Dividends Are Back: 3 Massively Undervalued Dividend Growth Stocks Set To Soar

Summary

- Dividend stocks are staging a comeback amid a broader market shift, offering promising opportunities for investors.

- Despite a top-heavy S&P 500, undervalued sectors are gaining momentum with strong fundamentals.

- Investors can capitalize on growth potential in defense, precious metals, and energy sectors poised for long-term gains.

GeorgePeters

Introduction

Guess what?

Dividend stocks are back!

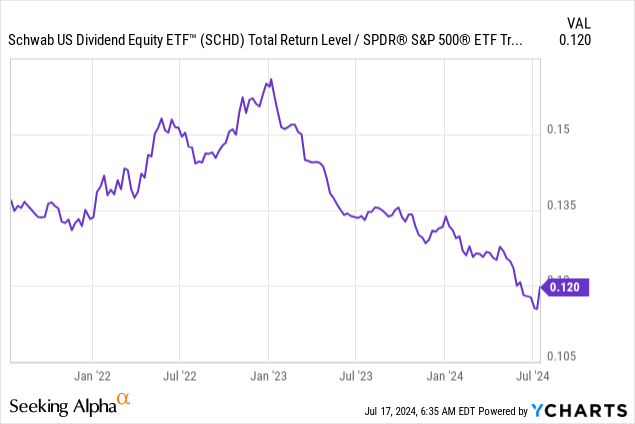

After roughly 1.5 years of non-stop underperformance, dividend stocks are making a comeback, as displayed by the ratio between the Schwab U.S. Dividend Equity ETF (SCHD) and the S&P 500 below.

Data by YCharts

Data by YCharts

Although we're still dealing with green shoots, current momentum is promising and increasingly backed by favorable fundamentals, as we'll discuss in this article.

It's also an important development, as I have beaten the drum for a while on the importance of avoiding the top-heavy S&P 500 and finding value in undervalued areas instead. This includes a recent article titled "Forget Big Tech, 3 Terrific Dividend Growth Stocks To Buy," where I also wrote that a broadening market would offer tremendous opportunities:

While the market is far from cheap, my point is not that investors should dump their shares. My thesis is a broadening of strength, as I expect the equal-weight S&P 500 to outperform the market-weighted S&P 500.

In this article, I'll update my thesis, discuss upcoming earnings, and present three dividend stocks that I consider to be significantly undervalued and poised to deliver elevated long-term gains.

So, let's get to it!

The Return Of Dividends

Ever since ChatGPT and AI, in general, became popular last year (supported by peaking inflation rates), the S&P 500 has been all about AI stocks.

