Earn Dividends Effortlessly with QDTE: 31% Annualized Return!

Recently, I’ve noticed that @孙哥888 has been sharing his purchases of $Roundhill N-100 0DTE Covered Call Strategy ETF(QDTE)$ . Honestly, I had never heard of this ETF before. I just found some information about it on the Internet. Here is a quick reference for those who are interested. Please let me know if there are any errors [Applaud][Applaud][Applaud]

Introduction to Roundhill N-100 0DTE Covered Call Strategy ETF (QDTE)

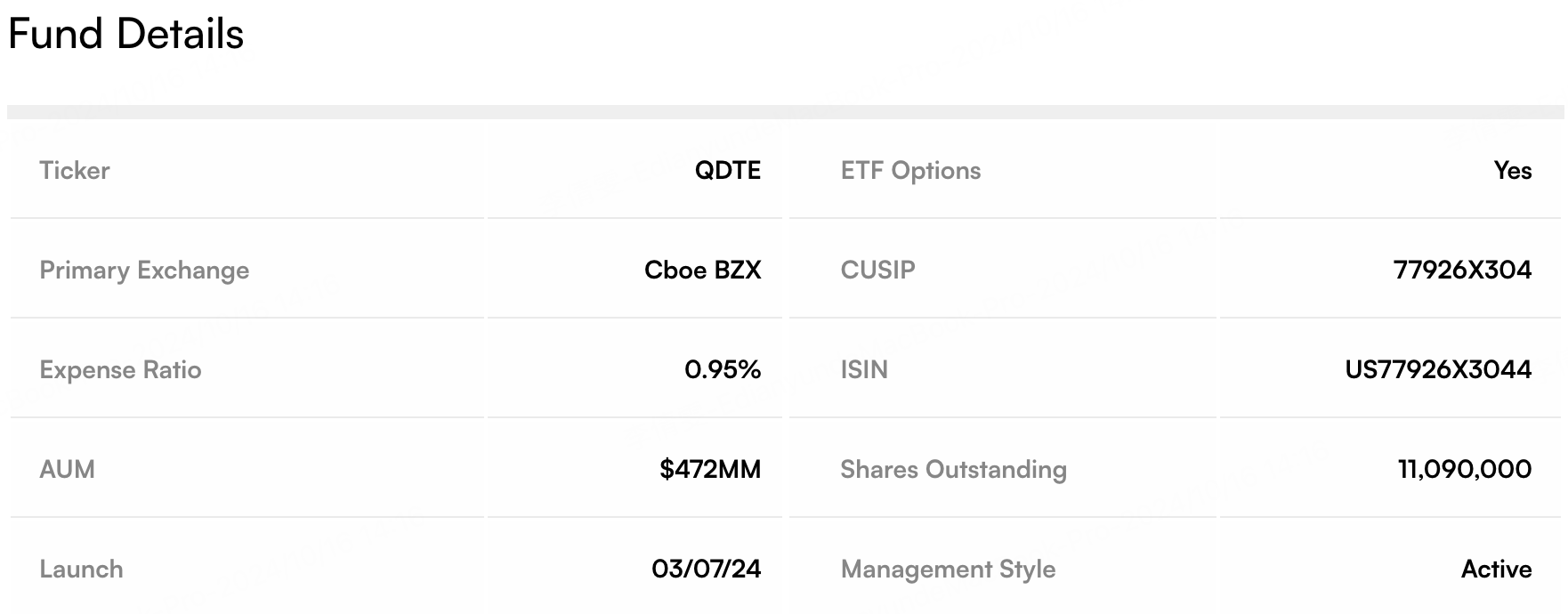

$Roundhill N-100 0DTE Covered Call Strategy ETF (QDTE)$ is an an exchange-traded fund designed to generate consistent income through a covered call options strategy, specifically by selling zero days to expiration (0DTE) options on stocks in the Nasdaq-100 index (N-100).

The ETF employs a covered call strategy, which involves holding a portfolio of Nasdaq-100 stocks while selling call options on those same stocks. By selling these options, the ETF collects premiums from option buyers, generating additional income.

