Here's Why We Think Super Micro Computer Will Hit Another All-Time High

Summary

- SMCI has been a clear winner in the market's ongoing AI rally, despite recently paring some of its gains on mixed earnings results.

- Yet the stock has been showing signs of a sustained recovery in recent weeks, underpinned by a successful Computex keynote that shows SMCI's mission-critical role in AI developments remains intact.

- SMCI also benefits from tangible fundamental tailwinds ahead, with improving supplies, additive growth from its first mover advantage in the provision of DLC solutions at scale, and increasing operating leverage.

- Trading at 2.5x estimated sales and 28.5x estimated earnings, SMCI's fundamental strength and emerging DLC advantage remain underappreciated, with potential for further upside.

JHVEPhoto

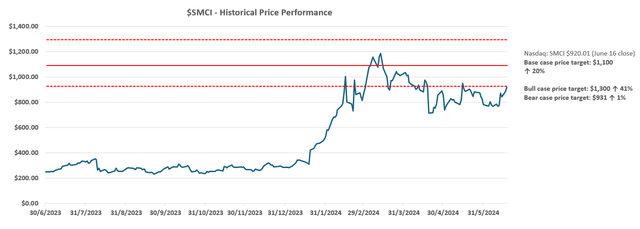

Since recognizing Super Micro Computer, Inc. (NASDAQ:SMCI) as a potentially overlooked AI winner during our initiating coverage in mid-2023, the stock has surged more than 400% before giving back some of its gains in recent months. Admittedly, it has been a volatile couple of months for the SMCI stock since its S&P 500 admission and mixed F3Q24 earnings update. But it has finally started to show some signs of a sustained recovery in recent weeks. Building on our previous coverage of SMCI, which focused on the stock's valuation considerations on the eve of its S&P 500 admission, the following analysis will dive further into why we believe the recent rally still has legs.

The company remains well-positioned for acceleration exiting FY 2024. Fundamentally, SMCI is primed for further ramp tailwinds heading into FY 2025, driven by its additive technology advantage to existing AI momentum and improving supply chains. Specifically, SMCI is currently the only server company that can provide direct liquid cooling ("DLC") solutions - the answer to unlocking incremental power efficiency in the AI- and data-first era - at scale. This makes DLC a key unique near-term growth driver for SMCI, as the technology addresses increasing optimization and scalability requirements from enterprise end-users.

SMCI also benefits from a sufficient cash runway to support its growth roadmap. The latest cash injection from the $1.5 billion convertible notes issuance earlier this year is expected to yield a competitive ROIC. Not only is the anticipated transition to DLC likely to drive an ensuing upgrade cycle to propel growth, but the lower cost of DLC production will also be accretive to SMCI's profit margins. The continued ramp of DLC sales at scale will also be key to offsetting near-term gross margin headwinds stemming from the aggressive pricing strategy implemented by management to drive market share gains. The recent impact on working capital from the end of F3Q inventory build is also likely to alleviate exiting F4Q due to SMCI's record-setting backlog. Taken together, SMCI is likely to benefit from an impending restoration to its cash flow strength, which we believe will, inadvertently, propel valuation gains.

Currently trading at about 2.5x estimated sales and 28.5x estimated earnings, SMCI continues to underperform its broader semiconductor and server peers with a comparable earnings outlook and capital intensity. We believe SMCI's DLC advantage and ensuing monetization roadmap for the technology, which will be additive to the existing benefit of AI-driven momentum, remains underappreciated at current levels.

SMCI's Direct Liquid Cooling Advantage

Admittedly, SMCI has been a key beneficiary of the AI-driven refresh cycle for data center infrastructure. This is evident in SMCI's ballooning server and storage systems sales growth in recent quarters, propelled by its proprietary building block rack scale plug-and-play architecture which enables upgrades without significant adjustments to existing infrastructure. This momentum is expected to be further sustained by the emerging ramp of SMCI's DLC technology, which will unlock greater scalability for customers looking to optimize the performance and efficiency gains of existing infrastructure.

