Tesla Earnings: Too Calm Before the Potential Storm?

Political Headwinds and Regulatory Uncertainty Add Complexity to Tesla’s Earnings Ahead of October 23rd Report

This article analyzes Tesla’s expected earnings move ahead of its October 23rd report after the bell, highlighting the lowest implied earnings move since October 2021. While Tesla’s historical trend has shown larger-than-expected earnings moves, political factors may shift the focus. Elon Musk’s endorsement of Donald Trump and ongoing controversies surrounding ESG policies, combined with potential regulatory changes in the electric vehicle industry, could overshadow Tesla’s financial performance.

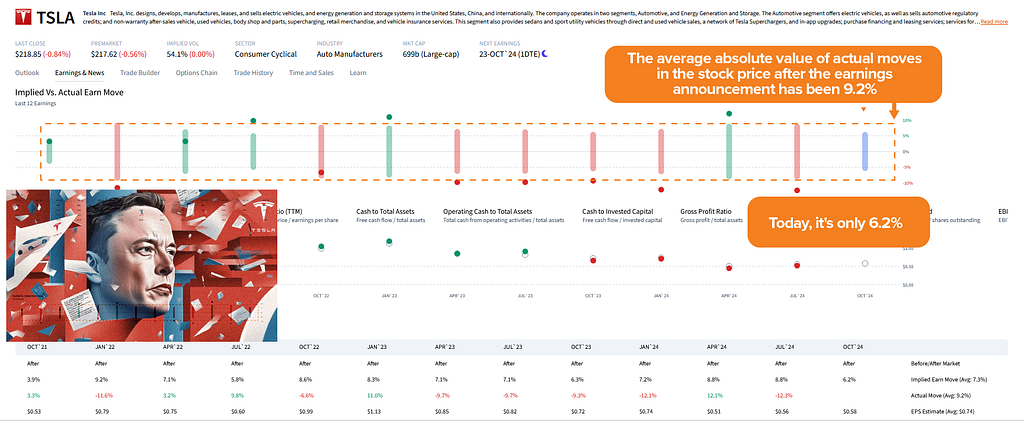

With Tesla’s earnings announcement just a day away, investors are closely monitoring the market’s pricing. According to ORATS data, Tesla’s expected move for this quarter’s earnings annoucement is the lowest since October 2021. Does this suggest a quiet reaction, or is the market underestimating the potential volatility?

The expected earnings move is derived from the straddle price — a combination of a call and a put option expiring immediately after the earnings event. By removing the residual value of the straddle after the event but before expiration and dividing that by the stock price, ORATS estimates the percentage move the market expects. For Tesla, that number is 6.2%, below its 12-quarter average of 7.3%.

Historically, however, Tesla has been no stranger to bigger swings. Over the last twelve quarters, Tesla’s actual earnings moves averaged 9.2%, consistently exceeding the implied moves. This indicates that while investors expect muted action this time, Tesla has a track record of delivering surprises.

The Political Overhang on Tesla’s Stock Price

One major factor influencing Tesla’s current stock price might not be earnings — it could be the political climate. Elon Musk, Tesla’s outspoken founder, has made waves by publicly endorsing Donald Trump ahead of the 2024 presidential election, which is just two weeks away. Musk’s ongoing Twitter/X feuds and his pointed criticism of the Biden administration’s policies have placed him in the crosshairs of investors who prioritize environmental, social, and governance (ESG) factors.

For many institutional investors focused on ESG, Musk’s political leanings and public statements could present a dilemma. As the CEO of one of the world’s most influential electric vehicle companies, Musk’s support of Trump — who has frequently questioned climate change policies — may alienate investors that favor green initiatives and long-term sustainability. Once viewed as the flagship for eco-conscious investing, Tesla may now be perceived through a more complicated lens.

The Political Landscape and Policy Shifts

The 2024 election also looms large over the future of the electric vehicle industry. Depending on the outcome, policy changes — such as adjustments to tax credits for electric vehicles or shifts in infrastructure investments — could either boost or hinder Tesla’s growth. A more conservative administration could roll back support for clean energy initiatives, while a progressive victory might further incentivize electric vehicle adoption through subsidies and infrastructure investments.

In addition, regulatory changes could directly impact Tesla’s operations. Potential adjustments to autonomous driving regulations, battery recycling mandates, and environmental standards are all on the horizon. As a company that operates at the forefront of these technologies, any shifts in the regulatory environment could lead to increased costs or new opportunities.

Public Opinion and Brand Perception

Beyond the institutional level, public opinion of Elon Musk has been a topic of fierce debate. His political stances, controversial statements, and high-profile feuds may alter how the broader public views Tesla’s brand. While some consumers admire Musk’s bold approach, others may be turned off by his increasingly polarizing persona. Public perception plays a significant role in consumer sentiment, which can influence sales — and, by extension, stock price. For Tesla, any decline in brand loyalty or consumer goodwill could affect demand for its vehicles, making this political context even more critical.

Will Tesla Defy Expectations Again?

With earnings dropping after the bell on October 22nd, the question remains: Will Tesla maintain this pattern of bigger-than-expected post-earnings movements, or is the market accurately predicting a more subdued response this time? Political headwinds and Tesla’s ongoing evolution from a niche electric vehicle manufacturer to a broader technology and energy company may lead to more tempered reactions in the stock. However, with a company as unpredictable as Tesla — and a founder as polarizing as Musk — one thing remains certain: volatility is never far away.

Conclusion

Tesla’s upcoming earnings report faces a confluence of factors beyond financial performance. While analyst estimates and implied moves are a good starting point, investors must also weigh the broader political landscape, regulatory risks, and evolving public opinion. As the 2024 election draws closer, policy changes regarding tax credits, autonomous driving, and environmental regulations could all significantly shape Tesla’s future. This time, it may not just be the company’s earnings that move the stock, but the political forces surrounding it.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.