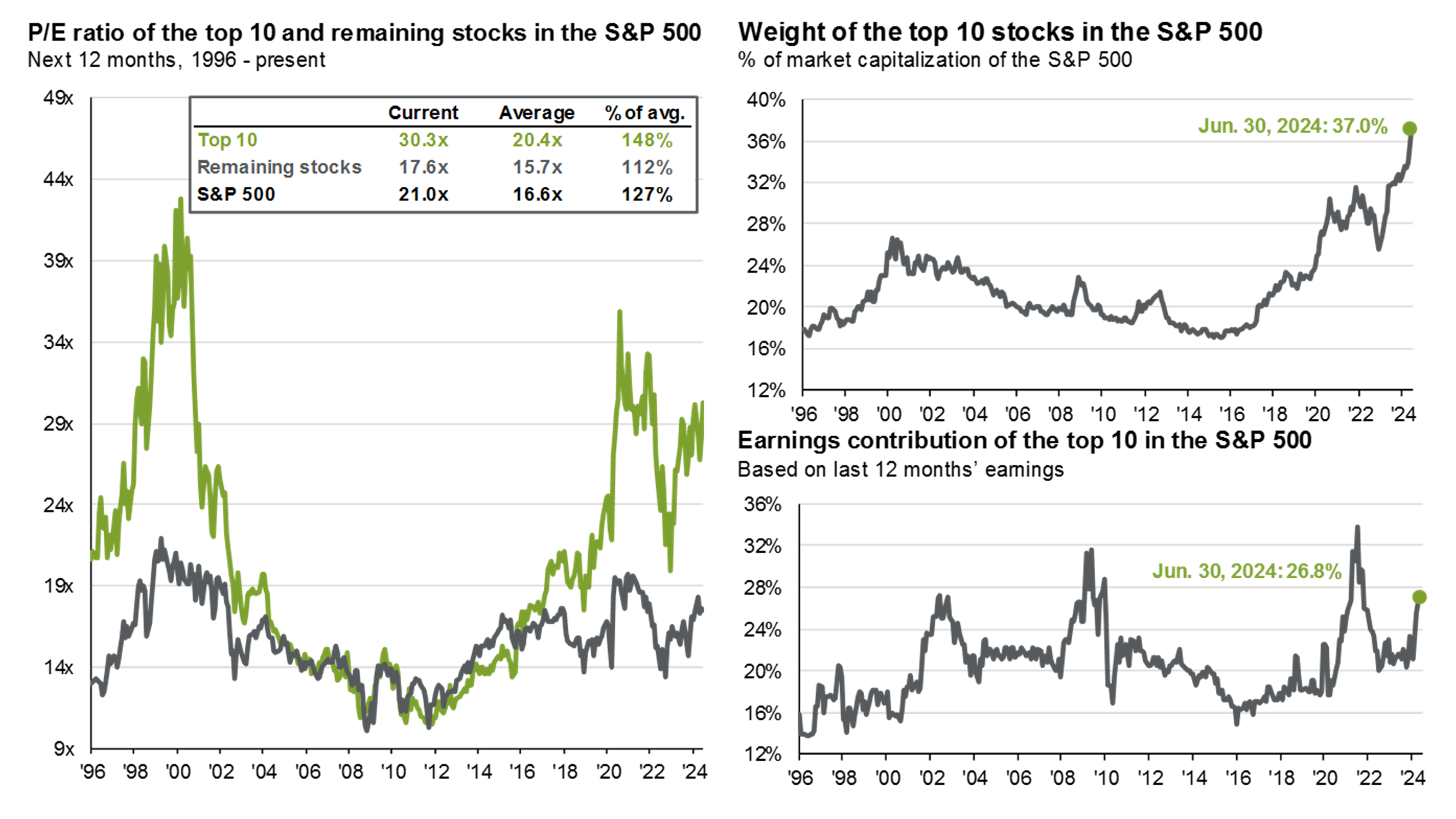

I have used the chart below in a number of other articles as well, as it shows that the biggest ten stocks of the S&P 500 accounted for 37% of its total value going into this month!

JPMorgan

While the stock price surges of the "big guys" were justified - most of them have truly fantastic business models - the risk/reward hasn't gotten any better for them.

As we head into the hot phase of the 2Q24 earnings season, we're dealing with a few interesting developments I wanted to share with you.

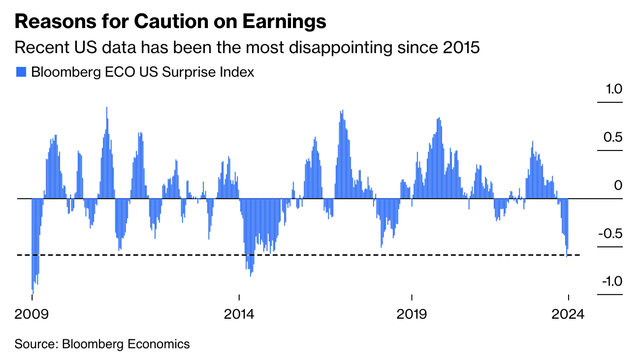

For example, the U.S. economic surprise index has hit its lowest level since 2015. While this does not mean that economic growth has hit the lowest level since 2015, it indicates that macroeconomic numbers have been much worse than expected.

Bloomberg

Generally speaking, this could indicate that earnings could come in lower than expected.

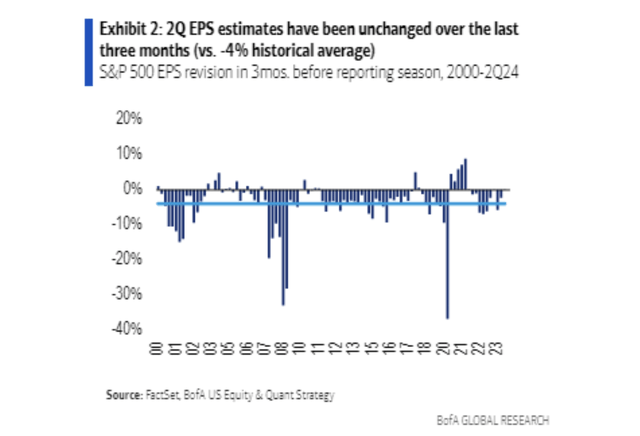

Bloomberg's John Authers makes a great case, as he noted that analysts had not revised their 2Q24 earnings estimates over the past three months (see the chart below).

Bank of America

While none of this is truly alarming news, it does show somewhat of an asymmetry between worse-than-expected economic data and unchanged S&P 500 earnings expectations.

From a risk/reward point-of-view, that's not great.

What's interesting as well is that if we dig deeper, we find that "average" S&P 500 earnings expectations are only unchanged because strength in the Mag-7/FANG+ has offset weakness in other areas.

