understanding the realized vol portion of option p/l

Thursday’s paid post was cutting to the heart of vol trading — dynamic hedging to isolate vol mispricing.

There’s a part in the paid section called A word on Option P/Ls that I’ll share here:

On option P/Ls

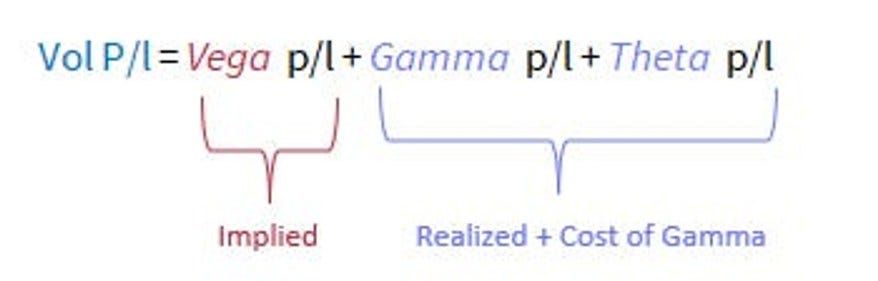

Once we strip out an option’s delta p/l, we are left with a “volatility p/l”.

Volatility p/l has an implied vol portion and a realized vol portion.

Vega p/l = implied vol portion

Gamma + Theta p/l = realized vol portion

We estimate the p/ls with the following formulas:

- Vega p/l = vega * vol change *contracts * multiplier

- Theta p/l = theta * days elapsed * contracts * multiplier

- Gamma p/l = 1/2 gamma * (change in stock)² * contracts * multiplier

- 💡See Moontower On Gamma for the derivation — it’s neat since it’s the same approximation for distance traveled in time t for a given acceleration

Let’s take inventory:

1) We start with the actual real-life option p/l

2) Subtract how much of that p/l comes should come from delta

3) The remainder should equal the sum of our estimated vega, gamma, and theta p/ls

Error

We have simplified “vol p/l” to be a function of realized vol (gamma) vs the cost or hurdle embedded in the implied vol (theta). We are ignoring the option price’s sensitivity to changes in interest rates (rho) or implied vol itself (vega).

But there are additional greeks such as volga and vanna that we can attribute some of the change in optin price and therefore p/l. But they are typically much smaller effects.

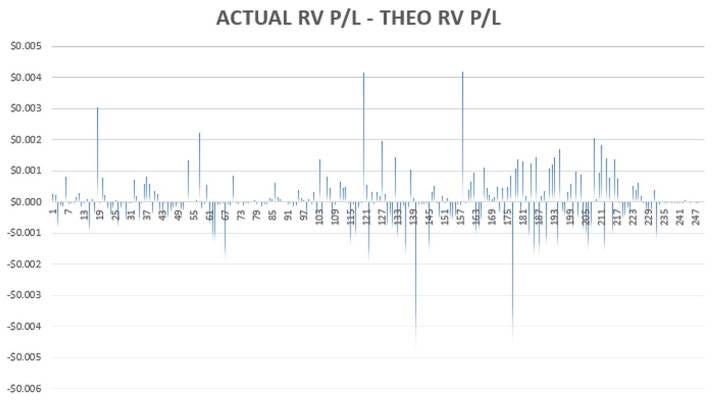

An easy way to see this is by comparing the hedged option p/l with what we expect from simply estimating the gamma + theta p/l.

That comparison is captured by comparing actual hedged p/l vs the predicted theoretical p/l.

Here’s a chart of the daily prediction errors for the whole year:

Even those spikes remain under 4 tenths of a cent. Overall, the prediction error each day is small percentage of the daily “volatility p/l”

💡There are higher order and “cross” greeks that will “explain” the error between this estimate of the vol p/l and what is actually experienced. But as you see, the error is small. Gamma, theta, and vega do the heavy lifting.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.