The bank that was killed by mistake under the Silicon Valley bank incident?

$SVB Financial Group(SIVB)$Bankruptcy has become the biggest hot spot in the financial circle this year. Although the impact is controllable at present, the market fluctuates a lot. Especially now that the pressure is returned to the central bank, the Fed will have to face a choice between "further hurting the economy" and "controlling inflation in rate hike".

The banking problem in Silicon Valley is a liquidity crisis caused by rate hike. The essence is that the continuous tightening increases the loss of bonds held by banks with long-term mismatch and increases the mismatch between assets and liabilities. The sudden run on banks enlarges the liquidity gap and leads to bankruptcy.

This problem affects almost all banks, because in the rate hike environment, whether it is$First Republic Bank(FRC)$$Zions(ZION)$$SentinelOne, Inc(S)$These regional banks, or$Citigroup(C)$$Wells Fargo(WFC)$$Bank of America(BAC)$These big banks have different sizes of long-term loans and short-term loans, but banks with good liquidity are still enough to cope with the current redemption.

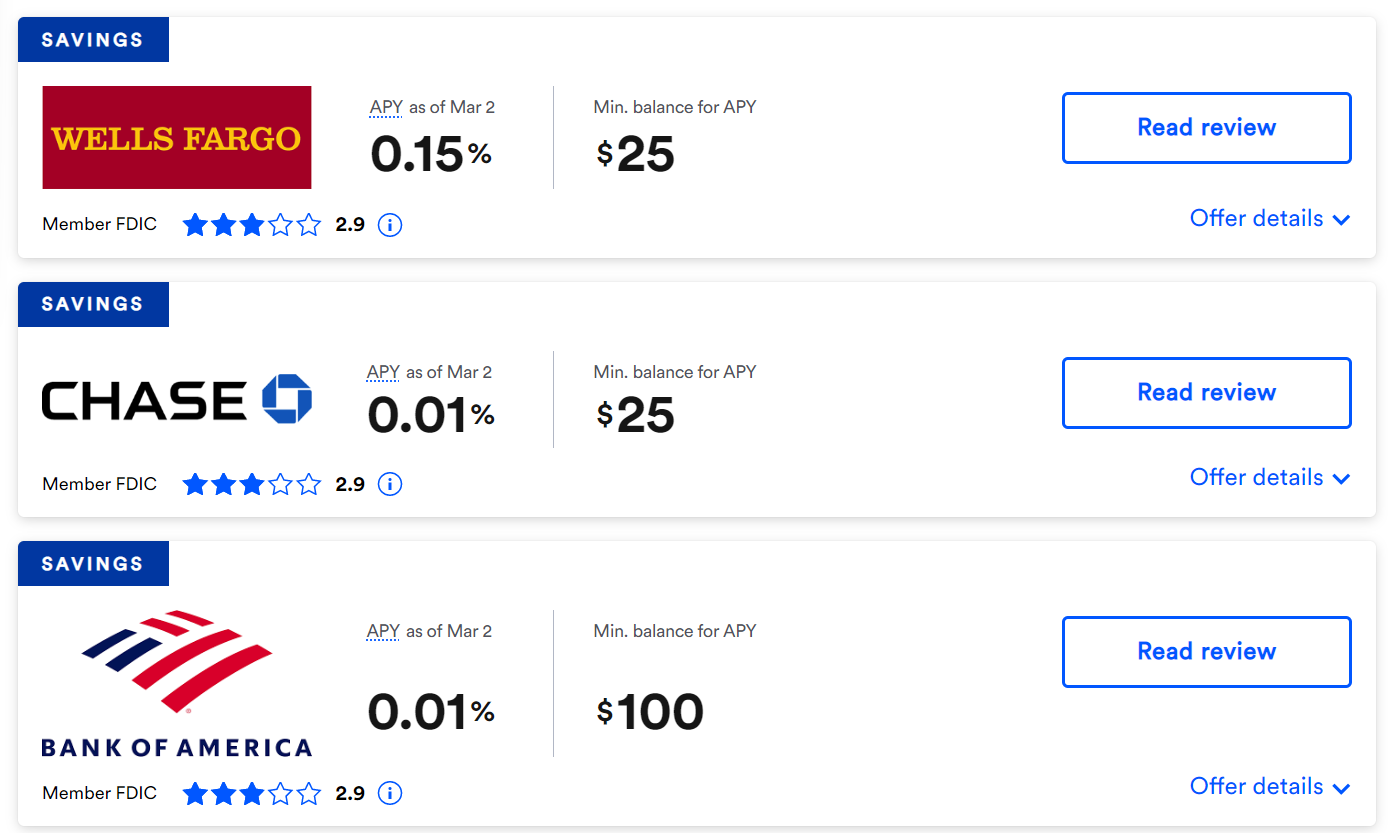

Is there any interest rate paid by banks to depositors that has not gone up with the rate hike?