0DTE options are contracts that expire on the same day they are written. These short-term options are highly volatile, but they offer the potential to generate frequent income for the fund.

What are the advantages of QDTE?

The covered call strategy is a favorite investment strategy of legendary investors such as Warren Buffett. In markets with low volatility or slight upward or downward movement, selling call options can generate considerable income since the premiums paid by option buyers serve as the primary source of return for investors. Due to the fact that 0DTE options expire very rapidly, the fund is able to sell options frequently and collect premiums.

There are some Tiger Community members who have already been using this strategy. However, the biggest advantage of this ETF is its ability to earn passively rather than handling it yourself.

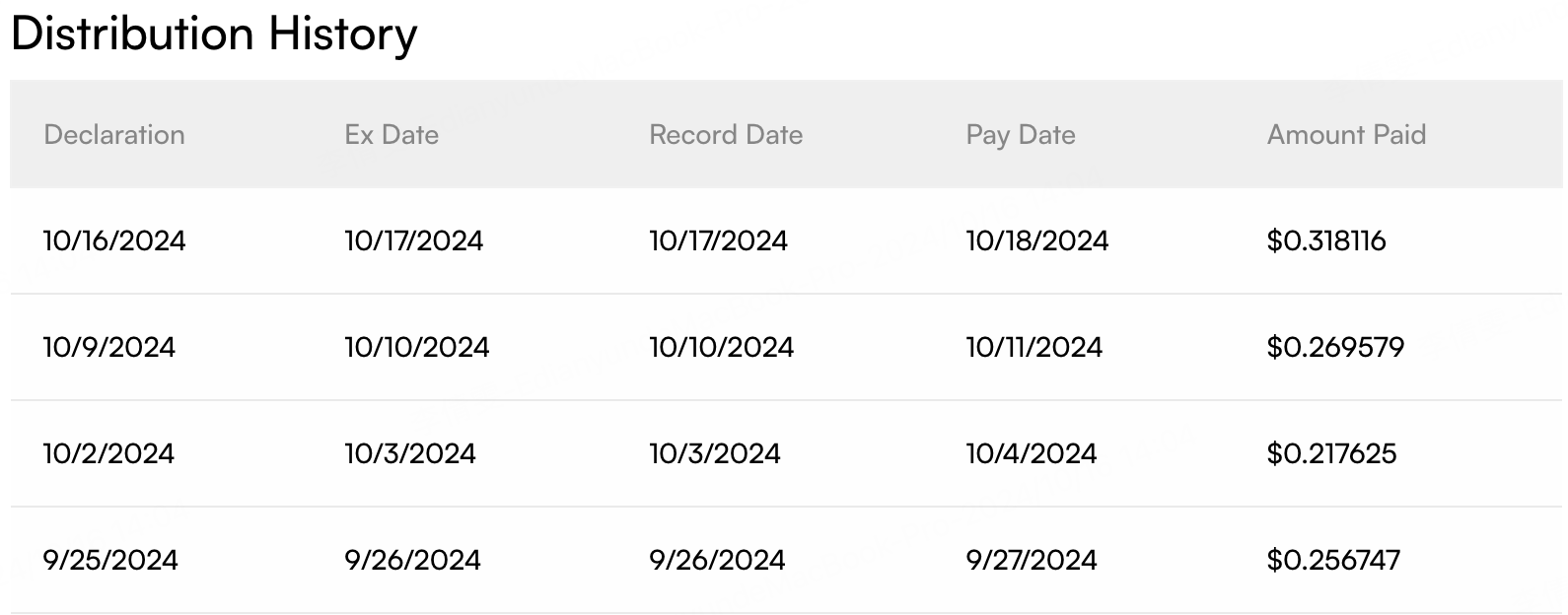

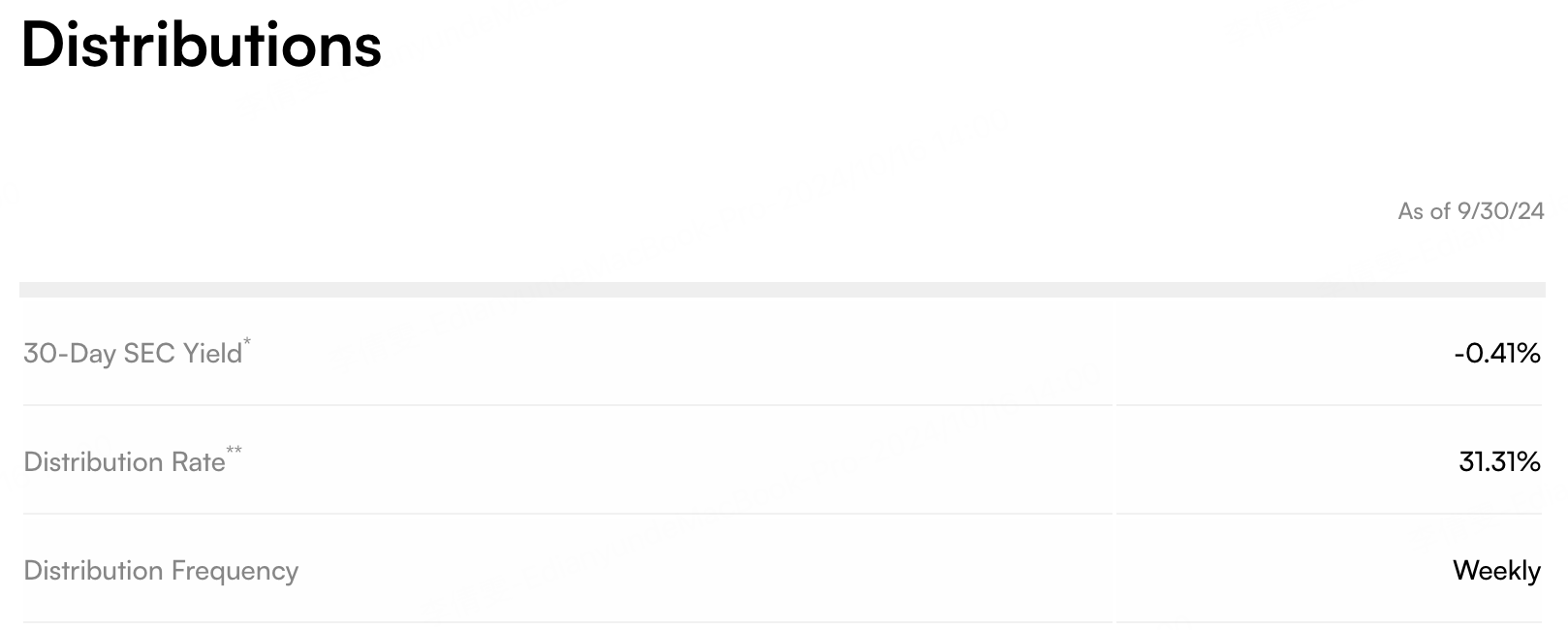

Despite the low interest-rate environment, it is rare to find products offering returns greater than 5%. Yet the QDTE has an impressive annualized return of 31%! (Based on data from the ETF’s website, its estimated annualized return is 31%. For more details, please click here)[Miser][Miser][Miser]

What are the disadvantages of QDTE?

Limited Upside Potential Since the ETF sells call options on the stocks it holds, the upside potential is capped. If the Nasdaq-100 stocks experience significant gains, the ETF will not fully benefit because the options will be exercised, and the stocks must be sold at a predetermined strike price.

Market Volatility Risk 0DTE options are highly volatile due to their short expiration window. Any sudden market movements could expose the fund to potential losses, especially if the stock price fluctuates sharply near the option’s strike price.

Downside Risk While the premium income can partially offset a decline in stock prices, it cannot fully compensate for a large drop in the value of the underlying stocks. Therefore, the ETF still carries downside risk if the market experiences significant declines.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- ashare·2024-10-17Will there be a 30% withholding tax on the returns for foreign investors?LikeReport

- Kcler·2024-12-13Yes there will be with holding taxLikeReport