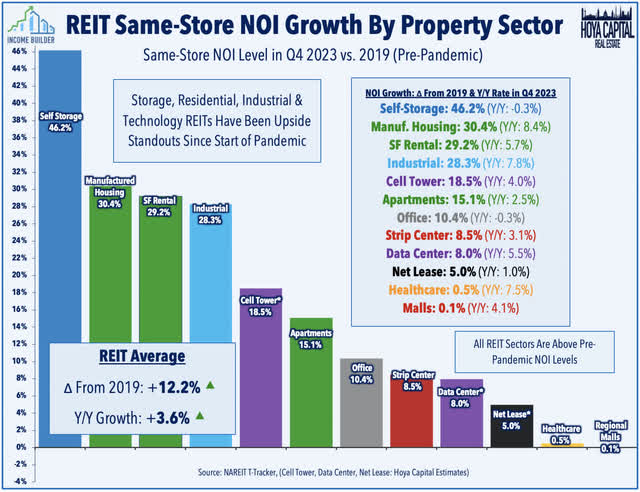

Resilient property-level fundamentals are the major reason that we haven't seen a more material increase in distress in non-office sectors. Fundamentals remain solid-to-strong across nearly every property sector, with the notable exception of coastal office properties. Public REITs reported that "same-store" property-level income, on average, was 12% above pre-pandemic levels in the fourth quarter. The residential, industrial, and technology sectors have been the upside standouts throughout the pandemic with most of these REITs reporting NOI levels that are over 20% above 2019 levels. Even the battered office REIT sector has posted positive 10% growth in property-level cash flows since 2019 as tenants in long-term leases continue to pay rents. Retail REITs - which had seen sharp declines in property-level cash flows early in the pandemic due to missed rent payments - have posted some of the more impressive property-level performance in recent quarters, while Senior Housing REITs have also enjoyed a swift NOI rebound this year.

Hoya Capital

The interest rate headwinds become very "real" when the underlying properties are financed with debt - particularly copious amounts of variable rate debt. With the scars of the Great Financial Crisis still visible, most public REITs were "preparing for winter" for the last decade, often to the frustration of some investors who turned to higher-leveraged and riskier alternatives in recent years. Private market players and non-traded REIT platforms were willing to take on more leverage and finance operations with short-term and variable-rate debt - a strategy that worked well in a near-zero rate environment but quickly crumbles when financing costs double or triple in a matter of months. Nareit reported earlier this year that nearly 50% of private real estate debt is priced based on variable rates compared to under 10% for public REITs. We've observed significant pain inflicted on the handful of public REITs that entered this period with variable rate debt loads in the 20-30% range - still relatively low compared to typical private equity firms - resulting in double-digit percentage point drags on Funds from Operations ("FFO").

Hoya Capital

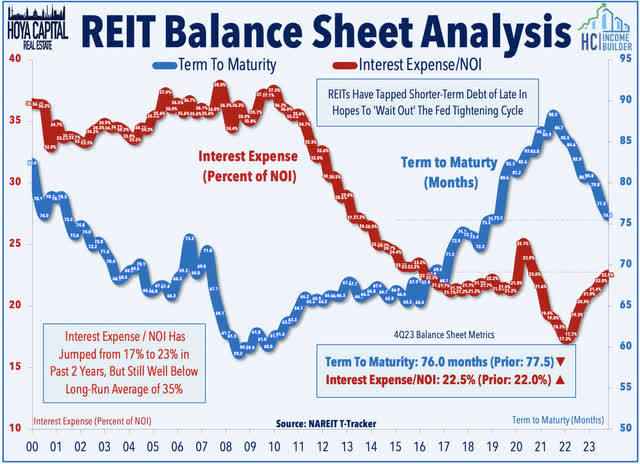

Access to long-term debt is perhaps the most distinct competitive advantage of the public REIT model, but it's an advantage that hardly gave public REITs much of an edge when debt capital was cheap and plentiful in the "zero-rate" economic environment of the 2010s. Compared to private institutions, publicly-traded REITs had far greater access to fixed-rate unsecured debt - which is usually in the form of 5-10 year corporate bonds. This allowed REITs to lock-in these fixed rates on 90% of their debt while simultaneously pushing their average debt maturity to nearly 7 years, on average, thus avoiding the need to refinance during these highly unfavorable market conditions. Even with the significant pullback in financing activity in recent months, the average term-to-maturity for public REITs is still over 6 years - well above the pre-GFC highs of around 4 years - and significantly above the weighted average term-to-maturity of around 3 years for private real estate assets. Hence, for many of the highly-levered players that lacked access to long-term capital, the trends observed in the chart below are magnified by a factor of 2-3x.