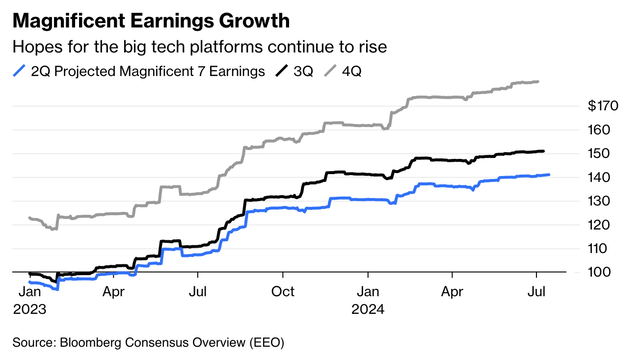

Mag-7 earnings expectations for 2Q, 3Q, and 4Q have consistently been hiked since early 2023. Although momentum has slowed since March, expectations have continued to increase.

Bloomberg

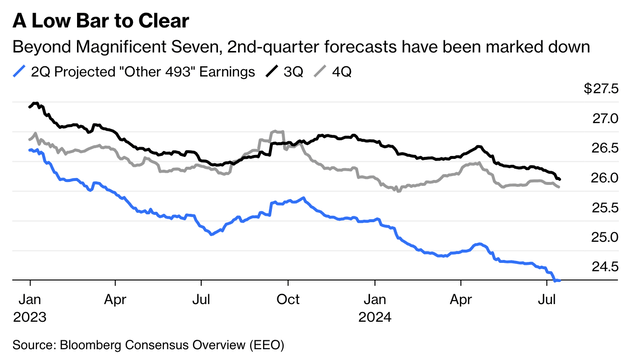

Meanwhile, this is what expectations for the "S&P 493" look like (the S&P 500 minus the Mag-7):

Bloomberg

While it may not seem like it, this provides a great risk/reward for a broadening market, where a bigger share of companies contributes to its performance.

- The Mag-7 are doing well. Analysts are upbeat, and "everyone" seems to be bullish.

- The S&P 493 has been left in the dust. Earnings growth expectations are poor, and "nobody" really cared to look beyond tech since last year.

While I'm obviously painting with a broad brush here, this is what John Authers wrote (emphasis added):

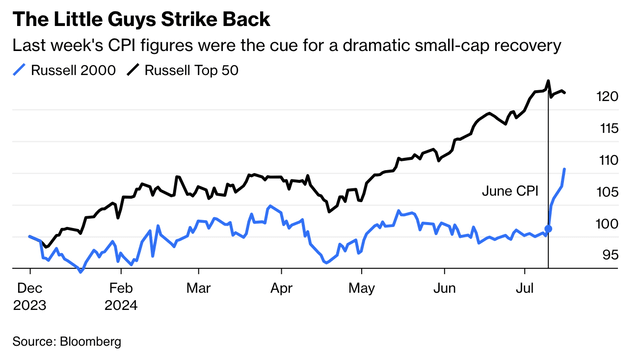

Glenmede’s Jason Pride and Mike Reynolds argue that this earnings season could kickstart a market broadening, and the gap between forecasts for the Mag 7 and everyone else certainly seems to provide the ideal setup. Thursday’s dramatic stock rotation after soft CPI boosted rate-cut hopes showed that there was an appetite for the non-Magnificents to outperform. That rotation continues with the Russell 2000 index, previously stagnant all year, rallying by about 11.5% in five days while the Russell’s Top 50 index of mega caps stalls:

Bloomberg

This brings me to three special dividend stocks that all bring something unique to the table. I believe if the market keeps betting on rate cuts, a broader market will massively benefit dividend stocks, as investors will have to look for high-quality income.

