Is It Time to Go Long on AMD with New GPU Launch?

On October 10, $Advanced Micro Devices(AMD)$ held a data center event to launch the MI325X AI accelerator and several networking chips.

However, despite the promising products, AMD's stock only briefly rose toward the end of the morning session, then continued to decline throughout the day, closing down about 4%, marking a two-day drop to its lowest closing price in a week. This is AMD's biggest intraday and closing drop since September 3.

One would expect the launch of powerful AI chips to be a positive move, especially since AMD's new products are going up against $NVIDIA Corp(NVDA)$ 's highly anticipated Blackwell architecture chips.

Why did AMD's stock keep falling?

Media reports suggest that the decline indicates investors are still waiting for AMD's AI business to yield returns. While AMD released new chips, its financial outlook hasn’t significantly changed. Like NVIDIA, AMD promises to roll out new AI accelerators each year to speed up innovation.

However, AMD still has a long way to go to catch up with NVIDIA. Wall Street is looking for signs of AMD making progress, which might not come until their next financial report, expected at the end of this month.

Analysts have noted that although AMD's management might claim its chips benchmark better than NVIDIA's Hopper series, in real workloads, the MI300X still trails behind the NVIDIA H100. Factors such as excellent memory density, software stack, networking, and power efficiency are just as crucial.

However, KeyBanc analyst John Vinh remains optimistic. He expects AMD to ship 500,000 Instinct MI300X AI accelerators this year, carving out a niche in the AI market.

For long-term AMD investors, consider using a diagonal spread strategy. A diagonal bull spread is a more cost-effective way to invest compared to a regular bull spread, making it a solid long-term bullish strategy.

What is a diagonal spread?

A diagonal spread involves using options with different strike prices and expiration dates to create a price difference. Typically, in this strategy, the long leg has a longer duration than the short leg. Diagonal spreads include both diagonal bull spreads and diagonal bear spreads.

A diagonal bull spread is similar to a traditional bull call spread but with enhancements. The key difference is that the two options in a diagonal spread have different expiration dates. In this strategy, the trader buys one long-dated call option with a lower strike price and sells one short-dated call option with a higher strike price, maintaining equal quantities of both options.

AMD Diagonal Spread Example

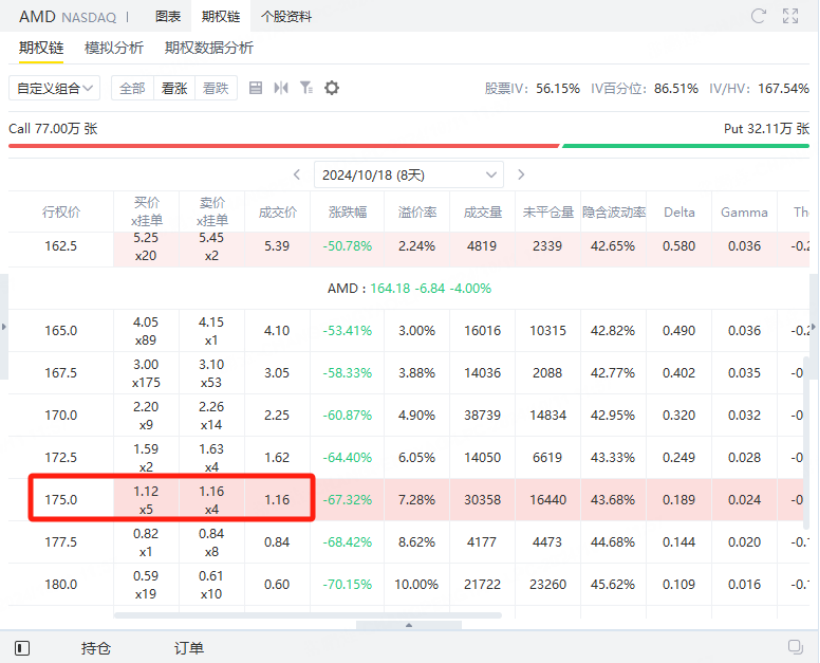

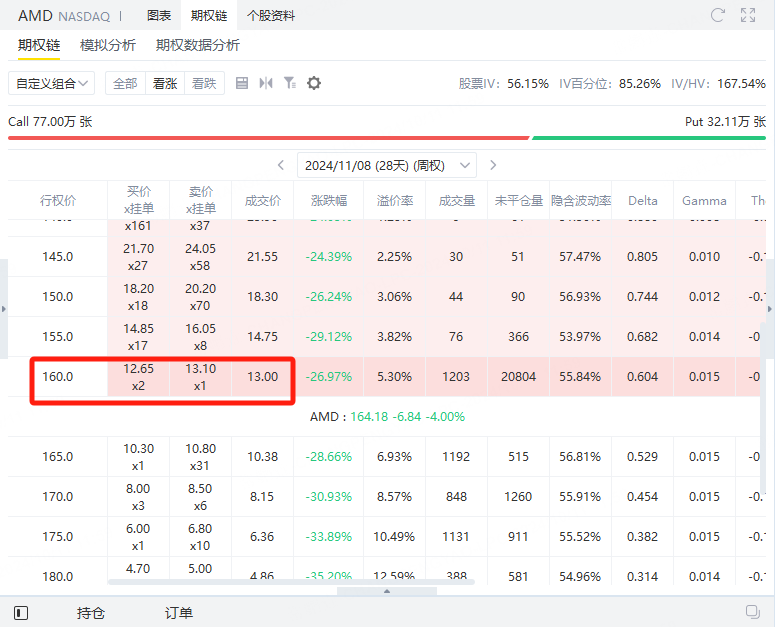

Suppose an investor is bullish on AMD for the next month and decides to buy a call option expiring on November 8, 2024. This option becomes our long leg, costing $1,300 based on the latest transaction price.

Profit

If the sold call option is not exercised, the investor makes a profit of $116. Relative to the $1,300 spent on the long leg, this amounts to about 8.92%. Since the short leg can be executed weekly, with 28 days remaining on the long leg, the investor could potentially sell the call option four times. Successfully obtaining premiums from these four sales would significantly reduce the cost of the long call option.

Compared to simply buying a call, the diagonal spread provides an additional source of premium income, reducing the overall net premium outlay of the strategy and shifting the Break-even point lower, thereby increasing the win rate.

Furthermore, investors can control the strike prices and expiration dates of the sold options, allowing for flexibility in risk management. Essentially, the diagonal spread is a lower-cost strategy for buying call options, making it worthwhile for investors to explore.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.