Hoya Capital

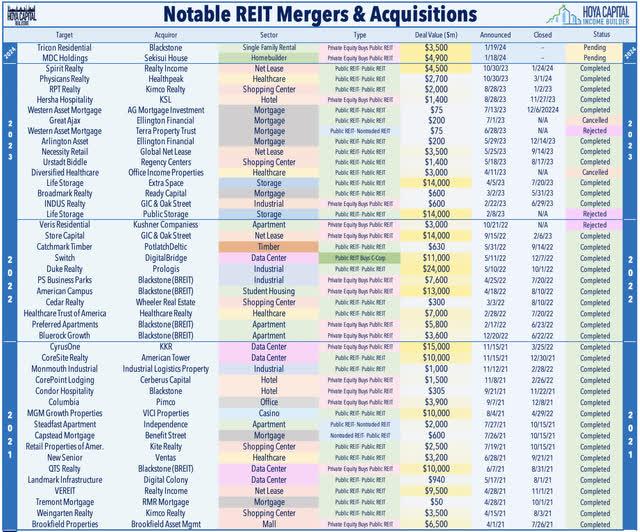

Distress for some is an opportunity for others, and we're beginning to see the public REITs with balance sheet firepower start to take advantage of capitulation from highly-levered players - a trend that will gather steam if debt markets remain tight. There's been no better example of these trends than Blackstone's flagship fund, BREIT, which has been forced to offload its best-performing assets this year as it seeks to raise capital to meet investor redemptions while simultaneously seeking to avoid a "mark-to-market" on many of its other assets - including five public equity REITs - that it acquired for significant premiums at the peak of the market in 2021. Since December 2022, BREIT has sold nearly $10B in assets to public REITs including its $5.5B sale of two Las Vegas casinos to VICI Properties (VICI), an $800M sale of a Texas resort to Ryman Hospitality (RHP), a $2.2B sale of Simply Self-Storage to Public Storage, and a $950M partial sale of The Bellagio casino to Realty Income (O). Of note, these deals have closed within four weeks, on average, a remarkably swift transaction timeline that few other entities besides public REITs could pull-off. This trickle of deal flow into public REITs should continue if benchmark interest rates remain elevated, but would accelerate significantly if public REIT valuations rebound while debt availability remained limited.

Hoya Capital

Concurrently, we've seen a modest rebound in M&A activity from within the public REIT sector itself, with nine public REIT-to-REIT mergers last year, headlined by two major deals in Q4: net lease REIT Realty Income's (O) acquisition of Spirit Realty, and healthcare REIT Healthpeak's (DOC) acquisition of medical office REIT Physicians Realty. This pair of mergers follow a handful of significant mergers earlier this year, the largest of which was the deal between Extra Space (EXR) and Life Storage, which combined to form the largest storage REIT. We also saw two mergers in the strip center space: Regency Centers (REG) acquired small-cap Urstadt Biddle, while Kimco Realty (KIM) acquired mid-cap RPT Realty. Other 'opportunistic' deals in the REIT space have included mortgage REIT Ready Capital's (RC) acquisition of Broadmark and Ellington Financial's (EFC) acquisition of Arlington Asset. We also saw some merger activity that was done more out of necessity rather than from a position of strength, including the merger between Global Net Lease (GNL) and Necessity Retail - a pair of externally managed REITs advised by AR Global.