Northrop Grumman (NOC) - Mission-Critical & Undervalued

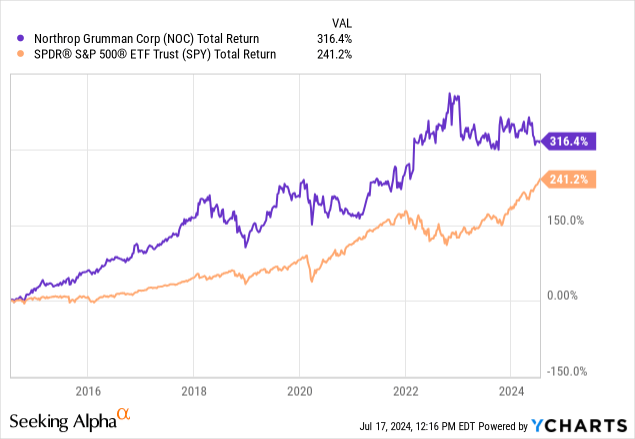

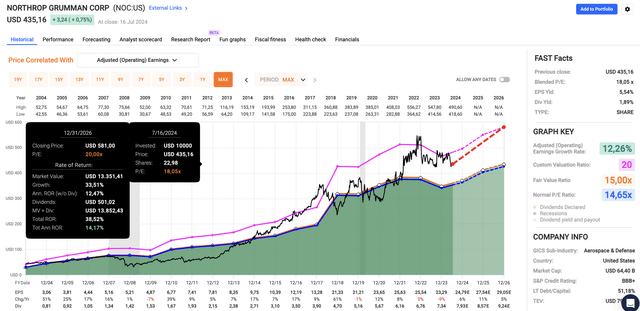

Northrop Grumman is one of America's largest defense contractors. Known for major programs like the B-2 Spirit bomber and its successor, the B-21 Raider, it has returned 316% over the past ten years, beating the elevated 241% return of the S&P 500 by a wide margin.

Data by YCharts

Data by YCharts

However, over the past five years, it has returned just 46%, while the S&P 500 more than doubled.

This underperformance was mainly caused by the pandemic, which disrupted supply chains and negatively impacted some major defense programs.

It also did not help that defense contractors encountered Department of Defense budget uncertainty in recent years.

That said, because of these issues, I have started to accumulate a lot (relatively speaking) of defense stocks, giving the industry a 20% weighting in my long-term dividend growth portfolio. Needless to say, this makes it an ultra-high-conviction investment for me.

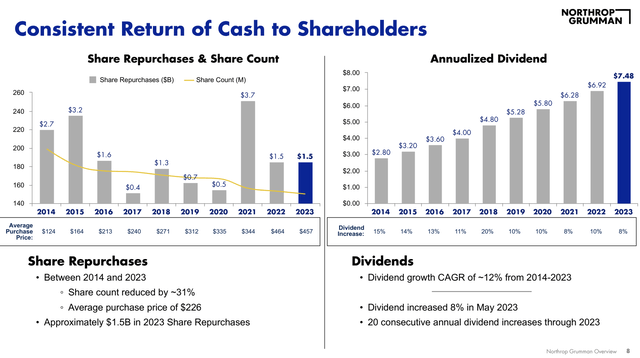

Northrop Grumman stands out for multiple reasons, including its focus on shareholder distributions.

Over the past ten years, this 1.9%-yielding stock has grown its dividend by 12% annually while buying back almost a third of its shares!

Northrop Grumman Corp.

Currently, the dividend has a payout ratio of just 31% and a number of tailwinds working in its favor - besides its dividend/buyback profile.