For example,$JPMorgan Chase(JPM)$,$Bank of America(BAC)$,$Wells Fargo(WFC)$For demand deposits, the interest rate has always been almost zero, and only for large certificates of deposit, the interest rate matching the current environment is given.

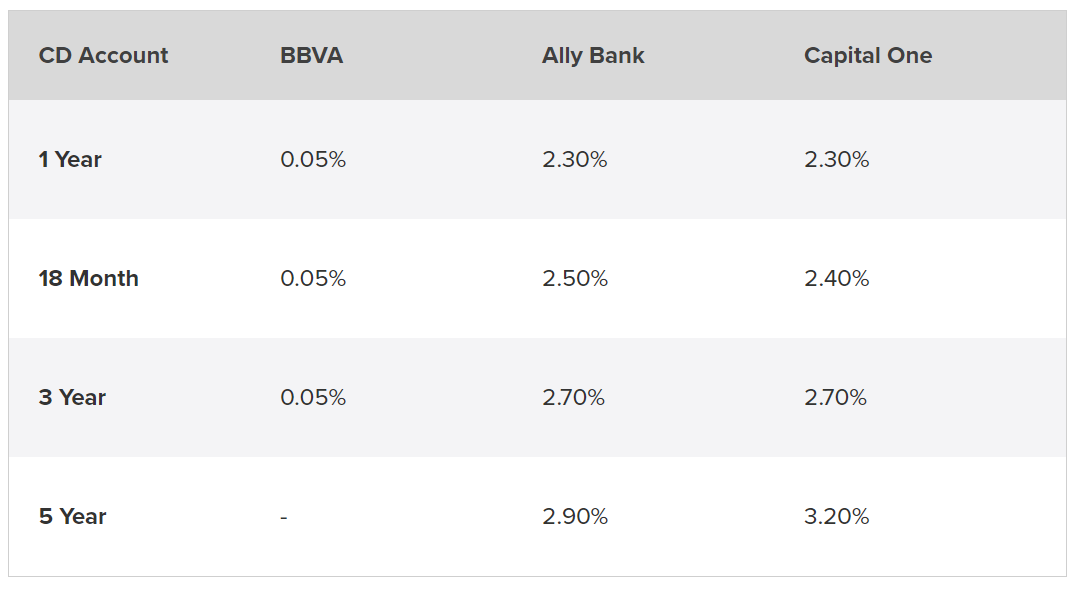

But this family$Banco Bilbao Vizcaya Argentaria SA(BBVA)$Even worse, not only ordinary deposits have almost zero interest rates, but also large certificates of deposit have hardly gone up with the central bank's rate hike, far lower than the interest rates given by peers.

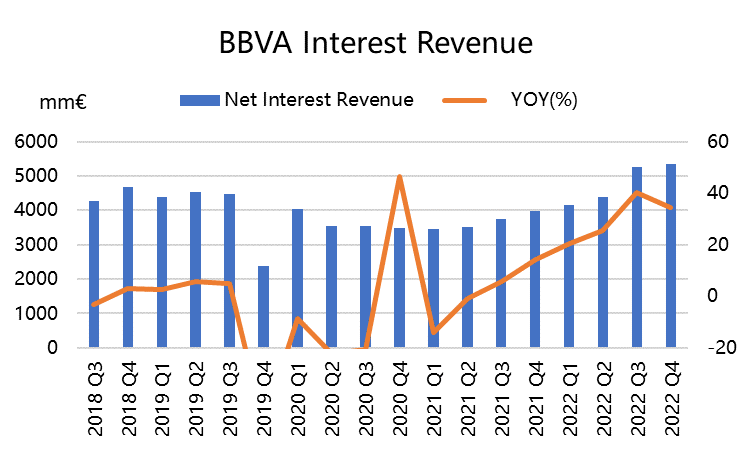

No matter how it got the user deposit, it also got it anyway, so it also got more performance than its peers.

Looking at the performance in the past 22 years, not only has the income increased (because the net interest income increased), but the profit has increased, and the non-performing loans have also declined, and the capital provision is more sufficient, which is simply reversed with all these troubled banks...

Of course, it doesn't mean that it has no long-term debt and can't cope with a run. No bank can cope with a run.

We are just curious, what kind of depositors will deposit their money in the bank without interest?

But in a word, this bank should not "plummet" because of liquidity problems.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

👍