Collar Strategy: Safeguard Gains in Chinese Stocks

With the Fed's eagerly anticipated rate cut finally landing, but surprising the market with a bold 50bp reduction, driving the fed funds rate down to 4.75%-5%, China swiftly followed suit.

Boosted by favorable measures like RRR cuts, interest rate reductions, and lower mortgage rates, Hong Kong stocks soared in early trading, with all three major indexes jumping roughly 2%.

Tech stocks led the charge, with $JD.com(JD)$ up nearly 4%, $Weibo(WB)$ and $NetEase(NTES)$ over 2%, and $MEITUAN(MPNGF)$ , $Alibaba(BABA)$ , $Xiaomi Corp.(XIACY)$ all close to 2% gains. $Tencent Holding Ltd.(TCEHY)$ also joined the rally.

The surge in Chinese stocks isn't unfounded. A quick look at historical data reveals that interest rate cuts often favor Chinese assets.

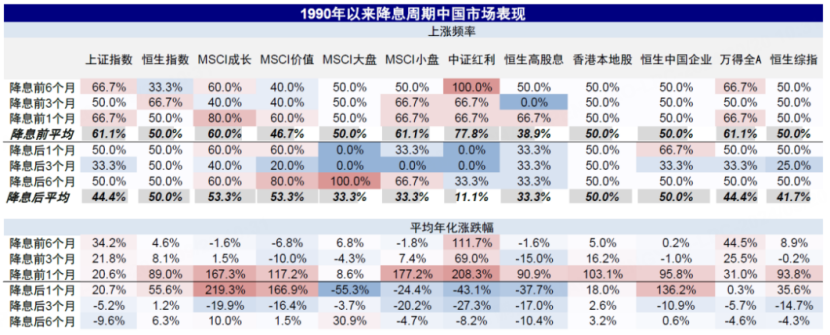

Here's a snapshot from six Fed easing cycles since the 90s:

- Growth outpaced value, and small caps beat large caps in the first month; however, the trend reversed six months later.

- Except for essentials and energy, most A-share sectors declined post-cut, while most Hong Kong sectors rallied, with Telecom (+11.5%) and IT (+10.1%) leading the pack.

- Local Hong Kong stocks lagged Chinese stocks initially but stayed positive, while the Hang Seng China Enterprises Index turned negative after three months.

For investors eyeing Chinese assets post-cut, options strategies on ETFs like $KraneShares CSI China Internet ETF(KWEB)$ in the US market can be lucrative. Fearing a potential short-term pullback amidst KWEB's surge, the Collar Strategy comes in handy.

What's a Collar Strategy?

It's a hybrid of two tried-and-true methods: Buy Protective Put (to hedge downside risk) and Sell Covered Call (to offset costs by selling call options). To balance both aspects, the innovative strategy of the Collar Option emerged.

With the Collar Strategy, you hold your stocks, buy an out-of-the-money put option as insurance, and simultaneously sell an out-of-the-money call option to cover the put's cost. It's like putting a collar around your stock's potential gains and losses, hence the name. It limits downside risk at the cost of capping some upside potential.

When you're bullish on a market position but want to shield it from a downturn, the Collar Strategy is your go-to. When the call option's proceeds fully cover the put's cost, it's a zero-cost Collar Strategy—a smart way to play the market with peace of mind.

Case Study: KWEB Collar Strategy

Suppose an investor holds 100 shares of KWEB currently trading at $27.23 and is uncertain about its near-term price movements. Seeking to insure their position, they opt for the Collar Strategy.

Step 1: Sell a call option with a strike price of $30 expiring on November 1st at $0.24 per share, generating $24 in Premium.

Porfit and Loss

The ultimate protection this strategy offers is: If KWEB drops below the put strike price of $25, regardless of how low it falls, the investor's losses will be capped.

Maximum Potential Loss = Put Strike Price - Stock Purchase Price + Call Premium Received - Put Premium Paid, which equates to $219. Regardless of how far KWEB plummets before the option expiration, even to $1, the investor's maximum loss remains $219.

Beyond limiting downside risk, the Collar Strategy preserves the potential for profit. The portfolio reaches its maximum gain when KWEB surpasses the call strike price of $30.

This case study underscores how the Collar Strategy empowers investors to safeguard their "wins" in KWEB while mitigating risks. Once the short-term volatility settles, investors can unwind the strategy and resume directional trading with confidence.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.