Why We Believe Gold Stocks Are the Hidden Opportunity in 2024’s Bull Market

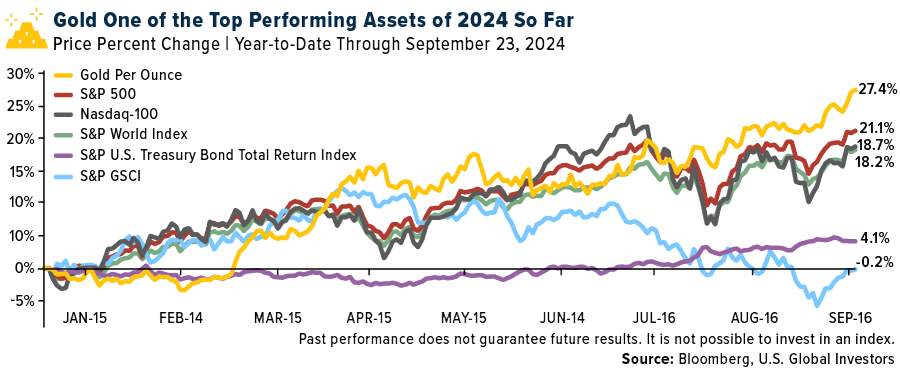

On Tuesday, gold hit a new all-time high of $2,670 an ounce, continuing a remarkable rally that’s seen the precious metal gain over 27% since the start of the year. If 2024 ended today, it would mark the best year for gold since 2010, when the asset finished up nearly 30%.

Despite the momentum, many investors still aren’t paying attention to what I consider to be one of the most obvious opportunities in the market today: gold stocks.

Some investors might be hesitant to buy into gold at these prices, but I believe there are several factors that suggest the rally still has room to run. Central banks around the world are entering a new phase of monetary easing, and investors — Western retail investors in particular — are finally starting to recognize gold’s value as a hedge against inflation and global uncertainty.

The real opportunity may not be in physical gold itself or the ETFs tracking it, though; instead, I believe it’s in the deeply undervalued gold mining stocks that have yet to catch up to the price of bullion.

Low Rates Push Investors to Consider Gold for Portfolio Diversification

At the heart of this gold rally is the Federal Reserve’s recent policy shift. The Fed made a decisive 50-basis-point (bp) rate cut last week, lowering the opportunity cost of holding a non-yielding asset like gold.

And this could be just the beginning. Analysts and market watchers expect another 50bps of easing this year, followed by an additional 100bps in 2025. This aggressive easing cycle should further increase the appeal of gold as a store of value.

The reason for this is that, when interest rates are low, investors have historically tended to move away from traditional fixed-income assets like bonds, which offer lower returns. As a result, they’ve looked for alternative investments, and gold has long been one of the most popular hedges against inflation and financial instability.