SMCI is currently the only provider of DLC solutions through its plug-and-play architecture at scale. This makes a strong competitive and first-mover advantage for SMCI, as DLC demand will likely ramp up alongside the increasing energy intensity of next-generation accelerated data center infrastructure needed to facilitate AI/ML workloads.

Specifically, increasingly complex workloads like AI training and inferencing are inherently compute-hungry. Despite the anticipated efficiency gains promised by the transition from general-purpose to accelerated computing, the latter will inevitably require "larger amounts of power" and, inadvertently, increase energy consumption and costs for data center operators and enterprise end-users. Although mainstream adoption of generative AI solutions remains in the early stages, the International Energy Agency is estimating electricity consumption by the global data center footprint to double between 2022 and 2026. To put into better perspective, recent studies show that one AI-generated image is estimated to consume "as much energy as 522 smartphones".

Admittedly, next-generation data center GPUs are increasingly touting better energy efficiency. For instance, NVIDIA Corporation's (NVDA) upcoming Blackwell GPUs are expected to deliver "up to 25x less cost and energy consumption" than its predecessor; Intel Corporation's (INTC) latest Gaudi 3 AI accelerator is expected to deliver 40% better power efficiency on average than competition. Yet improvements in GPU configurations alone are unlikely to suffice in addressing the impending acceleration in energy demand to support increasingly complex workloads. Adjacent technology improvements, such as SMCI's DLC solutions, will be critical to addressing the impending increase in both cost and environmental implications of pursuing AI developments.

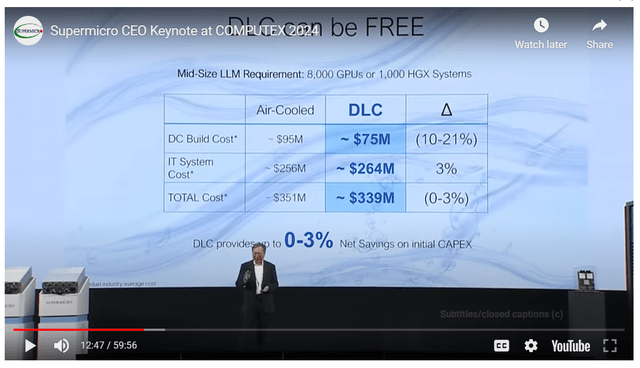

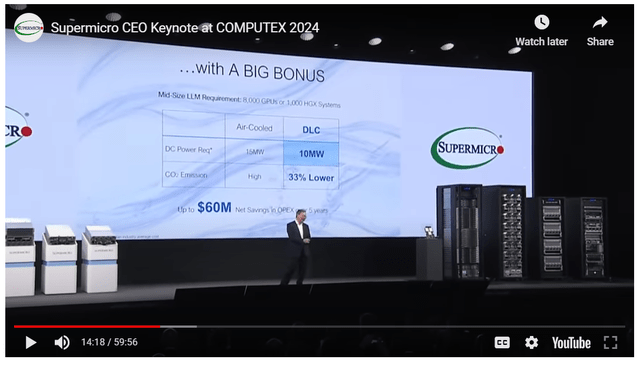

Specifically, SMCI's DLC solution, when complemented by its rack-scale plug-and-play architecture, is capable of reducing data center power consumption by up to 40%. On the grand scale, SMCI's liquid-cooled racks can deliver up to 3% in initial capex reduction, and up to $60 million in net opex reduction over five years, contributing favorably to TCO considerations.

supermicro.com

supermicro.com

Many of the next-generation AI accelerator chips critical in powering the transition to accelerated computing have been designed with optimized compatibility with DLC technology. For instance, Nvidia has long embraced compatibility with liquid-cooling technology for its GPUs. The AI darling had referenced liquid cooling as a solution that is "maturing in the age of AI" back in mid-2022 before OpenAI's ChatGPT even went viral. Nvidia even went further to cite the critical role of liquid cooling in reducing both data center rack count and power costs.

