Tesla Earnings Ahead: Short Strangle Strategy

$Tesla Motors(TSLA)$ is set to release its earnings report after-hour trading on October 23. Analysts expect Q3 2024 revenue to reach $25.674 billion, a year-over-year increase of 9.95%. However, earnings per share are projected at $0.50, down 5.96% compared to last year.

In Q2, Tesla's revenue grew about 2.3% year-over-year, surpassing market expectations and showing a return to positive growth. Still, disappointing actual sales revenue and the delayed Robotaxi announcement led to a downturn, with shares dropping over 12% post-earnings.

During the recent Robotaxi event, despite Elon Musk's ambitious promises, the lack of critical data left investors unsatisfied, resulting in nearly a 9% decline in stock price on that day.

What to Watch in Q3

For the upcoming earnings report, investors will focus on several key areas:

Automotive revenue

Impact of price cuts on profit margins

Performance of the energy storage business

Progress on the Robotaxi project and its potential revenue

Delivery forecasts for the next two years

In Q2, Tesla reported automotive revenue of $19.878 billion, down from $21.268 billion the previous year—a drop of 7%. The gross margin was 18%, reflecting a decline of about 20 basis points from last year.

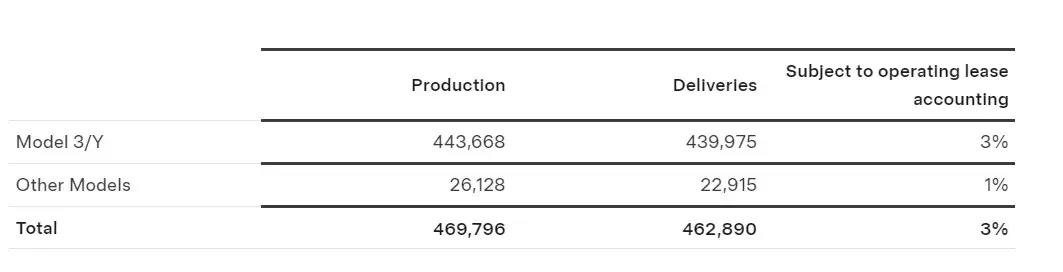

Earlier this month, Tesla announced third-quarter deliveries of 463,000 vehicles, a year-over-year increase of 6.4% and a quarter-over-quarter increase of 4.3%. This marks the first quarter this year with a year-over-year sales increase.

Historical Earnings Performance

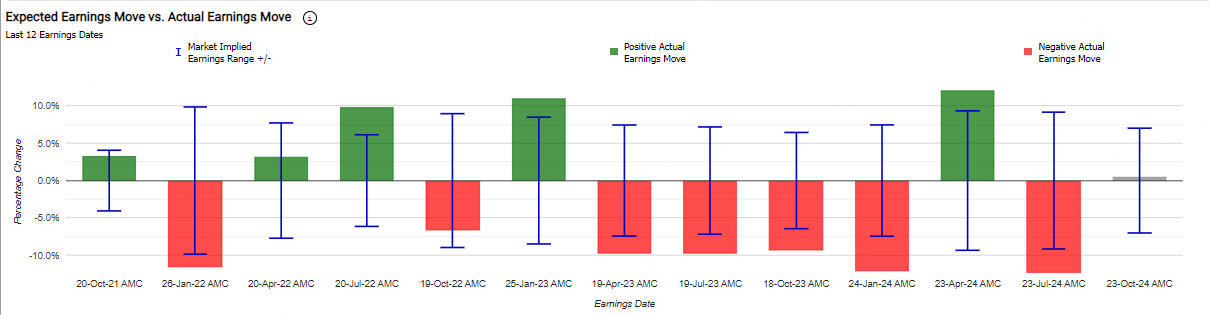

The current implied volatility is ±7%, suggesting that the options market expects a post-earnings price swing of about 7%. In comparison, the average price movement over the last four quarters was around 11.5%.

In the last 12 earnings reports, Tesla shares had a 42% chance of rising, with a maximum increase of 12.1% and a maximum decrease of -12.3%. Historically, Tesla's stock has shown about a 70% chance of volatility exceeding market estimates. Currently, options skew indicates a bullish sentiment towards Tesla.