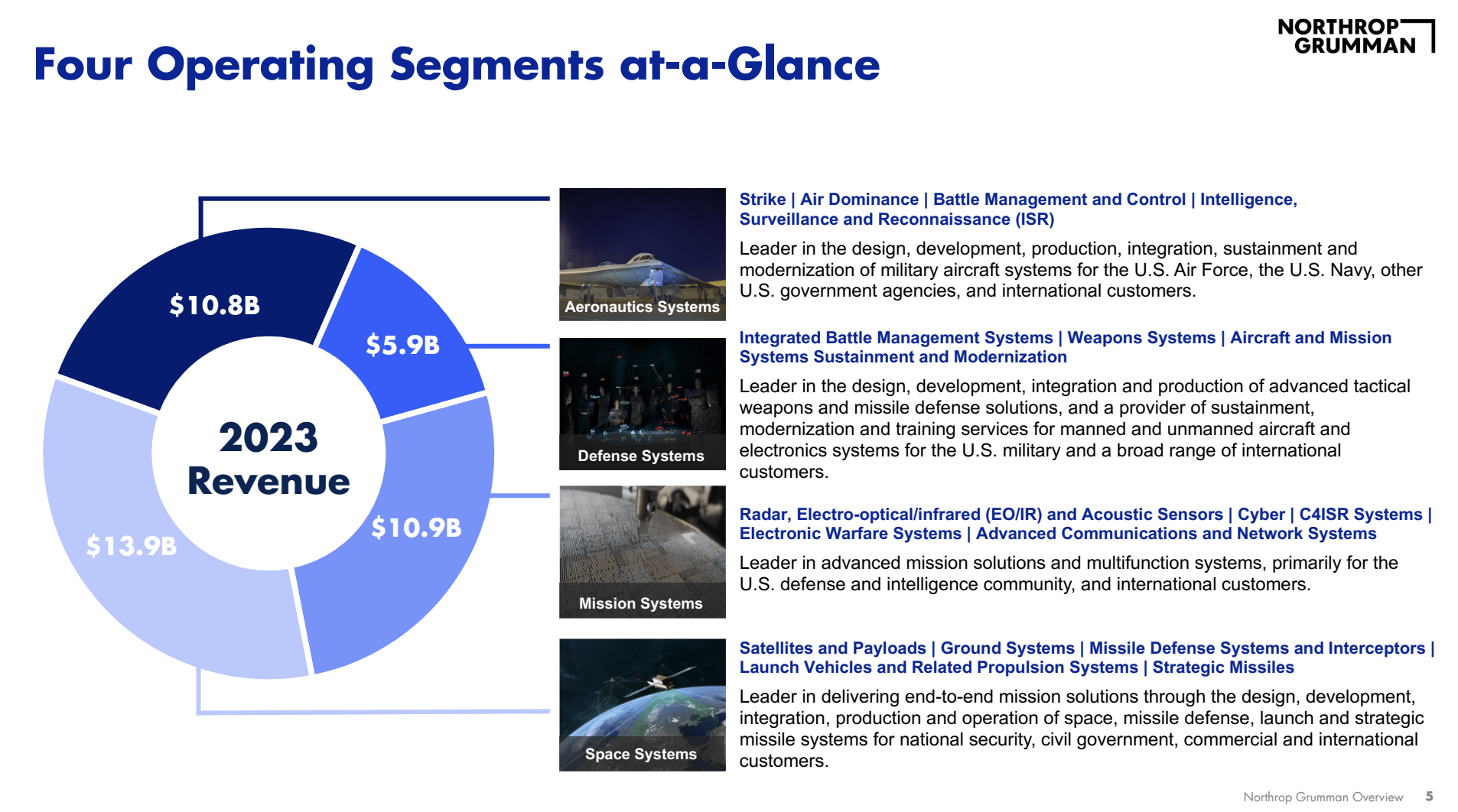

One of them is its highly diversified business model, which comes with major exposure to fast-growing programs like missile defense, space, intelligence, and others.

Northrop Grumman Corp.

During the latest Bernstein Strategic Decisions Conference, the company noted it is optimistic about continued funding for strategic programs like the B-21 and Sentinel, which are crucial to national security.

Additionally, the International Ballistic Missile Defense ("IBCS") program is expected to contribute significantly to revenue growth, with projected demand potentially reaching $10 billion from various international partners.

Foreign markets, especially in Europe, offer great growth opportunities for the company, as most NATO nations have not met the 2% of GDP defense investment requirements.

This has led to a high demand for modernization, including in reconnaissance.

Northrop Grumman has a significant presence in this area through programs like the MG-4C Triton (shown below).

Northrop Grumman Corp. (MG-4C Triton)

NOC controls 20% of the North American UAV market, with expectations to become the second-largest player. Programs like Triton help it to achieve this. It also has a wide range of other drones, including an experimental underwater drone, the Manta Ray.

Valuation-wise, the stock trades at a blended P/E ratio of 18.1x. In past articles, I have applied a 20x multiple, as I believe this better fits its growth profile of 5-11% annual EPS growth, as seen in the chart above.

FAST Graphs

Based on this, I believe we are dealing with a fair stock price of roughly $580, 33% above the current price.

As a result, NOC is a stock I'm consistently adding to, as I believe it's one of the best low-risk dividend growers on the market.

Franco-Nevada Corp. (FNV) - A Fantastic High-Margin Streamer

In March, I wrote an article titled "Franco-Nevada: Forget Volatile Miners - This Is How To Win With Gold."

Since then, Franco Nevada is up 14%, beating the 8% return of the S&P 500 by a decent margin.