Hoya Capital

While REIT stock prices don't yet reflect it, macroeconomic conditions are evolving in an ideal manner for public REITs to finally exploit their competitive advantage - access to nimble equity capital and long-term fixed rate debt - which was of little advantage in the "lower forever" environment. And while past periods of significant tightening were remembered as those of distress, they can rightfully also be remembered as periods of a significant revolution and rebirth that spanned many of the public REITs that exist today. The S&L Crisis of the late 1980s - which resulted in the failure of nearly a third of community banks and resulted in significantly constrained access to debt capital - spawned the dawn of the 'Modern REIT Era.' A second wave of REIT IPOs followed in the aftermath of 9/11 and again after the Great Financial Crisis as the limited access to (and high cost of) debt capital, combined with a lift in equity market valuations of public REITs - pushed otherwise distressed highly-levered private portfolios into the public equity markets, a theme that we could very well see repeat over the coming quarters.

Hoya Capital

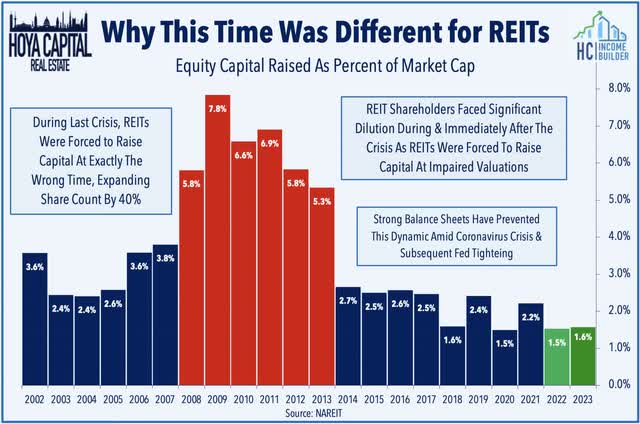

Deeper Dive: REIT Balance Sheets

The ability to avoid "forced" capital raising events has been the cornerstone of REIT balance sheet management since the GFC - a time in which many REITs were forced to raise equity through secondary offerings at "firesale" valuations just to keep the lights on, resulting in substantial shareholder dilution which ultimately led to a "lost decade" for REITs. While REITs entered this tightening period on very solid footing with deeper access to capital, the same can't necessarily be said about many private market players that rely on the short-term borrowing or continuous equity inflows to keep the wheels spinning. Much the opposite of their role during the Great Financial Crisis, many well-capitalized REITs are equipped to "play offense" and take advantage of compelling acquisition opportunities if we do indeed see further distress in private markets from higher rates and tighter credit conditions.

Hoya Capital

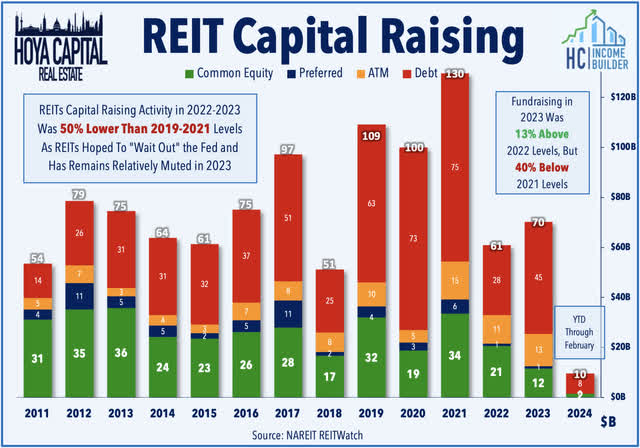

S&P reported last month that REIT capital-raising activity recovered in the back-half of 2023 to finish the year with a total haul that was 13% above full-year 2022, but still 40% below the record-setting pace from 2021. Through the first two months of 2024, REITs have raised $10.7B, which is about 12% lower than the pace during 2023. The majority of the capital raised over the last two years has been through debt offerings, which have accounted for roughly 65% of the total capital raised this year - above the historical average of around 50%. At $7.0B, American Tower (AMT) raised the most capital overall in 2023 - almost all of which through debt - followed by healthcare REIT Welltower (WELL) at $6.1 billion - which raised most of its capital through its at-the-market common stock program. Technology REIT Uniti Group (UNIT) had the largest single-offering of the year with its $2.6 billion bond offering. We saw a small handful of preferred equity offerings last year: Bluerock Homes issued $500M of unlisted Series A preferred stock, while Gladstone Land (LAND) issued $200M of new Series C preferred stock.

