Hong Kong Stock Weekly: Falling! Hang Seng Index fell 6% weekly. What happened?

Falling!

This week, apart from rising 0.17% on Monday, Hong Kong stocks fell continuously for the other four days, and even fell to a climax on Friday, with the volume falling by 3.04%. The Hang Seng Index fell by 6.07% all week, the biggest decline since the end of October last year!

What happened here?

On the news front, Federal Reserve Chairman Powell testified before the Senate Banking Committee on Tuesday that "the latest economic data is stronger than expected, which indicates that the final interest rate level may be higher than the previous forecast." "If the overall data shows that it is necessary to accelerate the tightening rate, we are prepared to increase the pace of interest rate increase."

After hawkish remarks were made, US stocks fell sharply. On Thursday, Silicon Valley banks plunged 60%, causing investors to sell banking stocks, and US stocks fell again.

Domestically, A shares also performed poorly, and the Shanghai Composite Index fell for five consecutive days. On the news front, the CPI data released in February fell short of market expectations, causing economic deflation concerns. At the same time, this week is a major conference week, and regional political risks have attracted market attention.

In terms of financial report, JD.COM released its fourth quarterly report on Thursday, and its revenue fell short of market expectations, and its share price plummeted, dragging down Alibaba and other e-commerce stocks.

Under a series of bad news, all sectors of Hong Kong stocks fell, among which the health care sector fell 4.68%:

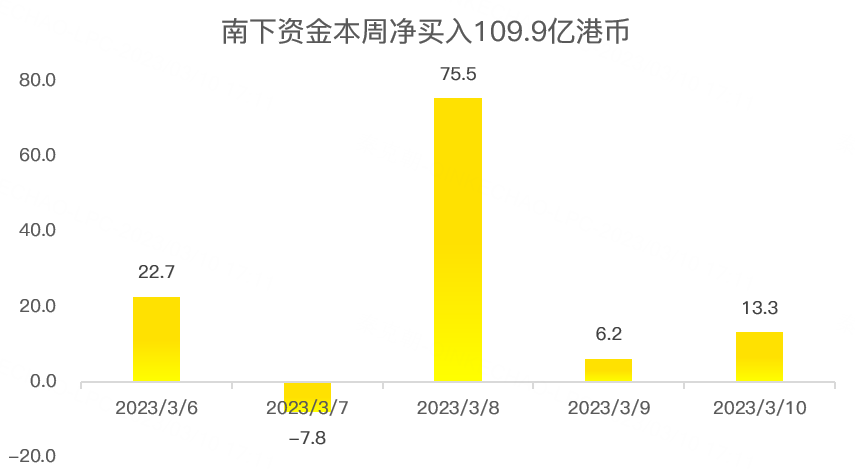

The market is not good, but the funds from the south continue to bargain-hunting, and this week they bought a net HK $11 billion:

This week's Hong Kong stock event:

1. JD.COM's 10 billion subsidy was fully launched at 8:00 pm on March 6, and the e-commerce price war was on the verge;

2. A number of fuel car companies announced price cuts;

3. TVB settled in Taobao live broadcast, and the stock price of the parent company TV broadcast soared;

4. China Unicom released its 2022 annual report, and its revenue growth rate reached a new high in 9 years;

5. JD.COM Group released its fourth quarterly report, and its revenue fell short of market expectations and its share price plummeted;

6. The Hong Kong Stock Connect under the Shanghai-Hong Kong Stock Connect has been adjusted and transferred to the Shanghai-Hong Kong Stock Connect;

7. The domestic "first share of investment and education" Q9 wealth landed in Hong Kong stocks;

8. The Netherlands announced new regulations on semiconductor export control, further tightening the export of cutting-edge lithography machines to China.

Tiger users traded hot stocks this week:

TOP5: TV broadcasting. This week, the company announced that it will reach a cooperation intention with Taobao through its subsidiary Shanghai Emerald Oriental Communication (TVBC). Both parties will jointly develop more than 48 live e-commerce broadcasts during the year, and this cooperation is expected to bring the company tens of millions of Hong Kong dollars in revenue. The transformation of live broadcast caused the stock price to rise sharply, and the weekly increase reached 87%;

TOP6: JD.COM Group, before the US stock market on Thursday, JD.COM released its fourth quarterly report, and its revenue was slightly less than market expectations. After the financial report, JD.COM's share price fell by 11.5%;

Big events to watch next week:

1. On March 14, the United States will release February CPI data, and economists predict a median of 6%, which has a significant impact on the US stock market;

2. On Wednesday, China Ping an, Wanguo Data, Kangfang Bio and other companies released financial reports;

3. Before the US stock market on Friday, Xpeng Motors released its fourth quarterly report, and the market expected revenue to be 5.686 billion, up 33.6% year-on-year. Pay attention to whether the actual data meets expectations.

$JD-SW(09618)$$TVB(00511)$$BIDU-SW(09888)$$XPENG-W(09868)$$TENCENT(00700)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- cheeryx·2023-03-11After the epidemic, the development of most physical industries is still slow. I think the decline of Hong Kong shares is normal.LikeReport

- 相信111·2023-03-11都是下跌,而且是跌蒙了的状态,不知道大家是不是这样认为的?LikeReport

- Wayne Montgomery·2023-03-11楼主认为港股、美股、A股全都呈现跌的趋势。LikeReport

- 巴股·2023-03-10这个很明显 就是用脚投票LikeReport

- tradelaggard·2023-03-13thx for sharingLikeReport

- ReneS·2023-03-13👍👍👍👍👍👍👍👍👍LikeReport

- jjshlq·2023-04-10[微笑][微笑][微笑]LikeReport

- Spellgirl·2023-03-16OkLikeReport

- TeoHY·2023-03-13OkLikeReport

- nur234·2023-03-13goodLikeReport

- Awesomebyc·2023-03-131LikeReport

- FlyDragon·2023-03-11好的LikeReport

- 暗黑传·2023-03-11okLikeReport

- ekwee75·2023-03-10[Happy]LikeReport

- Cold Eye·2023-03-10okLikeReport