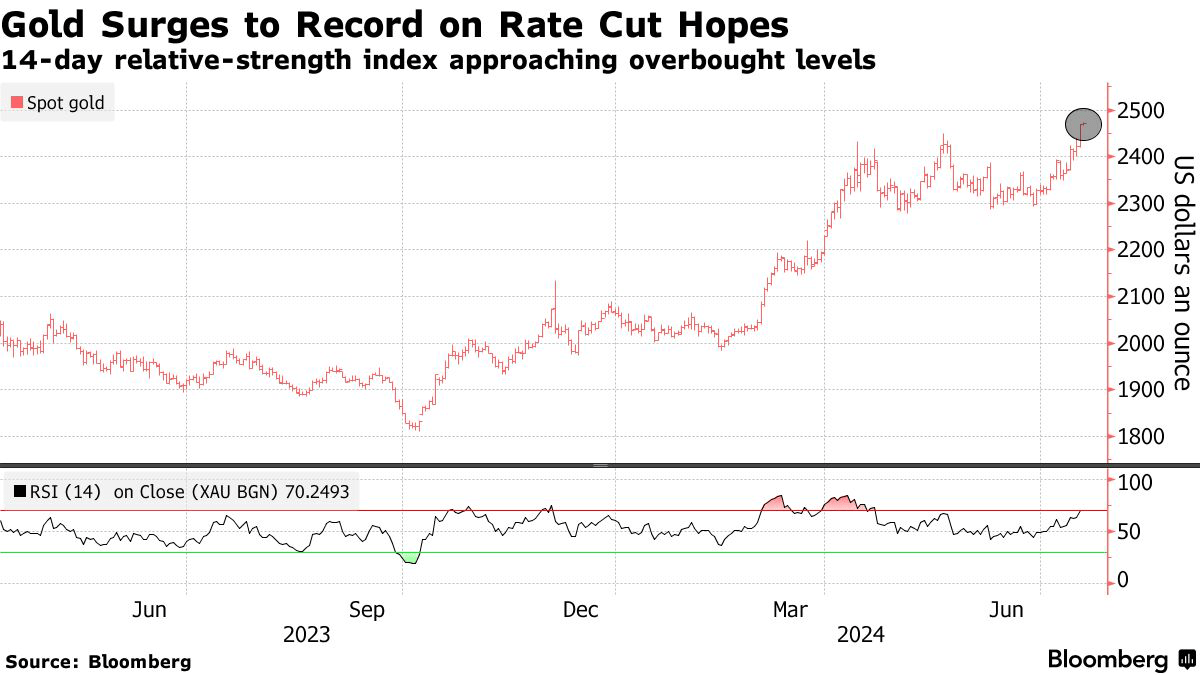

The reason why I have liked gold for a while is the tricky situation of the Fed. It has the tough task of balancing economic growth and inflation. Inflation is coming down very slowly, while economic risks are building.

As a result, investors want to own gold, as it is perfect protection if the Fed needs to pick protecting economic growth over fighting inflation.

Bloomberg

That's where FNV comes in. Unlike most miners, which have horrible long-term total returns, it has a fantastic business model.

This Canadian giant is a streamer, which means it does not mine gold. It finances mining operations. In return for financing, it gets to buy a part of the mine's production at a discounted price.

While the biggest risk is subdued demand for new mining operations, it is a very attractive way to invest in precious metals, as FNV does not have operational risks.

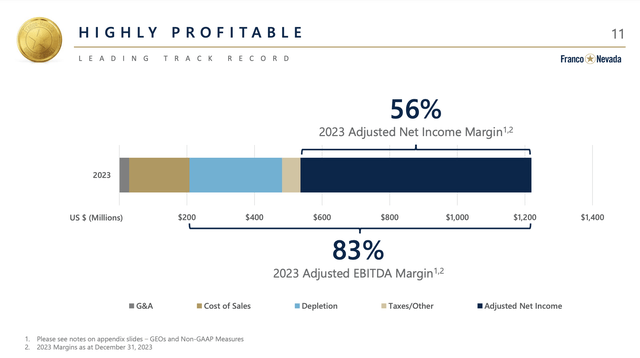

Last year, it had an 83% adjusted EBITDA margin and a 56% net income margin. No miner can compete with this.

Franco-Nevada Corporation

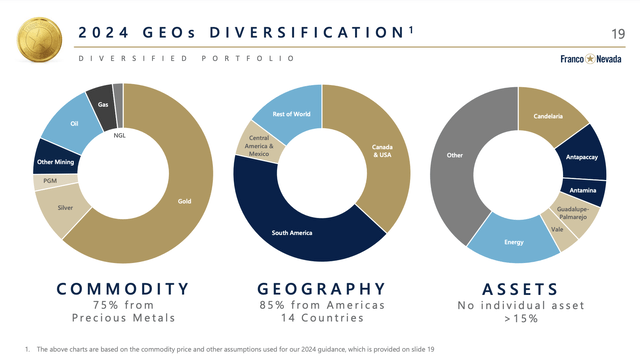

Besides gold, FNV has exposure to other commodities, including silver and energy, as it owns royalty interests in oil and gas as well.

As we can see below, 25% of its income comes from non-precious metal operations. No individual asset accounts for more than 15% of its revenue.

Franco-Nevada Corporation

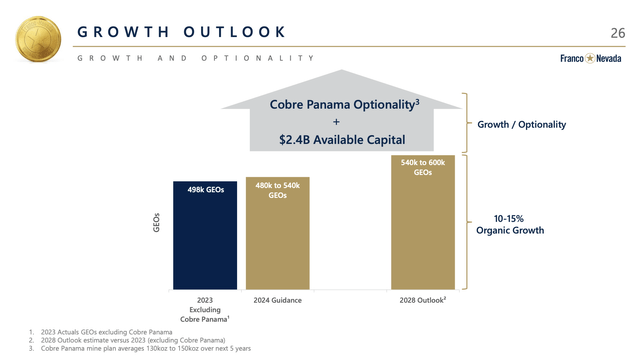

Additionally, the streamer has no debt and $2.3 billion in available capital. More than half of these consists of cash.