Hoya Capital

Even as benchmark interest rates doubled from a year earlier and even with market values of REITs lower by 20-30% during that time, REITs balance sheets remain healthy by historical standards, merely giving back the incremental pandemic-era improvement. Debt as a percent of Enterprise Value still accounts for less than 35% of the REITs' capital stack, down from an average of roughly 45% in the pre-recession period - and substantially below the 60-80% Loan-to-Value ratios that are typical in the private commercial real estate space. Interest coverage ratios (calculated by dividing EBITDA over interest expense) have seen a shaper erosion over the past several quarters from its all-time highs set last year, however, but still stand at 4.12x, which roughly matches the coverage ratio at the end of 2019 and compares very favorably to the 2.75x average in the three years before the GFC period.

Hoya Capital

Credit quality is even stronger on the residential-side. Owing to years of tight mortgage lending conditions and a generally slow post-recession recovery in homeownership, the residential real estate market has undergone a period of significant deleveraging over the last decade. At of the end of Q4, the mortgage debt service payment ratio as a percent of disposable income remained near the lowest level on record at 3.99%. By comparison, this level was at 7.13% in Q4 2007 before the GFC recession. Importantly, subprime loans and adjustable-rate mortgages - the dynamite that led to a cascading financial market collapse in 2008 - have been essentially non-existent throughout this cycle. Adjustable-rate mortgages - which would be most "at-risk" from the surge in rates have accounted for less than 5% of mortgages originated since 2009, down from nearly 30% at the peak in 2005.

Hoya Capital

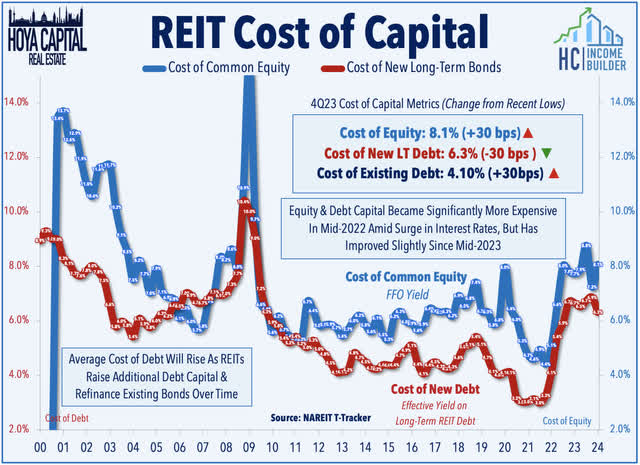

That said - not all REITs are created equal, and the broad-based sector average does mask some of the intensifying issues in several of the more at-risk sectors and among REITs that have been more aggressive in their balance sheet management. A handful of small and mid-cap REITs - some of which would be considered as having a rather strong balance sheet relative to similar private equity portfolios - have incurred significant charges to "fix" their floating rate debt exposure, while others have continued to roll the dice by maintaining a sizable chunk of variable rate debt. The BofA BBB US Corporate Index Effective Yield - a proxy for the incremental cost of real estate debt capital - has surged from as low as 2.20% in late 2021 to as high as 6.67% at the October 2023 peak and now sits at 5.56%. On a percentage basis, this represents a nearly 200% increase in interest costs on variable rate debt. The cost of equity - which we compute based on average FFO yields - is now 8.1% for the average REIT, up from a low of 4.4% in late 2021.

Hoya Capital

Deeper Dive: REIT Fundamentals

As noted, the pockets of distress are almost entirely debt-driven - and further isolated to the office sector - as nearly every property sector reported "same-store" property-level income above pre-pandemic levels. REIT company-level metrics have tracked this rebound in property-level performance relatively closely throughout the pandemic - with the exception of the highly-levered REITs that expect sharp FFO declines this year even as property-level cash flows continue to increase. REIT FFO ("Funds From Operations") has fully recovered the sharp declines from early in the pandemic and in the fourth quarter, FFO was 20% above its 4Q19 pre-pandemic level on an absolute basis, and roughly 9% above pre-pandemic levels on a per-share basis. Same-store Net Operating Income, meanwhile, was roughly 12% above the pre-pandemic level in the fourth quarter.