In the past six earnings announcements, Tesla’s performance has shown swings of -9.7%, -9.7%, -9.3%, -12.1%, +12.1%, and -12.3%.

Short Volatility Strategy: Short Strangle

In a long strangle, investors buy out-of-the-money call and put options. The call option's strike price is above the current market price of the underlying asset, while the put option's strike price is below it. This strategy has substantial profit potential because the call option can theoretically rise infinitely if the asset's price increases, while the put option can generate profits if the price decreases. The risk is limited to the premiums paid for these options.

In a short strangle, investors sell an out-of-the-money put option and an out-of-the-money call option simultaneously. This tactic is market-neutral and has limited profit potential. The strategy profits when the underlying stock trades within a narrow range between the break-even points. The maximum profit equals the premiums received from selling the two options minus any transaction costs.

For investors who don’t wish to predict Tesla's price movements, the focus can shift to predicting volatility. Reviewing the last 12 quarters of earnings, Tesla's maximum increase was +12.1%, and the maximum decrease was -12.3%.

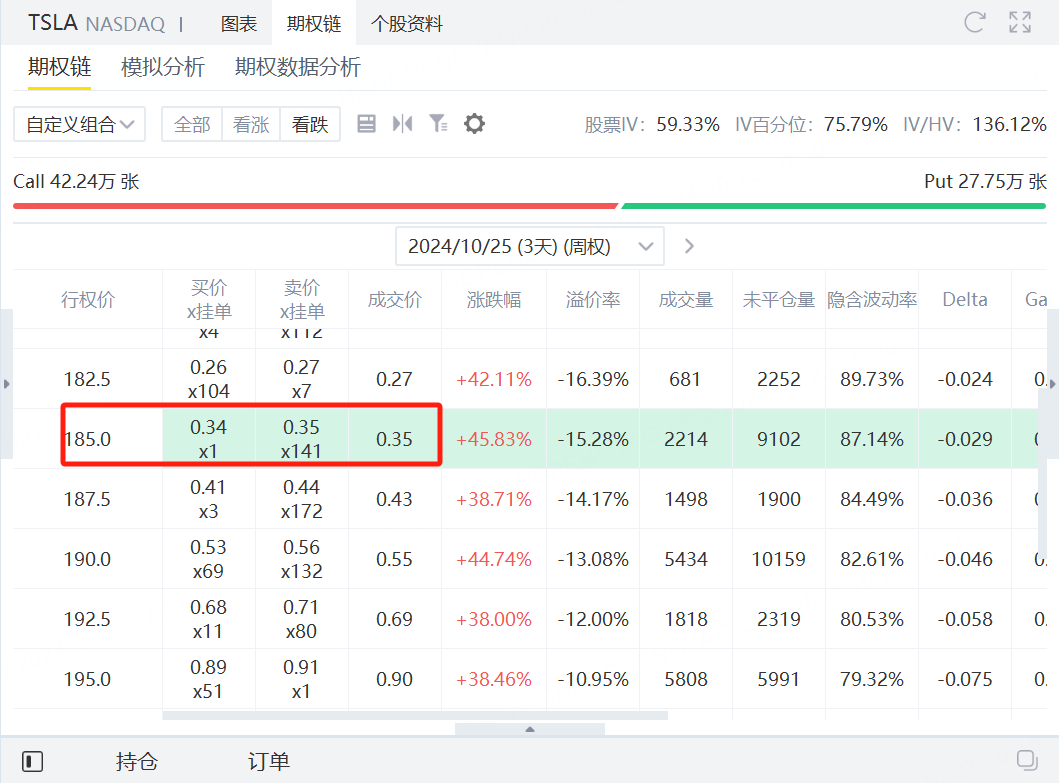

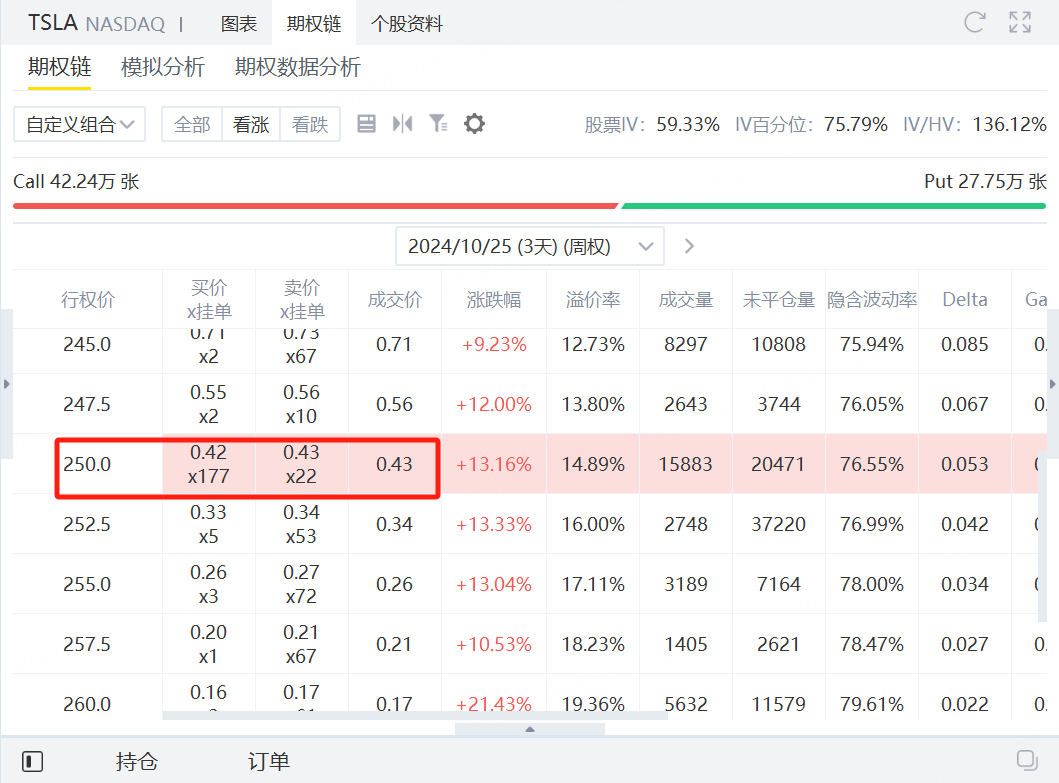

Based on this, investors can use a short volatility strategy, betting that Tesla's price movement will remain within ±15%. With Tesla’s current price at $218, a 15% range means the stock could fluctuate between $185.30 and $250.70.

1.Execution Steps

Step 1: Sell a call option with a strike price of $250 to receive a premium of $43.

2.Profit and Loss Analysis