Since its IPO, the company has increased its reserves by 3.5x and plans to produce more than 540 thousand gold-equivalent ounces by 2028, implying 10% organic growth with additional opportunities in Panama.

Franco-Nevada Corporation

Currently yielding 1.1%, the company has grown its dividend by 8.2% per year over the past five years.

It has a sub-40% payout ratio and an attractive valuation.

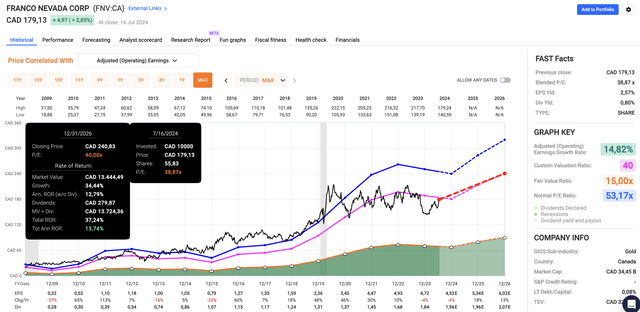

Currently trading at a blended P/E ratio of 33.3x, it trades a mile below its normalized P/E ratio of 53.2x. While this may seem like a lofty valuation, it is quite common for ultra-high-margin companies to trade at elevated multiples. After all, they generate more earnings from every revenue dollar.

Using the FactSet data in the chart below, the company is expected to grow EPS by 18% and 13% in 2025 and 2026, respectively.

Even applying a 40x multiple (like I did in my March article) gives us an annual return estimate of at least 13%.

FAST Graphs

As such, I believe FNV is a great play for a broader market, a weaker dollar, and a bigger focus on quality income - despite its somewhat low yield.

EOG Resources (EOG) - Undervalued Energy Dividends

By now, I doubt it is a surprise to many when I say that I really like the energy sector. This includes upstream (oil and gas production), midstream (pipeline and similar infrastructure), downstream (refining), and related services.

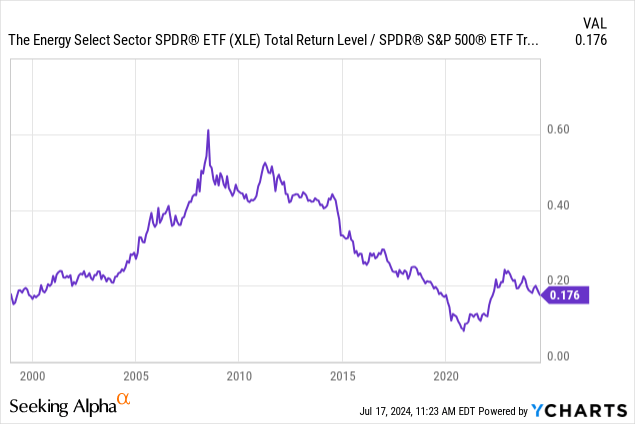

I believe energy is one of the best sectors to bet on broadening market strength, as it is massively undervalued, having underperformed the S&P 500 very consistently since 2011.

Data by YCharts

Data by YCharts

Although I don't have a crystal ball, I believe the energy/S&P 500 ratio above bottomed after the pandemic.

- The shale revolution in the U.S. ended, slowing one of the biggest oil and gas supply engine of the past two decades. This shifts pricing power back to OPEC.

- People figured out the energy transition did not "kill" oil and gas. On the contrary, demand is healthy and expected to remain strong for many more decades.

- Elevated geopolitical tensions have become a bigger bullish factor.

That's where EOG Resources comes in.

My most recent in-depth article on this company was written on June 13, when I called it "Undervalued And Underappreciated."

Since then, shares have appreciated 10%, with a lot more room to grow - I think.

What sets EOG Resources apart is its position as one of America's largest onshore oil and gas producers, with super-efficient operations.

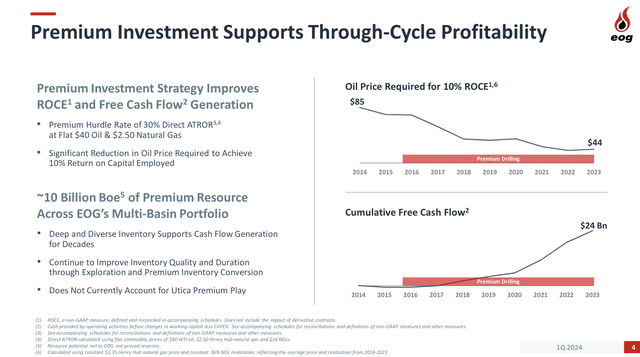

The oil price required to generate a 10% return on capital is just $44. That's down from $85 in 2014.