Hoya Capital

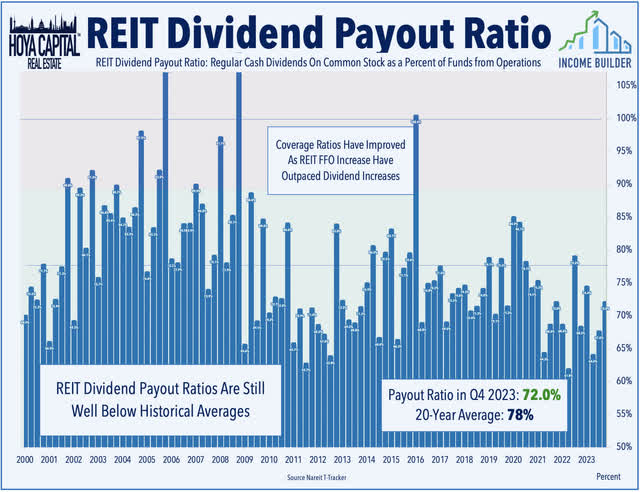

Powered by more than 120 REIT dividend hikes in both 2021 and 2022 - and another 80 dividend hikes in 2023 - dividends per share have finally fully recovered from the wave of pandemic-era dividend cuts in 2020. With FFO growth significantly outpacing dividend growth since the start of the pandemic, REIT dividend payout ratios remained at just 72% in Q4 - well below the 20-year average of 80%. With a relatively low dividend payout ratio, the average REIT has built up a buffer to protect current payout levels if macroeconomic conditions take an unfavorable turn. As always, the sector average does mask some elevated payout ratios across several sectors: Mortgage REITs currently pay out about 95-100% of EPS, on average, while Cannabis REIT payout ratios are also elevated. Other higher-risk sectors have built up a decent buffer as office REITs pay just 70% of FFO while hotel REITs pay less than 40%.

Hoya Capital

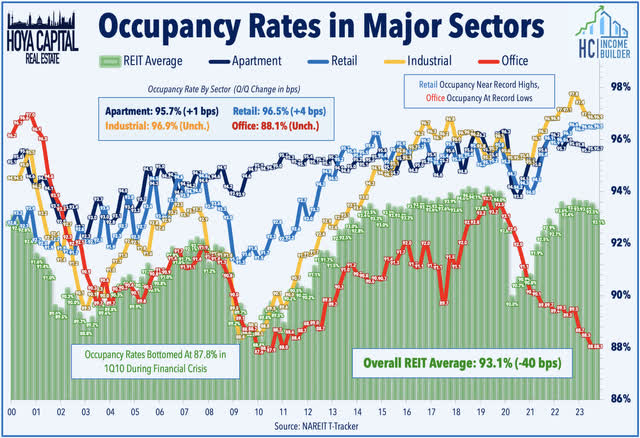

After recording the largest year-over-year decline on record in 2020 which dragged the sector-wide occupancy rate to 89.8%, REIT occupancy rates have rebounded since mid-2020 back to 93.1% - towards the upper-end of its 20-year average. By comparison, occupancy levels dipped as low as 88% during the Financial Crisis and took three years to recover back above 90%. Residential and industrial REITs have continued to report near-record-high occupancy rates in recent quarters while retail REITs noted a solid sequential improvement as the "retail apocalypse" trends subside. Office REIT occupancy, however, has seen substantial declines since the start of 2020 and remained 400 basis points below pre-pandemic levels at 88.3% in the third quarter.