This continues to corroborate a strong ramp trajectory for SMCI's proprietary DLC solution ahead. Specifically, management anticipates DLC deployments to penetrate 15% of new data center builds worldwide over the next 12 months, up from 1% adoption observed steadily over the past three decades. Penetration is estimated to reach 30% in the year to follow, highlighting another potentially accelerating revenue stream for SMCI to sustain its current pace of breakneck growth.

The anticipated pace of market share gains is not only complemented by current AI development needs, but also by improving supply availability from SMCI. The company anticipates full capacity for its liquid-cooled racks at 5,000 units per month, with the near-term ramp-up pace towards 2,000 units per month exiting FY 2024.

In addition to the robust demand environment, SMCI also benefits from a more favorable cost structure for the production of liquid-cooled racks compared to its traditional air-cooling solutions. Based on management's keynote at Computex 2024, SMCI is capable of building DLC solutions at a lower cost than traditional air-cooling solutions. Scalability is also high, with DLC's estimated production-to-delivery completion timeline set within two to four weeks, which is reduced significantly from the traditional 4 to 12 months.

The upcoming ramp of SMCI's DLC solution also coincides with new systems coming later this year, fitted with upgraded chips such as the next-generation H200, B100, and B200 GPUs from Nvidia; Gaudi 2 and Gaudi 3 accelerators from Intel; and Instinct MI300X and MI300A accelerators from Advanced Micro Devices, Inc. (AMD). This accordingly reinforces SMCI's forward demand environment, building on Nvidia's recent expectations for incremental GPU uptake from enterprise and sovereign end-markets, while initial deployments at hyperscalers continue to ramp.

Fundamental Considerations

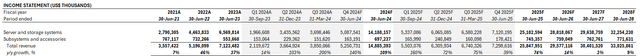

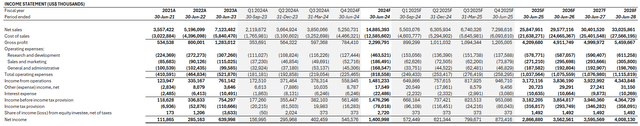

Adjusting our previous forecast for SMCI's F3Q24 results and raised revenue guidance for FY 2024, we estimate current year revenue growth at 109% to $14.9 billion. The server and storage systems segment will continue to spearhead growth acceleration at SMCI.

Author

Specifically, we anticipate sequential acceleration starting in the current quarter, with a stronger pace of growth exiting the coming December quarter. Recall that SMCI's backlog has reached a record high in F3Q24, underscoring how demand remains a function of supply availability for the company. And the anticipated strength of SMCI's near-term growth trajectory will be supported by its improving supply chains.

In the current quarter, we expect SMCI's growth trajectory to benefit from the release of the late inventory build observed exiting F3Q24, which had previously weighed on its working capital and cash flows underpinning its valuation. This will be further reinforced by the continued ramp of DLC solutions towards scale, alongside incremental systems production capacity coming online from SMCI's Malaysian facility at the end of calendar 2024. Anticipated incremental demand for next-generation systems based on the updated GPU cycle from chipmakers like Nvidia, AMD, and Intel later calendar 2024 should also bolster expectations for a sequential growth uptick ahead at SMCI.

On the profitability front, our forecast has considered management's conservative expectations for a slight sequential decline in gross margins to reflect their continued adoption of an aggressive pricing strategy in exchange for market share gains. However, over the longer term, we remain confident in the materialization of SMCI's margin accretive factors.

These include economies of scale benefits from the continued ramp of SMCI's new facilities across the U.S., Malaysia, and Taiwan, which are expected to yield a combined incremental annualized revenue capacity of $25 billion; and lower cost, higher margin next-generation products like SMCI's DLC rack solutions. SMCI's long-term margin accretive factors are further corroborated by the company's disciplined opex spend management observed in recent quarters. Taken together, SMCI remains well-positioned to return gross margins to the higher range of its 14% to 17% target range once new products and capacity ramp towards scale.