EOG Resources

Moreover, as I wrote in my June article, during the recent Bernstein Strategic Decisions Conference, the company noted that it prioritizes projects that meet strict return thresholds, including a 30% after-tax rate of return at $40 per barrel of oil and $2.50 per MMBtu of natural gas.

Historically, oil prices have averaged roughly $65 in the past decade, which puts EOG in a great spot - purely statistically speaking.

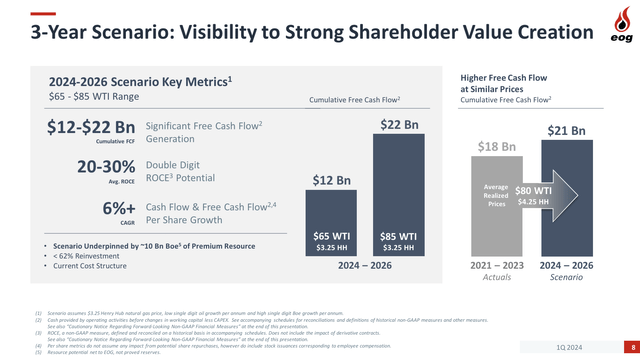

Due to more favorable energy fundamentals, the company now believes in a "new normal" between $65 and $85 WTI.

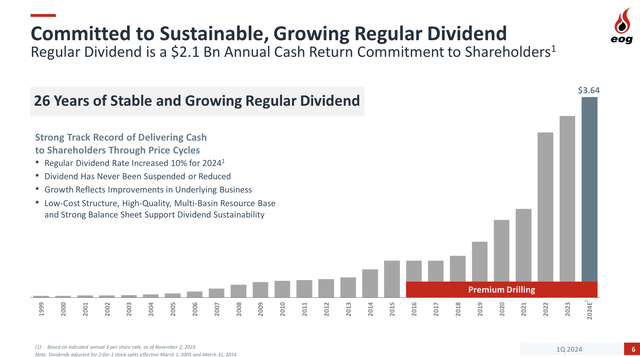

This is great news for investors, as the company has a focus on its shareholders. It hasn't cut its dividend in 26 years and massively increased total dividends since it started to deploy "premium drilling" in 2014.

EOG Resources

Currently yielding 2.8%, EOG estimates it can generate $22 billion in cumulative free cash flow through 2026 at $85 WTI/$3.24 Henry Hub. That would be 29% of its current market cap (10% annualized).

EOG Resources

As the company aims to return at least 70% of its free cash flow to shareholders, we're looking at a base case of 6-7% in annual returns.

Especially if oil prices continue to rise, investors could be in for much higher returns.

It also helps that it has a credit rating of A- and a highly favorable valuation.

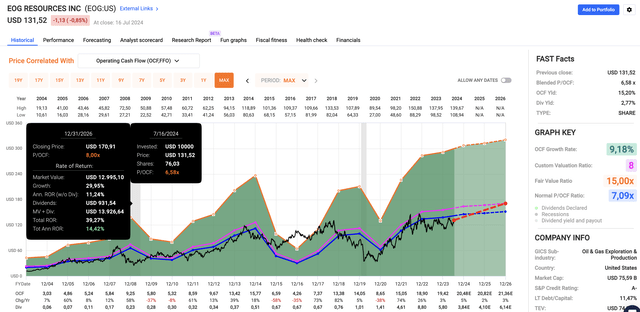

EOG trades at a blended P/OCF (operating cash flow) ratio of just 6.6x. It has a normalized P/OCF ratio of 7.1x. As I wrote in my in-depth article, I do not believe EOG should trade below an 8x multiple.

Currently, this implies a fair stock price of $171, 30% above the current price.

FAST Graphs

All things considered, I believe EOG offers a great risk/reward for investors seeking value with the potential to benefit from a strong long-term bull market in oil and gas.

Takeaway

Dividend stocks are finally making a strong comeback after a long period of underperformance.

With favorable fundamentals and a broadening market, there's a unique opportunity to invest in undervalued areas.

- Northrop Grumman offers strong defense sector growth with a 1.9% yield and 12% annual dividend growth.

- Franco-Nevada provides high-margin exposure to gold without mining risks, enjoying an 83% EBITDA margin and a 1.1% yield.

- EOG Resources stands out in energy with a 2.8% yield and efficient operations that promise strong returns even at moderate oil prices.

I believe these stocks are well-positioned to deliver elevated long-term gains in a broadening market.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.