Hoya Capital

Deeper Dive: REIT Valuations & Growth

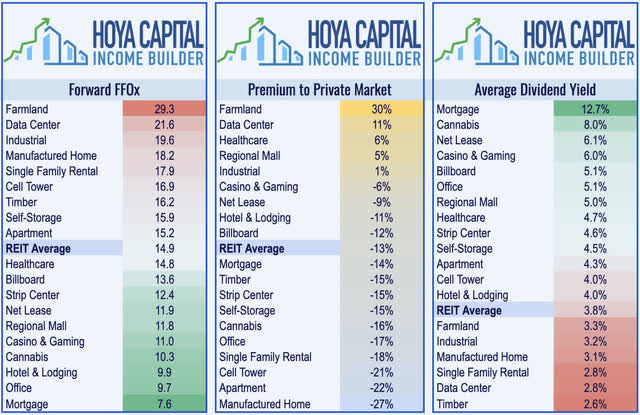

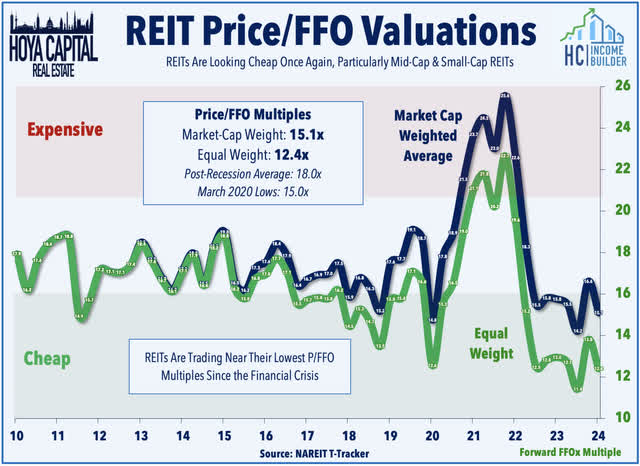

The extended sell-off from late-2021 through late-2023 - combined with the nearly 20% increase in FFO during this time - has pulled REIT valuations to the lowest level since the end of the Great Financial Crisis. Equity REITs currently trade at an average forward Price/FFO multiple of around 15x using a market-cap weighted average. The market-cap-weighted average, however, is somewhat distorted by the massive weight of richly-valued technology REITs, and on an equal-weight basis, REITs trade at a 13x median P/FFO multiple, which is near the lowest levels since the early 2000s. The average REIT also trades at an estimated 10-20% discount to its Net Asset Value, as implied by current private market valuations. Equity REITs pay a dividend yield of 3.8% on a market-cap-weighted basis, but this dividend yield climbs to over 5.5% on an equal-weight basis, and roughly 8.0% when including mortgage REITs.

Hoya Capital

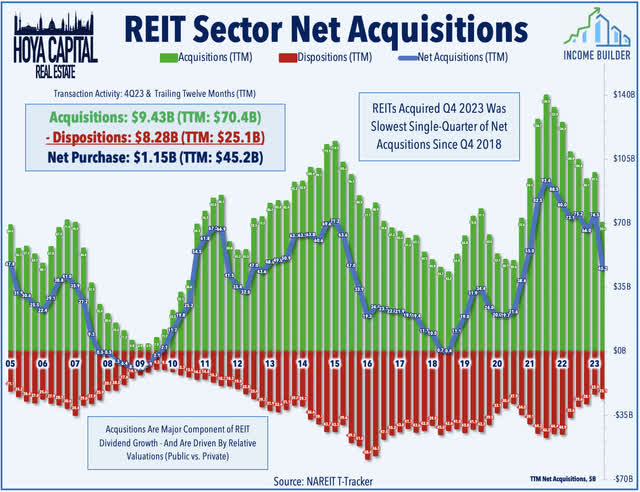

Equity valuations can and do play an important role in the ability of REITs to grow accretively, given the usage of secondary equity offerings to fund major acquisitions. So naturally, REITs have "hunkered down" in recent quarters as stock price valuations remain low by historical standards and in relation to private market-implied valuations. REIT external growth comes in two forms – buying and building. Acquisitions have historically been a key component of FFO/share growth, accounting for more than half of the REIT sector's FFO growth over the past three decades with the balance coming from "organic" same-store growth and through ground-up development and redevelopment. With a historically large "bid-ask" spread for private real estate assets, REITs have slowed their acquisitions over the past several quarters with gross purchases of only $1.1B in Q4 - the lowest since Q4 of 2018 - but as noted above, we believe that opportunities should emerge if debt markets remain tight if and when public REIT stock prices rebound.