Author

Valuation Considerations

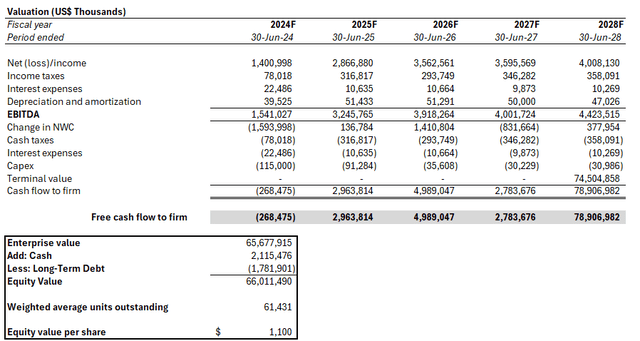

We remain confident that SMCI has the fundamental capability to return the stock towards new all-time highs. Taking into consideration the foregoing analysis, we are setting the base case price target at $1,100 apiece.

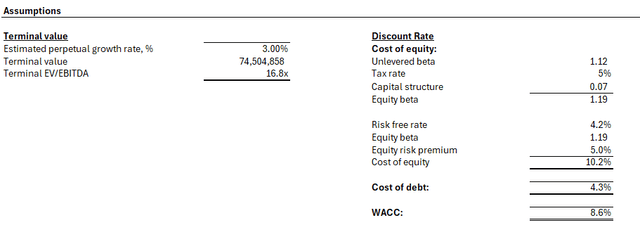

Author

The price is derived based on the discounted cash flow approach, with consideration of cash flow projections taken in conjunction with the fundamental forecast discussed in the earlier section. The analysis considers a WACC of 8.6%, which is in line with SMCI's risk profile and capital structure. An estimated perpetual growth rate of 3.0% is also applied to FY 2028E EBITDA to determine SMCI's terminal value. The valuation assumption applied in line with the pace of economic expansion across SMCI's core operating regions and reflective of its anticipated long-term steady-state growth outlook.

Author

Author

Looking ahead, we remain cautious of continued volatility due to non-fundamental considerations. Specifically, SMCI is currently one of the most heavily shorted stocks in the S&P 500, with its short float exceeding 7%. This compares to the less-than-5% observed across its server peers, as well as broader market AI winners like Nvidia.

With anticipation for a strong fundamental trajectory ahead, which is supportive of cash flow growth and ensuing valuation gains, the relatively hefty short interest currently observed in SMCI may reverse in the near term. This is consistent with the early onset of Nvidia's recent upsurge in mid-2023 when short-sellers were forced to mitigate their exposure following the chipmaker's earlier rounds of blockbuster earnings outperformance and "blow-out" guidance.

As a result, the current 7%+ short float on the SMCI stock serves as not only a potential indicator for near-term volatility, but also prospects for a further upsurge fuelled by tangible fundamental strength. Recall that management has acknowledged conservatism to SMCI's growth and earnings outlook existing FY 2024, citing a strong demand environment and improving supplies to address its record backlog. Paired with multiple margin accretive factors through FY 2025 and beyond as discussed in the foregoing analysis, we believe SMCI remains well-positioned for a further upsurge towards its upside scenario at $1,300 apiece, which would set a new record-high for the stock.

Conclusion

SMCI remains well-positioned fundamentally for both the near- and longer-term, with improving supplies reinforcing optimized monetization of its strong demand environment. More importantly, further penetration for its DLC solution will be additive to existing AI-driven growth. And the ramp trajectory of SMCI's competitive advantage in DLC solutions at scale remains strong, given continued industry prioritization of optimization and new infrastructure builds to support increasingly complex, and compute and energy-intensive AI workloads.

Taken together with the favorable cost structure of its DLC ramp, improving economies of scale at new facilities, and robust cash flows supported by the latest convertible issuance to fund long-term growth initiatives with strong returns, the SMCI stock shows a favorable risk-reward set-up at current levels.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.