Navigating the Uranium ETF Landscape: Opportunities Amidst Tech Giants' Energy Shift

The article explores the substantial investments made by tech giants such as $Microsoft(MSFT)$, $Alphabet(GOOG)$ (the parent company of Google), Amazon, and Meta in artificial intelligence and cloud computing, as well as the impact of this trend on the demand for energy in data centers.

The burgeoning development of artificial intelligence has driven a surge in demand for data center capacity to handle AI workloads and store the vast amount of data required. Data centers are energy-intensive, and AI applications consume more energy than traditional computing.

Driven by sustainability goals, many tech giants have committed to powering their data centers with renewable energy. They are increasingly exploring nuclear energy to meet their power needs. Governments worldwide also recognize nuclear energy as a key option for achieving net-zero emissions goals.

$Uranium(UEC)$ is primarily used in nuclear power plants and is one of the most carbon-free forms of electricity generation. However, nuclear energy currently accounts for only around 10% of global electricity generation, with this proportion being approximately 20% in developed countries like the $United(UBCP)$ States.

Despite the growing demand for uranium, the supply faces numerous challenges, and expanding uranium supply takes a long time. President Biden signed a bill yesterday banning the import of Russian enriched uranium, including some exemptions that allow imports until 2028 if alternative sources are not found. The bill allocates approximately $2.7 billion to increase domestic uranium supply.

Please continue reading for an introduction to the provided uranium ETFs and related tools such as $Global X Uranium ETF(URA)$ (URA), $Sprott Uranium Miners ETF(URNM)$ (URNM), Sprott Junior Uranium Miners ETF (URNJ), and VanEck Vectors Uranium+ Nuclear Energy ETF (NLR).

$Global X(EFFE)$ Uranium ETF (URA)

Company Overview

$Total(TSS)$ Assets: $3.28 billion

The $Global X(SCTO)$ Uranium ETF (URA) tracks a basket of uranium miners and nuclear component producers. The fund has an expense ratio of 0.69% and a year-to-date return of 13%.

Uranium companies account for over 70% of its holdings, with nearly half being Canadian companies. Interestingly, one of its top three holdings is the Sprott Physical Uranium Trust (TSX: UU), with a weight of 9.01%.

Other major holdings include leading uranium producer $Cameco(CCJ)$ (Toronto Stock Exchange: CCO, New York Stock Exchange: CCJ) with a 22.77% stake and NexGen Energy (Toronto Stock Exchange: NXE, New York Stock Exchange: NXE) with a 5.32% stake.

Data Source: VettaFi

Sprott Uranium Miners ETF (URNM)

Company Overview

Total Assets: $1.79 billion

The Sprott Uranium Miners ETF (URNM) includes uranium producers and explorers for broader investment exposure. The fund has an expense ratio of 0.75% and a year-to-date return of 13%.

Small-cap stocks account for 37.82% of the ETF's holdings. Its top three holdings are:

Cameco Corporation (CCJ) at 15.97%; $National(NHLD)$ Atomic Company Kazatomprom JSC-sponsored GDR RegS (KAP) at 14%; Sprott Physical Uranium Trust (UUT) at 12%.

Data Source: VettaFi

Sprott Junior Uranium Miners ETF (URNJ)

Company Overview

Total Assets: $380 million

The Sprott Junior Uranium Miners ETF is the newest member of the uranium ETF space. Launched in February 2023, it tracks the NASDAQ Sprott Junior Uranium Miners Index (INDEXNASDAQ: NSURNJ), which follows small uranium companies.

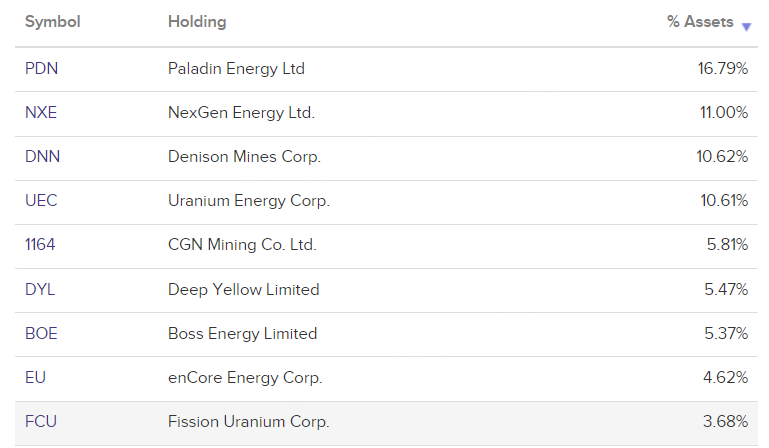

The fund's 34 constituent stocks are all uranium mining, development, or exploration companies, with Paladin Energy (ASX: PDN, OTCQX: PALAF) as the largest holding at 16.79%, followed by NexGen Energy at 11% and $Denison Mines(DNN)$ Corporation (NYSEAMERICAN: DNN) at 10.62%. Its year-to-date return is 18%.

Data Source: VettaFi

VanEck Vectors Uranium+ Nuclear Energy ETF (NLR)

Company Overview

Total Assets: $170 million

The VanEck Vectors Uranium+ Nuclear Energy ETF, launched in 2007, tracks a market-cap-weighted index of stocks in the uranium and nuclear energy industries. It has an expense ratio of 0.61% and a year-to-date return of 17%.

Large-cap companies make up nearly 43.9% of its holdings. The top three holdings are $Constellation(STZ.B)$ Energy Group (NASDAQ: CEG) at 8.53%, PG&E (New York Stock Exchange: PCG) at 8.18%, and Cameco Corporation (New York Stock Exchange: CCO) at 6.90%.

Data Source: VettaFi

$(SPY)$ $(.SPX)$ $(.DJI)$ $(URA)$ $(URNM)$ $(URNJ)$ $(NLR)$Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great uranium