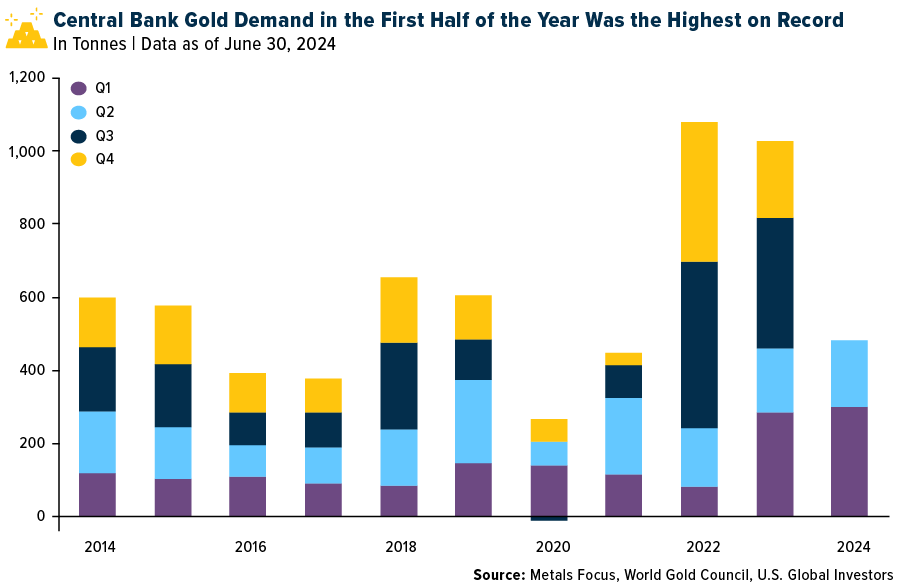

Record Central Bank Gold Purchases Fuel the Rally

It’s not just investors driving gold’s rise. Central banks are playing a massive role. In recent years, these institutions have significantly increased their gold reserves, and their buying spree shows no signs of slowing down. Central bank purchases now account for about a quarter of total global gold demand, which is double what it was before 2022. Gold-buying reached a new record high of 483 tonnes in the first half of the year, a 5% increase over the same period in 2023, according to the World Gold Council (WGC).

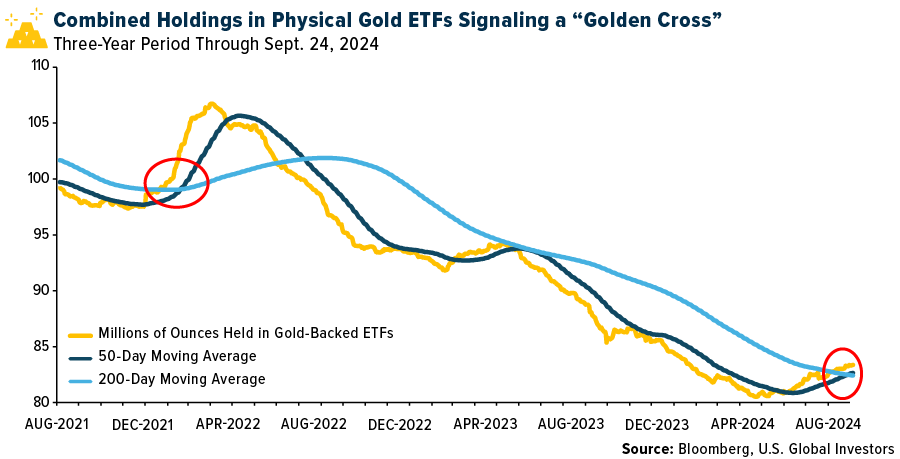

Despite this backdrop, many Western retail investors have been slow to embrace gold this cycles. According to a recent Bank of America study, 71% of U.S. financial advisors have little to no gold allocation, often representing less than 1% of their portfolios.

However, that narrative is changing. With the Fed’s rate cuts finally materializing, investors are starting to return to gold-backed ETFs once again. The WGC reported positive fund flows into North American gold bullion ETFs during July and August, with European products seeing similar momentum since May. For the first time since 2022, the 50-day moving average for gold holdings has crossed above its 200-day moving average, a bullish signal known as the “golden cross.” This is a sign that the gold rally could be starting to gain serious traction among investors.

Gold Mining Stocks Remain Undervalued Despite Rising Metal Prices

While the spotlight has been on gold prices and ETFs, gold mining stocks remain highly undervalued by comparison. Over the past couple of years, shares of gold mining companies have underperformed relative to gold itself, primarily due to rising costs and a general lack of interest. In 2022 and 2023, a sharp rise in the all-in sustaining cost (AISC), a measure of the cost to produce one ounce of gold, weighed heavily on mining stocks, which in turn led to many investors losing confidence in the sector.

But here’s the thing: The underperformance of gold mining stocks relative to the underlying metal has created what I consider to be an incredible opportunity. Right now, these stocks are trading at levels that don’t reflect the continued rise in gold prices. And since gold mining stocks have typically moved out of lockstep with the broader market, they offer a level of diversification that I believe can help hedge portfolios against market downturns.

It’s not just me saying this. Some of the most well-known contrarian investors are taking note. Stanley Druckenmiller, for example, made headlines when he sold off big tech stocks like Alphabet and Amazon in late 2023 and started buying into gold miners like Newmont and Barrick.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.