This strategy is effectively a short strangle. By selling options with distant strike prices, the aim is to capture premiums at both ends. Here’s a breakdown of the potential outcomes:

1)Premium Income

- Sell Call Option (Strike Price $250): Premium = $43

- Sell Put Option (Strike Price $185): Premium = $35

- Total Premium Income: $43 + $35 = $78

- The maximum profit occurs when Tesla's stock price is between $185 and $250 at expiration. In this scenario, neither option will be exercised, and you keep the entire premium: $78

2)Loss Scenarios

If Stock Price Exceeds $250:

- Once the stock price exceeds $250, the sold call option incurs a loss.

- For every $1 increase above $250, the loss increases by $100, but the losses can be partially offset by premiums already earned.

- Loss Calculation at Expiration: (TSLA current price -$250) x $100- $78 (total premiums received).

If Stock Price Falls Below $185:

- Once the stock price drops below $185, the sold put option incurs a loss.

- For every $1 decrease below $185, the loss increases by $1, but the losses can be partially offset by premiums already earned.

- Loss Calculation at Expiration: ($185 - TSLA current price) x $100 - $78 (total premiums received).

3)Break-Even Points

- Upper Break-Even Point: $250 + $0.78 = $250.78 (above $250.78, a net loss begins).

- Lower Break-Even Point = $185-0.78 = $184.22 (below $184.22, a net loss begins).

Conclusion

- Maximum Profit: $78, achievable when Tesla's stock price fluctuates between $185 and $250.

- Risk: Significant losses may occur if the stock price breaks through either strike price. It is crucial to monitor stock price movements closely.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.