Hoya Capital

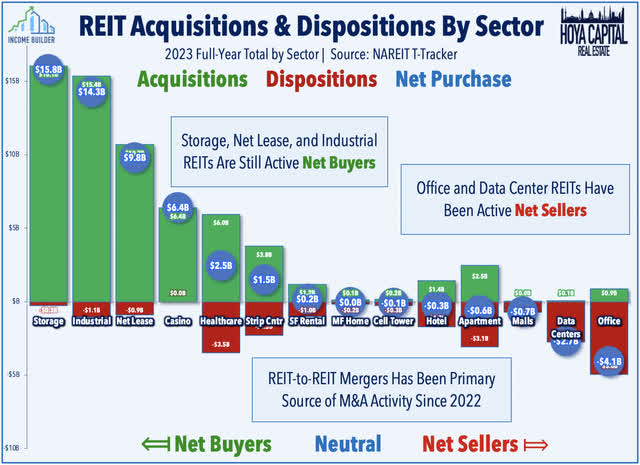

Nearly all of the M&A activity since the start of 2023 has been through the dozen REIT-to-REIT mergers discussed above. At the property-sector level, storage, net lease, industrial, and casino REITs have been far-and-away the most active acquirers of private market assets in recent quarters - accounting for more than half of total net purchases across the REIT industry - with some taking a surprising "business as usual" approach to external growth despite the shifting interest rate environment. We noted in our Earnings Recap that net lease REITs reported an average increase in acquisition cap rates of only around 130 basis points between Q4 2021 and Q4 2023, during which time the benchmark 10-Year Treasury Yield increased by over 200 basis points. Most other REIT sectors have been more reluctant to "hit the bid" on slow-to-adjust private market valuations. Data Centers and Office REITs have been the most significant "net sellers" over the past year.

Hoya Capital

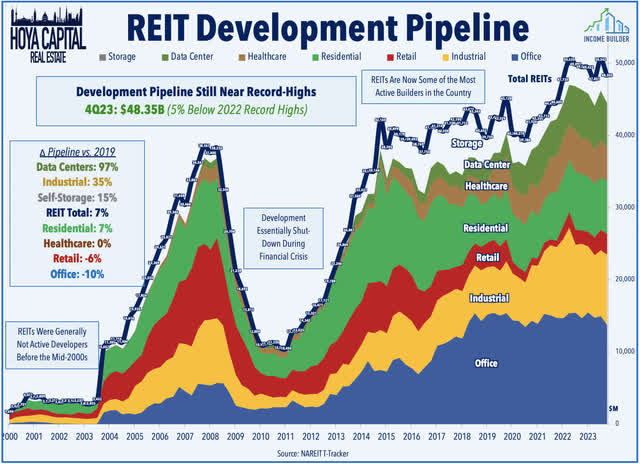

REITs have become some of the most active builders in the country over the past decade and - despite the pressure from higher rates - REITs expanded their pipeline in 2023 to levels that exceeded the prior record set just before the pandemic, but new groundbreaking have been few-and-far-between over the past quarter given the unfavorable rate environment. Much of this expansion has been fueled by three property sectors - data center, industrial, and self-storage - which have expanded their pipelines by 97%, 35%, and 15%, respectively, since the end of 2019 - and some of this inflated pipeline is the result of higher construction costs and lingering supply chain delays that prolong the development timeline. Retail REITs, on the other hand, have engaged in minimal development activity over the past several years - which has fueled the recent occupancy increases - while the pipeline in office has also pulled back materially over the last several quarters, as expected.

Hoya Capital

Takeaways: Not Out of the Woods, Yet

Two years of persistent rate-driven pressure on commercial and residential real estate markets appeared to be easing in early 2024, but firming inflation has again muddied the outlook. Expectations of "Higher for Longer" have merely shifted to "High for Long" and many private equity funds and some highly-levered REITs were ill-prepared for a period of sustained 4-5%+ benchmark rates. Private markets are finally feeling the pain that beset public REIT investors over the prior 18 months. Commercial property values have now declined over 20% nationally - and nearly 40% in some troubled segments. Pockets of distress remain almost entirely debt-driven, however, and isolated almost entirely to the office sector as resilient property-level fundamentals - and the strong balance sheets of REITs themselves - have helped to contain and prevent the potential "cascading" of distress that we saw during the GFC under similar credit and valuation conditions. Macroeconomic conditions are aligning in an ideal manner for low-levered entities with access to "nimble" equity capital - conditions that maximize the true competitive advantage of the public REIT model, which these entities have been unable to exploit in the "lower forever" environment.

Hoya Capital

For an in-depth analysis of all real estate sectors, check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.